Stockholders Rights Statement With The Third Parties

Description

How to fill out Stockholders' Rights Plan Of Datascope Corp.?

- Log in to your existing US Legal Forms account and ensure your subscription is active. If it requires renewal, follow your payment plan guidelines to update it.

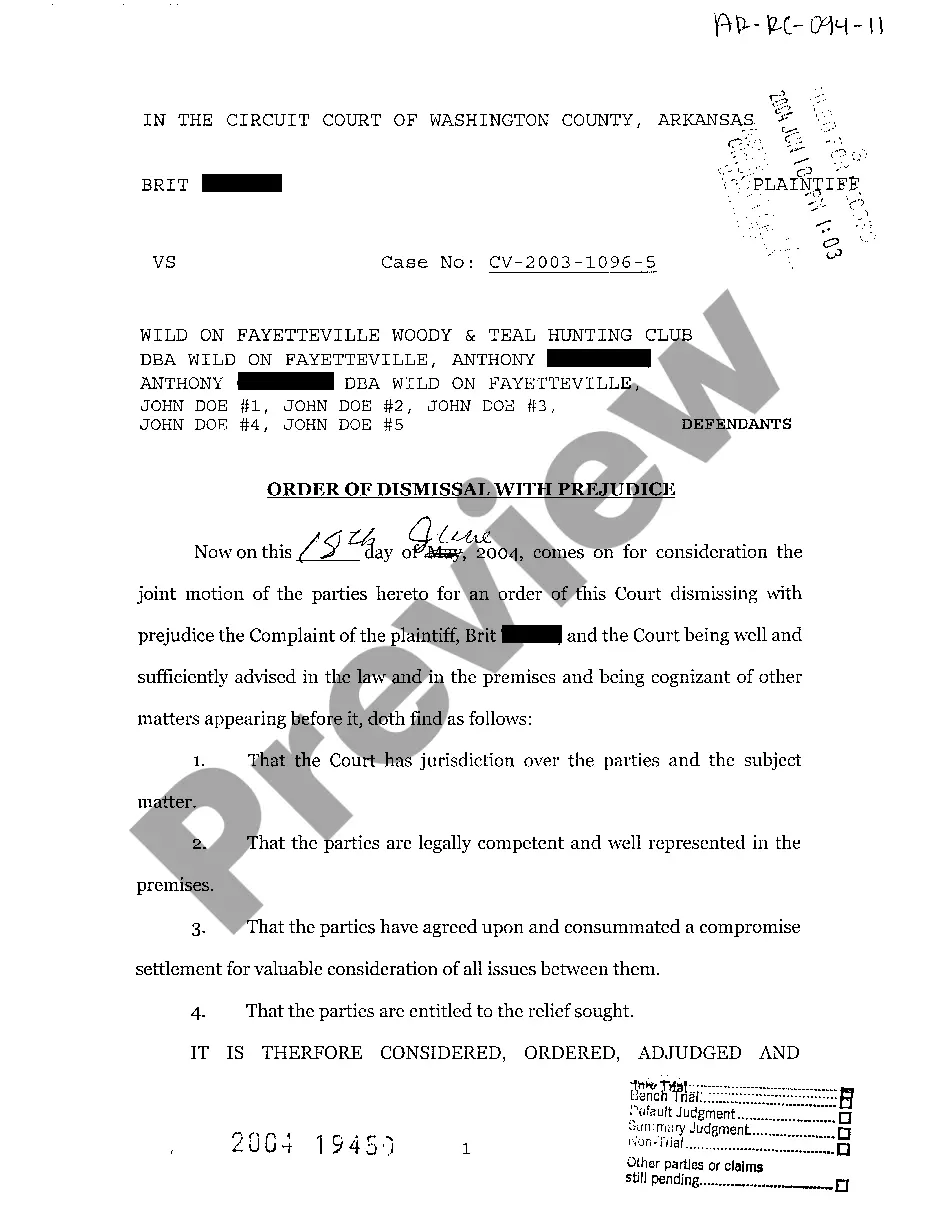

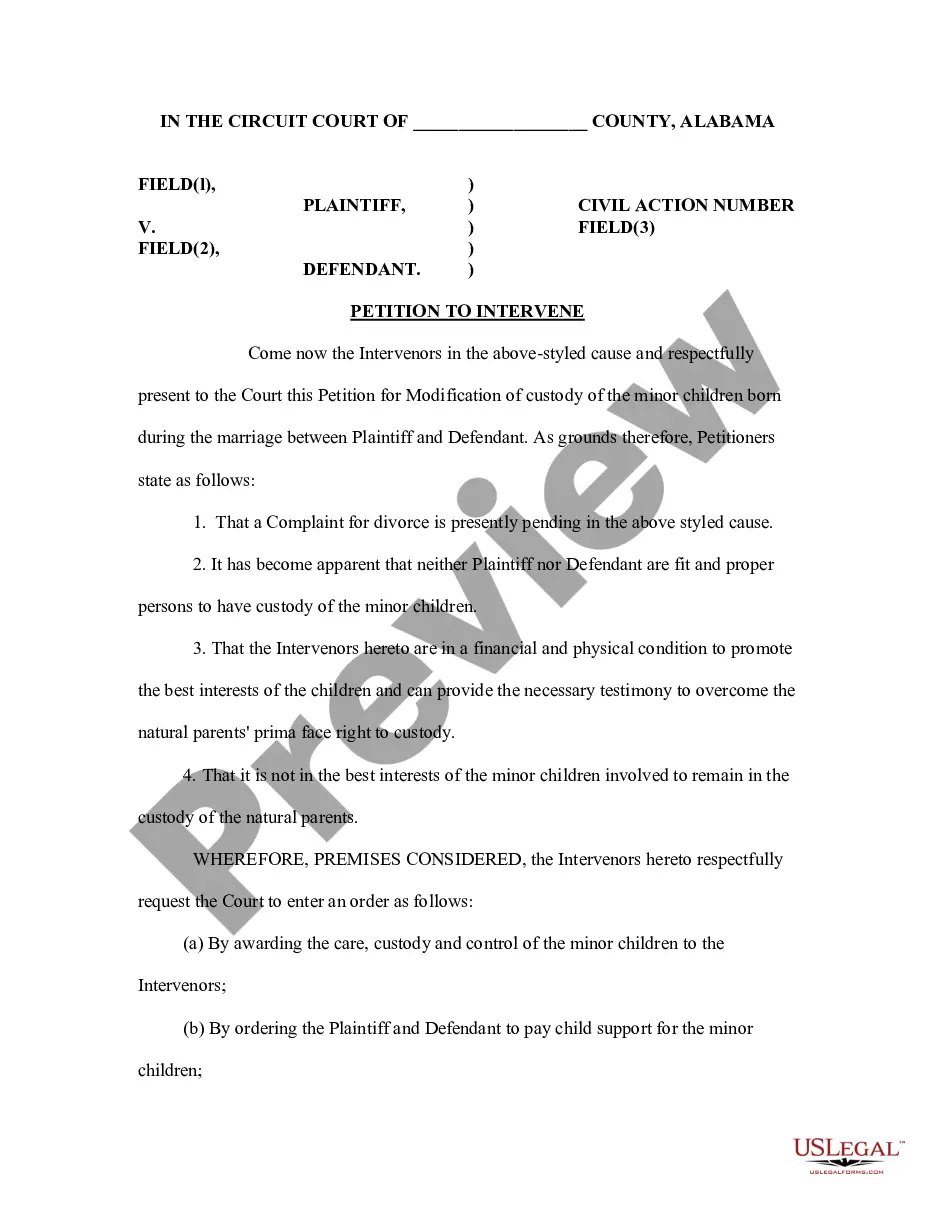

- For new users, start by selecting the desired document type. Use the Preview mode and description to confirm it aligns with your needs and jurisdiction requirements.

- If the initial template isn’t suitable, utilize the Search tab to find the correct form that matches your specific requirements.

- Proceed to purchase the document by clicking the Buy Now button, then choose a subscription plan that fits your needs. You will need to create an account to access your documents.

- Complete your purchase by entering your payment details through credit card or PayPal to finalize your subscription.

- Once purchased, download the legal template directly to your device. You can find it anytime in the My Forms section of your profile.

In conclusion, US Legal Forms not only simplifies the legal document process but also empowers users to create legally sound documents with ease. With a robust collection of over 85,000 forms and dedicated support, you can rest assured that your legal needs are met.

Start your hassle-free legal journey today!

Form popularity

FAQ

Typically, a shareholders agreement is drafted by the company's legal counsel in consultation with the shareholders. Legal experts ensure that the agreement complies with laws and reflects shareholder intentions accurately. The stockholders rights statement with the third parties often informs this process, guiding the legal framework necessary for protecting rights and interests. Utilizing credible legal resources like uslegalforms can streamline this important task.

Yes, a 25% shareholder can potentially be removed, but the process depends on the company's bylaws and the shareholders agreement. Typically, a significant vote may be necessary, depending on the context and the shareholders' rights. The stockholders rights statement with the third parties helps clarify these procedures, ensuring all parties are aware of their options. Knowing the guidelines allows shareholders to navigate the situation with confidence.

No, not all shareholders are required to be part of a shareholders agreement, although it can be beneficial. Some agreements may only involve certain shareholders to protect their rights and outline their responsibilities. The stockholders rights statement with the third parties can provide clarity on who should be included and how the agreement affects each party involved. This understanding can foster smoother operations and collaboration among shareholders.

The 10% shareholder rule stipulates that shareholders owning at least 10% of a company's shares can propose matters at annual meetings. This rule aims to empower larger stakeholders to influence crucial decisions and drive accountability within the company. Understanding this rule is critical for shareholders who wish to leverage the stockholders rights statement with the third parties to protect their interests and advocate effectively for change.

Any shareholder who meets specific eligibility criteria can submit proposals, usually including ownership of shares for a designated time. Institutional investors, individual shareholders, and others with an interest in the company can participate. The stockholders rights statement with the third parties serves as a guideline to help prospective submitters navigate the process smoothly. Engaging in this manner allows for broader participation in corporate governance.

Shareholder proposals vary widely, but they typically include social, environmental, or corporate governance issues. Common types include requests for changes in company policy or practices, such as sustainability initiatives or board diversity. Each proposal must align with the stockholders rights statement with the third parties to ensure proper evaluation and consideration. Understanding these types empowers shareholders to influence company decisions effectively.

Yes, shareholders can submit proposals without being physically present at meetings. They often provide their proposals in writing, either through their proxy or by mail. This process ensures that all voices are heard, even if some cannot attend in person. The stockholders rights statement with the third parties plays a crucial role in outlining how these proposals can be executed.

Combining financial statements involves adding together line items from each statement to create a comprehensive view of your business. Ensure to align the accounting periods and reflect any fair value adjustments where applicable. This method helps to clarify financial performance and assess compliance with stockholders rights statements with the third parties.

Shareholders possess several fundamental rights that protect their interests. These rights include the right to vote on key company matters, receive dividends, access important information, participate in shareholder meetings, and sell their shares. Understanding these rights empowers shareholders and helps them engage with their stockholders rights statement with the third parties effectively.

To consolidate financial statements effectively, gather the financial data from each subsidiary. Then, combine these figures into a single statement, ensuring you eliminate intercompany transactions and balances to avoid double-counting. This process provides a clearer picture of the financial health of the overall organization, allowing stockholders to review the stockholders rights statement with the third parties.