Fidelity 401k Withdrawal Time Frame

Description

How to fill out Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

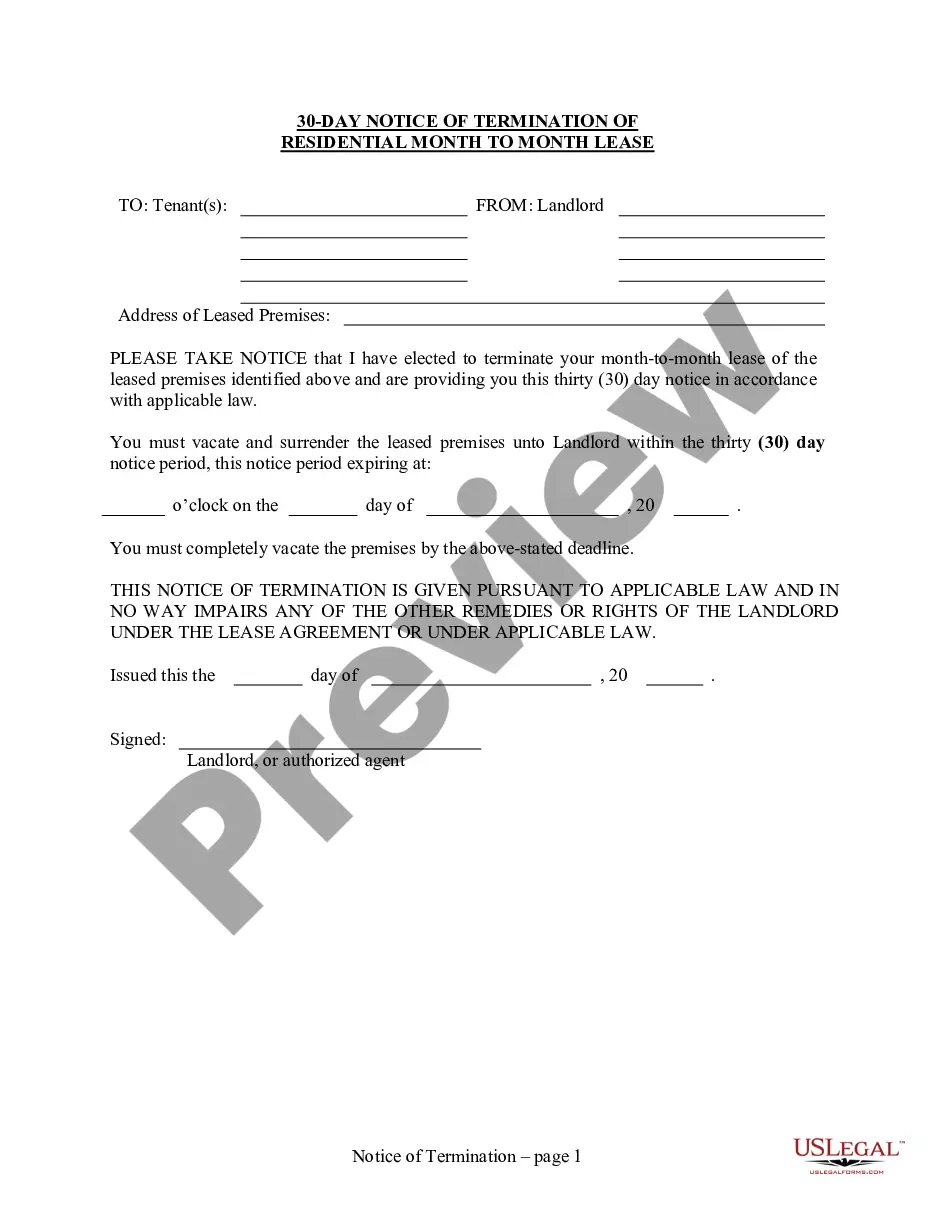

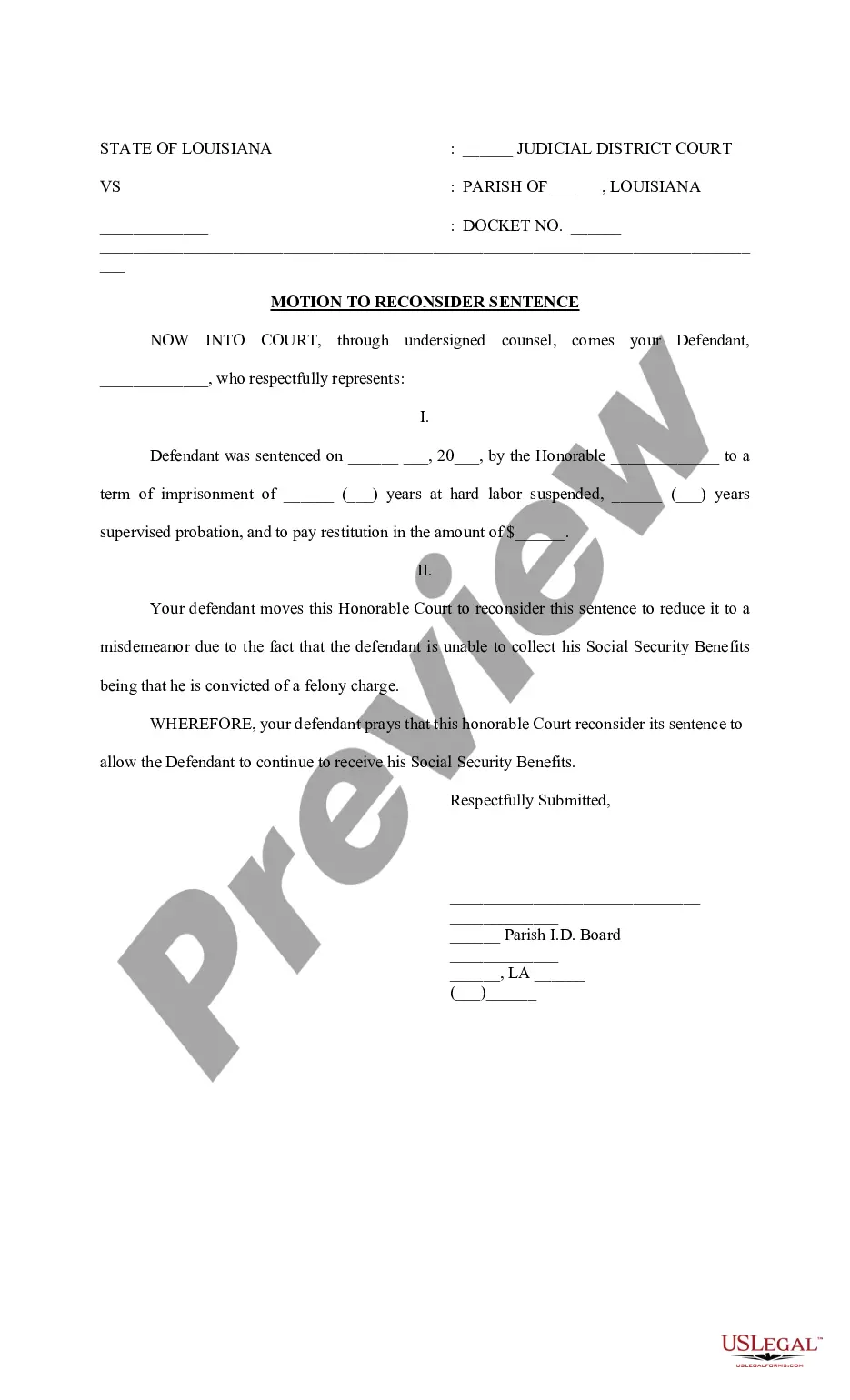

The Fidelity 401k Withdrawal Time Frame presented on this site is a reusable legal document crafted by experienced attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal practitioners with upwards of 85,000 validated, state-specific forms for various business and personal needs. It represents the quickest, most direct, and most reliable method to secure the documentation you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Register for US Legal Forms to have authenticated legal templates for all of life’s scenarios readily available.

- Search for the document you require and review it.

- Browse through the file you searched and preview it or examine the form description to confirm it meets your needs. If it does not, use the search bar to locate the appropriate one. Click Buy Now once you find the document you require.

- Subscribe and Log In.

- Select the pricing plan that fits you and set up an account. Utilize PayPal or a credit card for prompt payment. If you already possess an account, Log In and review your subscription to proceed.

- Acquire the fillable template.

- Choose the format you desire for your Fidelity 401k Withdrawal Time Frame (PDF, Word, RTF) and store the document on your device.

- Finish and sign the documents.

- Print the template to fill it out by hand. Alternatively, employ an online multifunctional PDF editor to swiftly and accurately complete and sign your form with a legally acceptable electronic signature.

- Re-download your documents anytime.

- Make use of the same document again whenever necessary. Access the My documents section of your profile to re-download any previously stored forms.

Form popularity

FAQ

To withdraw from your 401k, you typically need to fill out a withdrawal request form provided by your plan administrator or employer. This form will require you to specify the amount you wish to withdraw and the reason for the withdrawal. It's important to keep the Fidelity 401k withdrawal time frame in mind, as your request may take several days to process. If you are unsure about the form or the process, consider using US Legal Forms for guidance and to ensure you have the correct documents.

Fidelity generally takes around 1 to 5 business days to make funds available after a withdrawal request. The specific time frame can vary based on your request type and any additional checks required. Keeping track of this Fidelity 401k withdrawal time frame ensures you know when to expect your funds. If you're ever in doubt, resources like USLegalForms can guide you through the process.

Typically, you can expect to receive funds from your 401k withdrawal within 5 to 10 business days. This includes both the processing time and the actual transfer to your account. If you opt for electronic transfer, the process may be quicker. Understanding this Fidelity 401k withdrawal time frame helps you plan for any upcoming financial needs.

The processing time for a 401k withdrawal through Fidelity can take between 3 to 7 business days. Factors such as the type of withdrawal and volume of requests can influence this timeframe. During this period, Fidelity ensures all necessary verifications are completed to adhere to regulations. Familiarizing yourself with this Fidelity 401k withdrawal time frame can prepare you for when you need access to your funds.

When you request a withdrawal, Fidelity typically takes about 1 to 3 business days to make your funds available. This is part of their overall Fidelity 401k withdrawal time frame, which includes processing your request and preparing the funds for distribution. After the processing period, you can expect the funds to transfer based on your chosen withdrawal method. Staying informed on these timelines can help you manage your finances more effectively.

The Fidelity 401k withdrawal time frame generally ranges from 5 to 10 business days. Once you initiate a withdrawal request, Fidelity requires time to process the paperwork and ensure everything is in order. Additionally, the transfer of funds to your bank account can add a few more days to the total time. By planning ahead, you can ensure a smoother withdrawal process.

Yes, when using TurboTax, you report your 401k withdrawal as income. This impacts your overall tax liability, so be sure to enter the amount from your 1099-R correctly. TurboTax will guide you through this process. Understanding the Fidelity 401k withdrawal time frame can help you prepare for any tax implications.

Yes, providing documentation for a 401k withdrawal is often necessary. The required paperwork may include forms to verify your identity and withdrawal reason. Each plan may have different requirements, so check yours for specifics. Knowing how the Fidelity 401k withdrawal time frame affects these requirements is crucial for a smooth process.

Yes, you must report your 401k withdrawal on your tax return. This requirement applies even if you do not receive the funds during the tax year. Your 1099-R will provide the necessary information to report the withdrawal. Being aware of the Fidelity 401k withdrawal time frame ensures you file accurately and on time.

Your employer usually has up to 30 days to process your 401k withdrawal request, but it can vary based on the plan. Some plans may even expedite the process for urgent requests. It's beneficial to check your plan’s guidelines on processing times. Understanding the Fidelity 401k withdrawal time frame can help set your expectations.