Grant Of Stock Options With Private Company

Description

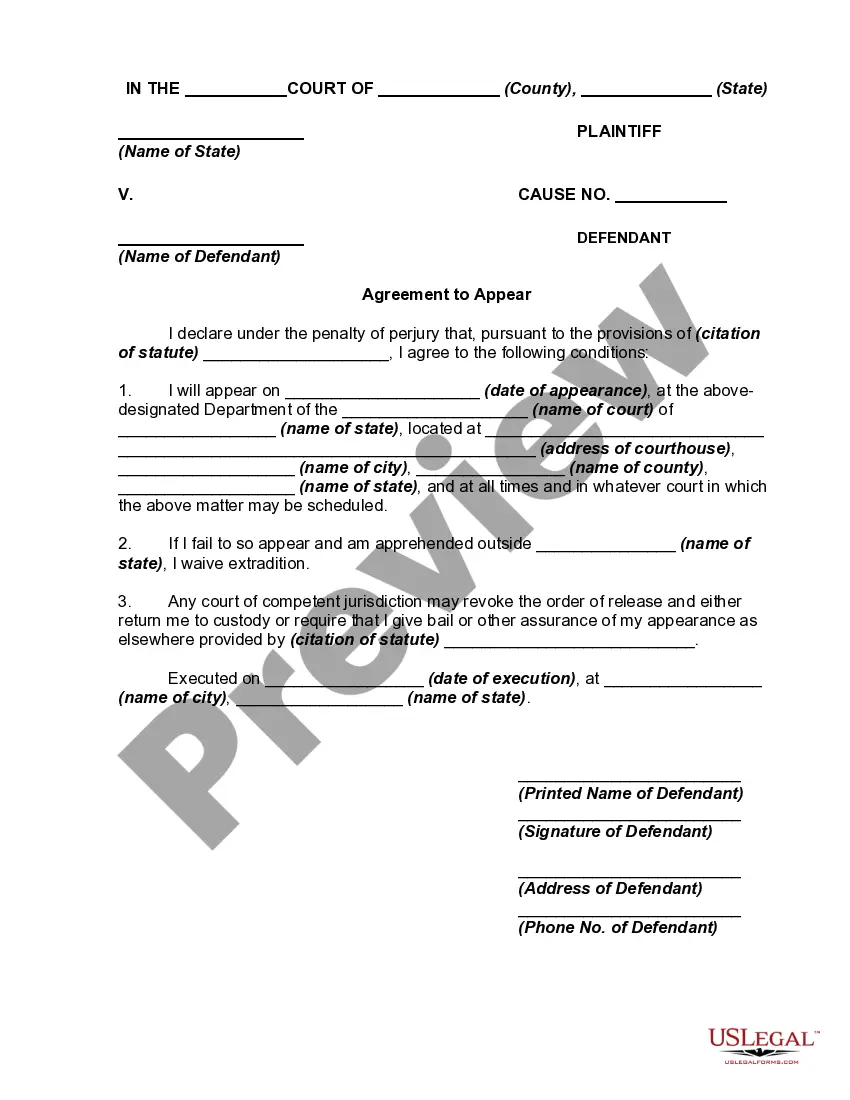

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

Legal papers management can be mind-boggling, even for the most skilled specialists. When you are searching for a Grant Of Stock Options With Private Company and don’t get the time to devote trying to find the correct and up-to-date version, the operations might be demanding. A robust online form catalogue might be a gamechanger for everyone who wants to handle these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from personal to enterprise paperwork, in one spot.

- Use advanced tools to complete and manage your Grant Of Stock Options With Private Company

- Gain access to a useful resource base of articles, tutorials and handbooks and materials related to your situation and needs

Save effort and time trying to find the paperwork you need, and make use of US Legal Forms’ advanced search and Preview feature to find Grant Of Stock Options With Private Company and get it. For those who have a monthly subscription, log in in your US Legal Forms account, search for the form, and get it. Review your My Forms tab to see the paperwork you previously downloaded as well as to manage your folders as you can see fit.

Should it be the first time with US Legal Forms, register a free account and obtain limitless usage of all benefits of the library. Here are the steps to consider after downloading the form you need:

- Confirm this is the proper form by previewing it and looking at its information.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are all set.

- Choose a subscription plan.

- Find the format you need, and Download, complete, sign, print out and send out your document.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Enhance your everyday document management in to a smooth and intuitive process right now.

Form popularity

FAQ

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Stock options are only for people This issue often arises when a consultant provides services to the company and asks to have their options titled in the name of their LLC. While it's usually fine to grant stock options to an individual consultant under the option plan, grants generally can't be made to an entity.

Many private companies offer equity compensation in the form of employee stock options. For employers, offering this benefit is one way to attract and retain talent. Equity compensation can create a shared interest in the company's overall success.

When the stock options are granted, the total stock option compensation expense is calculated as the fair market value of the stock options x the number of options granted. The company would debit stock option compensation expense and credit ?equity APIC ? stock option?.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.