Doing Business Dba Business With Irs

Description

How to fill out USLegal Pamphlet On Doing Business As DBA Filing Or Registration?

It’s clear that you can’t transform into a legal specialist instantly, nor can you learn how to swiftly create Doing Business Dba Business With Irs without possessing a specific set of abilities.

Drafting legal documents is an elaborate task that demands a particular level of education and expertise. Therefore, why not entrust the development of the Doing Business Dba Business With Irs to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can access everything from judicial documents to designs for internal corporate correspondence.

Select Buy now. After the payment is processed, you can download the Doing Business Dba Business With Irs, fill it out, print it, and send or submit it by mail to the specified individuals or organizations.

You can revisit your documents from the My documents tab whenever you wish. If you’re an existing client, you can simply Log In, and find and download the template from the same tab.

- Here’s how to begin with our platform and obtain the form you require in just a few minutes.

- Locate the form you need by utilizing the search bar at the top of the webpage.

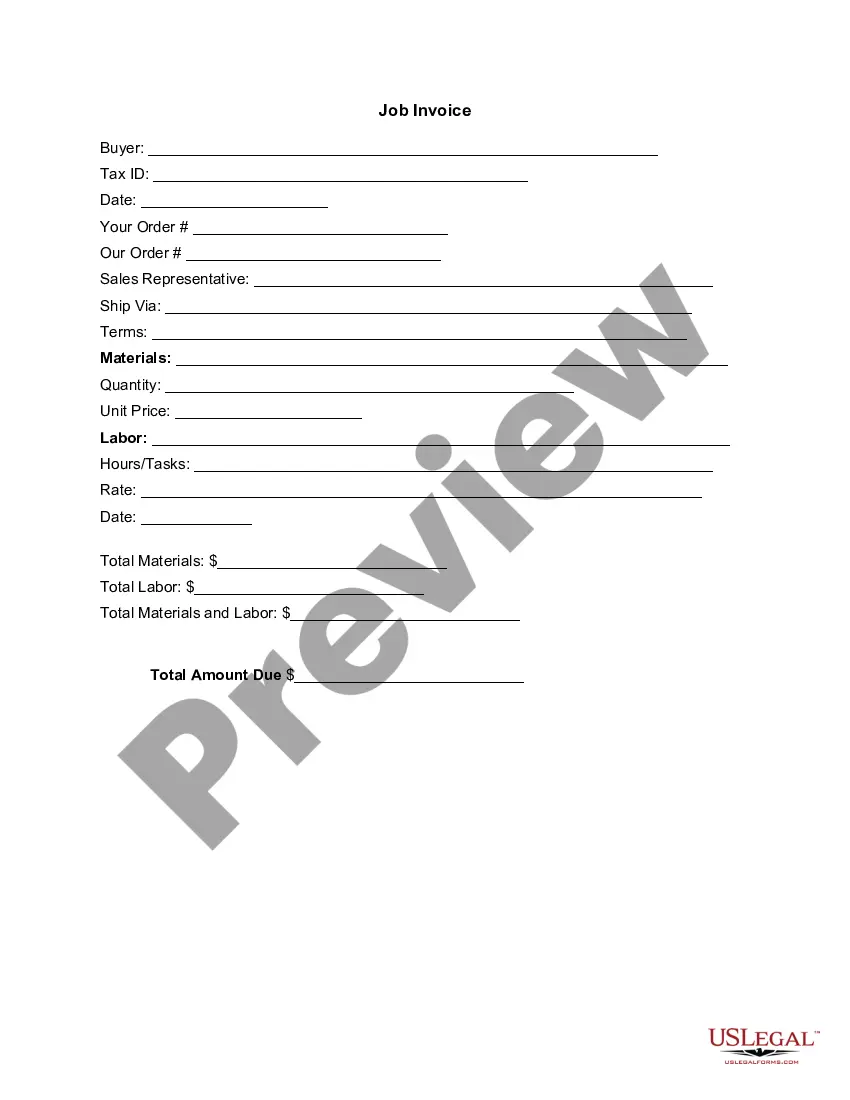

- Preview it (if this feature is available) and review the supporting description to ascertain whether Doing Business Dba Business With Irs is what you seek.

- Re-initiate your search if you require a different form.

- Establish a free account and choose a subscription plan to acquire the template.

Form popularity

FAQ

Sole Proprietorship or Partnership: If you operate as a sole proprietor or a partnership using a DBA, your business income and expenses will be reported on your personal income tax return. You will use Schedule C (Form 1040) to report your business income and deductible expenses.

For example, if your LLC is registered under the name ?Jane Jones Enterprises LLC," but you wish to do business under the name ?JJ's Computer Services," you would use ?Jane Jones Enterprises LLC, DBA JJ's Computer Services."

A fictitious business name is a business, often a sole proprietorship or partnership, where the owners register for a business name but pass all revenues to personal tax identification numbers.

A fictitious business name is a name used by a natural person or entity for conducting business under such a name, which is different from its legal name. In the case of entities, such as corporations, a fictitious business name is any name different from that used in the articles of incorporation.

Open a free IRS online application or print out a copy of Form SS-4. On the form, provide information about your business, including how it is structured, the number of employees, and your principal business activities. Submit your online application on the IRS website.