Unsecured Payment Rate With 700 Credit Score

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive research and considerable financial investment.

If you’re seeking a simpler and more cost-effective method for crafting Unsecured Payment Rate With 700 Credit Score or any other documents without the hassle of bureaucratic procedures, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal issues. With just a few clicks, you can quickly access state- and county-specific forms meticulously prepared for you by our legal professionals.

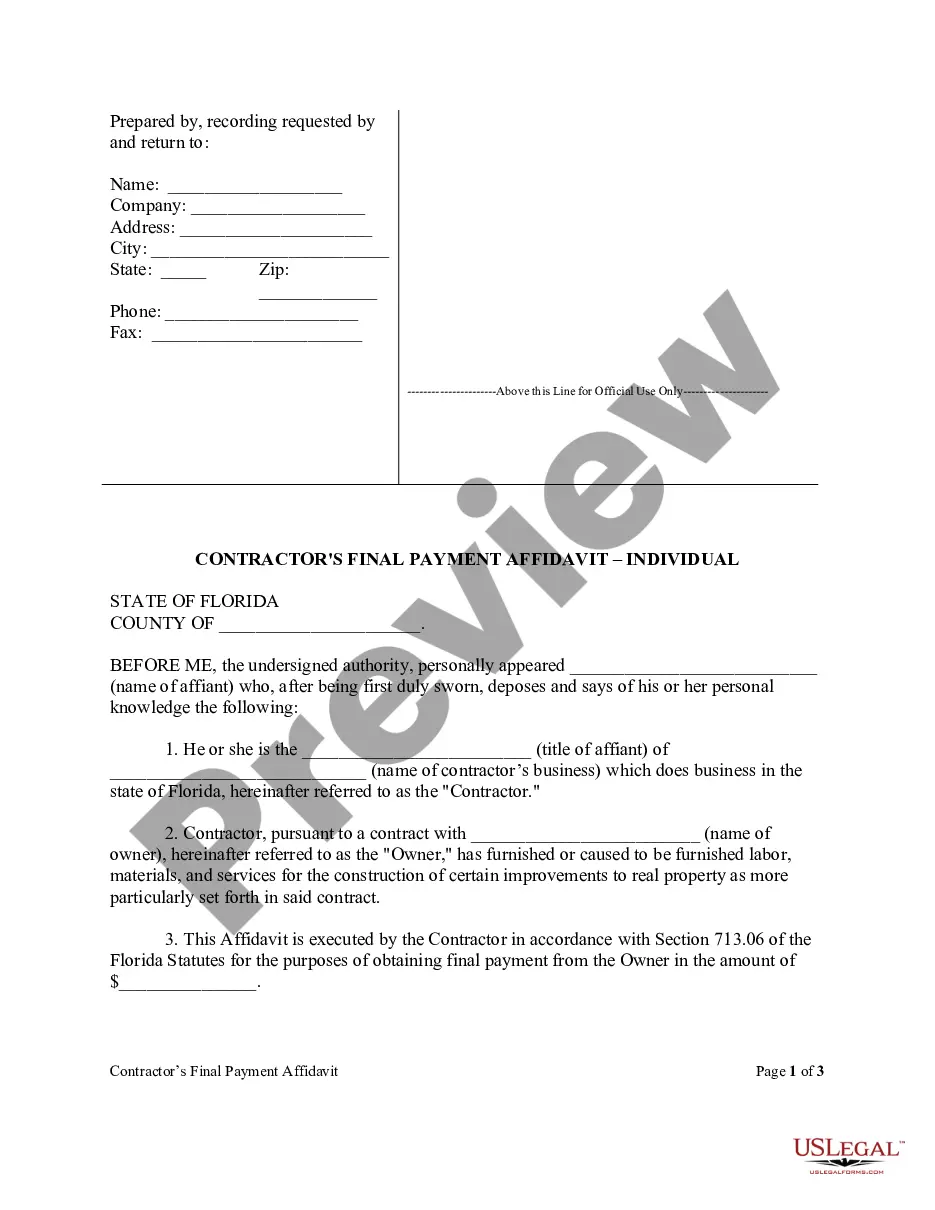

Review the form's preview and descriptions to ensure that you are accessing the correct form. Confirm that the form you choose meets the standards of your state and county. Select the most appropriate subscription plan to obtain the Unsecured Payment Rate With 700 Credit Score. Download the form. Then fill it out, authenticate it, and print it.

- Utilize our platform whenever you require a reliable and trustworthy service through which you can swiftly find and download the Unsecured Payment Rate With 700 Credit Score.

- If you’re familiar with our services and have previously established an account, simply Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Not registered yet? No worries. Registering takes only a few minutes and allows you to browse the catalog.

- However, before diving right into downloading Unsecured Payment Rate With 700 Credit Score, heed these suggestions.

Form popularity

FAQ

Lower Interest Rates This rate dictates the price at which banks can borrow money from the government. Borrowers with a credit score of 700 or higher tend to be offered rates closer to Federal Reserve rates. Therefore, typically, the higher your credit score, the less you pay on debt expenditures.

You need a credit score of 600 or above to qualify for a $5,000 personal loan in most cases. Other common requirements for a $5,000 loan include being at least 18 years old, having enough income to afford the monthly payments, and owning a valid bank account.

What credit score is needed to get a high-limit credit card? VantageScore 3.0 credit score rangeAverage credit card limit300?640$3,481.02640?700$4,735.10700?750$5,968.01750+$8,954.33

A Higher FICO Score Saves You Money 700-7597.64 %680-6997.817 %660-6798.031 %640-6598.461 %620-6399.007 %3 more rows

What Does a 700 Credit Score Get You? Type of CreditDo You Qualify?Personal LoanYESAuto LoanYESNo Annual Fee Credit CardYESCredit Card with RewardsYES2 more rows