Class C Corporation Foreign Shareholder

Description

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Managing legal paperwork can be exasperating, even for experienced experts.

When you are searching for a Class C Corporation Foreign Shareholder and do not have the opportunity to dedicate to finding the correct and updated version, the process can be daunting.

With US Legal Forms, you can also access a valuable reservoir of articles, guides, and handbooks pertinent to your situation and needs.

Reduce time and effort spent searching for the required documents by using US Legal Forms’ sophisticated search and Preview tool to locate Class C Corporation Foreign Shareholder.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your everyday document management into a simple and user-friendly operation today.

- If you hold a monthly subscription, Log In to your US Legal Forms account, find the form, and acquire it.

- Check your My documents section to see previously saved documents and organize your folders as needed.

- If you are new to US Legal Forms, create an account to gain unlimited access to all platform advantages.

- After downloading the required form, follow these steps.

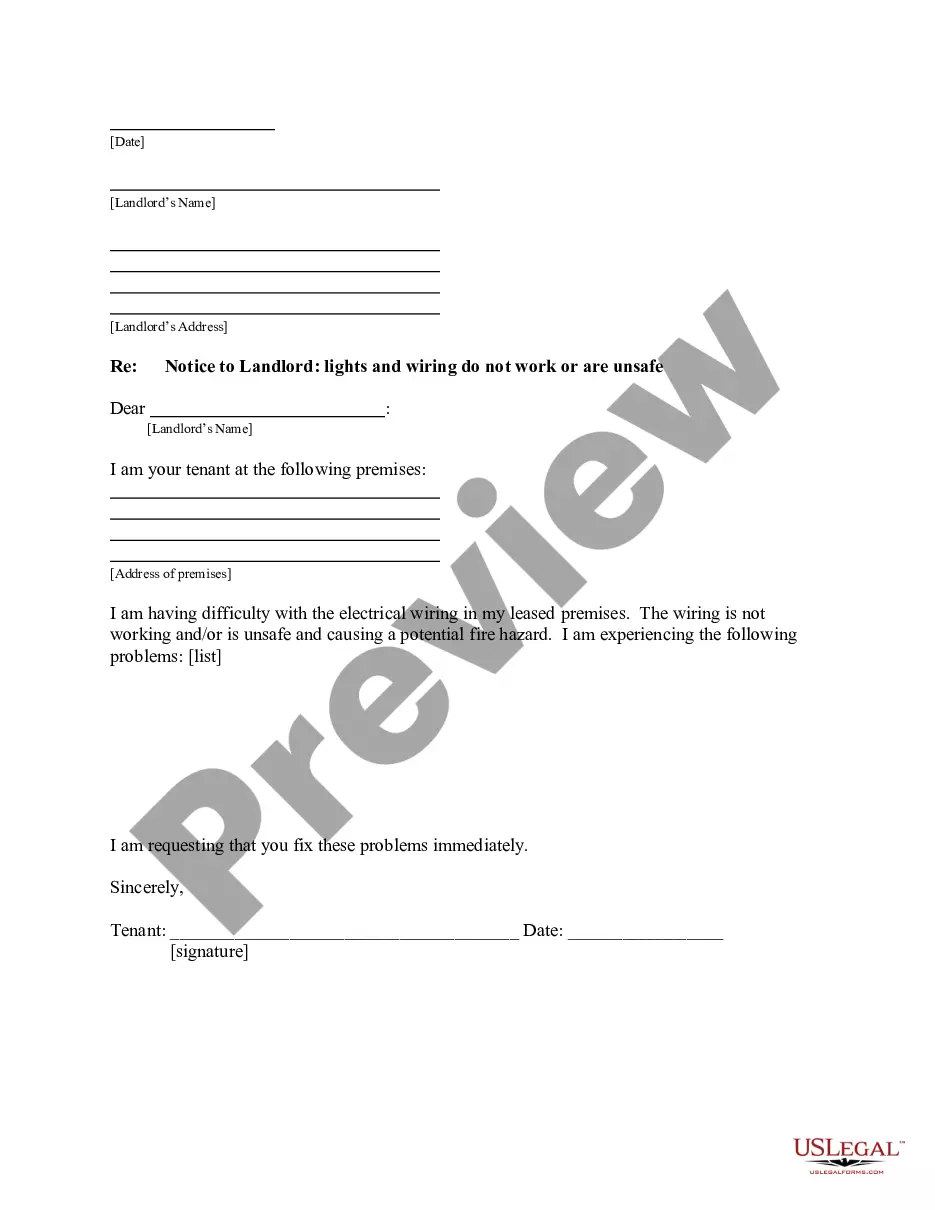

- Verify it is the correct form by previewing and reviewing its information.

- Confirm that the template is valid in your state or county.

- Select Buy Now when you’re ready.

- Choose a monthly subscription package.

- Select the format you need, and Download, fill out, eSign, print, and send your document.

- A robust online form directory can dramatically improve the experience for those wanting to effectively handle these matters.

- US Legal Forms stands out as a leader in online legal documents, offering over 85,000 state-specific legal forms anytime you need them.

- Utilize modern tools to complete and supervise your Class C Corporation Foreign Shareholder.

Form popularity

FAQ

Yes, a non-US citizen can own a corporation in the United States, including a Class C corporation. As a Class C corporation foreign shareholder, you can have full ownership and control over your business. This arrangement allows for leveraging the legal protections associated with establishing a business in the U.S.

The primary requirement for shareholders in a Class C Corporation is that they can be both individuals and entities, including foreign shareholders. There are no residency requirements, making it a suitable platform for both local and international investors. Understanding these requirements is crucial for setting up your investment structure effectively.

Certainly, a non-US citizen can own a Class C Corporation without restrictions. This ownership structure is widely favored among foreign investors due to its flexibility in terms of shareholder composition. Therefore, if you are a foreign investor, forming a C Corporation is a solid choice for your business operations in the U.S.

In any month-to-month agreement (whether residential or non-residential) Louisiana Civil Code 2728 will seek to prevent a party who has had such an agreement terminated from going through undue hardship by requiring that ten (10) days' notice must be issued and received by the party said amount of days.

Under a year-long lease agreement in Louisiana, if you plan to terminate the lease early, you typically need to provide your landlord with a 30-day notice. This means that you must inform the landlord at least 30 days before the date you intend to move out.

A new trial may be granted, upon contradictory motion of any party or by the court on its own motion, to all or any of the parties and on all or part of the issues, or for reargument only.

Parties may obtain discovery by one or more of the following methods: depositions upon oral examination or written questions; written interrogatories; production of documents or things or permission to enter upon land or other property, for inspection and other purposes; physical and mental examinations, including ...

1071. Cross-claims. A party by petition may assert as a cross-claim a demand against a co-party arising out of the transaction or occurrence that is the subject matter either of the original action or a reconventional demand or relating to any property that is the subject matter of the original action.

The tutor shall file a petition setting forth the subject matter to be determined affecting the minor's interest, with his recommendations and the reasons therefor, and with a written concurrence by the undertutor.

For evictions in Louisiana based on non-payment of rent, the landlord must give a 5-day notice to the tenant. (Title XI CCP 4701). For evictions based on non-compliance of the lease agreement, the landlord must give a 5-day notice to the tenant. (Title XI CCP 4701).