Independent Contractor Accounting With Cargo Van

Description

How to fill out Accounting Agreement - Self-Employed Independent Contractor?

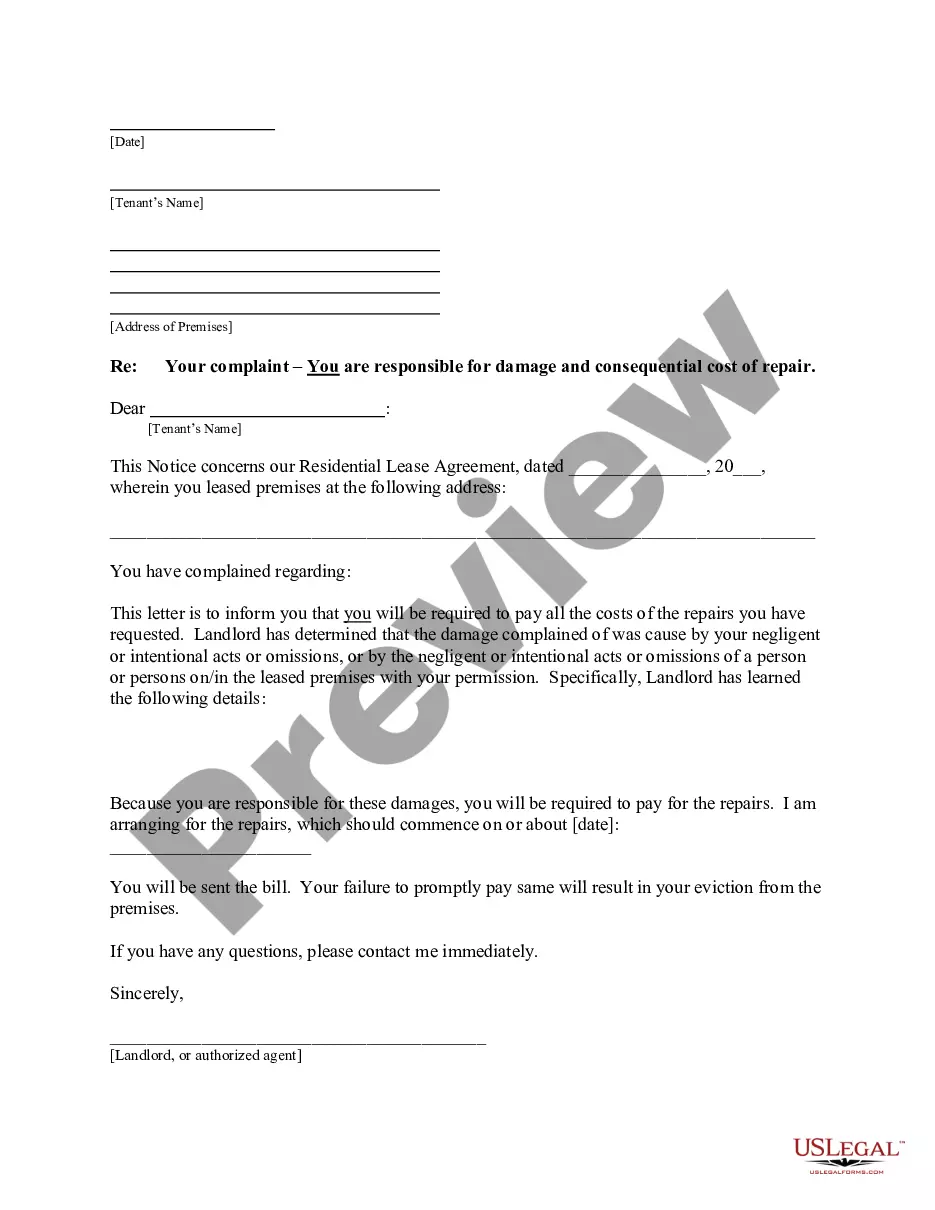

What is the most trustworthy service to obtain the Independent Contractor Accounting With Cargo Van and other current versions of legal documents? US Legal Forms is the answer!

It's the best collection of legal paperwork for any scenario. Each template is meticulously drafted and confirmed for adherence to federal and local regulations. They are categorized by industry and jurisdiction, making it simple to find what you need.

US Legal Forms is an ideal solution for anyone needing to manage legal paperwork. Premium users can enjoy even more benefits as they can fill out and electronically sign the previously saved documents at any time within the integrated PDF editing tool. Check it out today!

- Experienced users of the platform only need to Log In to the system, verify their subscription status, and click the Download button next to the Independent Contractor Accounting With Cargo Van to acquire it.

- Once saved, the template remains accessible for future use within the My documents section of your profile.

- If you do not yet have an account with us, here are the steps you need to follow to create one.

- Form conformity analysis. Before obtaining any template, ensure it aligns with your use case conditions and meets your state or county's guidelines. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

The primary qualifications for getting a cargo van job as an independent contractor are a valid driver's license, a clean driving record, and a cargo van suitable for the types of products you plan to carry.

There are direct expenses to consider, like renovations and a paint job, and indirect expenses, like insurance, utilities, and home repairs. Homeowners can also write off portions of their property taxes and mortgage interest.

Purchase. If you are leasing your truck, you can deduct the entire amount of each month's payment. Purchasers typically see higher deductions in the first two years, however, because of the depreciation schedule.

As an owner/operator, you should receive a 1099-NEC at year-end from any customer that paid you more than $600 during the year. You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on Schedule C.

Owner-operators can usually deduct the following expenses: trucking-industry and business-related subscriptions, association dues, computers and software, Internet service, cleaning supplies, business interest, office supplies, DOT physicals, drug testing, sleep apnea studies, postage and other business-related