Example Of Investment Agreement

Description

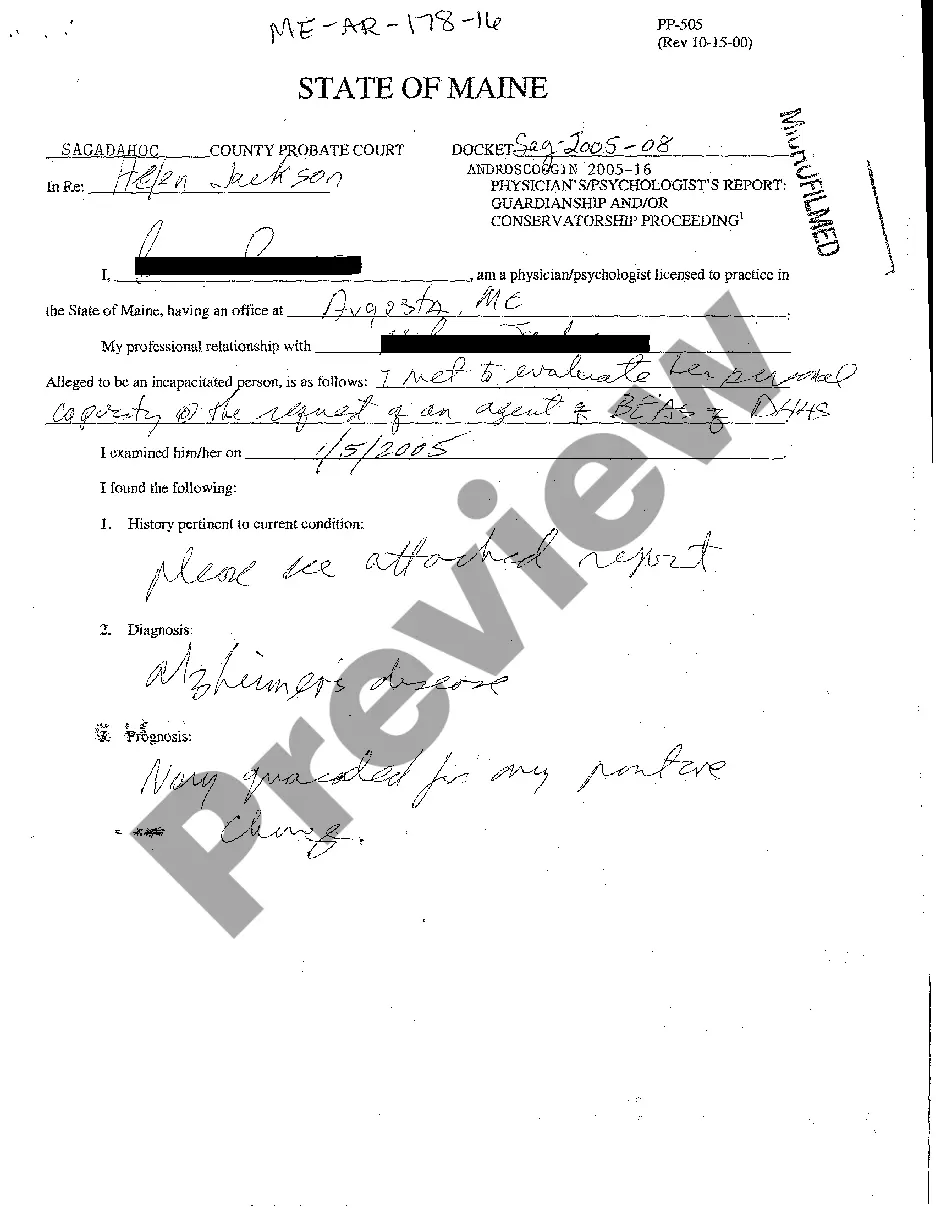

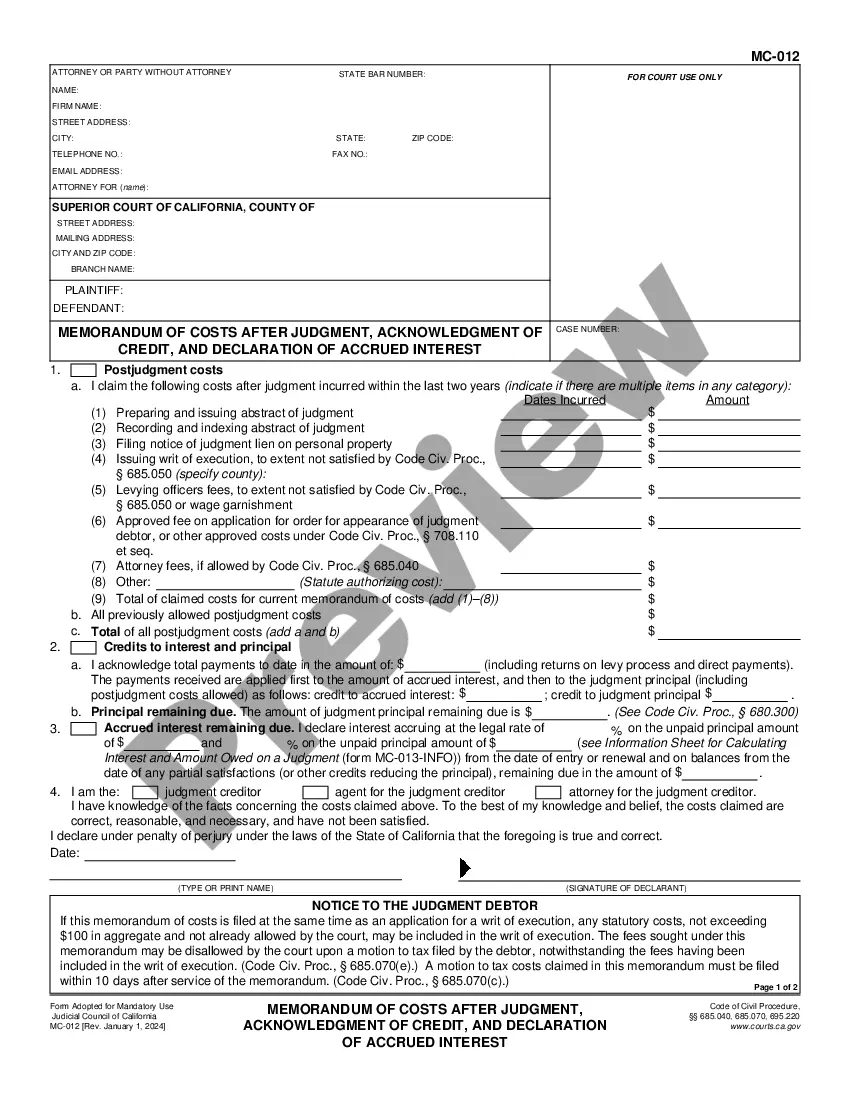

How to fill out Investor Rights Agreement Regarding The Purchase Of Series C Preferred Stock Shares?

Managing legal documents can be overwhelming, even for experienced professionals.

When you seek an Example Of Investment Agreement and don’t have time to invest in finding the correct and current version, the process can become stressful.

US Legal Forms caters to all your requirements, from personal to corporate paperwork, all in one location.

Leverage advanced tools to create and manage your Example Of Investment Agreement.

Here are the actions to take after downloading the desired form: Check that it's the correct document by previewing it and reviewing its details.

- Access a valuable library of articles, guides, handbooks, and resources relevant to your needs.

- Save time and effort searching for the documents you require, and utilize US Legal Forms’ advanced search and Review feature to find and download your Example Of Investment Agreement.

- If you have a monthly subscription, Log In to your US Legal Forms account, locate the form, and download it.

- Check your My documents tab to view previously saved documents and manage your folders as needed.

- If it's your first time using US Legal Forms, create an account for unlimited access to all platform benefits.

- A comprehensive web form directory can significantly benefit anyone aiming to navigate these situations effectively.

- US Legal Forms stands out as a leader in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name. File a fictitious name with the Department of State. Apply for licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

The forms are available online at floridarevenue.com/forms.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

Good news, Florida doesn't require a ?general? business license at the state-level for Sole Proprietors. So there's nothing to do for this step. However, depending on your industry, and where you're doing business, you may need an industry-specific license or a license issued by your municipality (ex: county or city).

You don't need to take any legal steps to form this type of business. If you are the only owner and begin conducting business, you automatically become a sole proprietorship. There is no need to formally file paperwork or submit anything at the federal, state, or local level to be recognized as such.

The state of Florida doesn't require or issue a state-wide business operating license. Instead, it regulates some industries and professionals, like doctors, lawyers and accountants. You likely have to get a business operating license from your city or county, though requirements vary.

Sole proprietors and independent contractors are self-employed individuals who go into business without registering their business as a legal entity such as a corporation, a partnership, or a limited liability company (LLC). A sole proprietorship is a single-person business of any type.

However, an LLC can elect to be treated as a sole proprietorship for tax purposes, which can result in tax savings.