Restricted Stock Between Withholding Tax

Description

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Locating a reliable resource for obtaining the most updated and pertinent legal templates is a significant part of navigating bureaucracy.

Acquiring the appropriate legal documents requires accuracy and carefulness, which is why it is crucial to obtain samples of Restricted Stock Between Withholding Tax exclusively from reputable sources, such as US Legal Forms.

After obtaining the form on your device, you can alter it using the editor or print it out and fill it in manually. Eliminate the complications associated with your legal documents. Explore the extensive collection at US Legal Forms to discover legal templates, verify their relevance to your case, and download them immediately.

- Utilize the library navigation or search function to find your template.

- Examine the form’s details to determine if it meets the requirements of your state and locality.

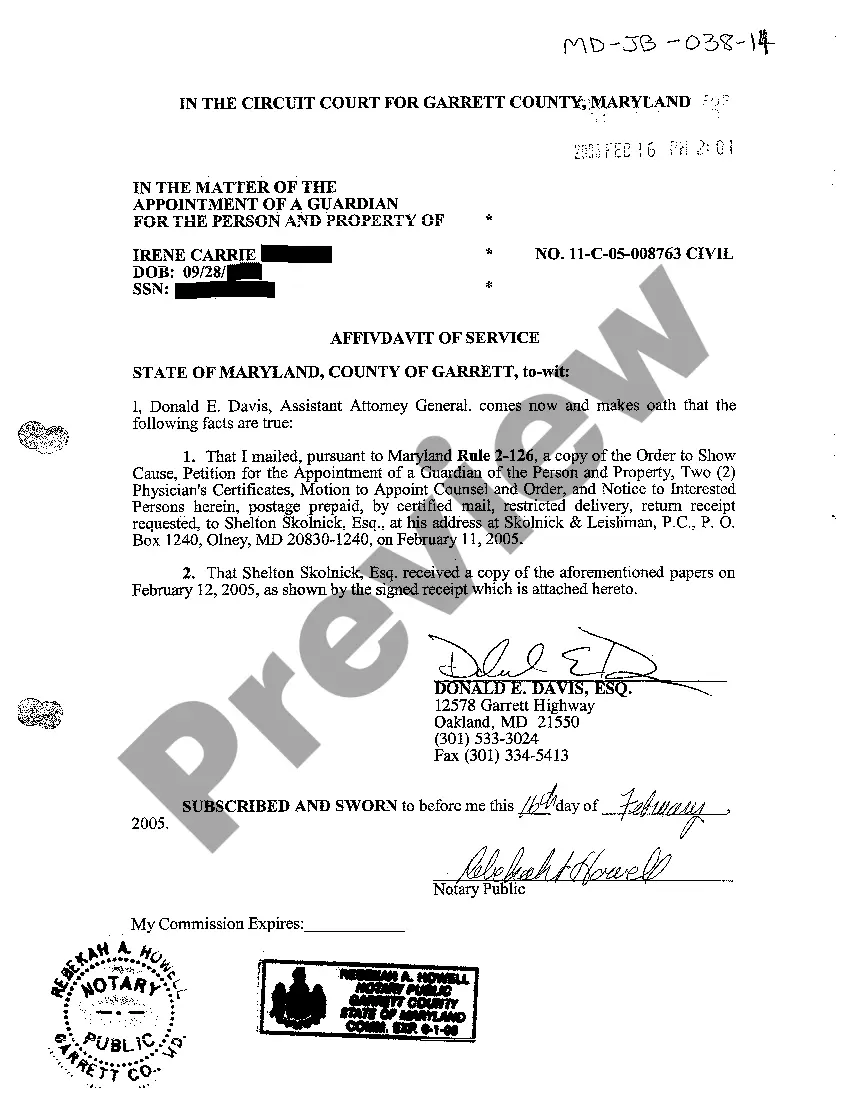

- Check the form preview, if available, to verify that the form aligns with what you are looking for.

- Return to the search to find the correct document if the Restricted Stock Between Withholding Tax does not satisfy your needs.

- If you are confident about the form’s applicability, download it.

- If you are an authorized user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your preferences.

- Continue to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the format for downloading Restricted Stock Between Withholding Tax.

Form popularity

FAQ

At vesting, RSU income is reported on your W2, and any taxes withheld are included as well. RSUs are like options with a $0 strike price. So, a RSU share is always at least as valuable as one stock option. However, because of this, companies typically grant more shares of options than RSUs.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

Locate Supplemental Tax Documentation Don't rely only on the 1099-B form. Instead, supply proof of the true cost basis of the restricted stock unit so you only pay taxes on what you owe. Some documentation may include the following: Records from your company supporting the vesting date and number of shares.

Income in the form of RSUs will typically be listed on the taxpayer's W-2 in the ?Other? category (Box 14). Taxpayers will simply translate the figure listed in Box 14 to their federal tax return and, if applicable, state tax return(s).

If you have RSUs the amount should be shown in box 14 of your W-2 copy. This amount should also be included in the wages (box 1) of your W-2. Box 14 is used by employers to list various items and there is not a standard list of codes, you can use the options for "Other Not Listed Here" in place of RSU Gain.