Carrier Self Employed For Universal Credit

Description

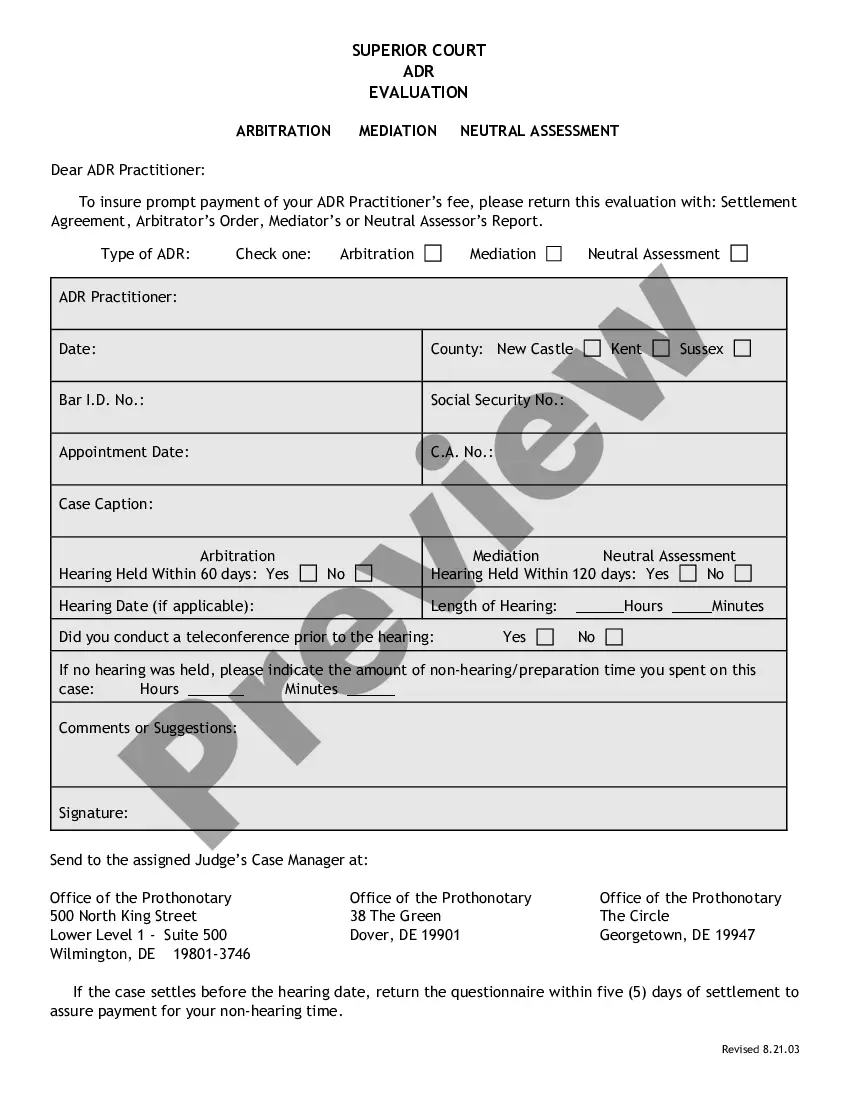

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

What is the most reliable service to obtain the Carrier Self Employed For Universal Credit and other recent versions of legal documents? US Legal Forms is the answer!

It's the largest assortment of legal paperwork for any purpose. Each template is meticulously drafted and confirmed for adherence to federal and local regulations. They are organized by area and state of usage, making it straightforward to find the one you require.

US Legal Forms is an excellent option for anyone needing to handle legal documentation. Premium members can access even more features, as they can complete and sign previously saved files electronically at any time using the integrated PDF editing tool. Try it out today!

- Experienced users of the platform merely need to Log In to the system, verify if their subscription is active, and click the Download button next to the Carrier Self Employed For Universal Credit to acquire it.

- Once saved, the template remains accessible for future use within the My documents section of your profile.

- If you do not yet possess an account with our library, follow these steps to create one.

- Form compliance assessment. Before obtaining any template, you must verify if it meets your use case criteria and the regulations of your state or county. Review the form description and use the Preview if available.

Form popularity

FAQ

There is no official minimum income requirement if you are claiming Universal Credit, as it is designed to support individuals based on their financial situation. However, if you earn below the minimum income floor, your benefits might be adjusted accordingly. As a carrier self employed for Universal Credit, exploring your earnings will help you maximize your benefits. Tools and guides available on platforms like USLegalForms can assist you in understanding this calculation.

Yes, Universal Credit can be backdated under certain circumstances. If you have a valid reason for the delay in your claim, you may be eligible for backdated payments. This can be particularly important for those who are carriers self employed for Universal Credit, as income during that period needs careful management. Consulting resources from USLegalForms can help clarify the rules around backdating Universal Credit.

The minimum income floor on Universal Credit is a set amount that assumes you earn a certain level from self-employment. This means if you earn less than this threshold, your Universal Credit payment might be calculated using the minimum income floor instead of your actual earnings. For those who are carriers self employed for Universal Credit, understanding this floor helps with effective budgeting and financing. Utilize resources like USLegalForms to gain insight into this aspect of your self-employment.

The cut-off for Universal Credit is determined by your income and personal circumstances. If your earnings exceed a certain limit, you may no longer qualify for Universal Credit benefits. As a carrier self employed for Universal Credit, you must track your income closely and report it regularly to avoid issues with your claims. Finding accurate information through USLegalForms can clarify your eligibility.

The minimum income for Universal Credit is based on your specific circumstances. As a carrier self employed for Universal Credit, you need to demonstrate that your income falls above a certain threshold. This threshold can change, so it's essential to check the latest guidelines on the official government site. This ensures you understand your rights and entitlements while working as a self-employed carrier.