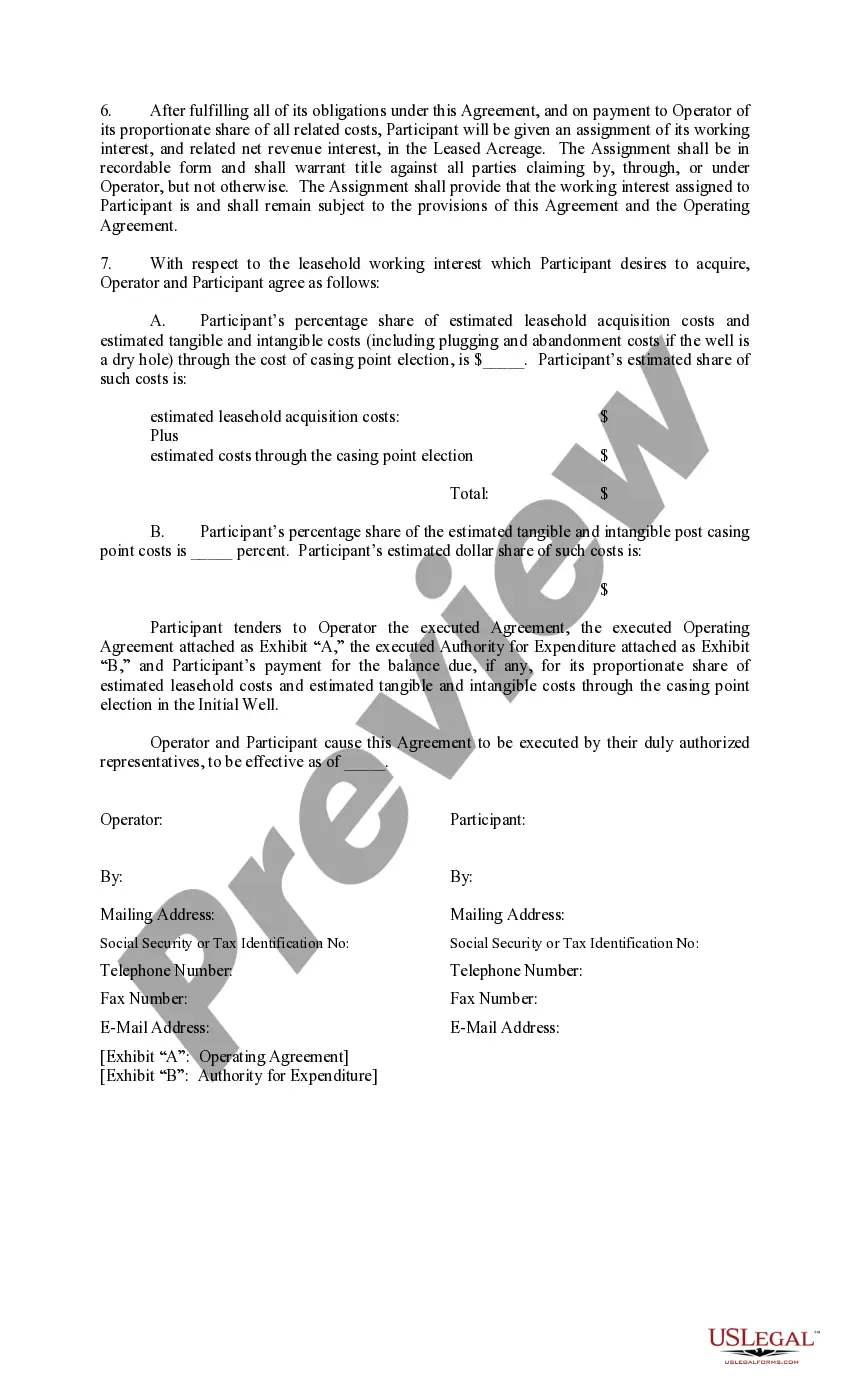

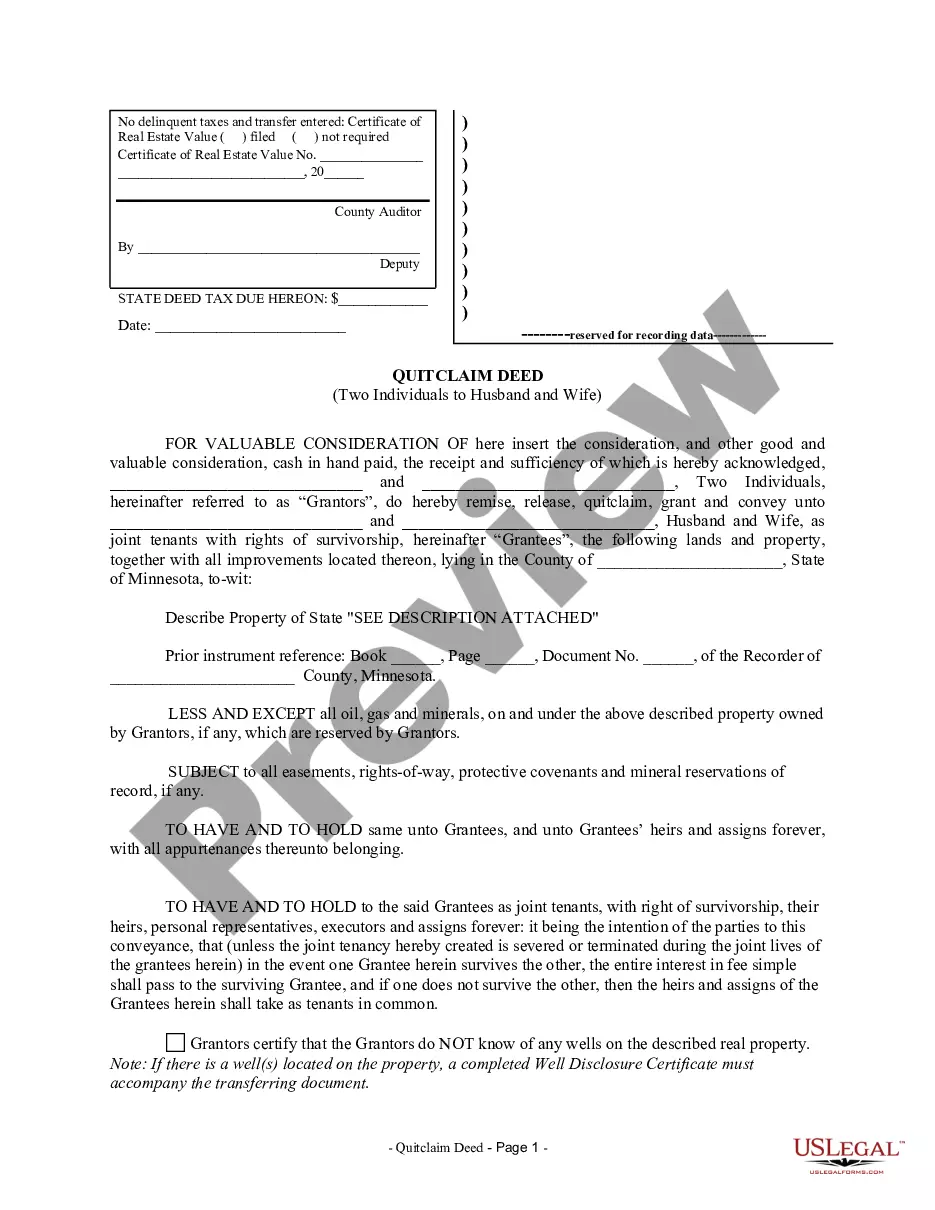

5013c Participating Agreement Form

Description

How to fill out Participation Agreement For Single Well?

What is the most dependable service to obtain the 5013c Participating Agreement Form and other updated versions of legal documentation.

US Legal Forms is the answer! It's the largest assortment of legal documents for any purpose. Each template is properly drafted and verified for adherence to federal and local laws and regulations.

US Legal Forms is an ideal solution for anyone who needs assistance with legal documentation. Premium users can enjoy even more benefits as they can fill out and authorize previously saved documents electronically at any time using the built-in PDF editing tool. Try it out today!

- They are organized by category and state of application, making it effortless to find the one you require.

- Experienced users of the website only need to Log In to the system, verify if their subscription is active, and click the Download button next to the 5013c Participating Agreement Form to obtain it.

- Once saved, the template is accessible for future use within the My documents section of your profile.

- If you have not created an account with us yet, here are the steps you need to follow to sign up.

Form popularity

FAQ

For example, a section 501(c)(3) organization may not publish or distribute printed statements or make oral statements on behalf of, or in opposition to, a candidate for public office. Consequently, a written or oral endorsement of a candidate is strictly forbidden.

Here's how you can fill out the Form W-9 for Nonprofits:Step #1: Write your corporation name.Step #2: Enter your business name.Step #3: Know your entity type.Step #4: Your exempt payee code.Step #5: Give your mailing address.Step #6: List account numbers.Step #7: Taxpayer Identification Number (TIN)More items...?

Here's how you can fill out the Form W-9 for Nonprofits:Step #1: Write your corporation name.Step #2: Enter your business name.Step #3: Know your entity type.Step #4: Your exempt payee code.Step #5: Give your mailing address.Step #6: List account numbers.Step #7: Taxpayer Identification Number (TIN)More items...?

Even though nonprofits are exempt from income tax and not subject to withholding taxes, you must fill out and issue Form W-9 to the requesting business entities. In fact, all nonprofits must submit this form in order to be eligible for the tax-exempt status.

Even though your nonprofit has tax-exempt status, you may need to fill out a W-9 when working with other businesses. by Jane Haskins, Esq. If your nonprofit corporation provides services to another business, you may be asked to fill out a W-9 form (Request for Taxpayer Identification Number and Certification).