Agreement Independent Contractor Form Contract Foreign

Description

How to fill out Research Agreement - Self-Employed Independent Contractor?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain situations may require extensive research and significant financial investment.

If you're seeking a simpler and more cost-effective method for preparing the Agreement Independent Contractor Form Contract Foreign or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our digital library of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs.

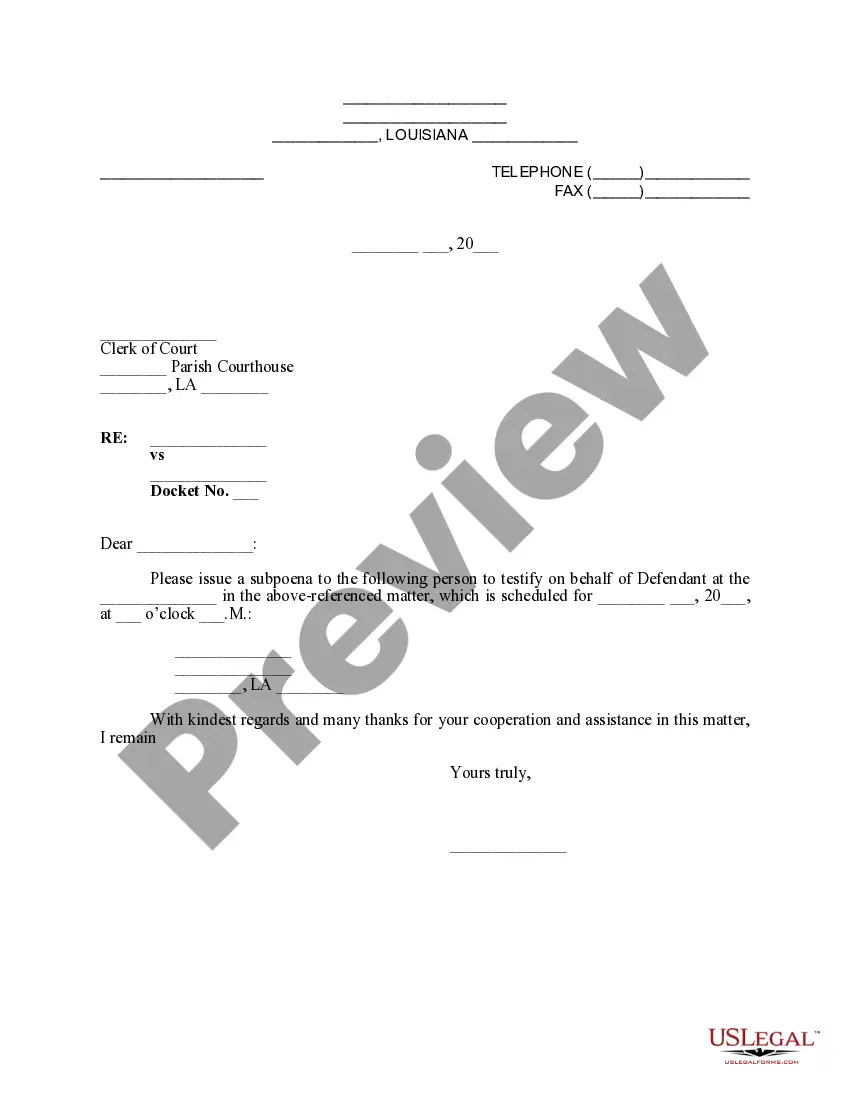

Examine the document preview and descriptions to confirm that you have located the form you require. Verify if the template you choose meets the standards of your state and county. Select the appropriate subscription plan to obtain the Agreement Independent Contractor Form Contract Foreign. Download the document, then complete, sign, and print it. US Legal Forms has a pristine reputation and over 25 years of experience. Join us today and make filling out forms a straightforward and efficient process!

- With just a few clicks, you can swiftly access state- and county-compliant templates carefully crafted for you by our legal professionals.

- Utilize our platform whenever you require a dependable and trustworthy service to quickly find and download the Agreement Independent Contractor Form Contract Foreign.

- If you're already familiar with our website and have set up an account, simply Log In, find the template, and download it or re-download it anytime later from the My documents section.

- Not registered yet? No problem. It takes only a few minutes to create an account and browse the catalog.

- Before directly downloading the Agreement Independent Contractor Form Contract Foreign, consider these tips.

Form popularity

FAQ

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. Filing a 1099 is required if: The contractor is located internationally but is a U.S. citizen.

All immigrants regardless of legal status are able to earn a living as independent contractors, or start a business using an ITIN or SSN. An independent contractor must pay self-employment tax and income tax. An independent contractor may use an ITIN to file and pay taxes instead of a SSN.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. Filing a 1099 is required if: The contractor is located internationally but is a U.S. citizen.

One of the most common ways to pay foreign independent contractors is to wire them the money via international bank transfer. Companies use their own local bank accounts to arrange payment through a global transfer network like SWIFT.

Form W-14 is completed by foreign contracting parties and is used to claim an exemption from withholding, in whole or in part, from the 2% tax. Form W-14 is provided to the government department or agency that is a party to the contract.