Value For Phantom

Description

How to fill out Book Value Phantom Stock Plan Of First Florida Banks, Inc.?

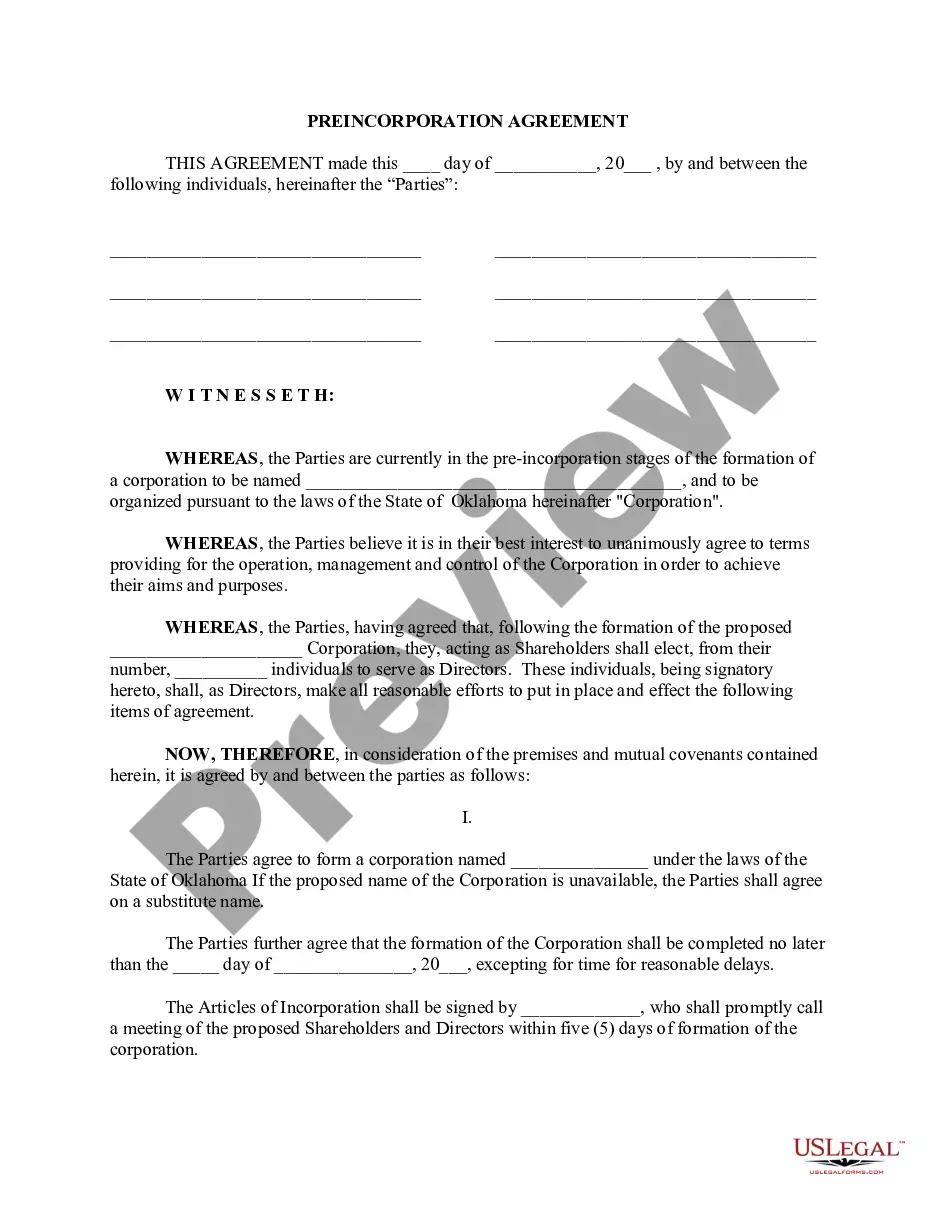

Using legal templates that meet the federal and local regulations is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the appropriate Value For Phantom sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal case. They are easy to browse with all papers collected by state and purpose of use. Our experts stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a Value For Phantom from our website.

Obtaining a Value For Phantom is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Analyze the template using the Preview option or via the text outline to make certain it meets your needs.

- Locate a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Value For Phantom and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

For example, suppose an employee received 10 phantom shares with a starting value of $7, and assume the shares are valued on the payment date at $15. At the date of payment the employee would receive $150 under a ?full value? plan and $80 under an ?appreciation only? plan.

The two types of phantom stock plans are "appreciation only," which doesn't include the value of the underlying shares, just the increase in stock over the amount of time the shares are held; and "full value," which pays the underlying value and the amount the stock increased while it was held.

The answer involves two variables: (a) the presumed value of the company, and (b) the number of shares to be used in the plan. Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares).

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock). As such, the sponsoring company must recognize the plan expense ratably over the vesting period. Varying accrual schedules can be found in the market.