Writer Forward Contract

Description

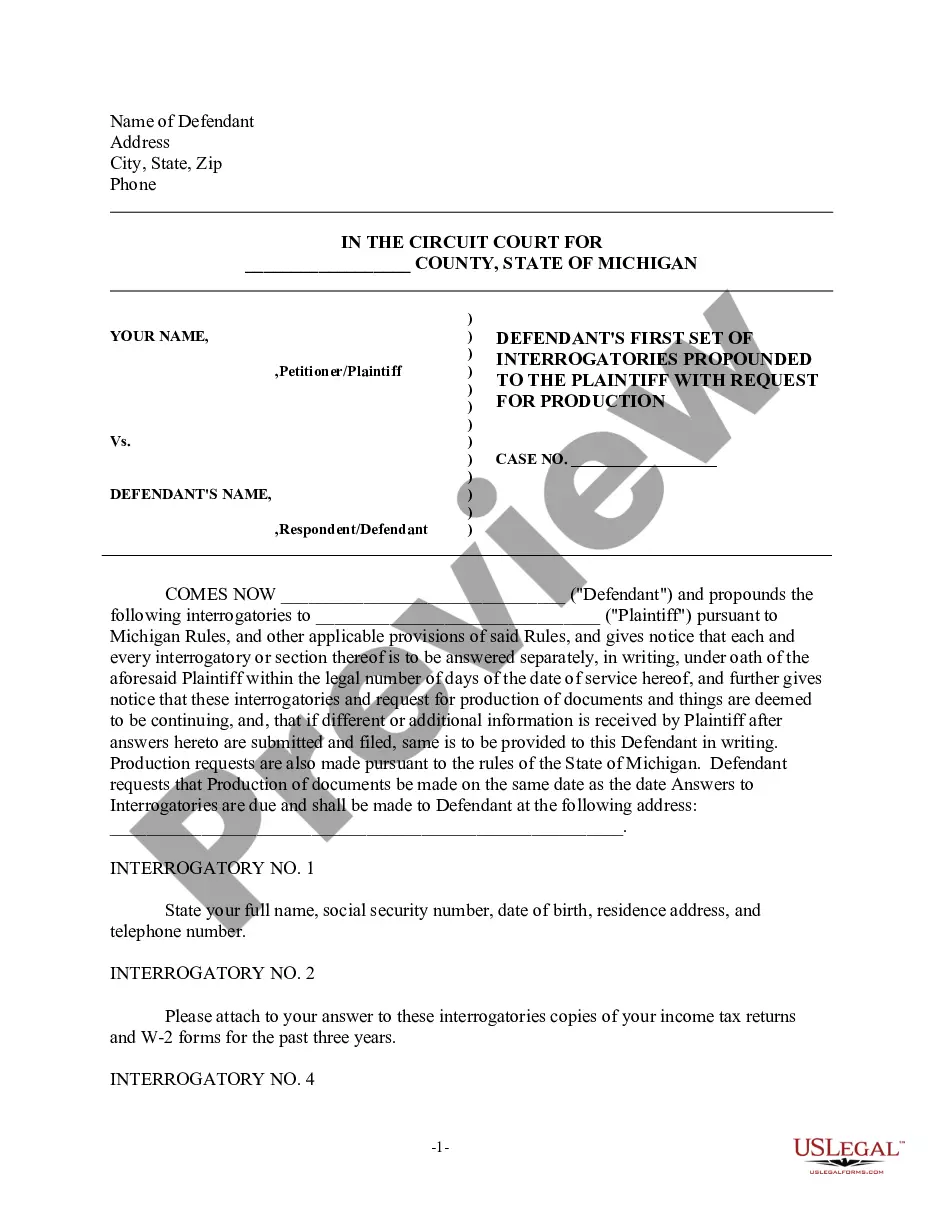

How to fill out Writers Guild Of America - Television Short Form Contract Writers Lending Agreement - For Movies Of The Week And Mini-Series?

Bureaucracy necessitates exactness and meticulousness.

Unless you manage document preparation like Writer Forward Contract on a regular basis, it might lead to some bewilderment.

Selecting the correct template from the outset will guarantee that your document submission will proceed seamlessly and avert any issues of resubmitting a file or repeating the entire work from the beginning.

If you are not a subscribed user, locating the desired template may require a few additional steps.

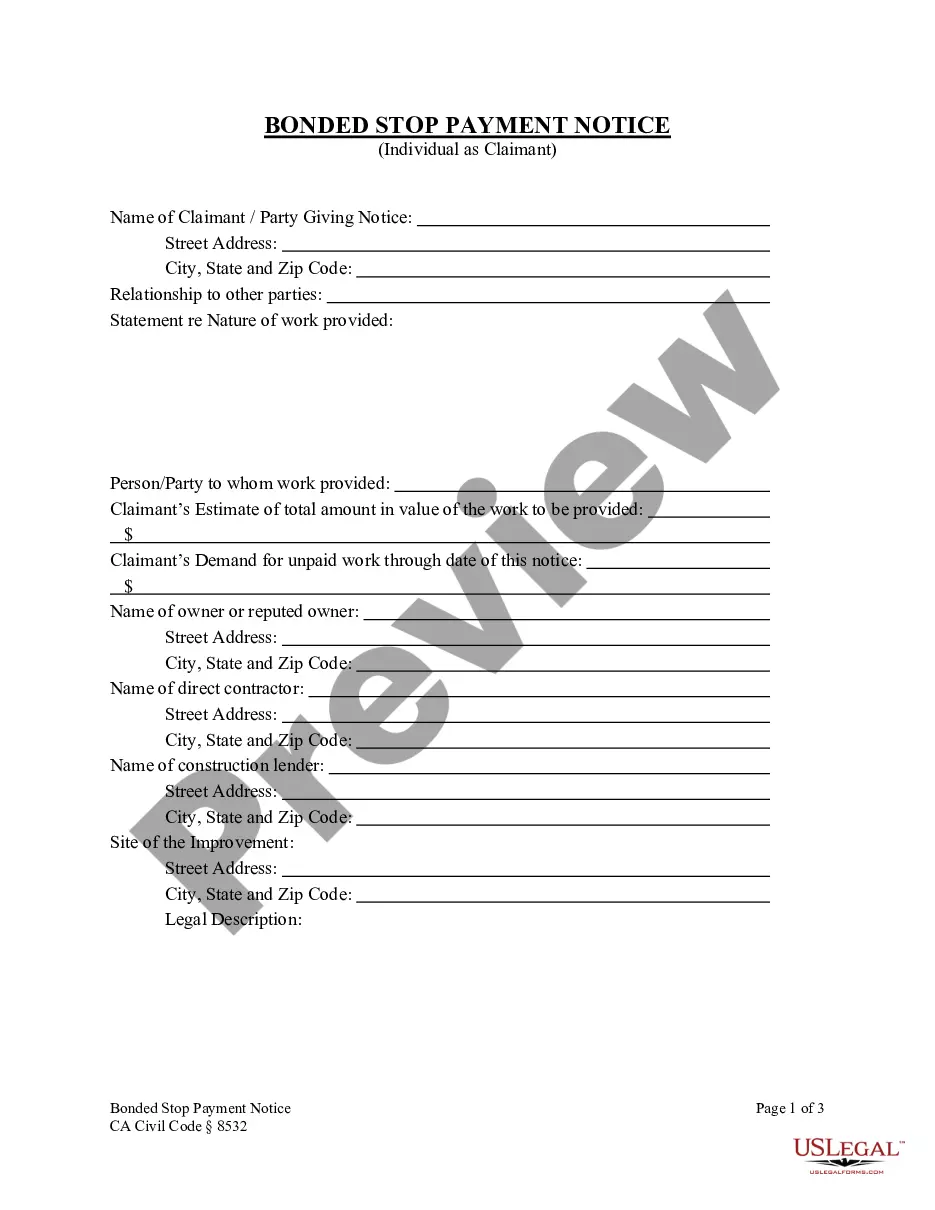

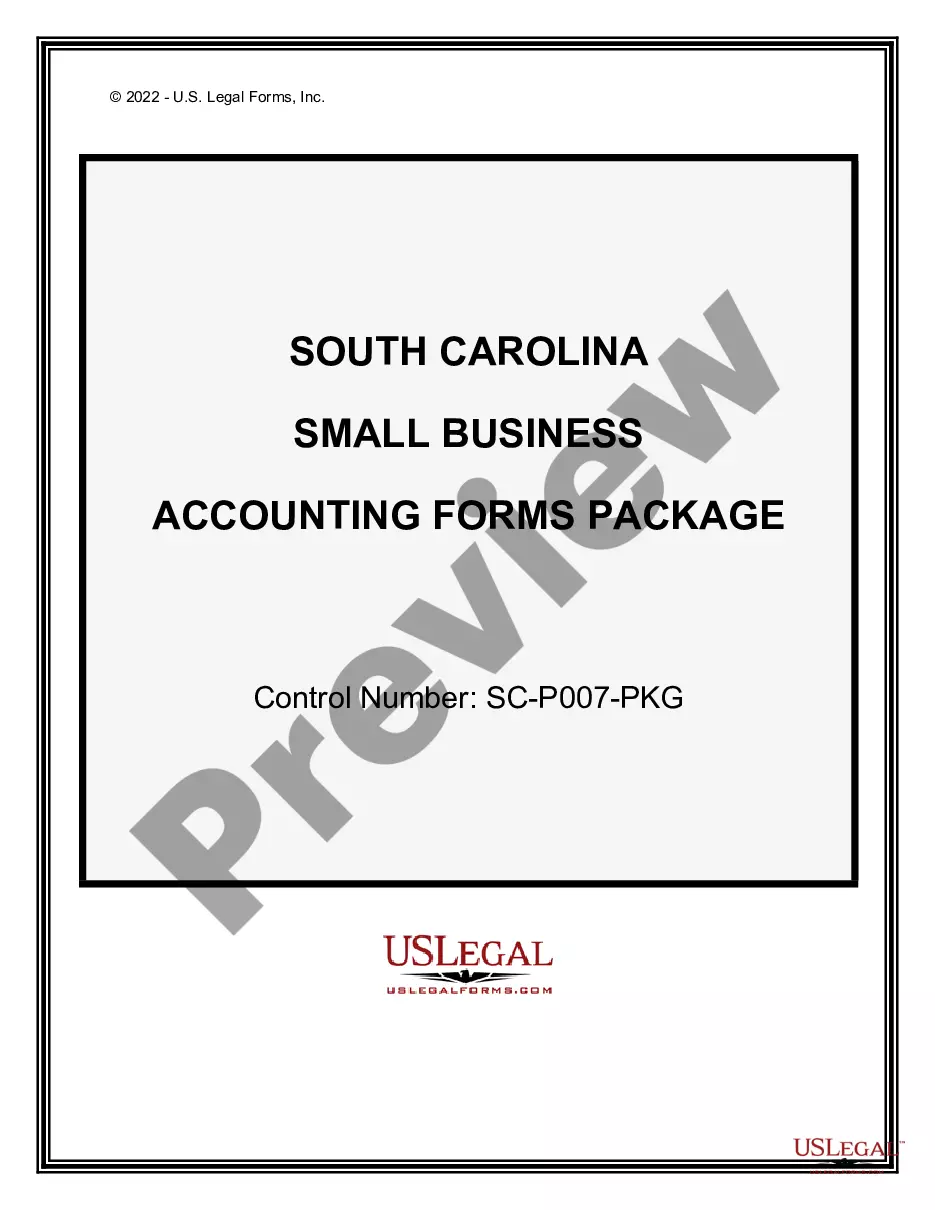

- You can always locate the suitable template for your documents in US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85 thousand samples for various fields.

- You can acquire the latest and most suitable version of the Writer Forward Contract by merely exploring it on the site.

- Find, store, and save templates in your profile or consult the description to confirm you have the correct one readily available.

- With an account at US Legal Forms, it is straightforward to obtain, store in one location, and navigate through the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Next, proceed to the My documents page, where your document list is maintained.

- Review the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

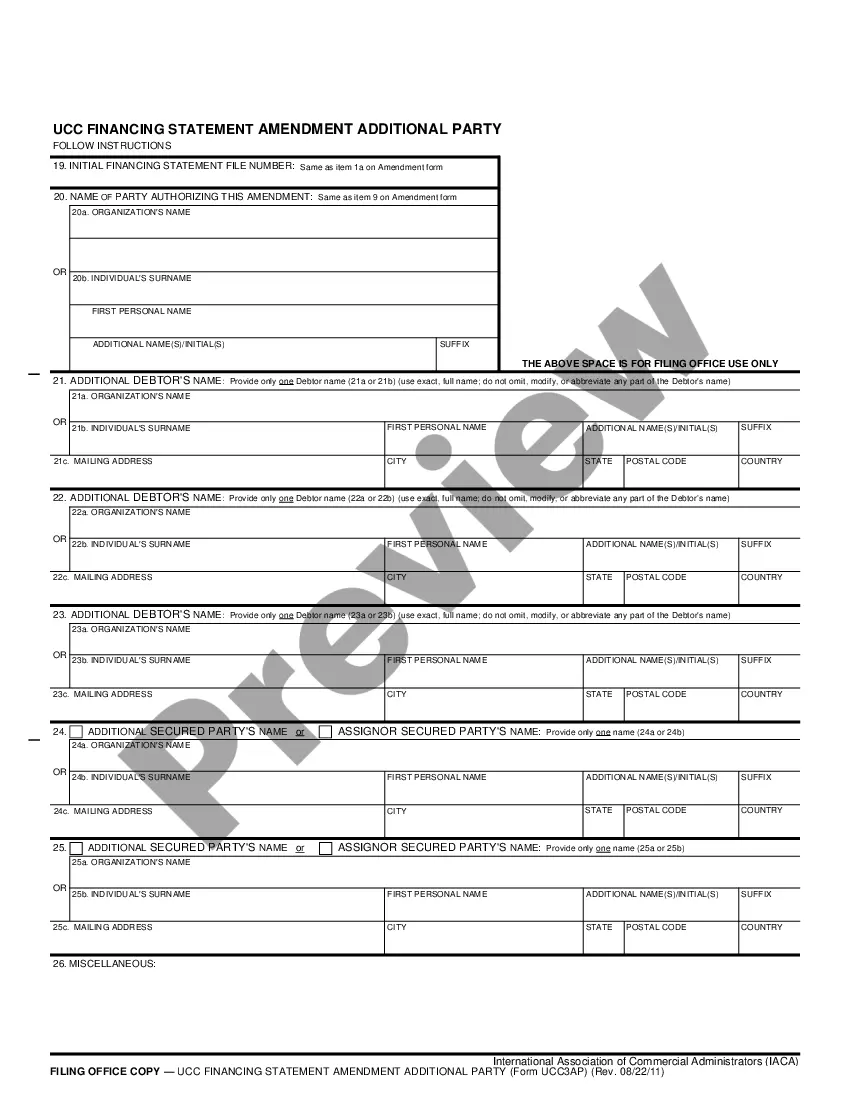

A forward contract, as stated, is a contract between two parties for the sale/delivery of a fixed amount of a commodity or asset at a future date for a set price. The value of the contract is set and the transaction is settled between the two parties. The value of a forward contract at initial negotiation is zero.

In a forward contract, the buyer and seller agree to buy or sell an underlying asset at a price they both agree on at an established future date. This price is called the forward price. This price is calculated using the spot price and the risk-free rate. The former refers to an asset's current market price.

Forward contracts can involve the exchange of foreign currency and other goods, not just commodities. For example, if oil is trading at $50 a barrel, the company might sign a forward contract with its supplier to buy 10,000 barrels of oil at $55 each every month for the next year.

Forward price = spot price 2212 cost of carry. The future value of that asset's dividends (this could also be coupons from bonds, monthly rent from a house, fruit from a crop, etc.) is calculated using the risk-free force of interest.

A synthetic forward contract uses call and put options with the same strike price and time to expiry to create an offsetting forward position. An investor can buy/sell a call option and sell/buy a put option with the same strike price and expiration date with the intent being to mimic a regular forward contract.