Child Credit With Itin

Description

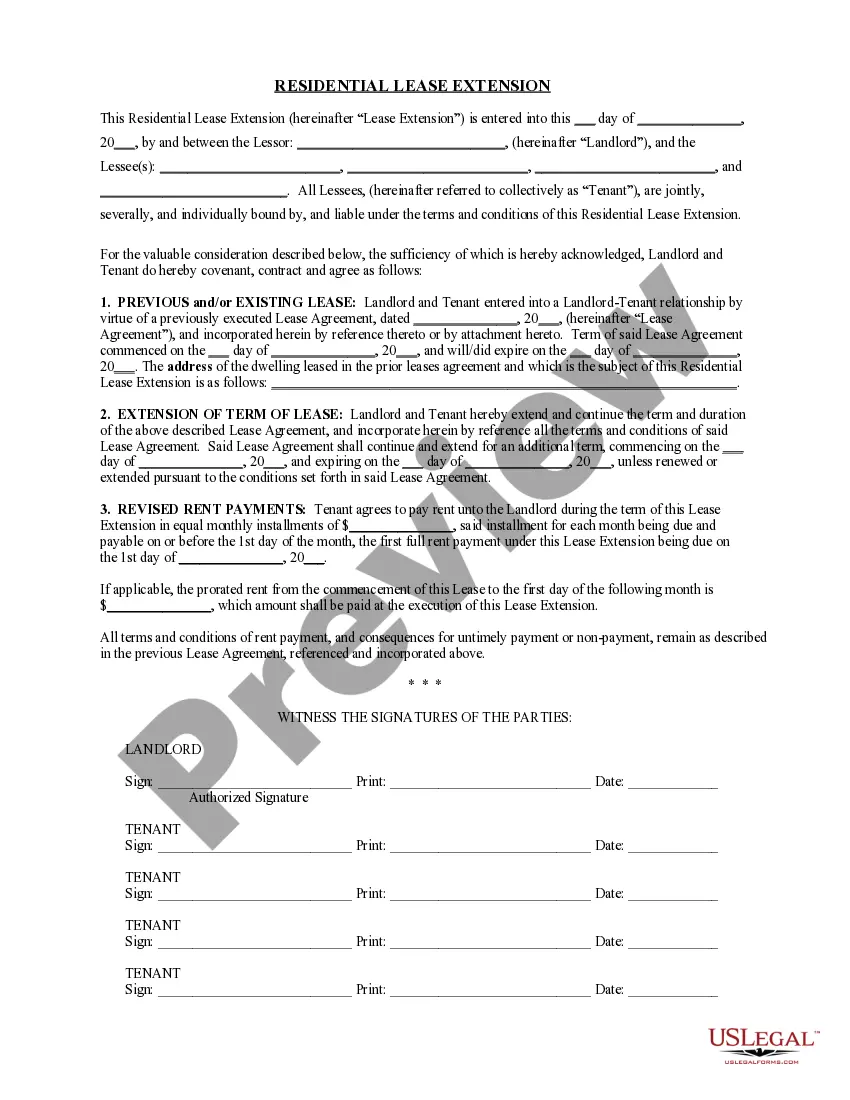

How to fill out Appearance Of Child Support Creditor Or Representative - B 281?

It’s clear that you cannot transform into a legal expert instantly, nor can you swiftly grasp how to prepare Child Credit With Itin without possessing a distinct set of abilities.

Developing legal documentation is a protracted journey necessitating specific education and competencies. So why not entrust the development of the Child Credit With Itin to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can obtain everything from judicial documents to templates for internal business communication.

If you require a different template, restart your search.

Sign up for a complimentary account and choose a subscription option to purchase the form. Select Buy now. Once your payment is processed, you can obtain the Child Credit With Itin, fill it out, print it, and dispatch or mail it to the relevant individuals or organizations.

- We recognize how vital compliance and adherence to federal and state regulations are.

- That’s why, on our platform, all forms are region-specific and current.

- Here’s how you can initiate your process on our website and obtain the document you need in just a few minutes.

- Identify the form you require using the search bar positioned at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to ascertain if Child Credit With Itin meets your needs.

Form popularity

FAQ

To obtain a credit score with an ITIN, start by applying for credit products that report your payment history to credit bureaus. As you make payments on time, your credit score will begin to develop, reflecting your financial responsibility. This approach will enhance your child credit with itin. Always monitor your credit report to stay informed and ensure your information is accurate.

Starting November 30, 2021, debt collectors face new restrictions under changes to the federal Fair Debt Collection Practices Act (FDCPA). The Fair Debt Collection Practices Act (FDCPA) (15 U.S.C. § 1692 and following) protects consumers from abusive debt collectors.

Consumer Credit and the Removal of Medical Collections from Credit Reports. The three nationwide consumer reporting companies announced the removal of medical collections under $500 from consumer credit reports on April 11, 2023.

One such recent development impacting consumer debt collections is the newly enacted Regulation F. Effective November 30, 2021, the Consumer Financial Protection Bureau (?CFPB?) enacted Regulation F to the Fair Debt Collection Practice Act (FDCPA). The full text of the Rule can be found here.

Legislative history The Fair Debt Collection Practices Act (FDCPA) was introduced into the United States House of Representatives on March 22, 1977. The act passed the House by a vote of 199-198 on April 4. The bill moved to the United States Senate Committee on Banking, Housing, and Urban Affairs.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.

The amended FDCPA allows debt collectors to use newer technologies, such as email and text messages, to communicate with consumers regarding their debts, subject to certain limitations, which protect consumers against harassment or abuse.