Agreement Investment Trust Withholding Tax

Description

How to fill out Advisory Agreement Between Real Estate Investment Trust And Corporation?

Precisely constructed official documents are one of the essential protections against complications and legal disputes, though acquiring them without a lawyer's support may require time.

Whether you need to swiftly locate a current Agreement Investment Trust Withholding Tax or any other forms related to employment, family, or business matters, US Legal Forms is reliably at your service.

For existing users of the US Legal Forms library, the process is even more straightforward. If your subscription is active, you only need to Log In to your account and click the Download button next to the desired document. Additionally, you can retrieve the Agreement Investment Trust Withholding Tax at any time, as all documentation previously acquired on the platform is stored within the My documents section of your profile. Save time and money on crafting formal documents. Experience US Legal Forms immediately!

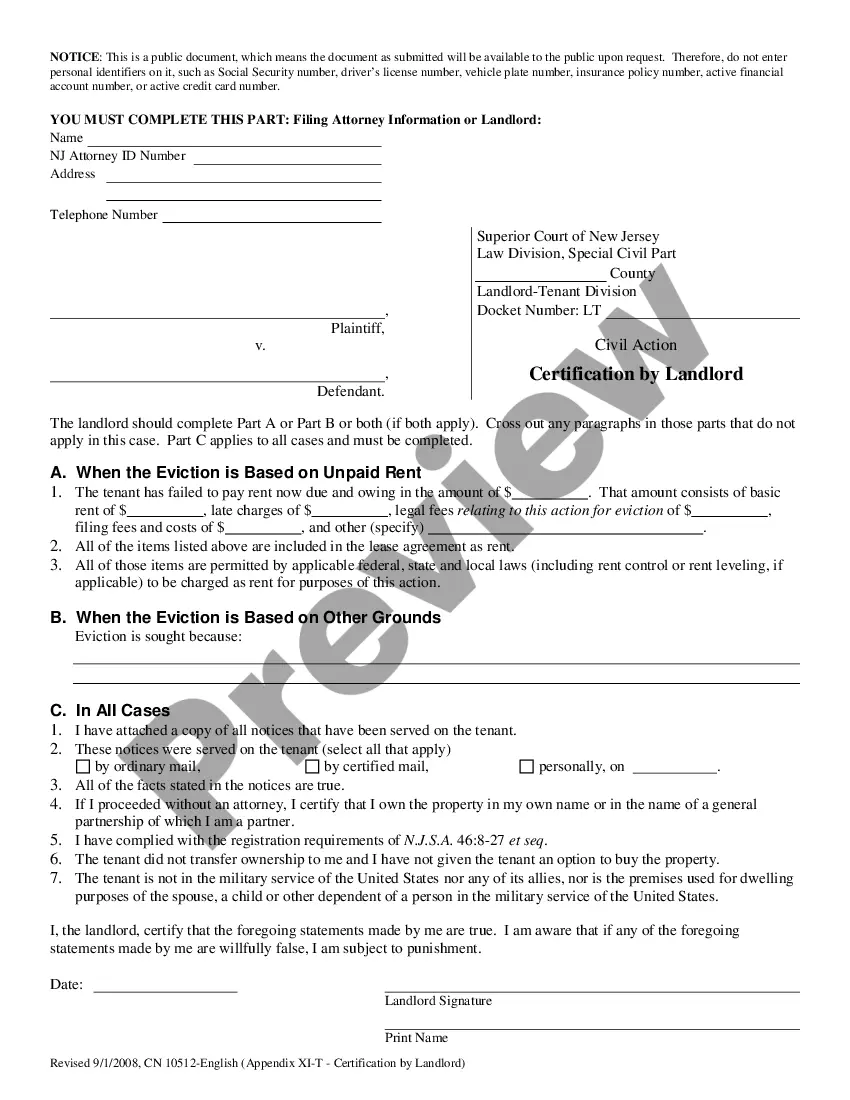

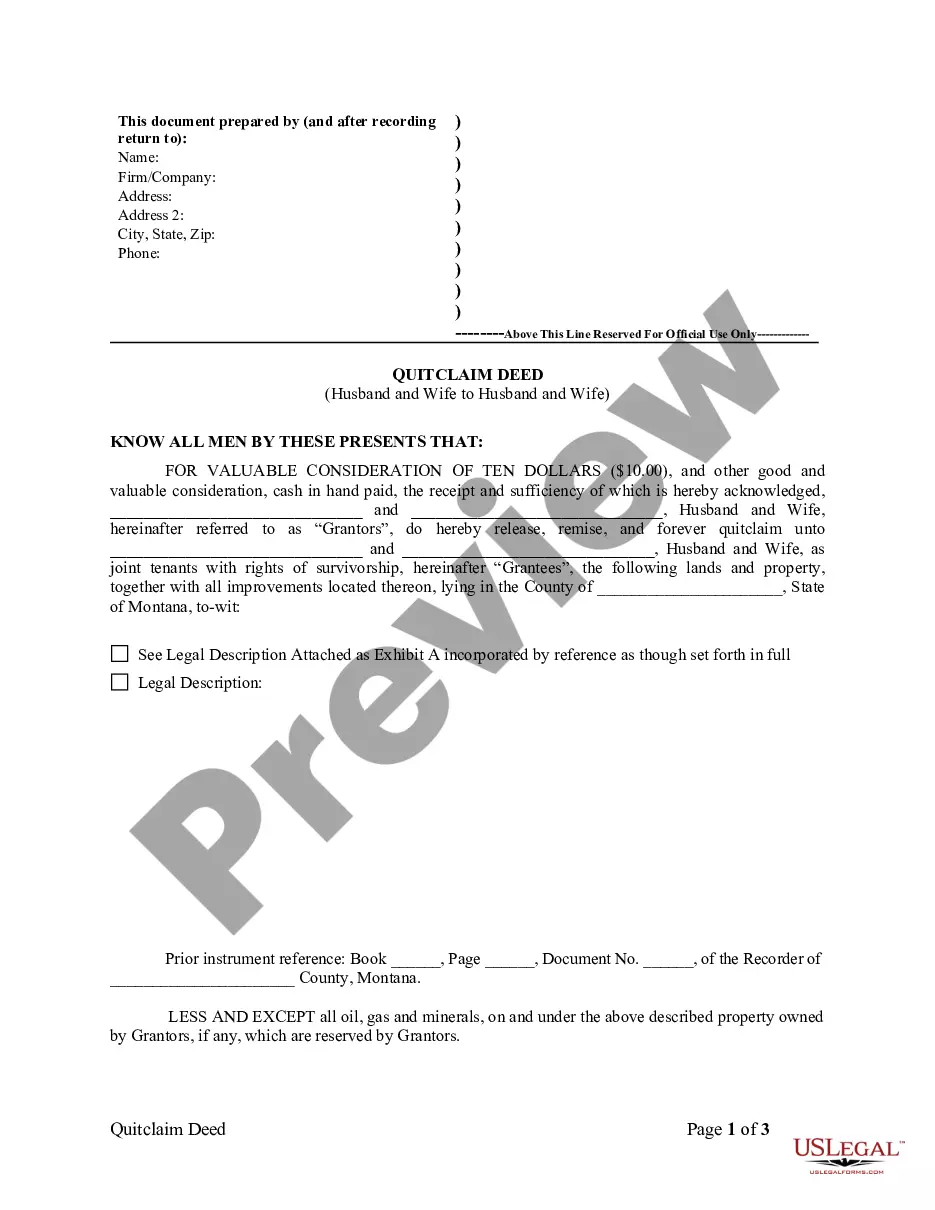

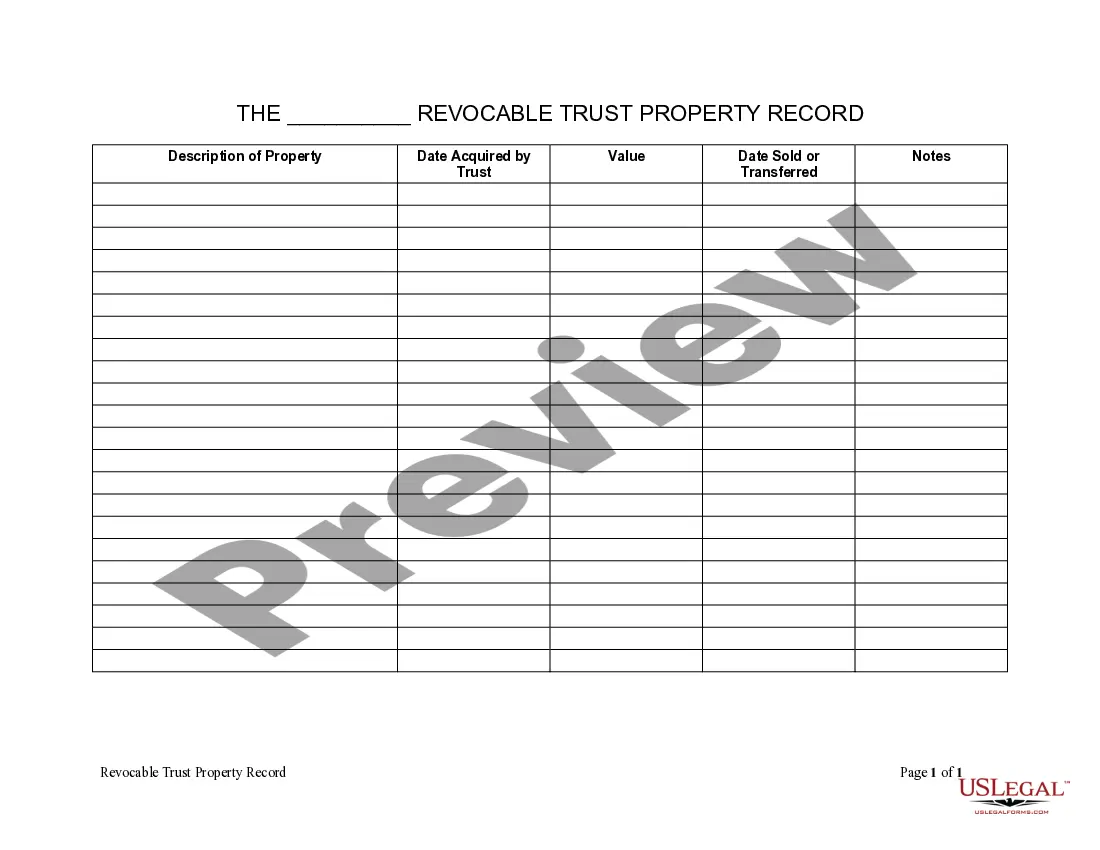

- Ensure that the form aligns with your situation and region by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Press Buy Now once you find the appropriate template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select either PDF or DOCX file format for your Agreement Investment Trust Withholding Tax.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

If you request a refund of overpaid tax, we'll aim to issue your refund within 28 days of receiving all the required information. You must make your request in writing and attach evidence to support your application. Complete the application form online (it can be saved to your computer).

MIT withholding tax is a final tax imposed on foreign residents in respect of fund payments (or an amount reasonably attributable to such payments) from Australian MITs.

Taxation of Managed Investment TrustsTrusts are not typically income tax paying entities, but rather thought of as a prism where income flows through to beneficiaries, retaining its source character. In some instances the Trustee is assessed where non-residents are presently entitled to trust income.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

If you are a non-resident actor, a non-resident withholding tax of 23% applies to amounts paid, credited, or provided as a benefit to you for film and video acting services rendered in Canada. Generally, the non-resident withholding tax is considered your final tax obligation to Canada on that income.