Self Employed Contractors For Universal Credit

Description

How to fill out Self-Employed Part Time Employee Contract?

Getting a go-to place to access the most current and appropriate legal templates is half the struggle of working with bureaucracy. Choosing the right legal documents calls for accuracy and attention to detail, which is why it is crucial to take samples of Self Employed Contractors For Universal Credit only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the details about the document’s use and relevance for your circumstances and in your state or county.

Consider the listed steps to finish your Self Employed Contractors For Universal Credit:

- Use the catalog navigation or search field to locate your template.

- View the form’s information to see if it suits the requirements of your state and region.

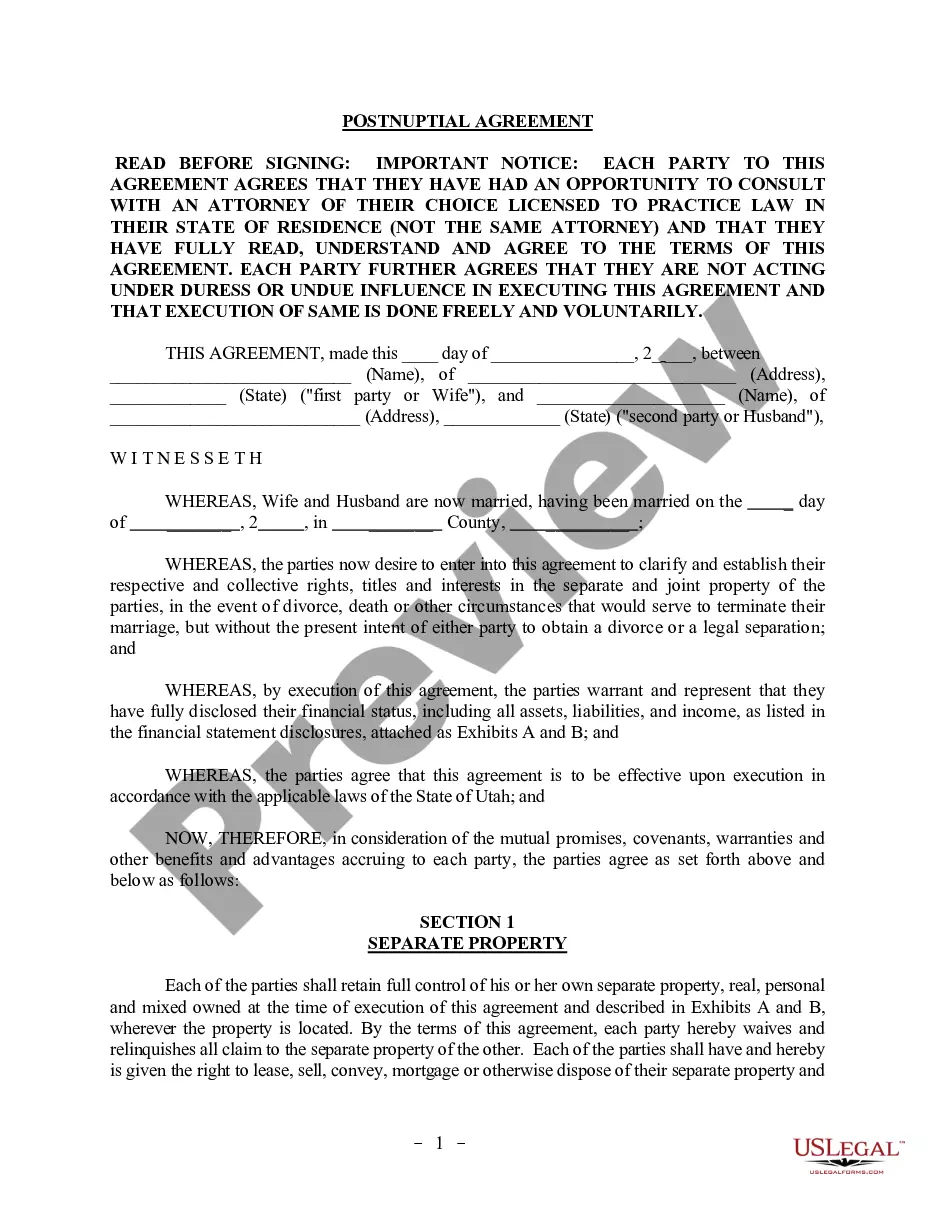

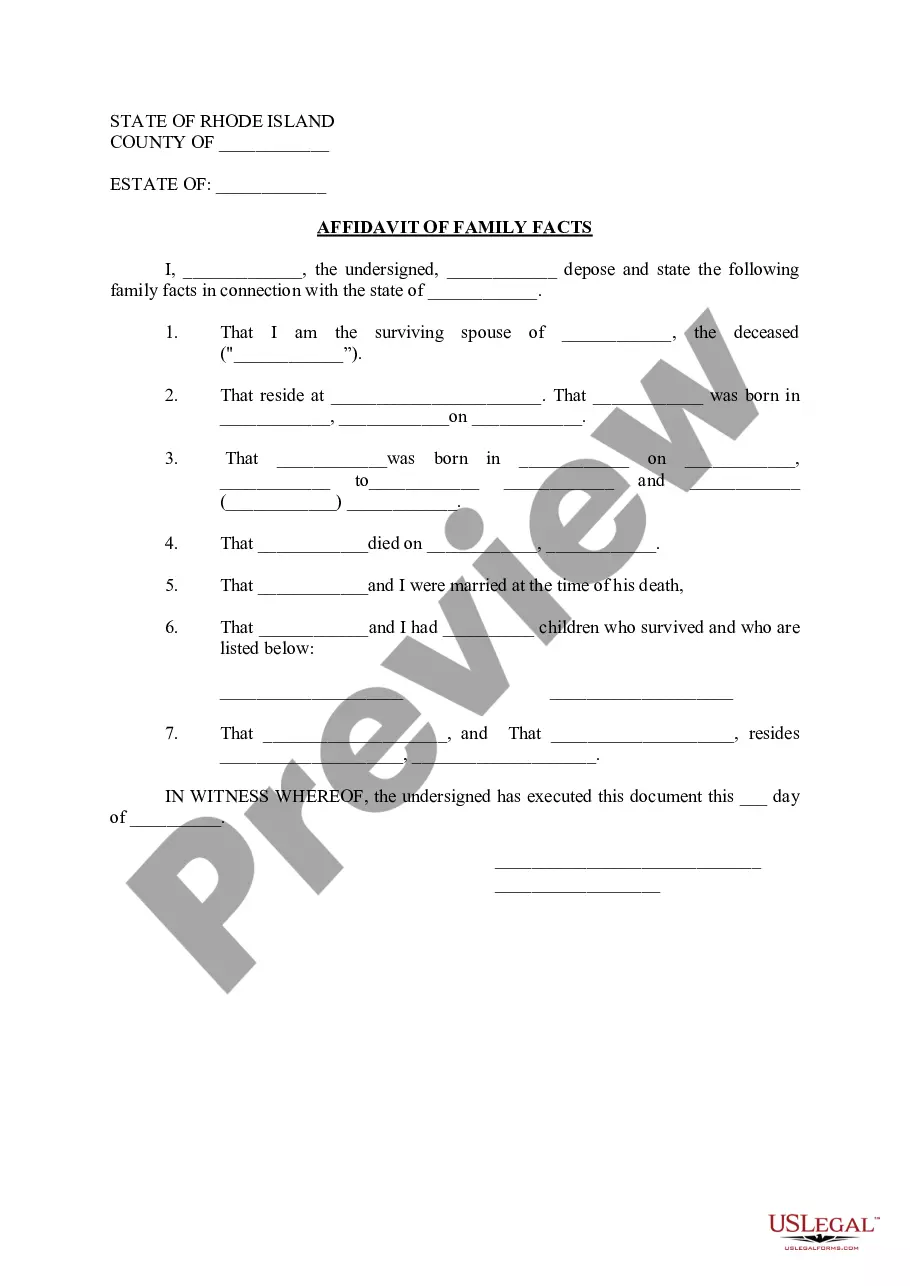

- View the form preview, if there is one, to make sure the form is definitely the one you are searching for.

- Get back to the search and look for the right template if the Self Employed Contractors For Universal Credit does not fit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a transaction method (bank card or PayPal).

- Select the document format for downloading Self Employed Contractors For Universal Credit.

- Once you have the form on your device, you can alter it using the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal paperwork. Explore the comprehensive US Legal Forms catalog to find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Employers calculate Social Security and Medicare taxes of most wage earners. However, you figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR). Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income.

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. ... 1099 Forms. ... Bank Statements. ... Profit/Loss Statements. ... Self-Employed Pay Stubs.

Any income from savings, assets and investments (for example, interest on savings, rent you receive from properties you own or dividends from shares) is considered to be 'capital'.

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.

What does 'minimum income floor ' mean if you're self-employed. The minimum income floor is the amount of money an employed person in a similar situation to you would earn on the National Living Wage or National Minimum Wage , after taking off tax and National Insurance.