Underwriting Agreement Purchase For Shares

Description

How to fill out Underwriting Agreement Between Internet.Com Corp. And Internet World Media, Inc. Regarding The Sale And Purchase Of Shares Of Common Stock?

Well-prepared official paperwork is among the essential safeguards for preventing complications and legal disputes, but obtaining it without an attorney's assistance may require time.

Whether you need to swiftly locate a current Underwriting Agreement Purchase For Shares or any other templates for employment, familial, or business contexts, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected file. Furthermore, you can retrieve the Underwriting Agreement Purchase For Shares at any time, as all documentation previously obtained on the platform is accessible within the My documents tab of your profile. Conserve time and resources on creating official documents. Explore US Legal Forms today!

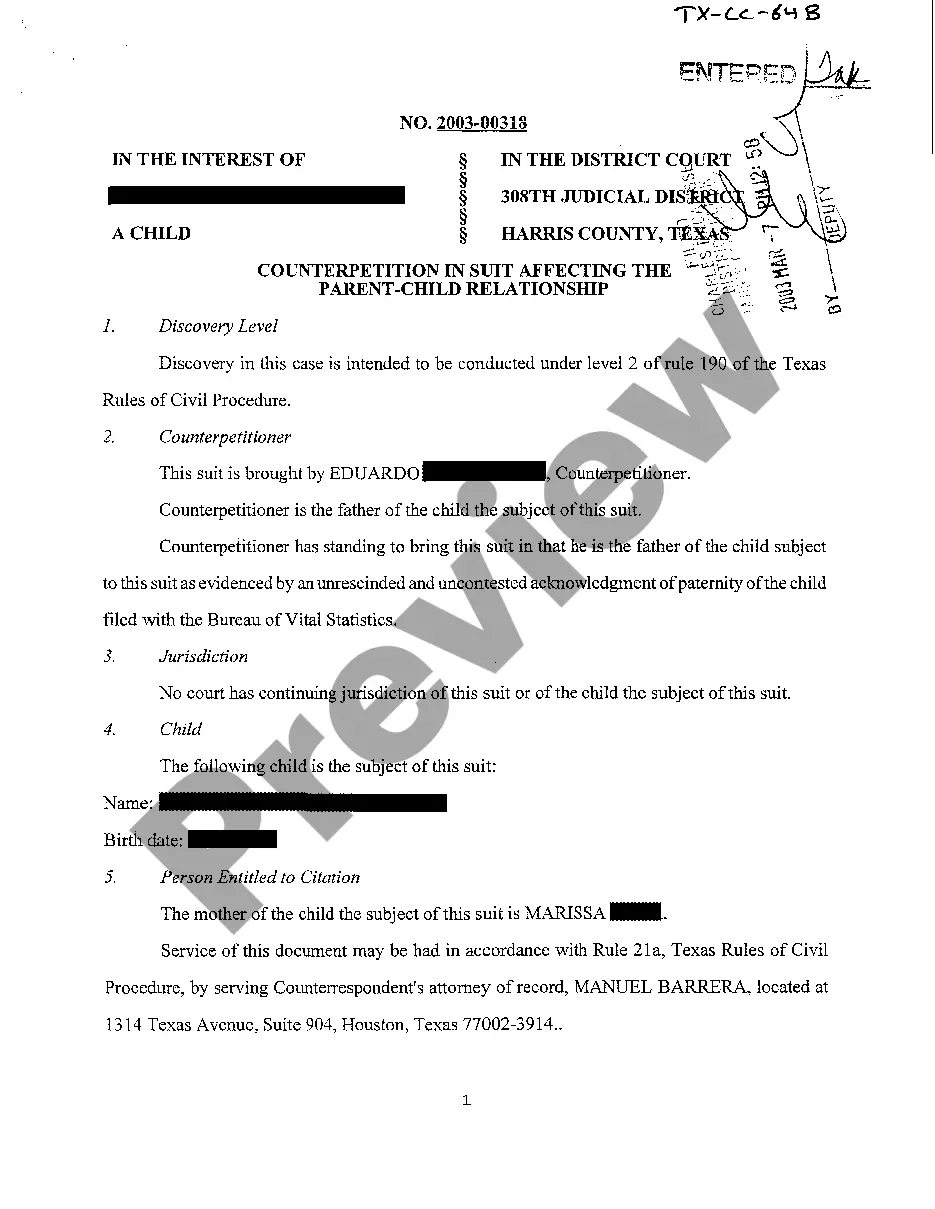

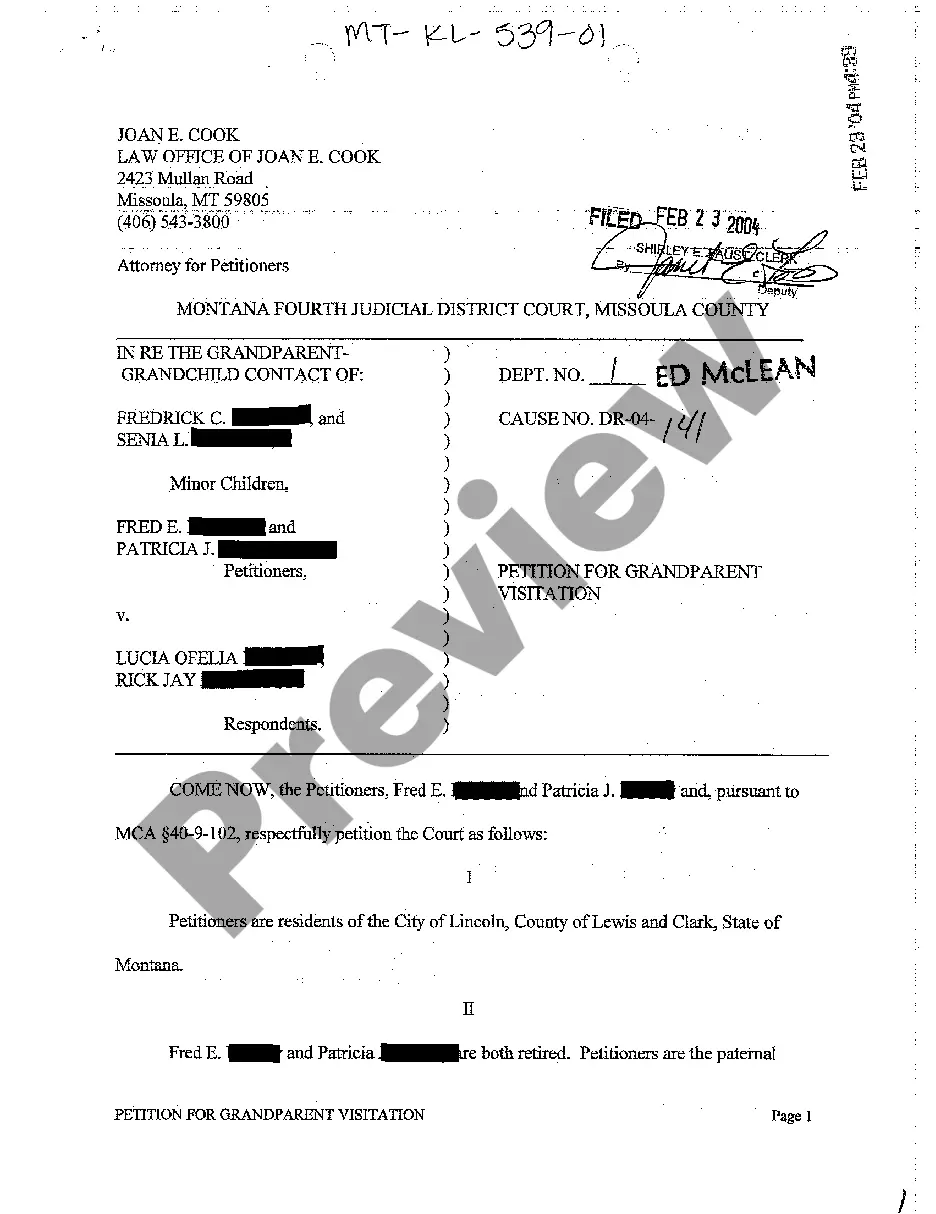

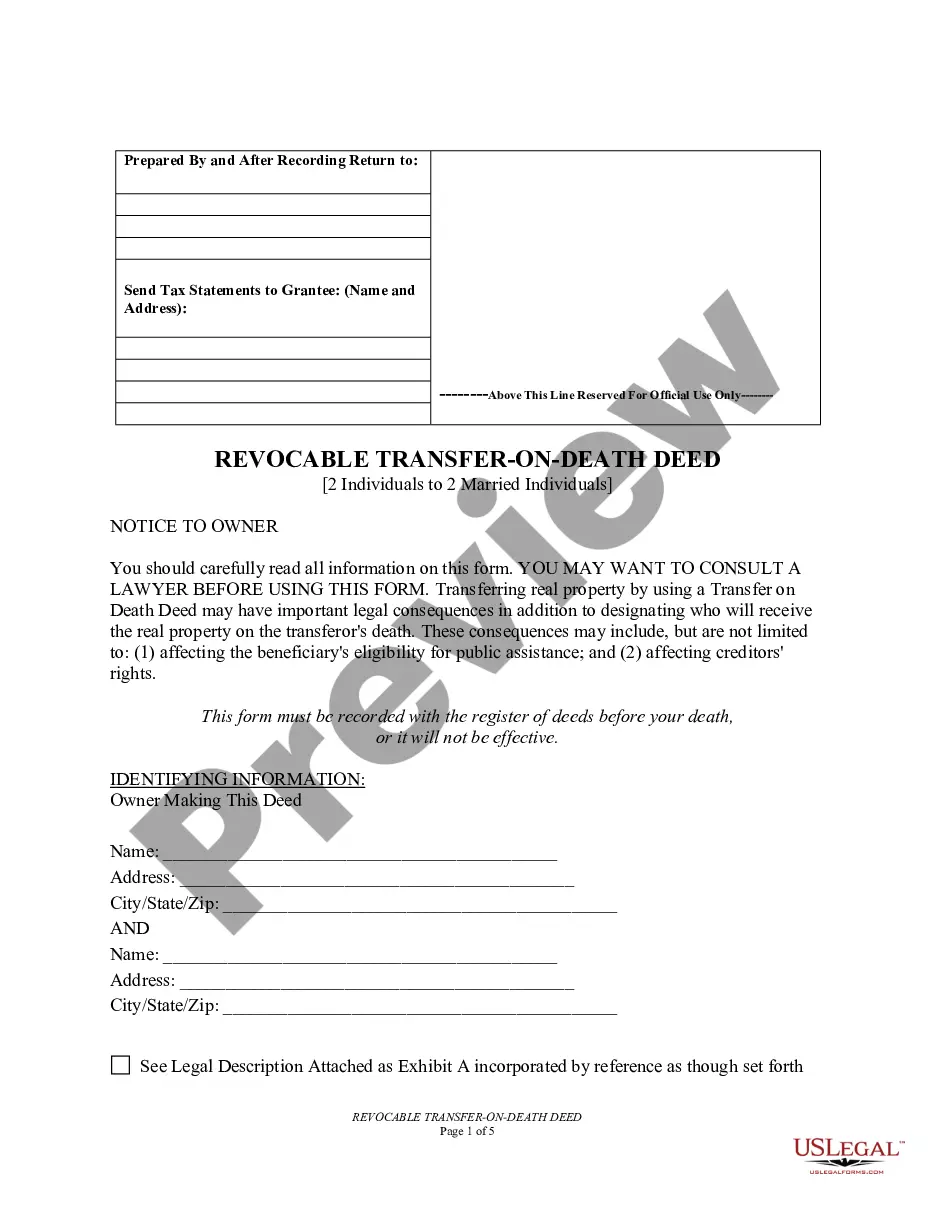

- Ensure that the document is appropriate for your situation and location by reviewing the description and preview.

- Search for an additional example (if necessary) through the Search bar in the header of the page.

- Click Buy Now when you find the correct template.

- Select the pricing plan, Log In to your account or create a new account.

- Choose your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Underwriting Agreement Purchase For Shares.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The underwriting agreement contains the details of the transaction, including the underwriting group's commitment to purchase the new securities issue, the agreed-upon price, the initial resale price, and the settlement date. A best-efforts underwriting agreement is mainly used in the sales of high-risk securities.

The most common type of underwriting agreement is a firm commitment in which the underwriter agrees to assume the risk of buying the entire inventory of stock issued in the IPO and sell to the public at the IPO price.

In the securities market, underwriting involves determining the risk and price of a particular security. It is a process seen most commonly during initial public offerings, wherein investment banks first buy or underwrite the securities of the issuing entity and then sell them in the market.

There are a number of standard documents that lawyers must prepare for an initial public offering (IPO) of a company. The main document is the S-1 registration statement.

In the context of share issues or offers, the financial institution that agrees to purchase or to procure other institutions (called sub-underwriters) to purchase the shares to the extent that they are not sold under the offer. Most large share issues and offers by listed companies are underwritten.