Special Power In

Description

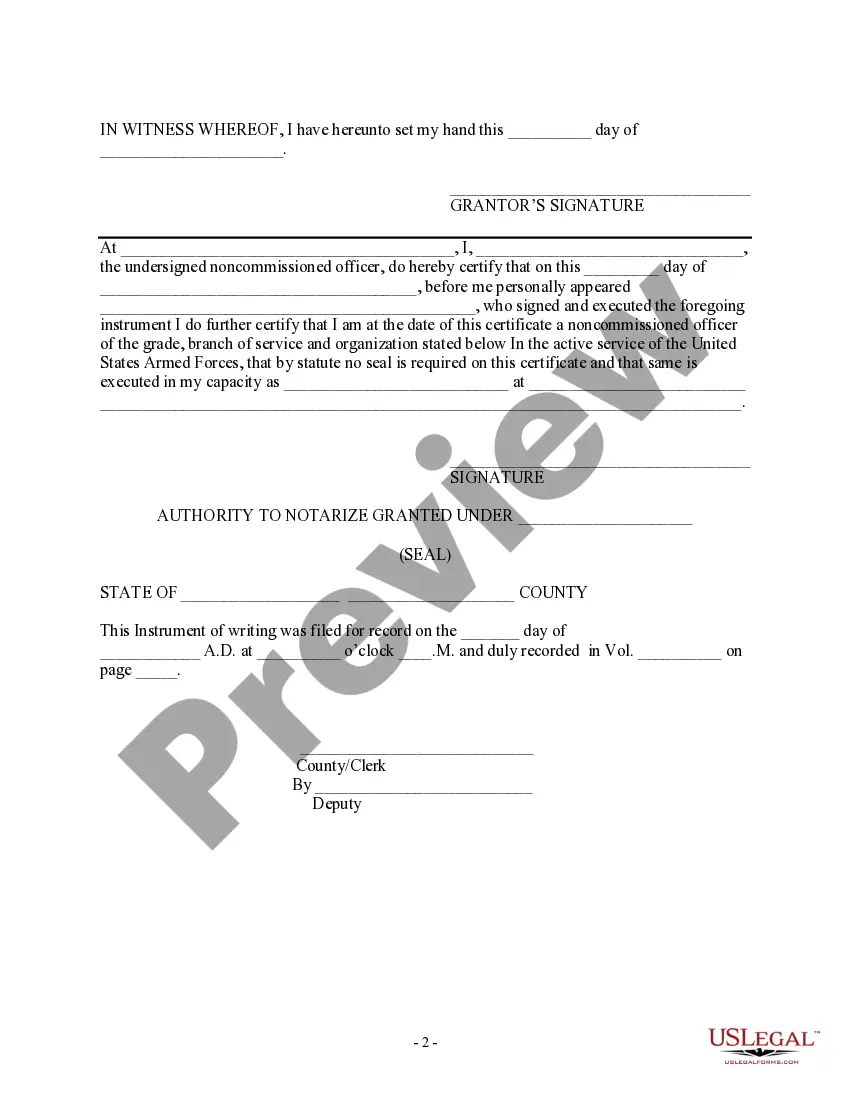

How to fill out Special Military Power Of Attorney?

It’s apparent that you can’t become a legal authority instantly, nor can you learn how to swiftly draft Special Power In without a distinct skill set.

Crafting legal documents is a labor-intensive endeavor demanding specific training and expertise. So why not entrust the creation of the Special Power In to the professionals.

With US Legal Forms, one of the most extensive legal document collections, you can access everything from courtroom paperwork to templates for in-office correspondence.

Select Buy now. After the payment is processed, you can download the Special Power In, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

You can access your documents again from the My documents tab anytime. If you’re a returning customer, you can simply Log In, and locate and download the template from the same section.

Regardless of the intention behind your forms—be it financial, legal, or personal—our website has got you covered. Explore US Legal Forms now!

- Start your journey on our website and acquire the form you need in just a few moments.

- Use the search bar at the top of the page to find the document you’re looking for.

- Preview it (if this option is available) and review the accompanying description to ascertain whether Special Power In is what you seek.

- If you require a different template, restart your search.

- Create a free account and choose a subscription plan to purchase the form.

Form popularity

FAQ

04 - LOCK-IN AGREEMENT (1) A lock-in agreement shall include, but not necessarily be limited to, the following: (a) The interest rate and discount points to be paid by the applicant on the residential mortgage loan, and if the residential mortgage loan has an adjustable interest rate, the initial interest rate to be ...

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.