Collector Messages With Page Numbers

Description

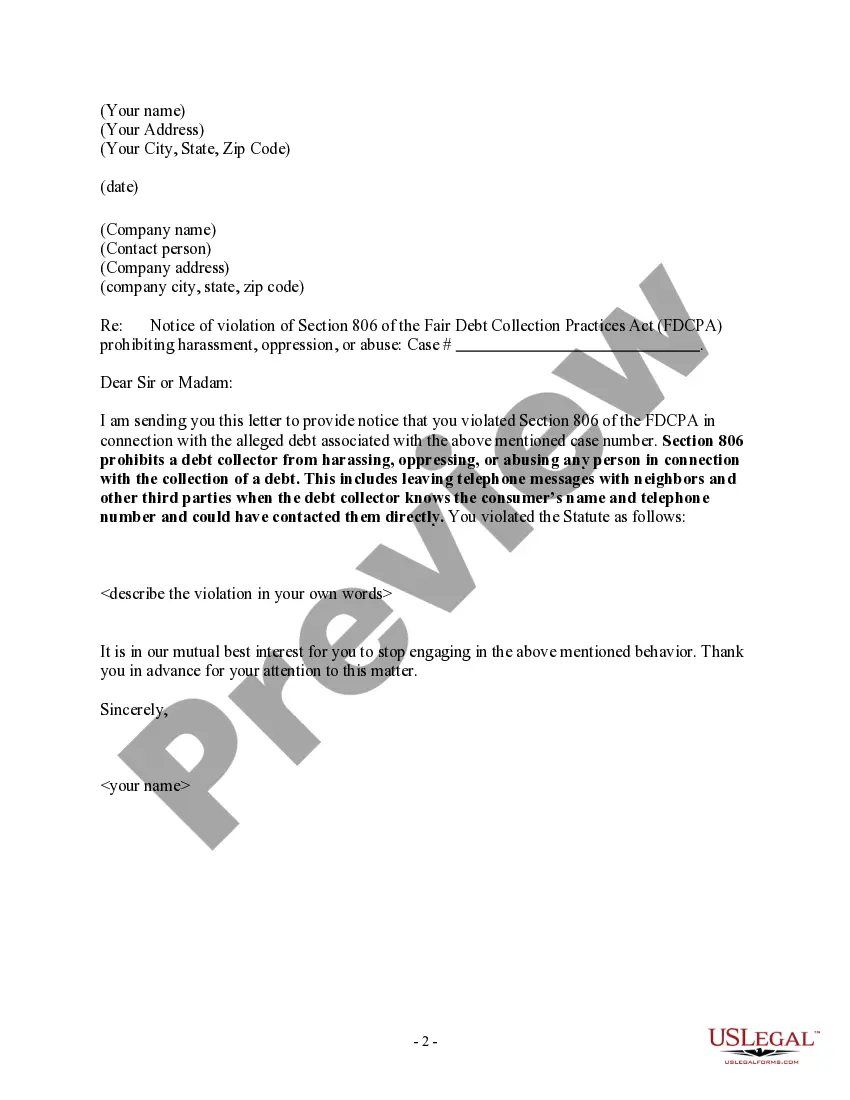

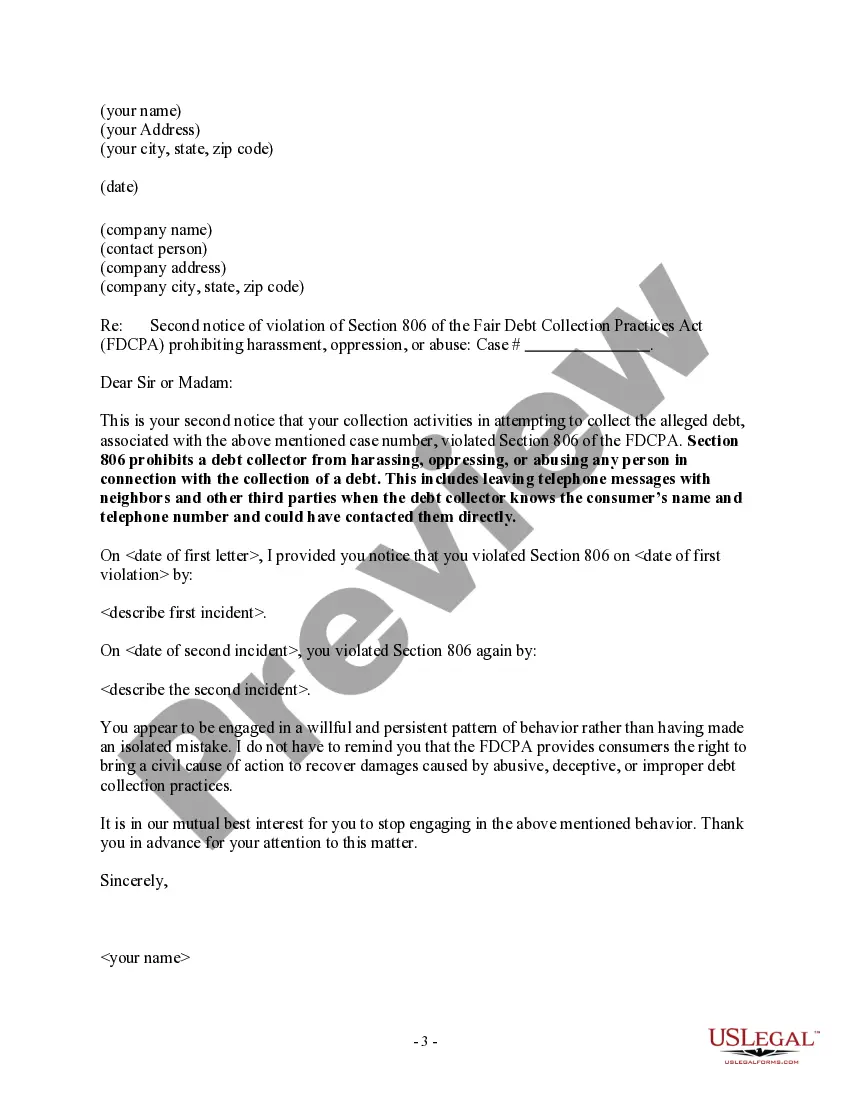

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes leaving telephone messages with neighbors or other 3rd parties when the debt collector knows the consumer's name and telephone number and could have contacted the consumer directly.

How to fill out Notice To Debt Collector - Unlawful Messages To 3rd Parties?

The Collector Messages With Page Numbers you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Collector Messages With Page Numbers will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or check the form description to ensure it fits your requirements. If it does not, make use of the search bar to find the correct one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your Collector Messages With Page Numbers (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your paperwork one more time. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

Regulation F allows emails and text messages to be sent with direct consent given by the consumer to the debt collector and indirect consent passed along by a creditor or previous debt collector who obtained direct consent.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.