When it becomes necessary to obtain information or documentation from Bank of America for legal proceedings, a legal process known as serving a subpoena on Bank of America is initiated. A subpoena is a legal document issued by a court that commands the bank to provide specific documents or testify in court. Bank of America, being one of the largest banks in the United States, is frequently involved in legal matters, such as civil cases, criminal investigations, or regulatory compliance issues. Subpoenas can be served on Bank of America for various reasons, including: 1. Civil Subpoena: In civil litigation, parties involved may request specific financial records or statements from Bank of America to support their claims or defenses. These subpoenas can request the production of bank statements, loan documents, transaction records, or any other relevant financial information related to the case. 2. Criminal Subpoena: Law enforcement agencies, prosecutors, or grand juries may serve criminal subpoenas on Bank of America to aid investigations related to suspected criminal activities. These subpoenas usually aim to obtain bank records, account information, wire transfer details, or any other financial records crucial to the investigation. 3. Regulatory Subpoena: Government agencies tasked with monitoring and regulating financial institutions, such as the Securities and Exchange Commission (SEC) or the Office of the Comptroller of the Currency (OCC), can serve subpoenas on Bank of America to gather information about potential regulatory violations. These subpoenas can involve requests for internal bank communications, compliance documentation, or related financial records. 4. Administrative Subpoena: Administrative bodies, like state agencies or professional licensing boards, may serve subpoenas on Bank of America as part of administrative proceedings. These may involve investigations related to licensing, disciplinary actions, or other regulatory matters. 5. Grand Jury Subpoena: A grand jury, empowered to conduct investigations or determine whether criminal charges should be filed, can serve a subpoena on Bank of America for documents or witness testimony in order to gather evidence. When serving a subpoena on Bank of America, it is crucial to comply with legal procedures and requirements. The subpoena should be properly drafted, clearly stating the specific documents or information being sought. It must then be served by an authorized individual, such as a process server, to Bank of America's registered agent or a designated representative. In summary, serving a subpoena on Bank of America involves issuing a legal document demanding the bank's cooperation in providing relevant documents, records, or testimony for use in legal proceedings. Various types of subpoenas, including civil, criminal, regulatory, administrative, and grand jury subpoenas, can be issued depending on the nature of the case or investigation. Proper adherence to legal procedures is essential to ensure the validity and effectiveness of the subpoena.

Serve Subpoena On Bank Of America

Description

How to fill out Serve Subpoena On Bank Of America?

Handling legal documents and procedures can be a lengthy addition to your overall day.

Issuing Subpoena On Bank Of America and similar forms typically necessitate that you search for them and find a way to fill them out correctly.

Consequently, whether you are managing financial, legal, or personal issues, having a comprehensive and user-friendly web library of forms readily available will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific forms and various resources to help you tackle your paperwork effortlessly.

Is this your first experience with US Legal Forms? Register and create an account in a matter of minutes, and you will gain access to the form library and Serve Subpoena On Bank Of America. After that, follow the steps below to finish your form.

- Explore the collection of relevant documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes with a high-quality service that enables you to compile any form within minutes without hidden fees.

- Simply Log In to your account, locate Serve Subpoena On Bank Of America, and obtain it immediately from the My documents section.

- You can also revisit previously downloaded forms.

Form popularity

FAQ

The mailing address for credit card payments varies based on the issuing bank or financial institution. For Bank of America, the address you should use will depend on whether you are sending a payment or an inquiry. To make sure your communication is directed to the right location, visit their official website or contact customer service. If you need to serve subpoena on Bank of America regarding credit accounts, ensuring you have the correct address is essential for legal compliance.

A subpoena for bank records is typically referred to as a subpoena duces tecum. This legal document requires a bank, such as Bank of America, to produce documents or records relevant to a legal investigation. To effectively serve a subpoena on Bank of America, you must ensure that the document complies with state laws and regulations. Utilizing platforms like US Legal Forms can help you draft an appropriate subpoena and guide you through the serving process.

The legal address for Bank of America is crucial when you want to serve a subpoena on them. Typically, this address is used for legal correspondence and should be accurate. By using services such as USLegalForms, you can easily obtain the correct legal address and streamline the process of serving documents to Bank of America.

Yes, you can serve a subpoena on Bank of America to access credit card records in a legal matter. These records can provide essential insights when building a case. To serve a subpoena on Bank of America efficiently, consider using a reliable service like USLegalForms, which simplifies the process and ensures compliance with legal requirements.

To stop a subpoena for bank records, you may file a motion to quash the subpoena with the appropriate court. This legal motion challenges the validity of the subpoena and can prevent Bank of America from disclosing the requested documents. Providing valid reasons, such as privacy concerns or lack of relevance, strengthens your case. Consulting legal platforms like US Legal Forms can guide you through the process of filing such motions, ensuring you understand your rights.

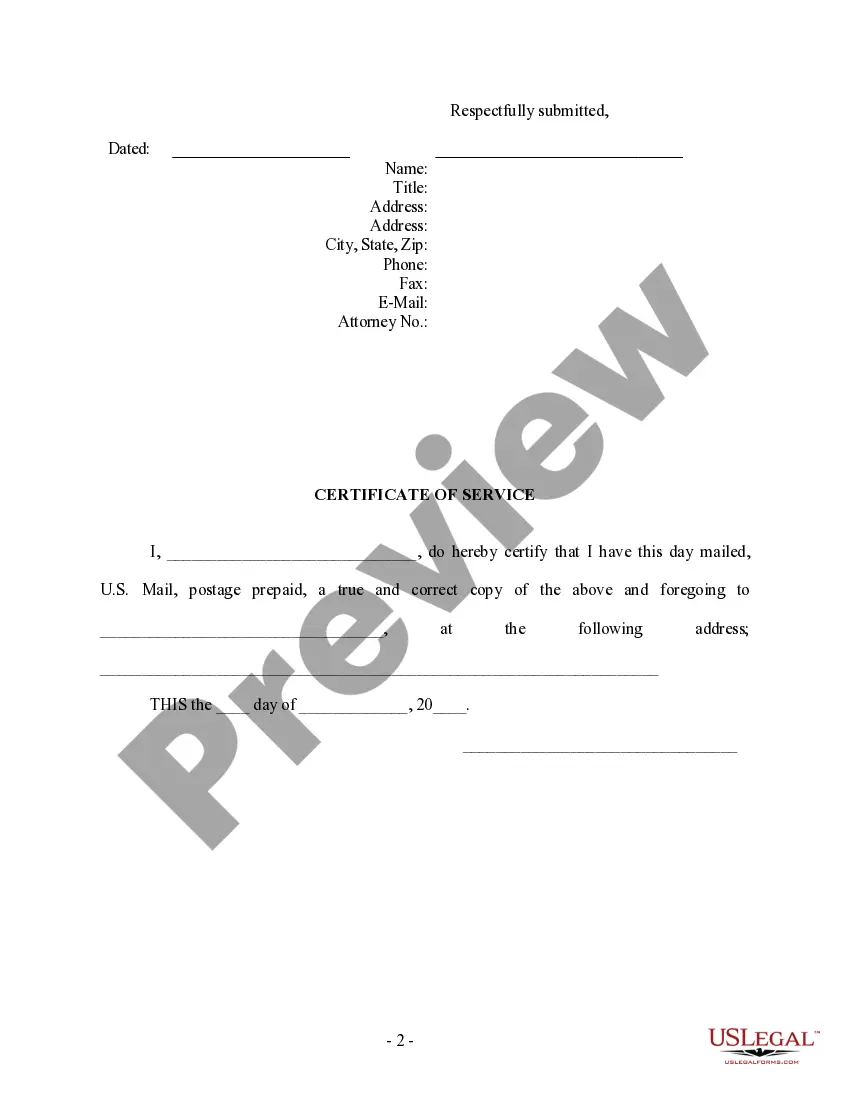

To send a subpoena to Bank of America, begin by preparing the subpoena document with all required information. You can deliver the subpoena in person or by postal service, ensuring you keep proof of delivery. It's essential to include specific language in the subpoena, especially if you need particular documents or transcripts. If you feel unsure, services like US Legal Forms offer reliable resources to help you draft and send your subpoena effectively.

To serve a subpoena on Bank of America, you must follow the proper legal procedures. Usually, you either deliver the subpoena directly to the bank’s local branch or send it via certified mail. Ensure that you include all pertinent details such as case number and recipient’s name to avoid delays. Using platforms like US Legal Forms can simplify this process, providing templates and guidance to help you navigate serving a subpoena correctly.

A subpoena for bank records is often referred to as a bank subpoena. When you serve a subpoena on Bank of America, it compels the bank to provide specific financial records relevant to a legal case. This legal document ensures that the necessary information can be obtained for proceedings, whether civil or criminal. Understanding the terminology helps streamline the process of serving a subpoena effectively.

Typically, a bank has a specified period, often around 14 to 30 days, to comply with a subpoena after receiving it. This timeframe can vary based on the jurisdiction and the specific requirements outlined in the subpoena. Prompt compliance is crucial to avoid further legal complications. You can improve your understanding of these timelines by referencing legal forms from UsLegalForms.

Yes, your bank records can be subpoenaed without your prior knowledge, particularly in legal investigations. This means that the bank may provide your records to the requesting party or court without notifying you. Understanding your rights regarding privacy and the limitations on bank disclosures can be helpful. Always consider consulting a legal expert if you have concerns.