Regarding Commercial Development Foreign

Description

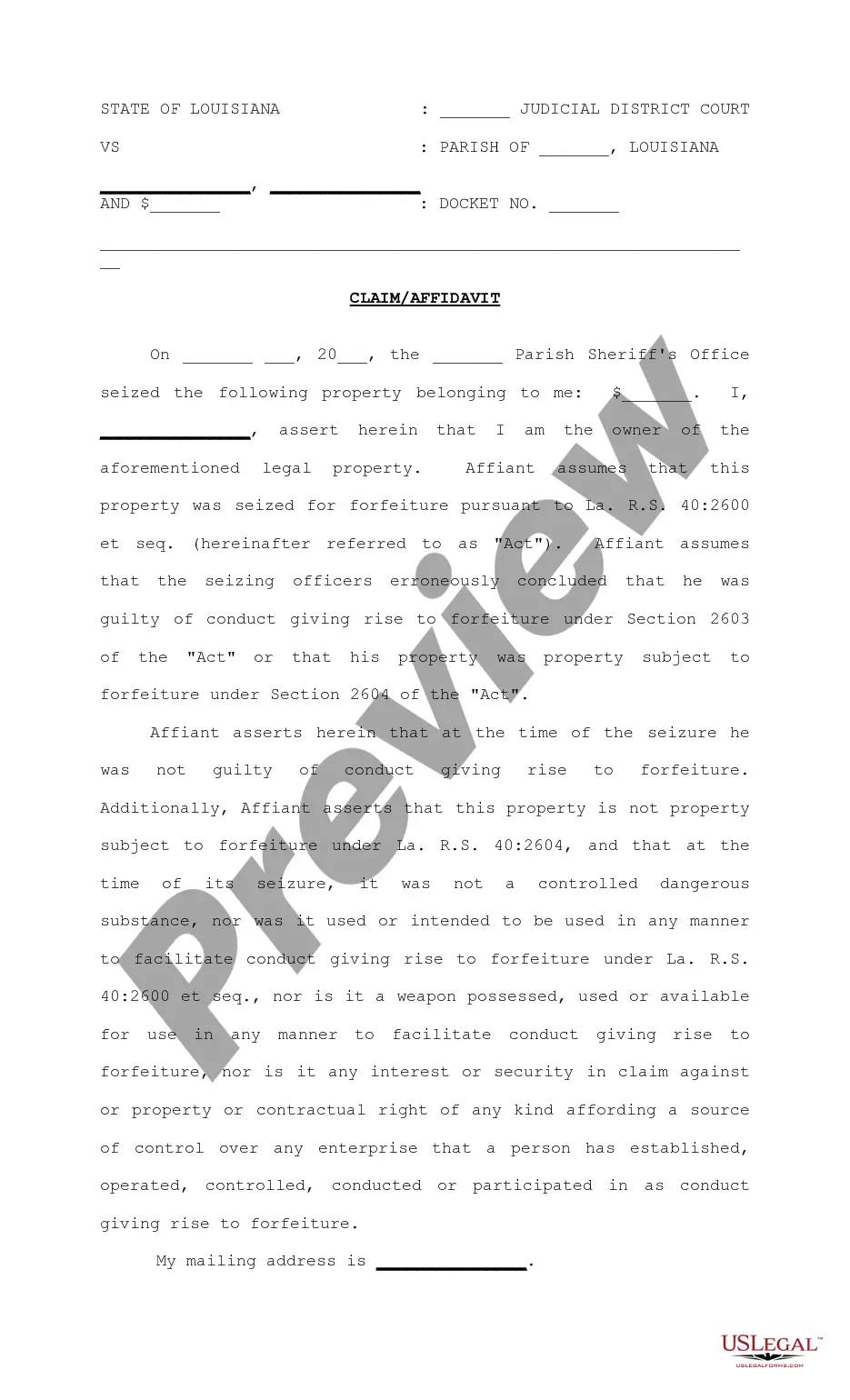

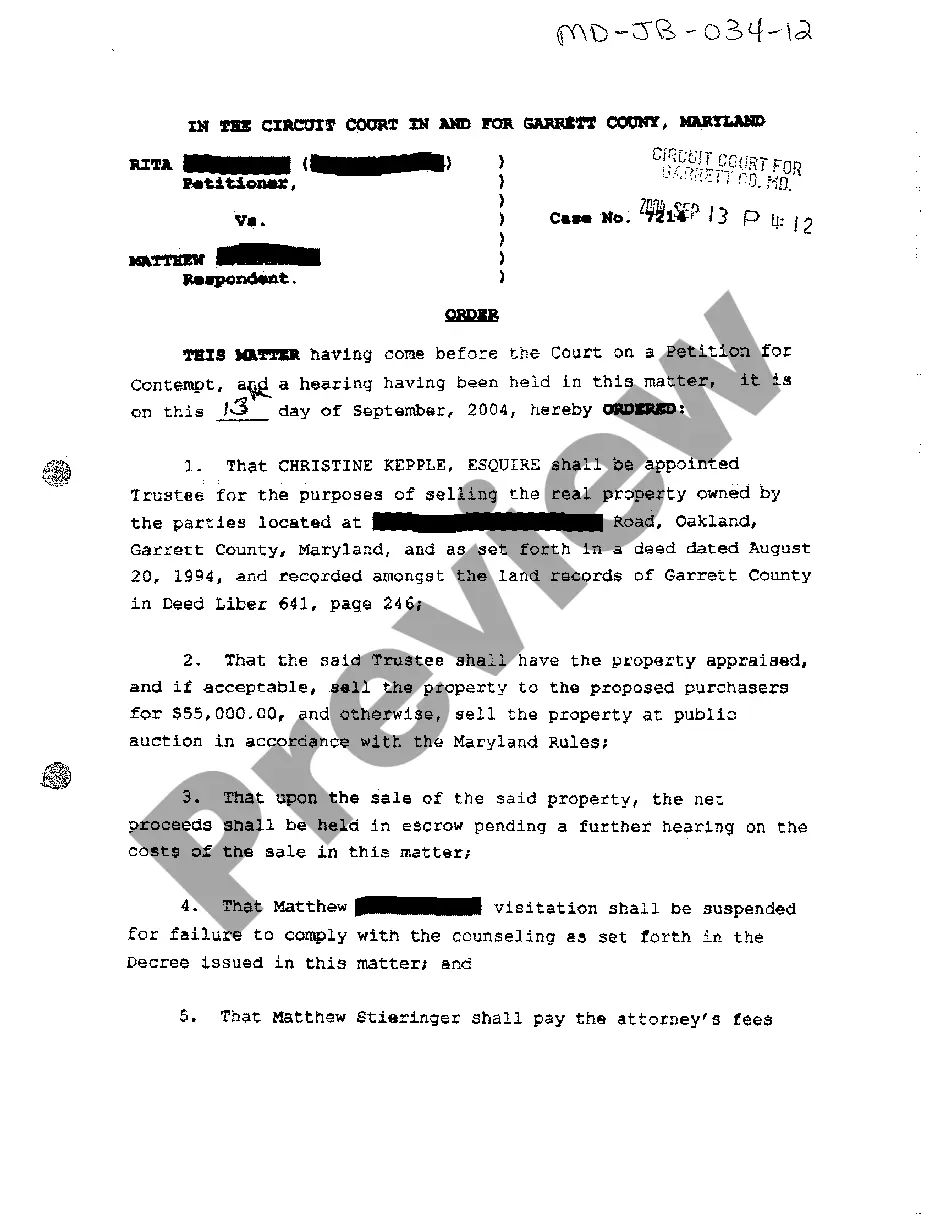

How to fill out Services Agreement Between The University Of Memphis And UTEK Corp. Regarding Commercial Development Of Specific Intellectual Property And Technology?

Individuals commonly link legal documentation with something complex that only a specialist can handle.

In some sense, this is accurate, as preparing Regarding Commercial Development Foreign requires significant knowledge in subject standards, including state and county laws.

However, with US Legal Forms, the process has become simpler: ready-made legal templates for any life and business event tailored to state regulations are compiled in one online library and are now accessible to everyone.

All templates in our collection are reusable: once obtained, they are saved in your profile. You can access them anytime needed through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, allowing you to search for Regarding Commercial Development Foreign or any other specific template in mere minutes.

- Previously registered users with an active subscription must Log In to their accounts and click Download to obtain the form.

- New users to the platform must first register for an account and subscribe before downloading any documentation.

- Here is the step-by-step guide on how to obtain Regarding Commercial Development Foreign.

- Carefully review the page content to ensure it meets your requirements.

- Examine the form description or check it via the Preview option.

- If the previous sample doesn't meet your needs, find another one using the Search bar above.

- Click Buy Now once you locate the appropriate Regarding Commercial Development Foreign.

- Select a pricing plan that aligns with your needs and budget.

- Register for an account or Log In to continue to the payment page.

- Complete your payment via PayPal or your credit card.

- Choose the format for your sample and click Download.

- Print your document or import it into an online editor for faster completion.

Form popularity

FAQ

The penalties for not filing various forms can vary; however, the IRS typically imposes fines starting at $25,000 for forms like the 5472. For ongoing failures to file, these penalties can escalate. It's important to stay informed about filing obligations to protect your commercial development foreign initiatives.

Yes, an LLC can indeed be owned by a foreign corporation. This structure often benefits foreign entities looking to engage in commercial development foreign opportunities within the United States. It allows for flexibility in management and taxation, making it an attractive option.

Failing to file Form 1042 can attract harsh penalties, with potential fines reaching 10% of the amount that should have been reported. This is particularly important for those engaged in commercial development foreign investments. To navigate these complexities, the uslegalforms platform can aid users in understanding compliance requirements.

The penalty for not filing Form 5472 starts at $25,000 per year. If the failure continues for two months after the IRS notice, additional penalties may arise. Engaging with professionals familiar with commercial development foreign can help mitigate these risks and ensure compliance.

Not reporting foreign income can result in significant penalties, including fines and possible criminal charges depending on the severity. The IRS takes this matter seriously, especially for entities involved in commercial development foreign ventures. Ensuring accurate reporting is vital to avoid complications with tax authorities.

Form 5472 is required to be filed by foreign-owned US disregarded entities engaged in commercial development foreign activities. This includes any foreign corporation that owns at least 25% of a US disregarded entity. Proper filing helps maintain transparency and compliance with US tax regulations.

Failing to file Form 5472 can lead to severe penalties, as the IRS can impose fines of $25,000 for each tax year the form is not submitted. Additionally, if the failure to file continues for more than 90 days after the IRS sends a notice, further penalties may accrue. Staying compliant is crucial in the context of commercial development foreign, to avoid unexpected financial burdens.

A foreign owned US disregarded entity is a business structure where a single owner, typically a foreign corporation, is not recognized as separate from its owner for tax purposes. This means that the income generated by the business is reported on the owner's tax returns. When it comes to commercial development foreign investments, understanding this structure can provide significant tax advantages and simplify reporting obligations.

Any foreign-owned U.S. corporation or certain domestic corporations with foreign shareholders must file form 5472. This requirement applies especially to those involved in commercial development foreign activities. Understanding your obligations to file this form is crucial for compliance, as failing to do so can result in penalties. Uslegalforms is here to assist you with all your filing needs.

As mentioned previously, U.S. owners of foreign disregarded entities engaged in commercial development foreign must file form 8858. This form reports vital financial interests and activities of these entities. Ensuring you file correctly protects you from potential tax issues. Uslegalforms can provide valuable support in navigating these filings.