Request Letter For Credit Card Replacement

Description

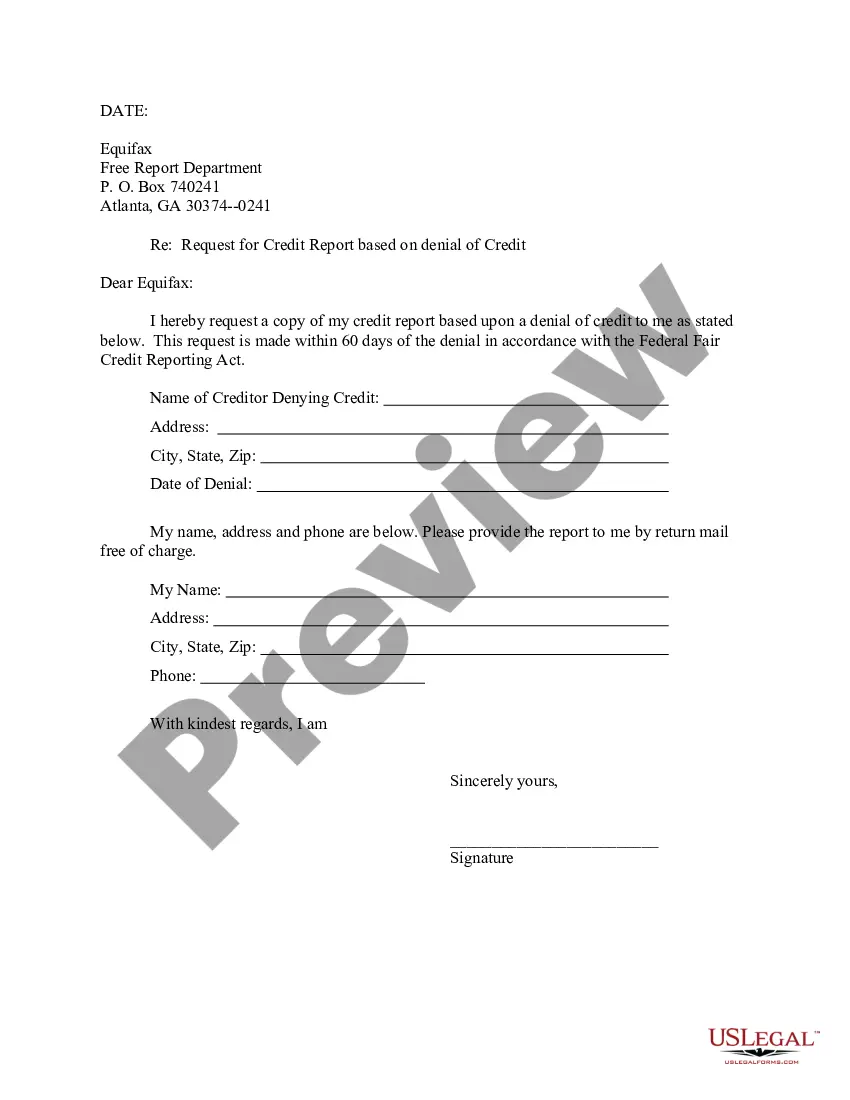

How to fill out Letter To Trans Union Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

It’s well known that you cannot instantly become a legal authority, nor can you swiftly compose a Request Letter For Credit Card Replacement without a distinct array of abilities.

Drafting legal papers is an elaborate task necessitating specific knowledge and expertise. So why not delegate the drafting of the Request Letter For Credit Card Replacement to the professionals.

With US Legal Forms, one of the most comprehensive legal template repositories, you can find everything from court papers to templates for professional correspondence.

You can access your forms again from the My documents section anytime. If you are a returning customer, you can easily Log In and find and download the template from the same section.

Regardless of the aim of your documents—whether financial and legal, or personal—our platform has you covered. Explore US Legal Forms today!

- Locate the form you require using the search bar at the upper section of the webpage.

- View it (if this feature is available) and read the accompanying description to verify if the Request Letter For Credit Card Replacement meets your needs.

- Initiate your search again if you require any additional forms.

- Establish a free account and choose a subscription plan to purchase the document.

- Click Buy now. After the payment is processed, you can retrieve the Request Letter For Credit Card Replacement, fill it out, print it, and send or mail it to the relevant parties or organizations.

Form popularity

FAQ

Requesting a letter of credit involves contacting your bank or financial institution to initiate the process. Typically, you will need to provide your account information and specify the amount and purpose of the credit. You may also need to submit a request letter for credit card replacement if you are doing this alongside obtaining a new credit card. Utilizing services like US Legal Forms can assist you in drafting the necessary documents effectively.

The time it takes to receive your replacement credit card typically varies by issuer. Generally, you can expect to receive your card within 7 to 10 business days after you submit your request. However, if you need a quicker solution, consider contacting your card issuer for expedited shipping options. Using a request letter for credit card replacement can help streamline the process.

Getting a credit card replacement is straightforward. First, you need to notify your credit card company about the lost or damaged card. They often require a request letter for credit card replacement, which you can quickly create using templates available on platforms like US Legal Forms. Once you submit your request, your replacement card will be processed and sent to you promptly.

To apply for a credit card replacement, start by contacting your bank or credit card issuer. They will guide you through the process and may require you to submit a request letter for credit card replacement. You can typically do this online or by phone. Once your request is approved, your new card should arrive in the mail within a few business days.

When writing to your bank manager about a lost credit card, begin by stating your situation clearly. Include relevant details such as your account number and the date you noticed the card was missing. Politely request a replacement and mention your desire to have a request letter for credit card replacement sent to you. Ensure your contact information is included for a swift response.

Filling out a credit card form requires you to provide specific personal information. Start with your name, address, and date of birth. Next, input your income details and choose your credit limit. Finally, make sure to review the form for accuracy before submitting your request letter for credit card replacement.

If you need to inform your bank about a lost debit card, compose a letter that includes your details and the circumstances of the loss. Specify your request for a replacement and mention the request letter for credit card replacement if applicable. It's essential to act quickly, so provide your contact information to aid faster communication.

When writing a letter to the bank for a replacement card, always start with your account information and reason for the request. Clearly state that you want a request letter for credit card replacement and provide context to your situation. Include your contact information for any follow-up they may require.

To request a replacement debit card, write a direct letter to your bank outlining your need. Be sure to mention your account details and include your request for a request letter for credit card replacement. Making your request clear and polite will help facilitate a swift response from your bank.

When writing a letter of replacement, ensure you include your personal information and state what you need replacing, such as a credit card. Clearly express your request for a request letter for credit card replacement, and provide additional details if necessary. Remember to sign off properly and thank the recipient for their attention.