Child Tax Credit With Disability Element

Description

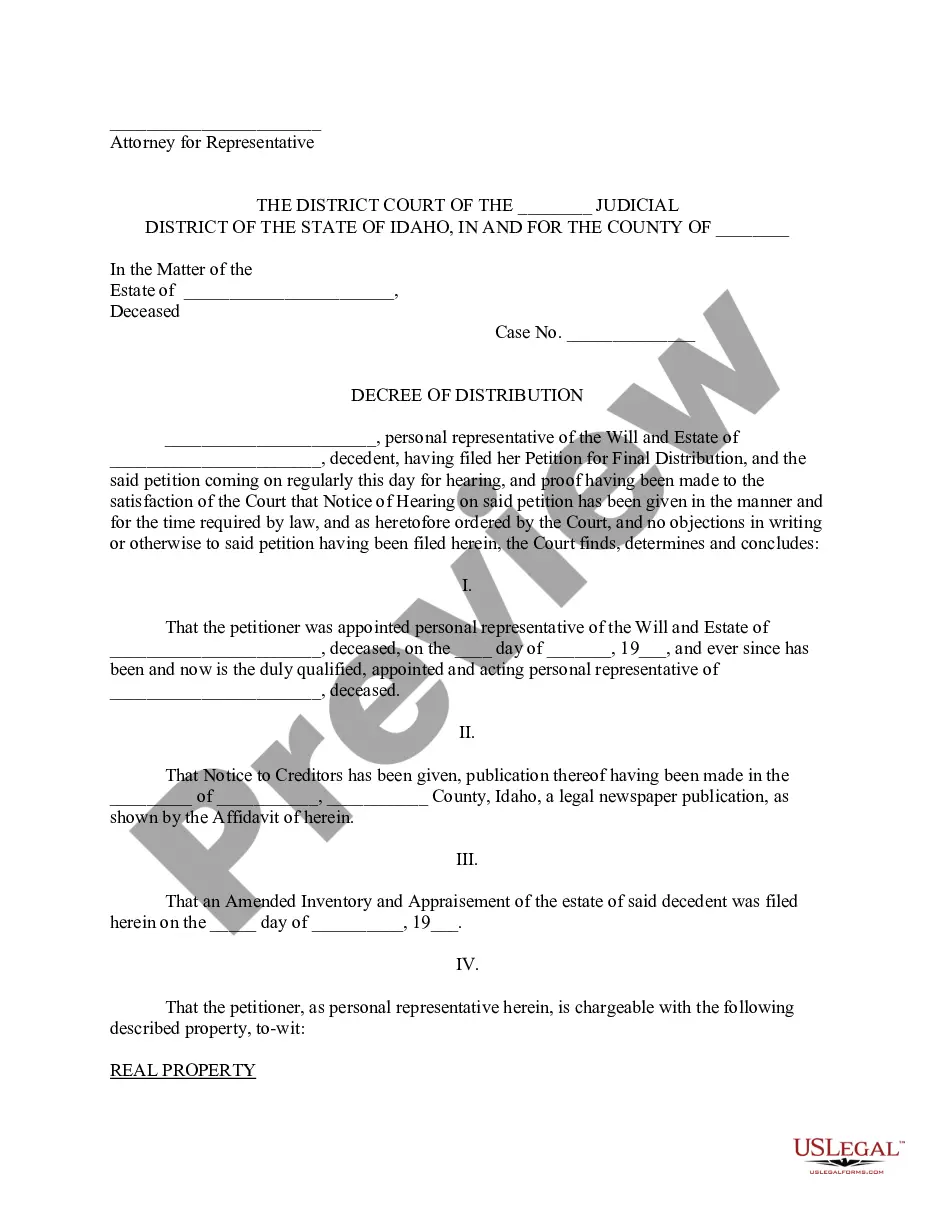

How to fill out Appearance Of Child Support Creditor Or Representative - B 281?

The Child Tax Credit With Disability Component visible on this webpage is a reusable formal framework created by expert attorneys in compliance with federal and state statutes.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any commercial and personal circumstances. It is the quickest, easiest, and most reliable way to acquire the paperwork you require, as the service assures the utmost level of data protection and anti-malware safeguards.

Register with US Legal Forms to have verified legal templates for all of life's situations readily available.

- Look for the document you require and review it.

- Browse the sample you searched and preview it or examine the form description to ensure it meets your requirements. If it does not, use the search feature to find the correct one. Click Buy Now once you have identified the template you require.

- Register and Log In.

- Select the pricing plan that works best for you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the fillable template.

- Choose the format you want for your Child Tax Credit With Disability Component (PDF, Word, RTF) and save the sample onto your device.

- Fill out and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Download your paperwork once more.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any forms you have purchased previously.

Form popularity

FAQ

The amount you receive for the disabled child element can vary based on your specific circumstances. Generally, this element offers additional financial support in recognition of the unique needs of families with disabled children. Understanding how the child tax credit with disability element works can significantly impact your overall financial strategy. If you need clarity, USLegalForms can guide you through the details.

Transcript Order Form - All transcript requests must be submitted on an AO 435 Transcript Request Form. Party requests shall be electronically filed in CM/ECF. Non-party requests shall be directed to the attention of the Clerk of Court by mail or email to MOEDml_ExecTeam@moed.uscourts.gov .

Missouri Annual Report Due Dates and Fees All Missouri annual reports are due within 3 months of the anniversary month when the business first incorporated. Corporations and nonprofits can elect to submit their reports annually OR biennially.

Accessing Case.net Users can access the Case.net web page by typing in the address field of their browser or by clicking the Case.net link available on the Missouri Judiciary home page, .

There are three ways to look at court records: Go to the courthouse and ask to look at paper records. Go to the courthouse and look at electronic court records. If your court offers it, look at electronic records over the internet. This is called ?remote access.?

Unlike most states, where LLCs have to file an ?Annual Report? (and pay a fee), Missouri LLCs don't have to file an Annual Report and they don't have to pay an annual fee to the Secretary of State. Missouri is one of the few states that doesn't have Annual Report requirements for LLCs.

Case.net is your access to the Missouri state courts automated case management system. From here you are able to inquire about case records including docket entries, parties, judgments and charges in public court.

The State of Missouri Judiciary offers a website called Case.net to provide free public access to case information. Case information available on Case.net comes from the information entered by judicial staff in the court's computer database. Case information is immediately available through the internet.

Internet access to civil and criminal court records is fee-based and can be found at ecf.mowd.uscourts.gov. Payment for copies is required at the time of the request. Include a self-addressed, stamped envelope for return of the copies. Copies are available in person during regular business hours.