Approval For Stock

Description

How to fill out Approval Of Authorization Of Preferred Stock?

Creating legal documents from the ground up can frequently be daunting. Specific situations may require extensive research and substantial financial investment.

If you’re looking for a more straightforward and economical method of producing Approval For Stock or any other documents without the hassle, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously crafted for you by our legal professionals.

Utilize our website whenever you require dependable and trustworthy services through which you can easily find and download the Approval For Stock. If you’re a returning user and have previously registered with us, simply Log In to your account, find the template, and download it or re-download it anytime in the My documents section.

Choose the most appropriate subscription plan to obtain the Approval For Stock. Download the form, then complete, validate, and print it. US Legal Forms boasts a strong reputation and over 25 years of experience. Join us today and make document execution simple and efficient!

- Don't have an account? No worries. Setting it up takes only a few minutes and allows you to browse the library.

- However, before proceeding to download Approval For Stock, consider these suggestions.

- Examine the document preview and descriptions to ensure you have the correct form.

- Ensure the template you select meets the standards of your state and county.

Form popularity

FAQ

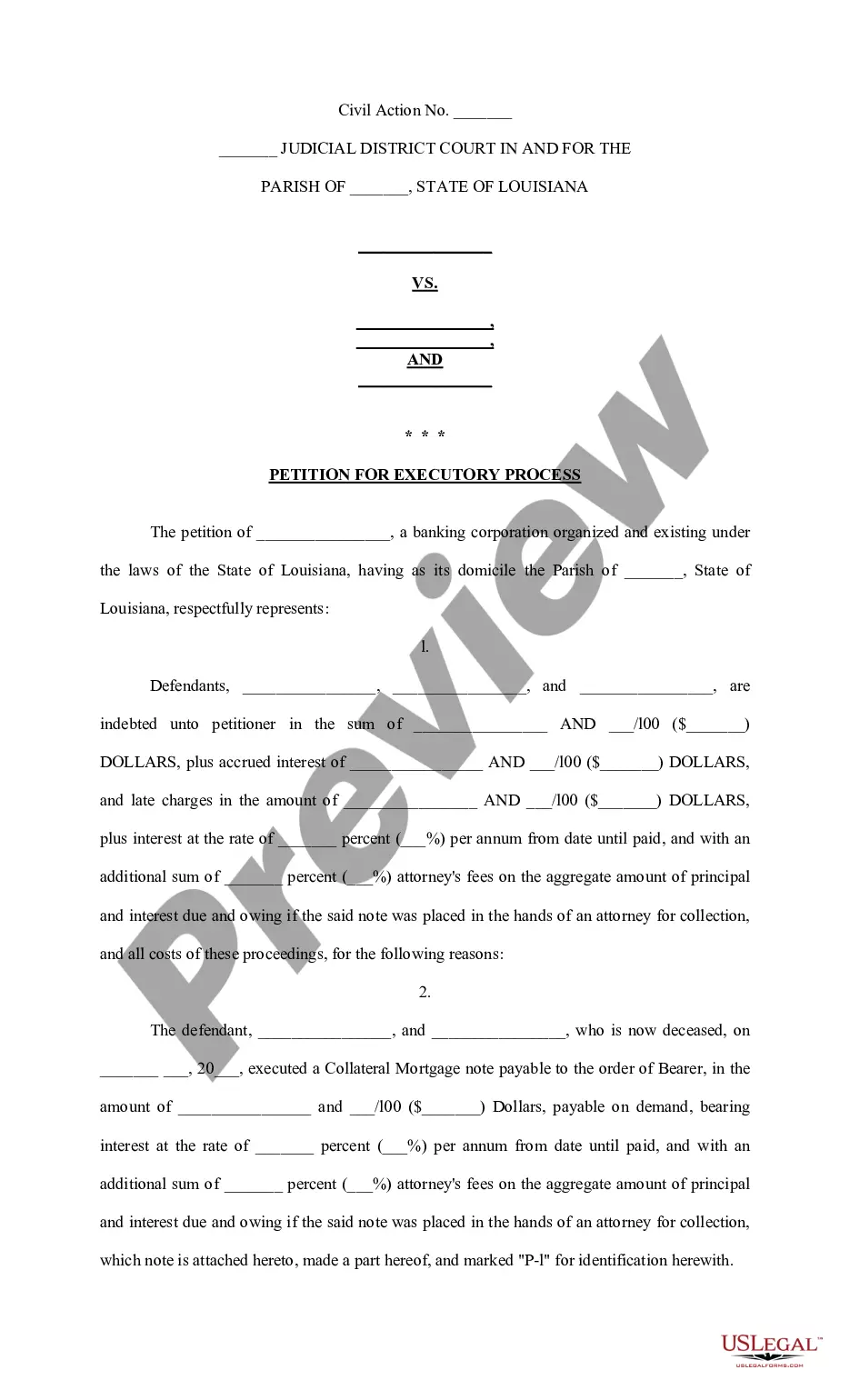

The documentation required for issuance of securities differs depending on the type of security. If the security is stock, then the documentation would include board approval and a fully executed stock purchase agreement.

An S-1 Form is necessary for regulatory purposes, but its value extends far beyond satisfying legal requirements. Consider that interested individuals who are thinking about buying a security can review the S-1 to learn more about the opportunity.

Shareholders can be either individuals or corporates. The company follows the rules prescribed by Companies Act 2013 while issuing the shares. Issue of Prospectus, Receiving Applications, Allotment of Shares are three basic steps of the procedure of issuing the shares.

The first step in the process is filing Form S-1 with the SEC. After submitting the initial S-1, the SEC reviews the submission and then comes back with comments. These comments will likely be detailed, which will help you as you fill out S-1/A to amend the original form.

SEC Form S-1 is the initial registration form for new securities required by the SEC for public companies that are based in the U.S. Any security that meets the criteria must have an S-1 filing before shares can be listed on a national exchange, such as the New York Stock Exchange.