Amount Court With No Contract

Description

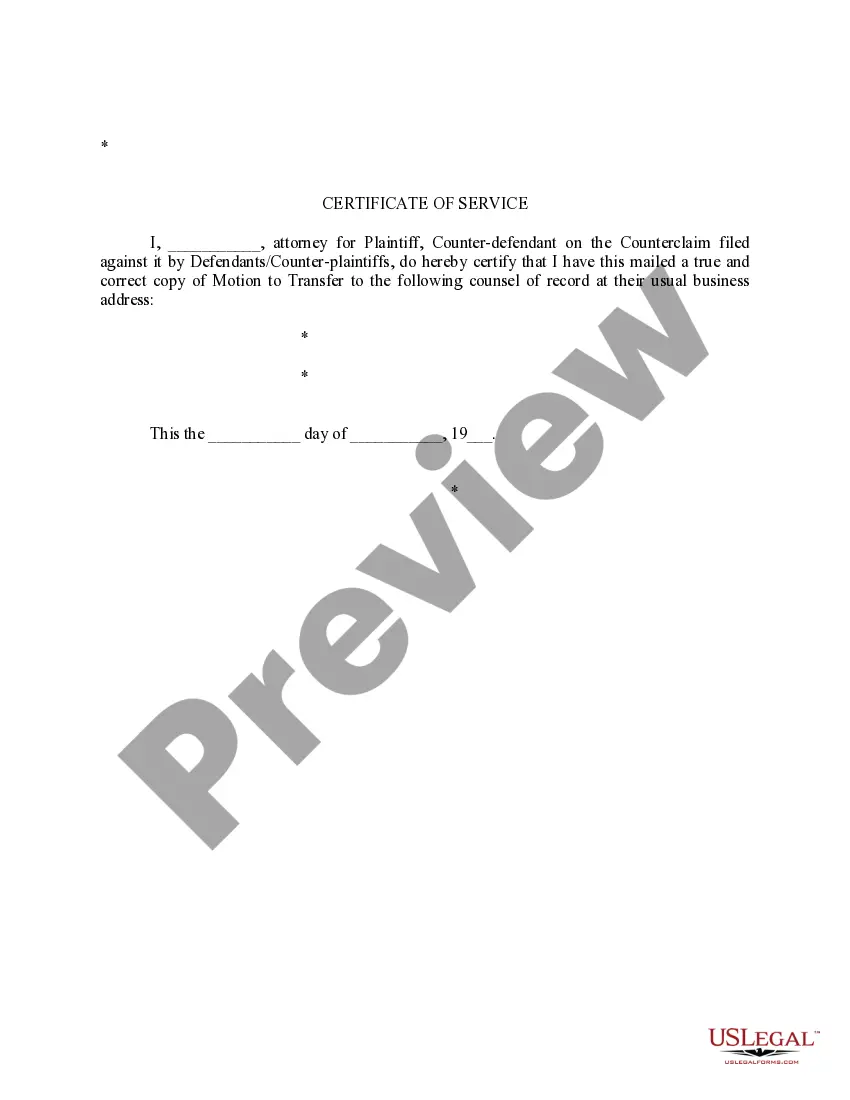

How to fill out Motion To Transfer For Amount In Excess Of Court's Jurisdiction?

Creating legal documents from the ground up can occasionally be daunting.

Certain cases may require extensive research and significant financial investment.

If you're seeking a simpler and more affordable method for preparing Amount Court With No Contract or any other forms without unnecessary obstacles, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

However, before diving directly into downloading Amount Court With No Contract, keep these tips in mind: Review the form preview and descriptions to ensure that you are on the correct document. Verify if the template you select meets the requirements of your state and county. Choose the most appropriate subscription plan to purchase the Amount Court With No Contract. Download the form, then complete, sign, and print it out. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us now and simplify your form execution process!

- With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously crafted by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services through which you can easily find and download the Amount Court With No Contract.

- If you’re already familiar with our website and have set up an account, simply Log In to your account, locate the form, and download it instantly or re-download it at any later time in the My documents section.

- Don't have an account? No problem. Registering takes only a few minutes, allowing you to navigate the library.

Form popularity

FAQ

Arizona law does not restrict the number or type of partners. A corporation or other business entity may be a partner. The partnership is liable for the acts of each partner in the ordinary course of business, and each partner is jointly and severally liable for all obligations of the partnership.

Is an Operating Agreement required for an LLC in Arizona? As per Section 29-3105 of the Arizona LLC Act, an Operating Agreement isn't required for an LLC in Arizona. But while it's not required in Arizona to conduct business, we strongly recommend having an Operating Agreement for your LLC.

FL-165 REQUEST TO ENTER DEFAULT (Family Law?Uniform Parentage) Page 1. Form Adopted for Mandatory Use. Judicial Council of California.

Phoenix, AZ 85038-9085. Arizona Department of Revenue, P.O. Box 29079, Phoenix, AZ 85038-9079.

Beginning in 2023, Arizona is doing away with a progressive tax system and instead applying a flat tax rate of 2.5% on taxable income. This tax rate will apply to income earned throughout 2023 that is reported on returns filed in 2024.

A. Except as provided in subsections B and C of this section, every partnership shall make a return for each taxable year, stating the taxable income computed in ance with subtitle A, chapter 1, subchapter K of the internal revenue code and any adjustments required pursuant to chapter 14 of this title.

This form is an information return. The penalty for failing to file, filing late (including extensions) or filing an incomplete information return is $100 for each month, or fraction of a month that the failure continues, up to a maximum penalty of $500.

File Arizona Form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an Arizona Partnership Income Tax Return.