Stock Agreement Shareholders With Call Option

Description

How to fill out Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

Getting a go-to place to take the most current and appropriate legal samples is half the struggle of working with bureaucracy. Finding the right legal documents calls for precision and attention to detail, which is the reason it is vital to take samples of Stock Agreement Shareholders With Call Option only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the information regarding the document’s use and relevance for your situation and in your state or region.

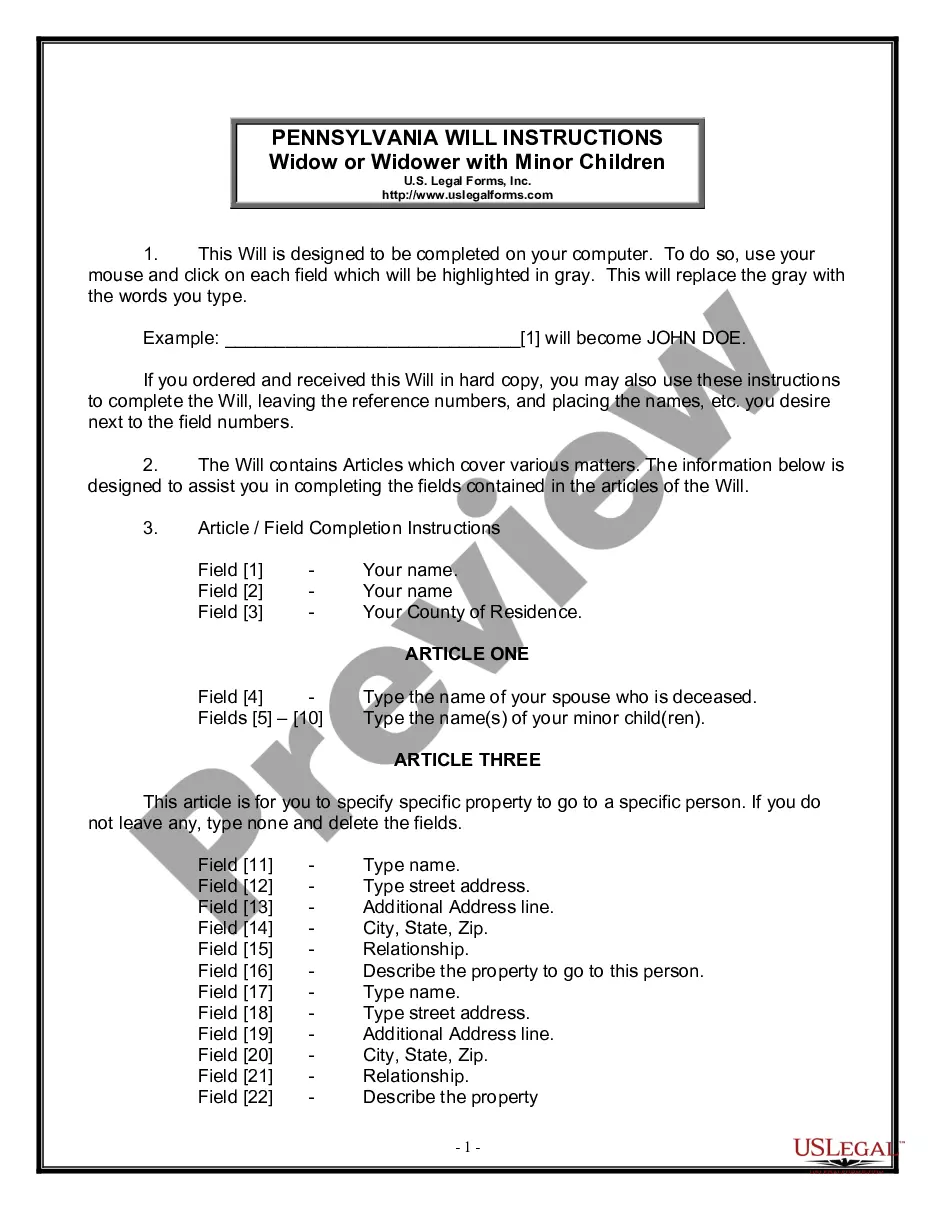

Consider the following steps to finish your Stock Agreement Shareholders With Call Option:

- Utilize the library navigation or search field to locate your template.

- Open the form’s information to see if it matches the requirements of your state and region.

- Open the form preview, if there is one, to ensure the form is the one you are interested in.

- Return to the search and look for the right template if the Stock Agreement Shareholders With Call Option does not suit your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Pick the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Pick the file format for downloading Stock Agreement Shareholders With Call Option.

- When you have the form on your gadget, you may alter it with the editor or print it and complete it manually.

Get rid of the headache that accompanies your legal paperwork. Discover the extensive US Legal Forms collection where you can find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

A call option writer makes money from the premium they received for writing the contract and entering into the position. This premium is the price the buyer paid to enter into the agreement. A call option buyer makes money if the price of the security remains above the strike price of the option.

For instance, 1 ABC 110 call option gives the owner the right to buy 100 ABC Inc. shares for $110 each (that's the strike price), regardless of the market price of ABC shares, until the option's expiration date.

There are two ways to write a call option ? sell covered calls or sell naked calls. When you write a covered call, you are selling an option on an underlying stock that you own. Writing a naked call means you are selling an option on a stock you do not currently own.

The biggest advantage of buying a call option is that it magnifies the gains in a stock's price. For a relatively small upfront cost, you can enjoy a stock's gains above the strike price until the option expires. So if you're buying a call, you usually expect the stock to rise before expiration.

Call options are a type of derivative contract that gives the holder the right but not the obligation to purchase a specified number of shares at a predetermined price, known as the "strike price" of the option.