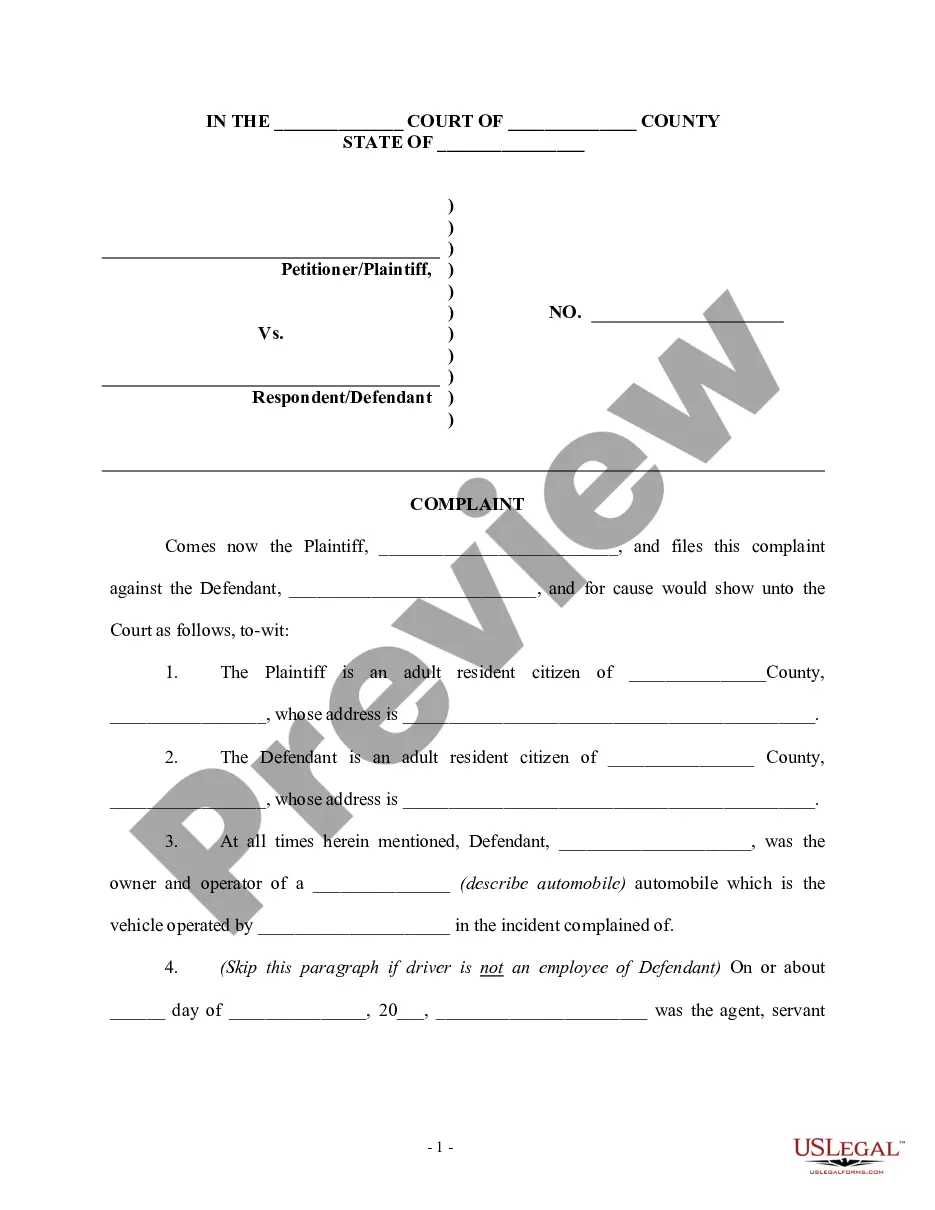

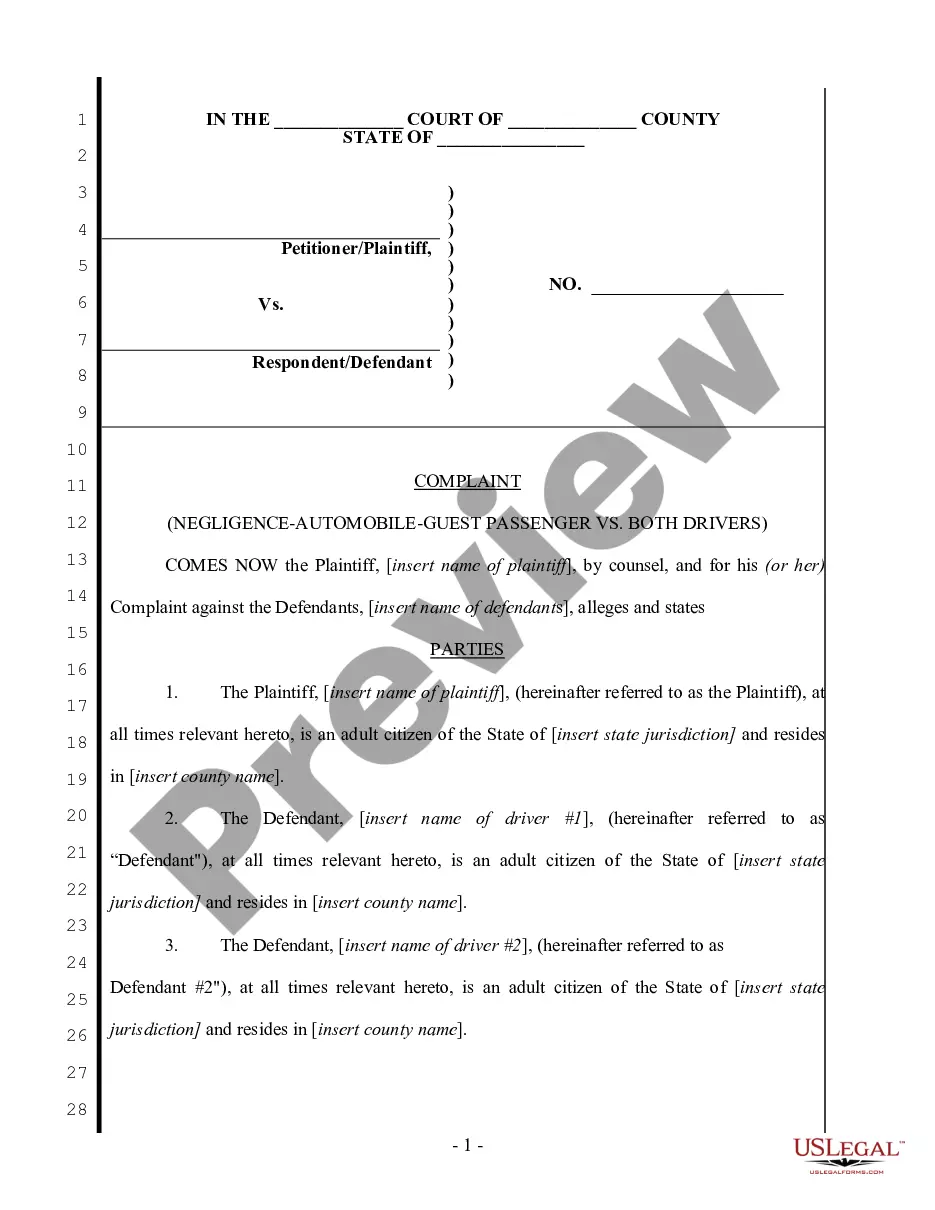

Regarding Auto Accident For Insurance

Description

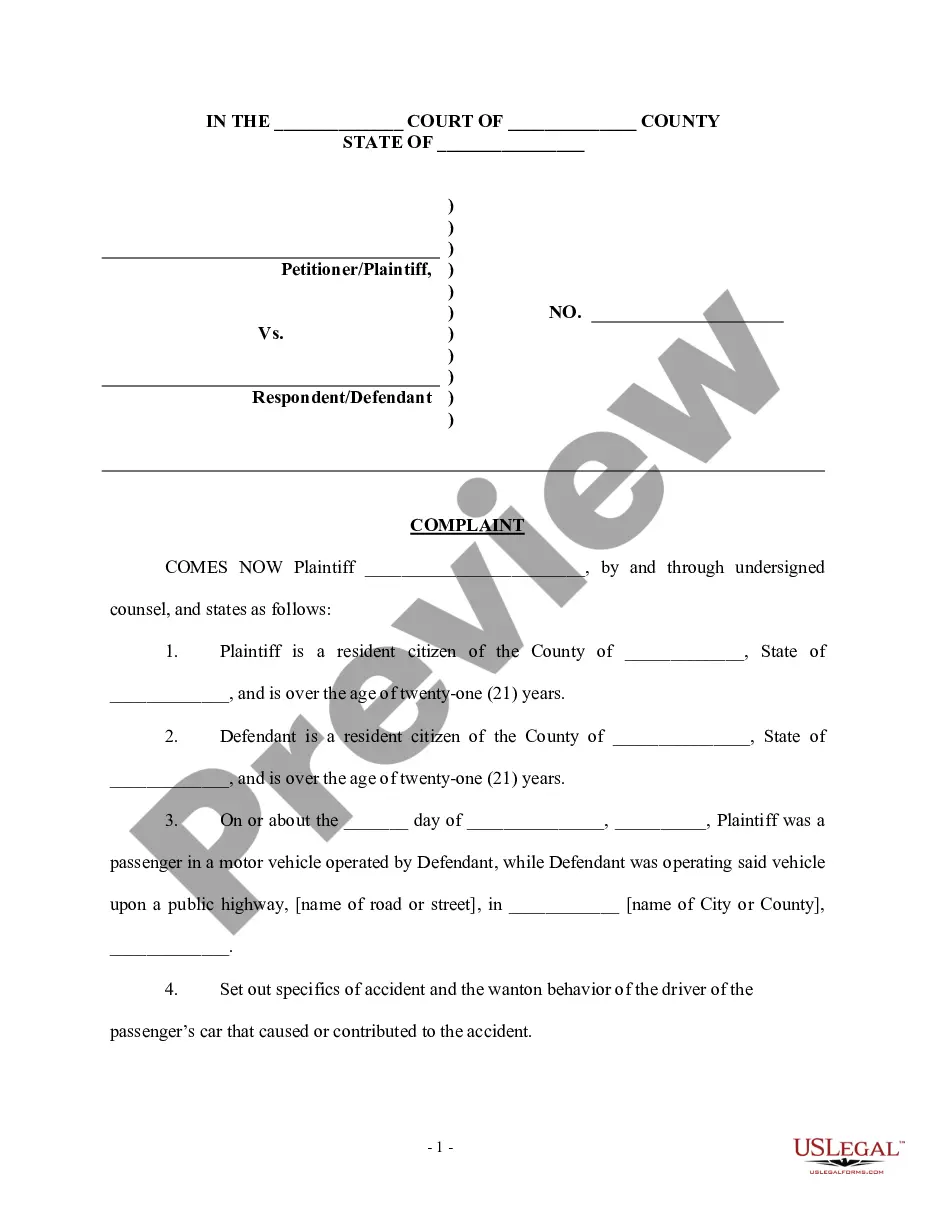

How to fill out Complaint Regarding Auto Accident (Guest Passenger Vs Defendant Driver)?

- Log in to your US Legal Forms account if you’ve used the service before. Ensure your subscription is active; if not, renew it according to your plan.

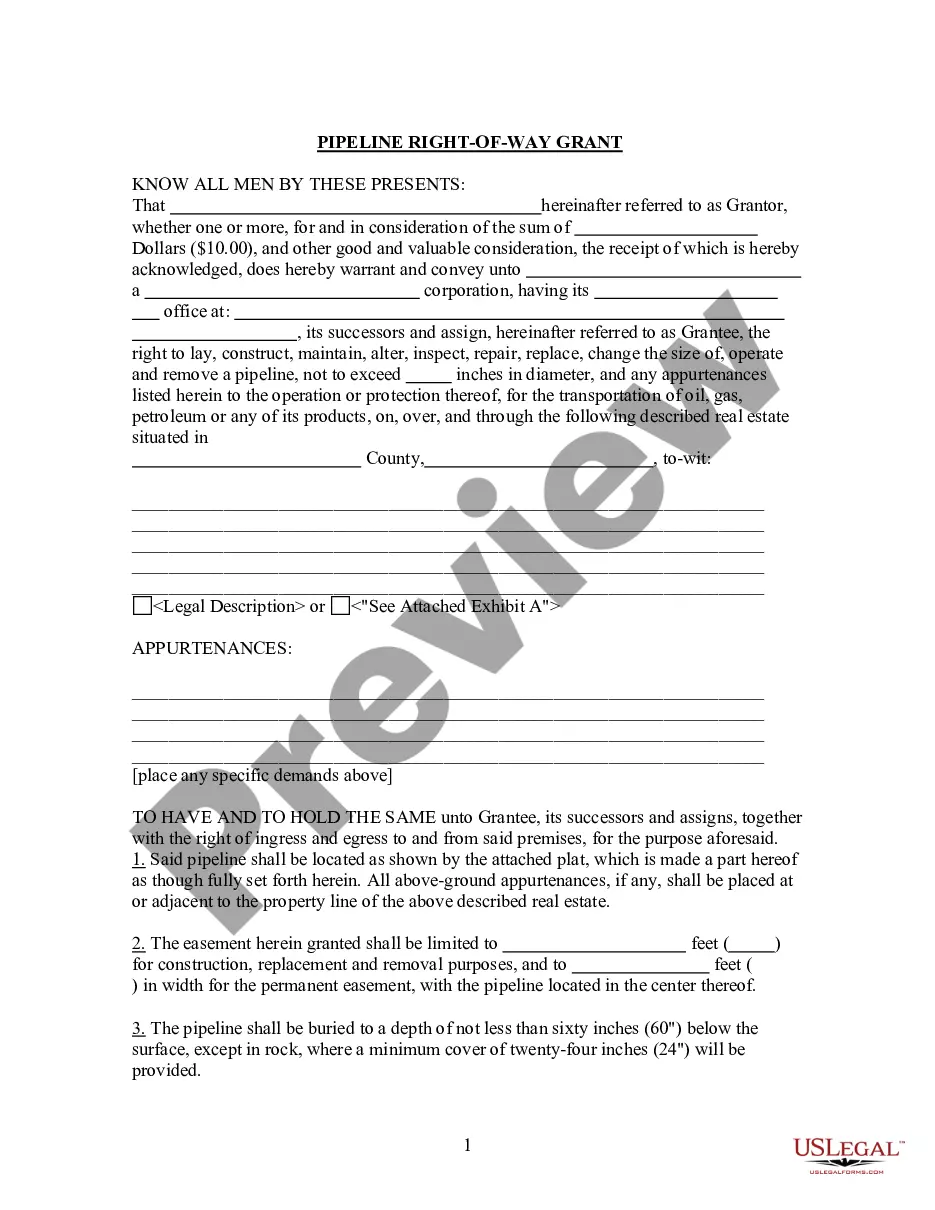

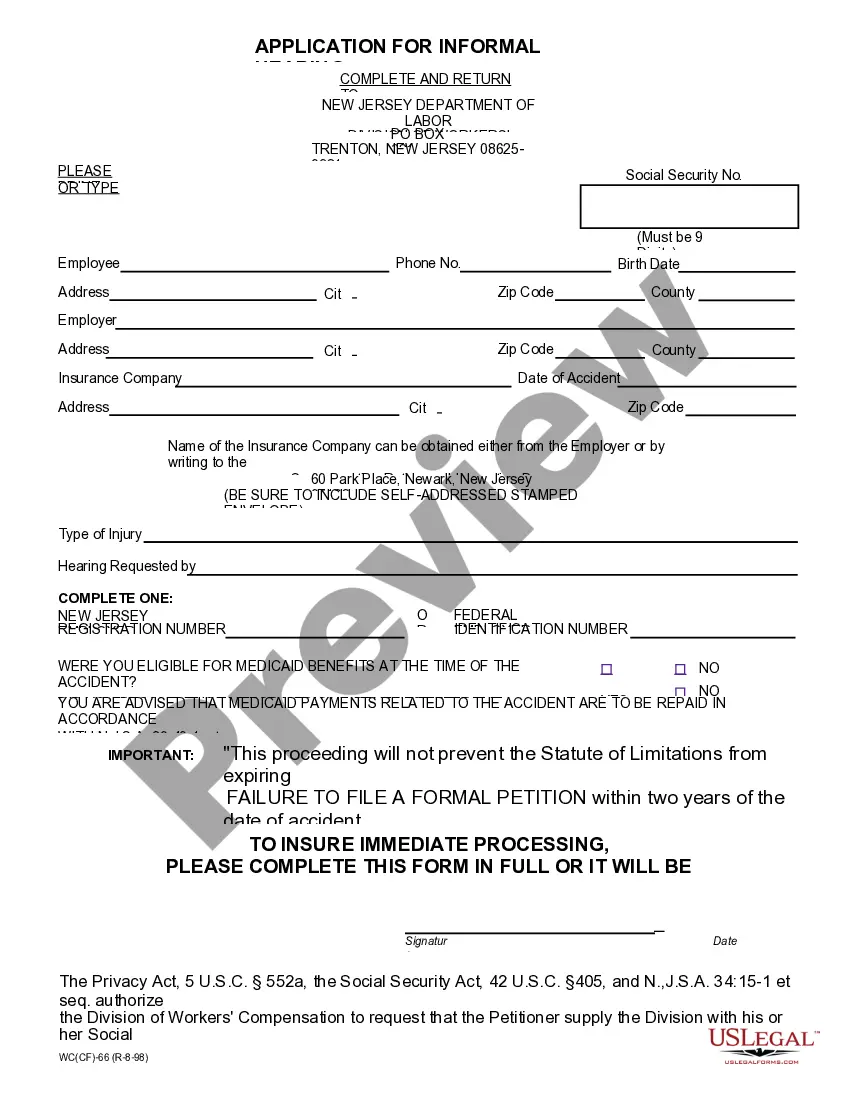

- If you're a new user, start by reviewing the available templates. Preview the description to select the form necessary for your auto accident insurance needs.

- If the right template is not found, utilize the Search tab to explore additional options that meet your specifications.

- Once you find the correct document, proceed to purchase it by clicking the 'Buy Now' button and selecting your preferred subscription plan.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Download the completed form to your device. You'll also find it at any time in the 'My Forms' section of your profile for future use.

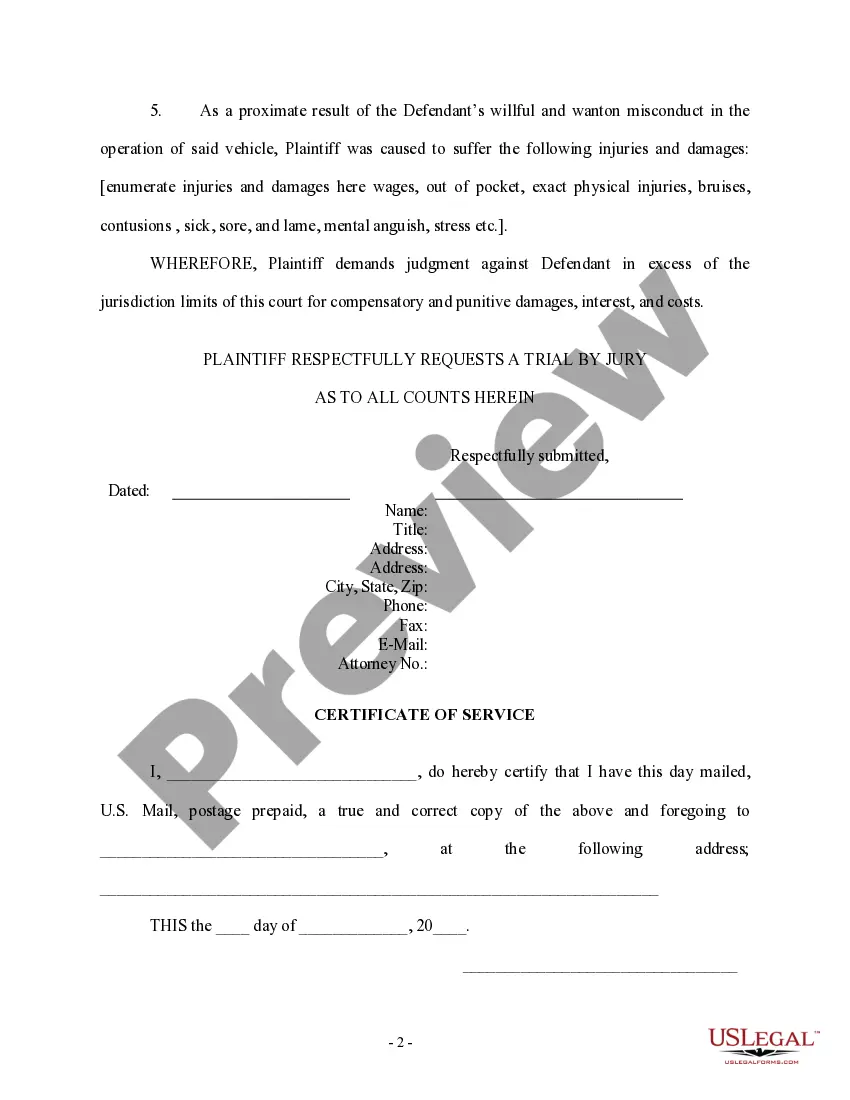

In conclusion, US Legal Forms simplifies the process of securing essential legal documents with a wide array of options tailored to individual needs. With expert assistance available, you can ensure your forms are filled out correctly and meet all legal standards.

Take control of your legal needs today and explore the extensive resources available at US Legal Forms!

Form popularity

FAQ

It’s essential not to provide personal opinions, exaggerate damages, or make assumptions about fault when speaking to insurance adjusters. Your conversations should focus on verifiable details and facts surrounding the accident. This approach protects your interests and maintains the credibility of your claim. Always be cautious, particularly regarding auto accident for insurance, to ensure your rights remain safeguarded.

After an accident, avoid discussing your injuries in detail, admitting fault, or expressing opinions about the accident’s cause. Such statements can jeopardize your claim and its evaluation process. Stick to the facts of the event to maintain your case's integrity. Always remember, regarding auto accident for insurance, careful communication is paramount.

In California, you should report an auto accident to your insurance as soon as possible, ideally within 24 hours. Delaying the report could result in complications or even denial of your claim. Check your policy for specific deadlines, as they can vary. Taking prompt action regarding auto accident for insurance can significantly influence the outcome.

Common red flags include inconsistent statements, lack of evidence, and claims that seem exaggerated. Insurers scrutinize these factors closely for potential fraud or misrepresentation. To navigate concerns, ensure your documentation is thorough and consistent. This attention to detail is crucial, especially regarding auto accident for insurance.

When filing a claim, you should focus on clear, factual statements about the accident. Avoid admitting fault, making emotional statements, or discussing speculative details. Keeping your communication straightforward helps maintain clarity. Remember, regarding auto accident for insurance, precise information benefits your claim process.

Yes, it's wise to inform your insurer about even a minor accident. Small accidents can sometimes lead to unforeseen complications or disputes later on. Reporting helps maintain transparency with your insurance company and can protect you if the other party files a claim. Remember, clarity is crucial in any situation regarding auto accidents for insurance.

Filing a claim with your insurance is usually more straightforward in the immediate aftermath of an accident. Your insurer can handle the complexities of the claim, often leading to quicker resolution. On the other hand, filing through the at-fault party's insurer may save you from potential higher premiums. Usually, the best option depends on your specific circumstances regarding auto accidents for insurance.

While you may not be legally required to report an accident not at fault, it's often in your best interest to do so. Reporting helps establish your position and clarifies the situation with your insurer. They can advocate on your behalf when you file a claim against the at-fault driver's policy. This can streamline the process regarding auto accidents for insurance.

Yes, it's advisable to report an accident that wasn't your fault to your insurer. Informing them allows for accurate reporting and ensures your policy remains up to date. They can offer support and guidance on how to navigate claims from the other party's insurance. Doing this helps you protect your rights and interests regarding auto accidents for insurance.

If the accident is not your fault, your insurance will typically handle your immediate claims, but you may need to seek reimbursement from the at-fault party's insurer. The process can involve documenting the accident and communicating with both insurance companies. Knowing the specifics about claims related to your injury and vehicle damage is vital. Always keep detailed records to help support your case regarding auto accidents for insurance.