Loan Modification For Heloc

Description

How to fill out Loan Modification Agreement - Multistate?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and significant financial investment.

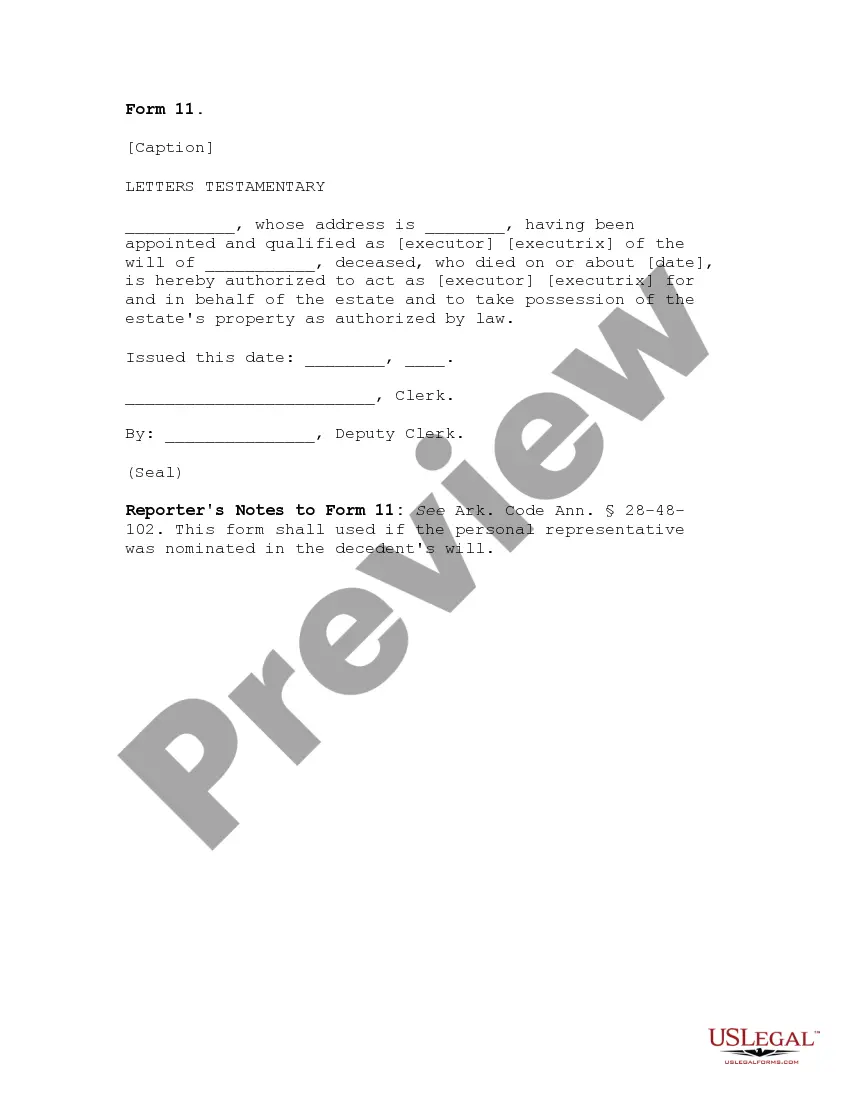

If you’re looking for a simpler and more budget-friendly method of preparing Loan Modification For Heloc or other forms without unnecessary complications, US Legal Forms is always accessible to you.

Our online repository of more than 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal needs. With just a few clicks, you can promptly acquire state- and county-specific templates meticulously prepared by our legal experts.

Review the form previews and descriptions to ensure you have located the document you need. Confirm that the template you select adheres to the criteria of your state and county. Choose the most appropriate subscription option to obtain the Loan Modification For Heloc. Download the form, then complete, sign, and print it. US Legal Forms has an immaculate reputation backed by over 25 years of experience. Join us today and make document execution simple and efficient!

- Utilize our website whenever you require reliable services to swiftly find and download the Loan Modification For Heloc.

- If you’re already familiar with our services and have set up an account with us previously, simply Log In to your account, locate the template, and download it or re-download it anytime from the My documents section.

- Don’t have an account? No problem. Registration takes just a few minutes and allows you to browse the catalog.

- But before proceeding to download Loan Modification For Heloc, remember to follow these guidelines.

Form popularity

FAQ

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company.

The National Mortgage Database (NMDB®) [1] program is jointly funded and managed by the Federal Housing Finance Agency (FHFA) and the Consumer Financial Protection Bureau (CFPB). This program is designed to provide a rich source of information about the U.S. mortgage market.

Mortgage Data is information about properties that are refinanced by banks and lending institutions. Banks, lenders, and real estate businesses use mortgage data to analyze the creditworthiness of an individual before granting them a mortgage.

The National Mortgage Database (NMDB) is the first component of the National Mortgage Database program. NMDB is updated quarterly for a nationally representative five percent sample of closed-end first-lien residential mortgages in the United States.

Government National Mortgage Association (Ginnie Mae) is a self-financing, wholly owned U.S. Government corporation within the Department of Housing and Urban Development. It is the primary financing mechanism for all government-insured or government-guaranteed mortgage loans.

Public Use Database - Fannie Mae and Freddie Mac The datasets supply mortgage lenders, planners, researchers, policymakers, and housing advocates with information concerning the flow of mortgage credit in America's neighborhoods.

A promissory note provides the financial details of the loan's repayment, such as the interest rate and method of payment. A mortgage specifies the procedure that will be followed if the borrower doesn't repay the loan. If you live in a deed of trust state, you will not get a mortgage note.

HMDA data are the most comprehensive source of publicly available information on the U.S. mortgage market. Learn more about mortgage activity from these data or download the data for your own analysis.