Title: Understanding the Impact of Written Debt on Mental Health: Types and Effects Keywords: Written debt, mental health, impact, types, effects, financial stress, anxiety, depression, stress management, coping mechanisms Introduction: Written debt refers to the accumulation of credit card debt, loans, mortgages, or any other type of debt that is documented through written agreements or contracts. While financial burdens have long been recognized as having a potentially detrimental impact on mental well-being, the specific effects of written debt on mental health have gained increasing attention in recent years. This article aims to provide a detailed description of written debt's association with mental health, highlighting the various types and their effects. Types of Written Debt with Mental Health: 1. Credit card debt: Credit card debt is one of the most prevalent forms of written debt affecting mental health. Accumulating high balances, struggling with high interest rates, and experiencing difficulties in making timely payments can lead to financial stress and various mental health issues. 2. Loan debt: Student loans, personal loans, or other forms of borrowing can result in significant financial stress. Balancing loan repayments with everyday living expenses can contribute to anxiety, stress, and feelings of being overwhelmed. 3. Mortgage debt: Large mortgage repayments or the inability to meet monthly mortgage obligations can create considerable financial pressure. This burden may lead to anxiety, depression, or even the fear of losing one's home, further impacting mental health. Effects of Written Debt on Mental Health: 1. Increased financial stress: Written debt can create a persistent sense of financial strain and insecurity. Constant worry about meeting repayment obligations, accruing high interest rates, or having limited financial resources can lead to chronic distress, exacerbating anxiety and depression. 2. Anxiety and depression: Individuals burdened with written debt may experience heightened levels of anxiety and depression due to constant financial pressure, potential debt collection efforts, or fears of the future. The impact may be further intensified when individuals face difficulties in managing debt on their own. 3. Impaired social and psychological well-being: The psychological toll of written debt can result in increased social isolation, withdrawal from activities, strained relationships, and decreased overall life satisfaction. Due to financial constraints, affected individuals might forego social events, hobbies, and self-care, leading to a diminished sense of well-being. 4. Negative coping mechanisms: Some individuals may turn to unhealthy coping mechanisms such as substance abuse, overspending, or gambling to escape their financial struggles. These behaviors can further exacerbate mental health issues and perpetuate a cycle of debt and distress. Coping Strategies and Support: 1. Seeking professional help: Working with financial advisors, debt counselors, or mental health professionals who specialize in financial and mental well-being can provide guidance and support in managing written debt and its impact on mental health. 2. Budgeting and financial planning: Developing a realistic budget and financial plan can help individuals regain control over their finances, reduce stress, and work towards debt repayment. Seek professional advice or utilize budgeting tools and resources available online. 3. Building social support: Connecting with friends, family, or support groups to share experiences and emotions can provide a sense of solidarity, encouragement, and practical assistance in navigating written debt-related challenges. Conclusion: Written debt, encompassing various forms of financial obligations, has considerable implications for mental health. Understanding the types and effects of written debt on mental well-being is crucial to foster awareness, prompt early intervention, and adopt appropriate coping strategies. Seeking support from professionals and building a support network can empower individuals to manage their debt-related stress effectively and promote mental wellness.

Written Debt With Mental Health

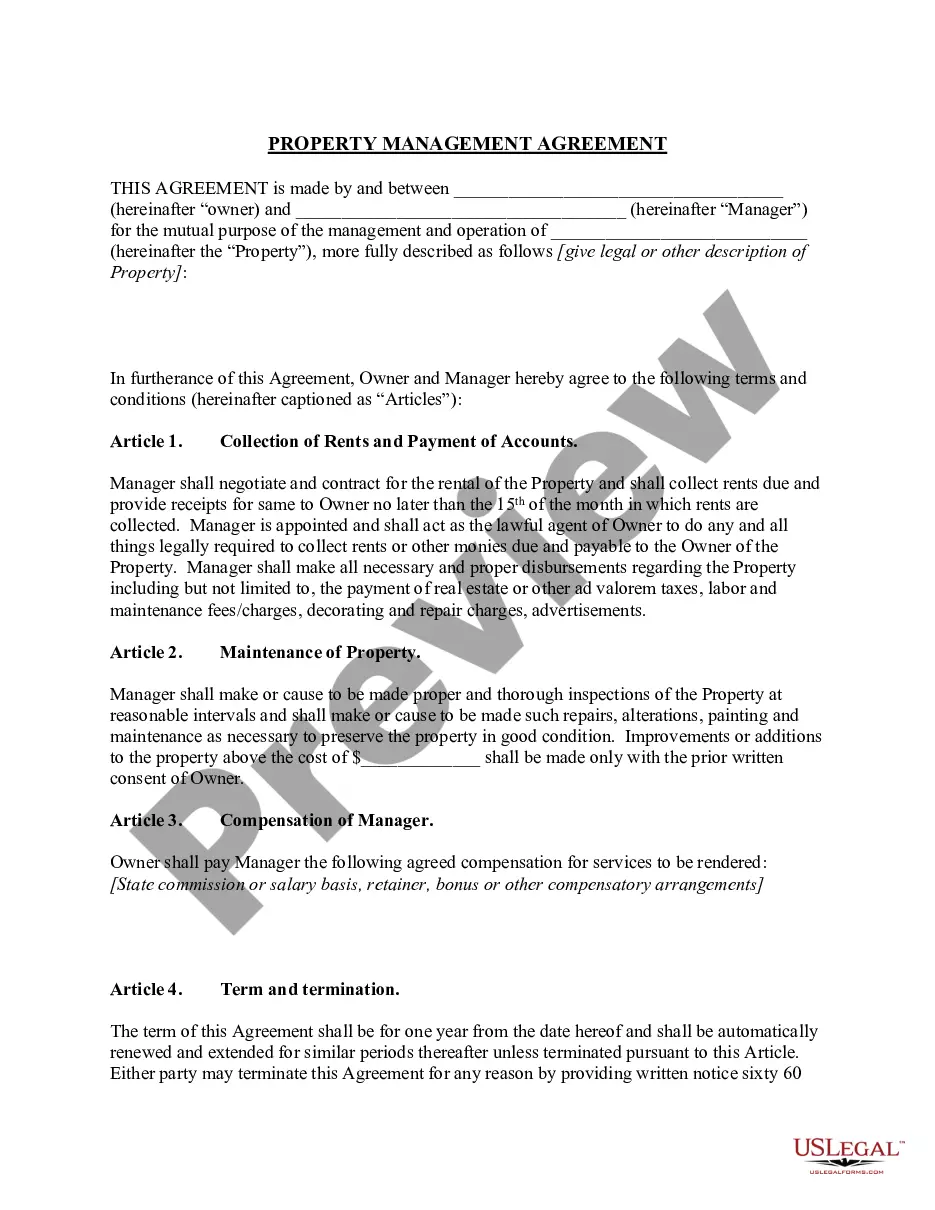

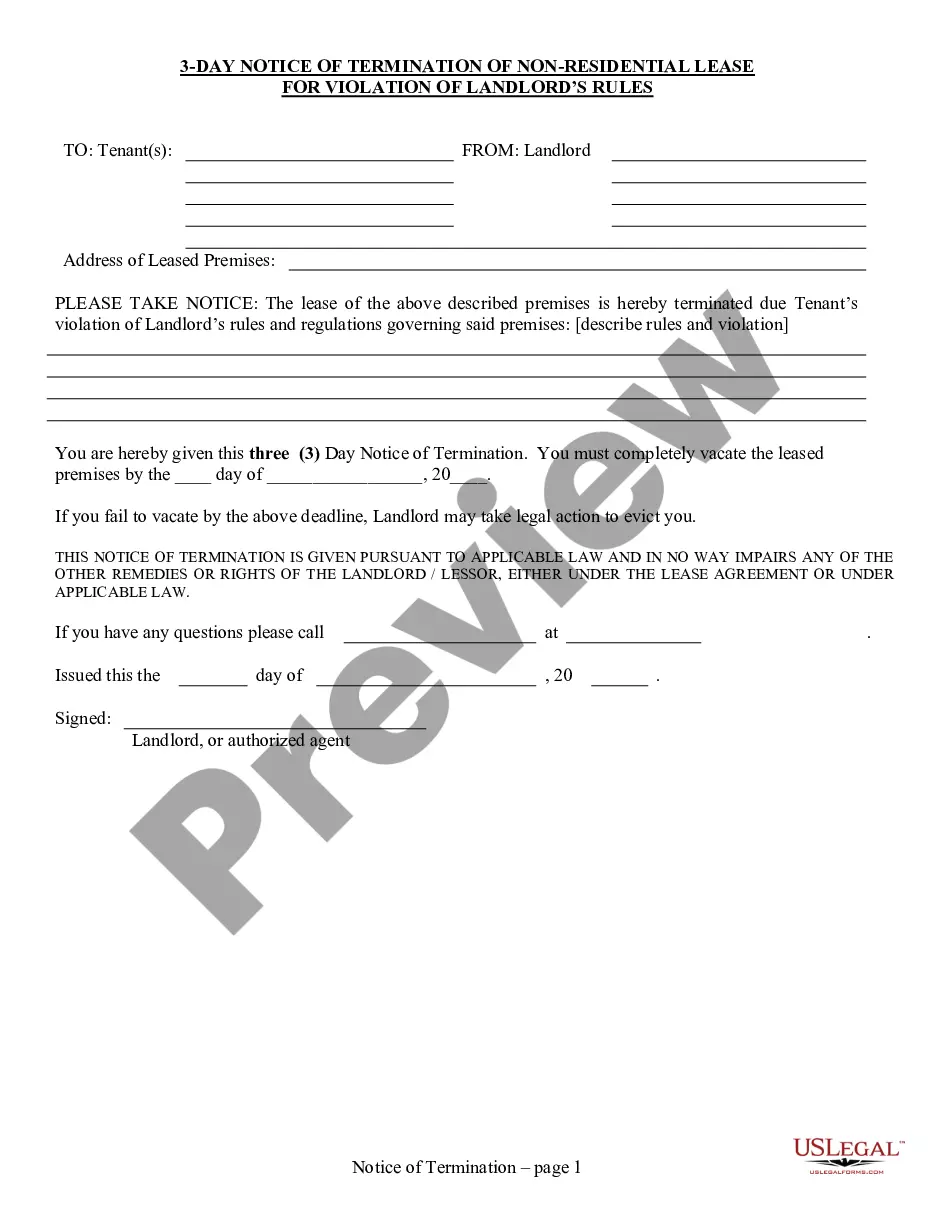

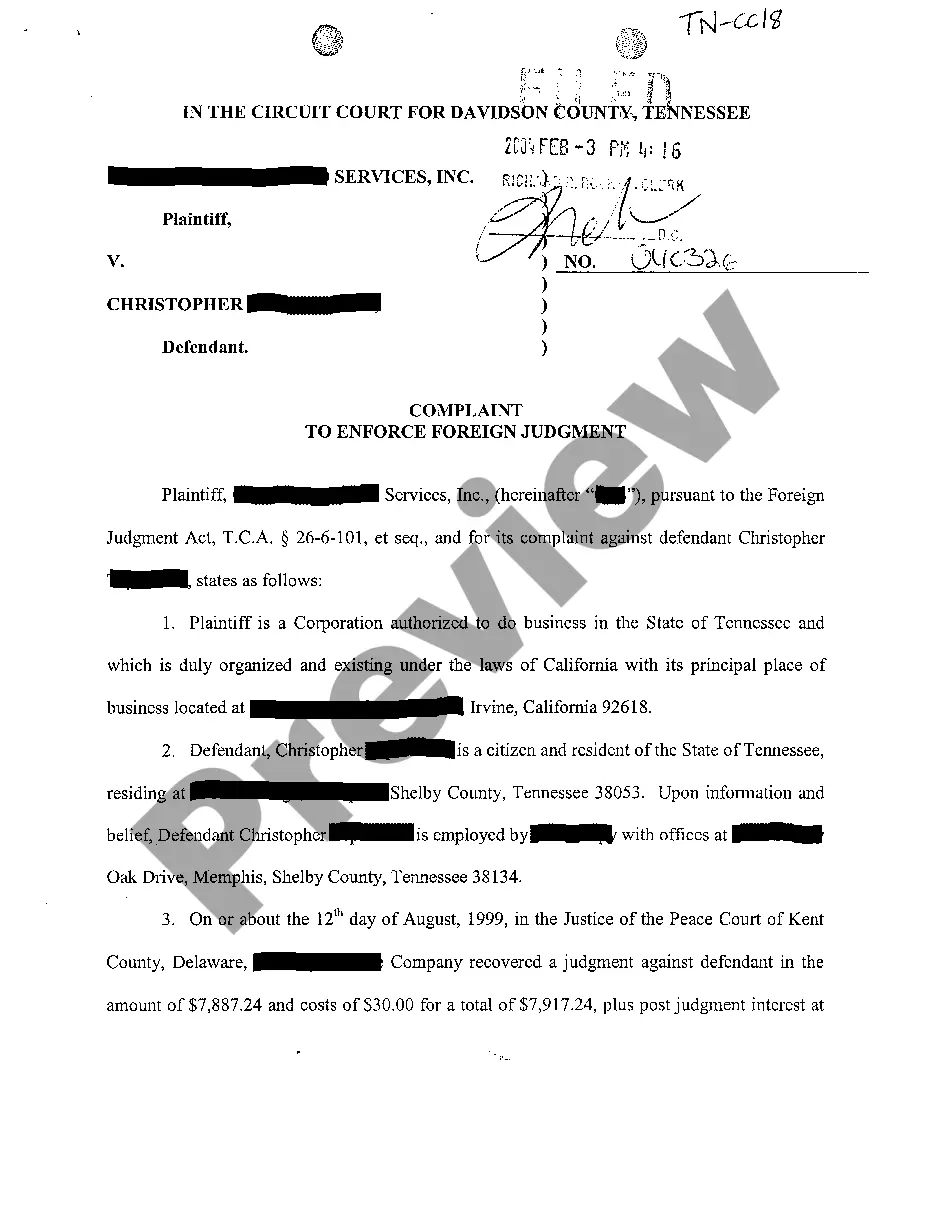

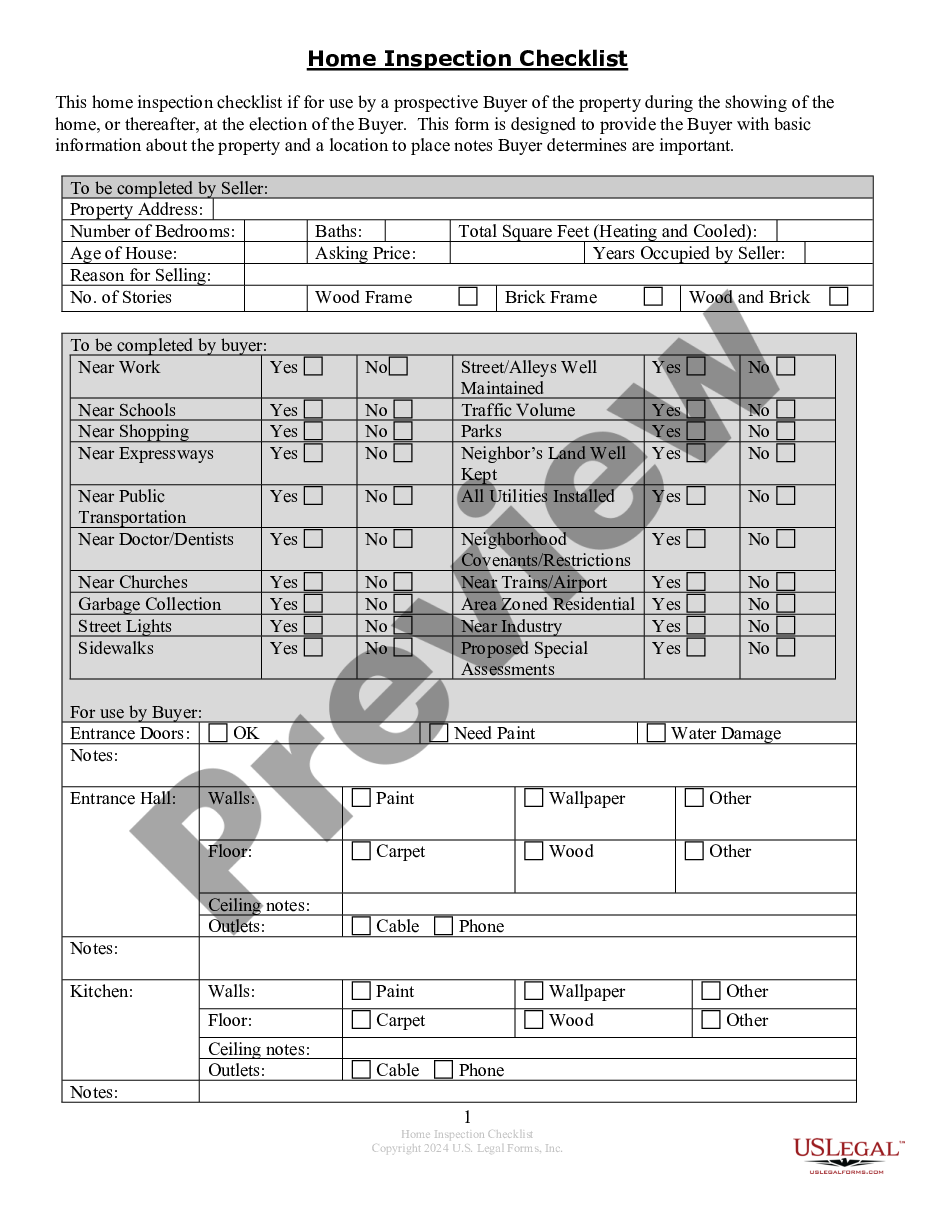

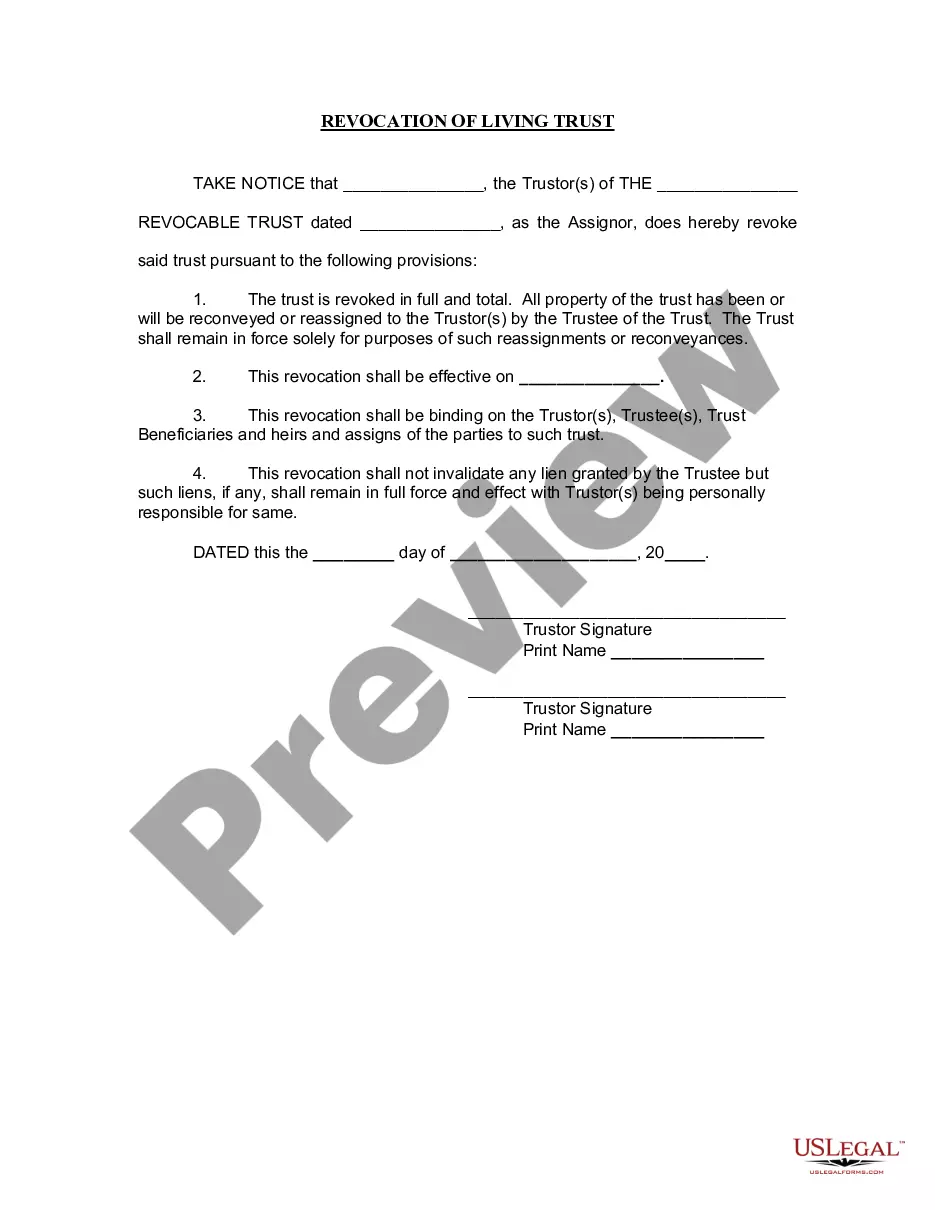

Description Qualified Written Request

How to fill out Written Cancellation Request?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Finding the right legal papers demands precision and attention to detail, which is the reason it is crucial to take samples of Written Debt With Mental Health only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information concerning the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Written Debt With Mental Health:

- Make use of the catalog navigation or search field to find your sample.

- View the form’s information to ascertain if it matches the requirements of your state and area.

- View the form preview, if there is one, to ensure the template is definitely the one you are looking for.

- Go back to the search and find the proper template if the Written Debt With Mental Health does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading Written Debt With Mental Health.

- When you have the form on your device, you may alter it with the editor or print it and finish it manually.

Eliminate the hassle that comes with your legal documentation. Explore the extensive US Legal Forms library where you can find legal samples, examine their relevance to your situation, and download them immediately.