Plan Of Reorganization Sample For Creditors

Description

How to fill out Plan Of Reorganization Sample For Creditors?

There is no longer a necessity to waste hours searching for legal documents to comply with your local state laws. US Legal Forms has compiled all of them in one location and made their access more streamlined.

Our site offers over 85,000 templates for various personal and business legal matters organized by jurisdiction and application area. All forms are accurately prepared and confirmed for legitimacy, so you can be assured of obtaining an up-to-date Plan Of Reorganization Sample For Creditors.

If you are aware of our service and already possess an account, ensure your subscription is activated before downloading any templates. Log In to your account, select the document, and click Download. You can also revisit any saved documents whenever necessary by accessing the My documents tab in your profile.

Print your form for manual completion or upload the sample if you prefer to edit it using an online editor. Preparing official documents under federal and state regulations is quick and effortless with our platform. Experience US Legal Forms now to maintain your documentation organized!

- If you've previously not interacted with our service, the process will require a few more steps to finalize.

- Here's how new users can locate the Plan Of Reorganization Sample For Creditors in our library.

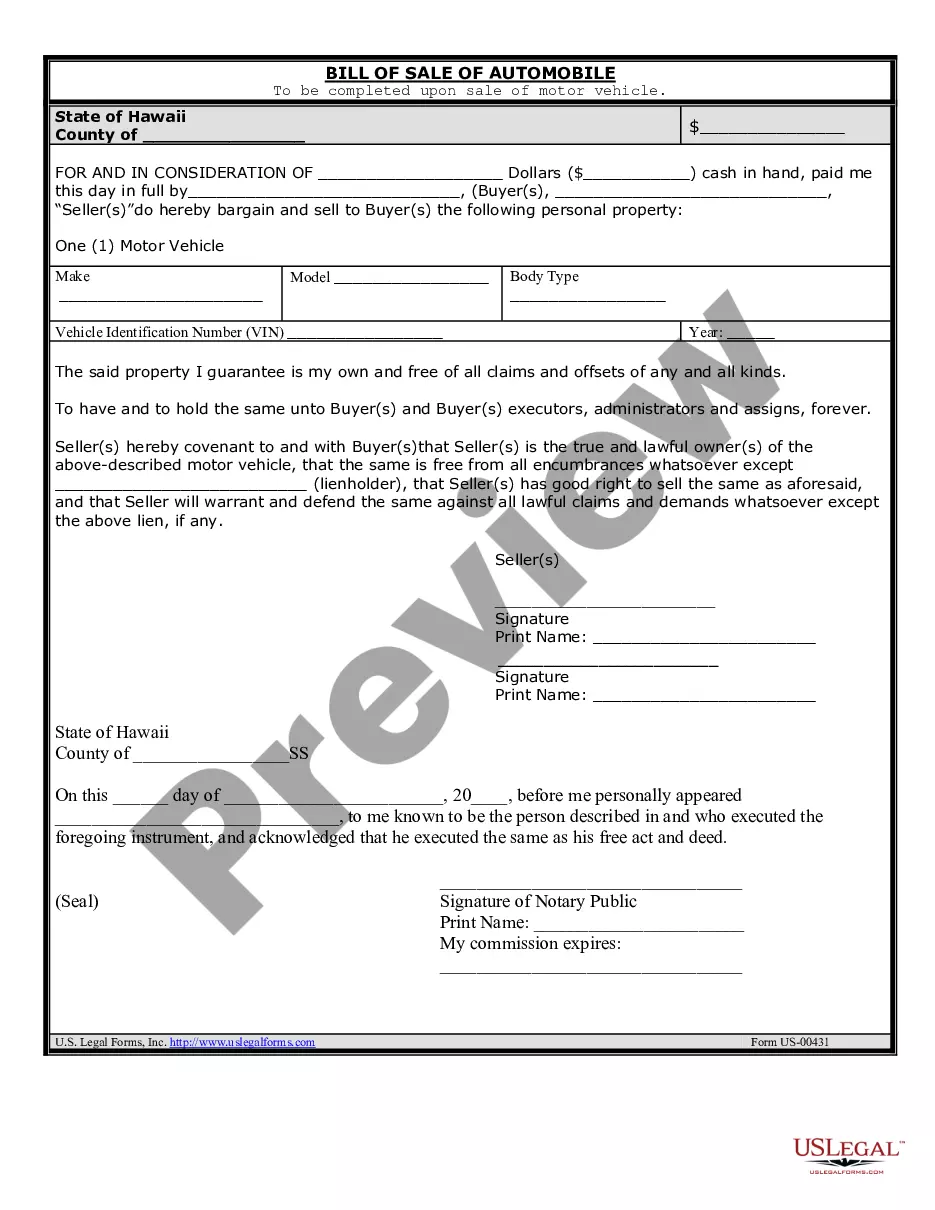

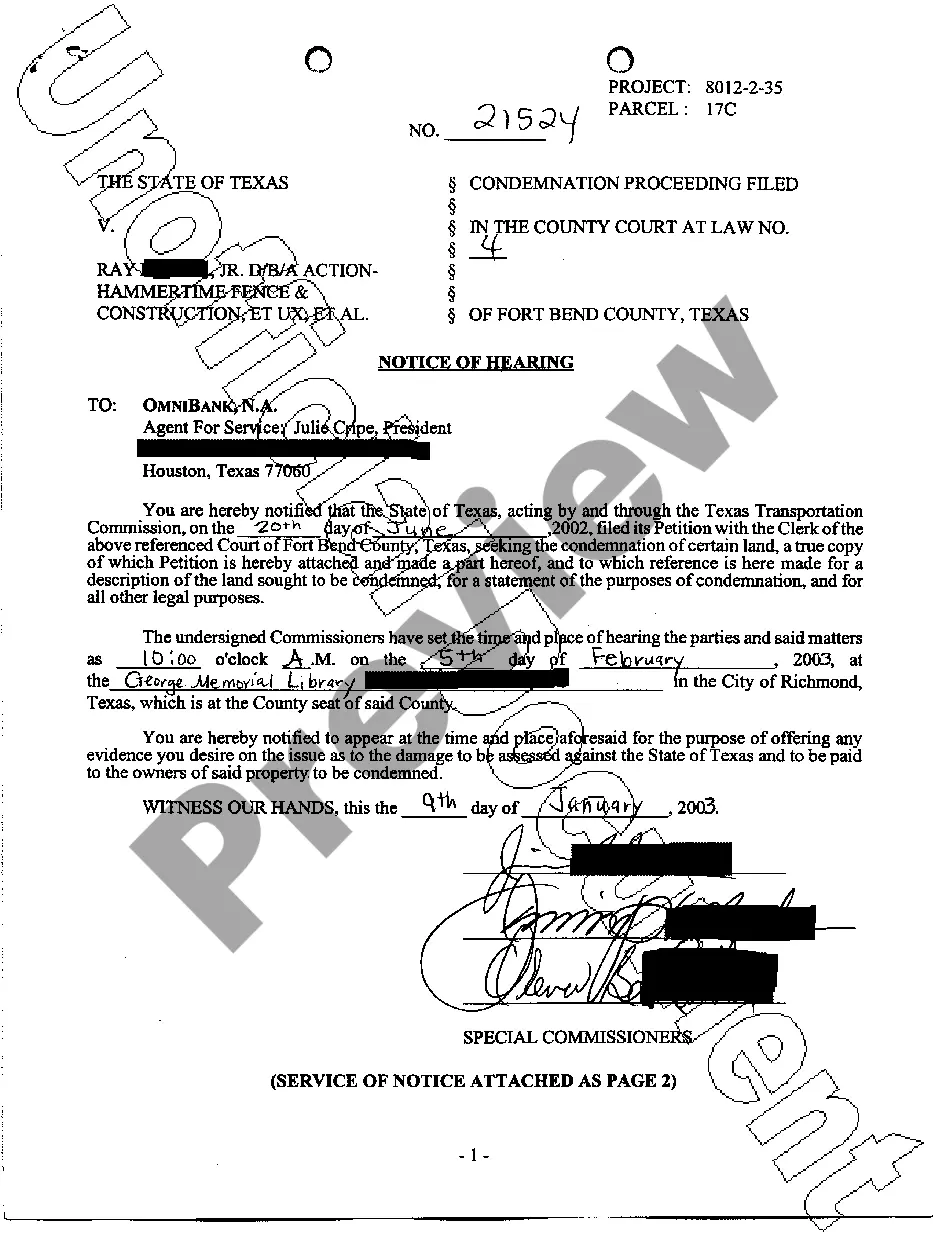

- Examine the page content thoroughly to confirm it contains the sample you need.

- To do so, use the form description and preview options if available.

- Employ the search bar above to find another template if the preceding one did not meet your needs.

- Once you identify the correct template, click Buy Now next to its name.

- Choose the desired pricing plan and either create an account or Log In.

- Complete your payment with a credit card or via PayPal to proceed.

- Select the file format for your Plan Of Reorganization Sample For Creditors and download it to your device.

Form popularity

FAQ

A POR declaration, or Plan of Reorganization declaration, is a formal statement filed in bankruptcy court outlining a debtor's proposed reorganization strategy. It serves as a crucial document for creditors to evaluate the viability of the restructuring plan. By providing a plan of reorganization sample for creditors, businesses can effectively communicate their intentions and proposals for debt repayment.

The three types of liquidation include voluntary liquidation, where a company’s owners decide to sell assets; compulsory liquidation, which is initiated by creditors through a court order; and members' voluntary liquidation, where solvent businesses liquidate to distribute assets to shareholders. Each type results in different processes and outcomes, underscoring the importance of a well-documented plan of reorganization sample for creditors when considering alternatives.

Restructuring is a broader term that can include various aspects of modifying the business's financial structure, while reorganization specifically refers to a legal process typically under bankruptcy protection. Both strategies may involve a plan of reorganization sample for creditors to negotiate and outline how debts will be handled. Understanding these approaches can help businesses determine their best course of action.

A plan of reorganization typically includes the details of how the business will restructure its debts, along with specific timelines for repayments. It outlines the treatment of different classes of creditors and the proposed financial structure moving forward. A plan of reorganization sample for creditors can be beneficial for understanding the anticipated outcomes and obligations during the restructuring process.

Liquidation results in the complete shutdown of a business, while administration offers a chance to reorganize and rectify financial troubles. In administration, a plan of reorganization sample for creditors may be introduced to negotiate new payment terms, thereby keeping the business operational. This strategy can help preserve jobs and maximize returns to creditors.

Liquidation and reorganization differ in their outcomes and processes. In liquidation, all assets are sold off, and the business ceases to exist. In contrast, reorganization involves creating a plan of reorganization sample for creditors that facilitates debt restructuring, allowing the business to thrive while repaying its obligations over time.

A disclosure statement is a document that outlines a debtor’s financial situation and the details of their plan of reorganization. It provides creditors with necessary information to assess the feasibility of the proposed plan. This document usually accompanies the plan of reorganization sample for creditors, ensuring all parties understand the proposed terms and conditions.

A plan of reorganization typically contains several key elements, including the company's financial situation, proposed changes to operations, and a schedule for debt repayment. Importantly, it should also address specific provisions for creditors, which can be found in a plan of reorganization sample for creditors. These elements work together to create a comprehensive roadmap for restructuring, enabling all stakeholders to understand their roles and potential outcomes in the recovery process.

POR stands for Plan of Reorganization in the context of restructuring. This plan is essential as it delineates how a distressed company intends to address its financial challenges and repay its creditors. Utilizing a plan of reorganization sample for creditors can help stakeholders understand the company's restructuring strategy and expected timelines. Thus, a well-crafted POR offers assurance to all parties involved during uncertain financial times.

A reorganization plan in finance is a formal document that outlines how a company will restructure its debts and operations. This plan is crucial for guiding the company back to financial stability. Specifically, when looking for a plan of reorganization sample for creditors, it details the proposed changes to satisfy creditor claims while ensuring the company's survival and growth. This provides creditors with clear expectations and potential outcomes.