Order Relief In Withholding Tax

Description

How to fill out Order For Relief In An Involuntary Case - B 253?

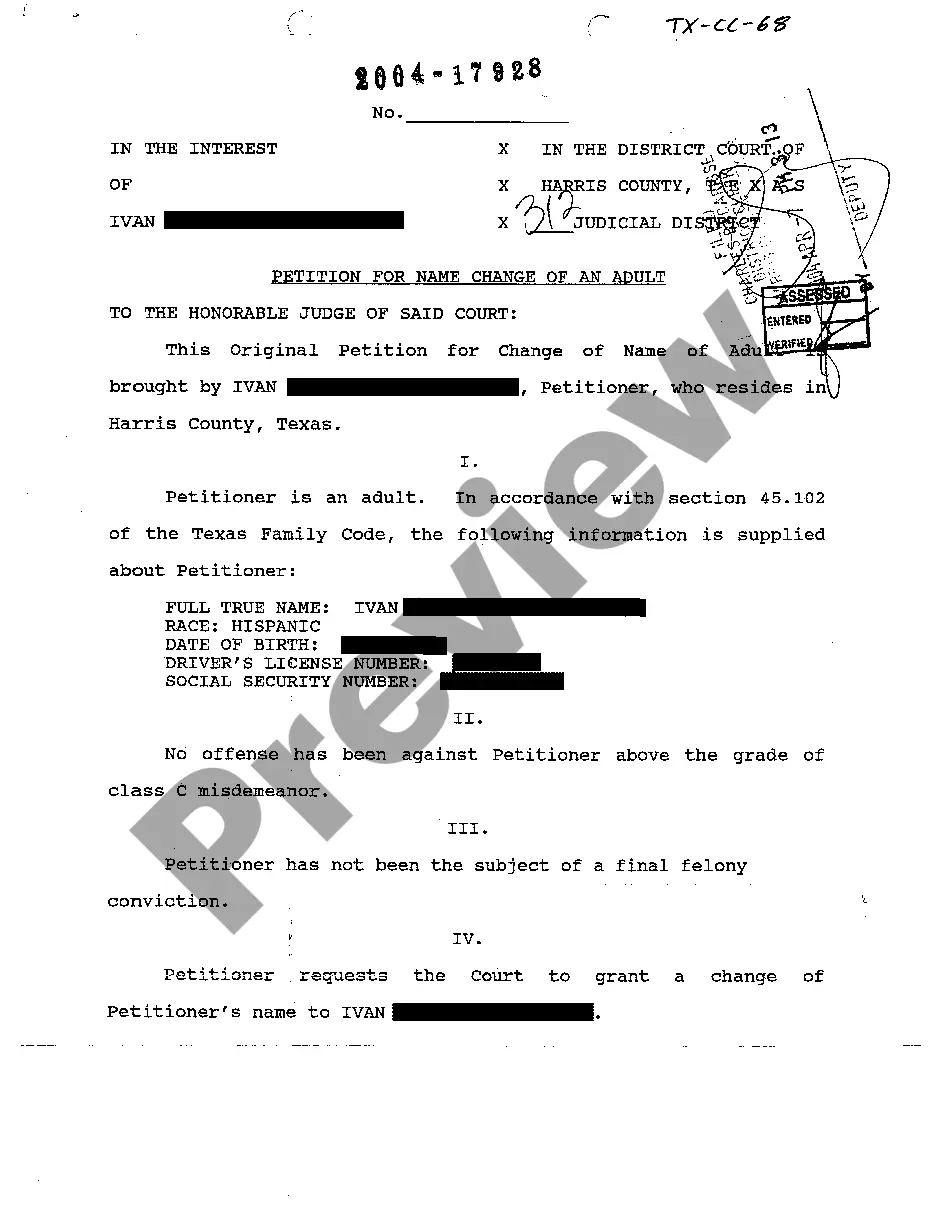

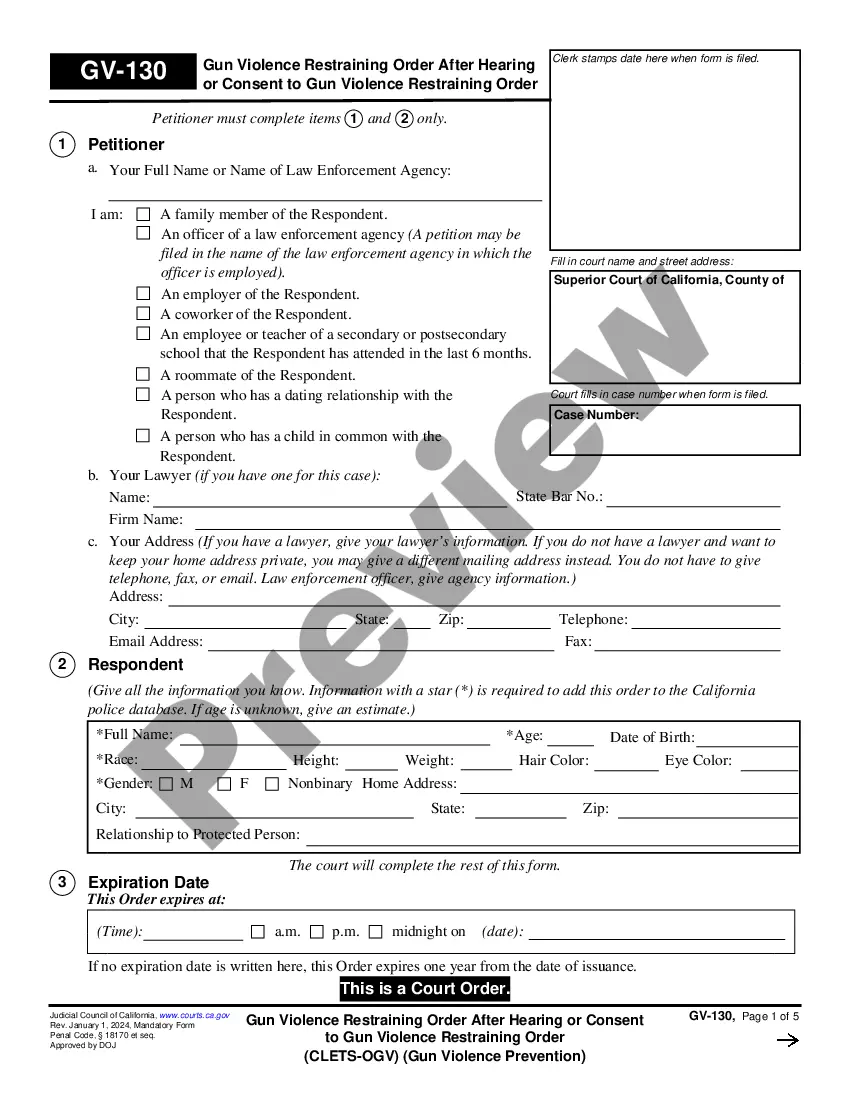

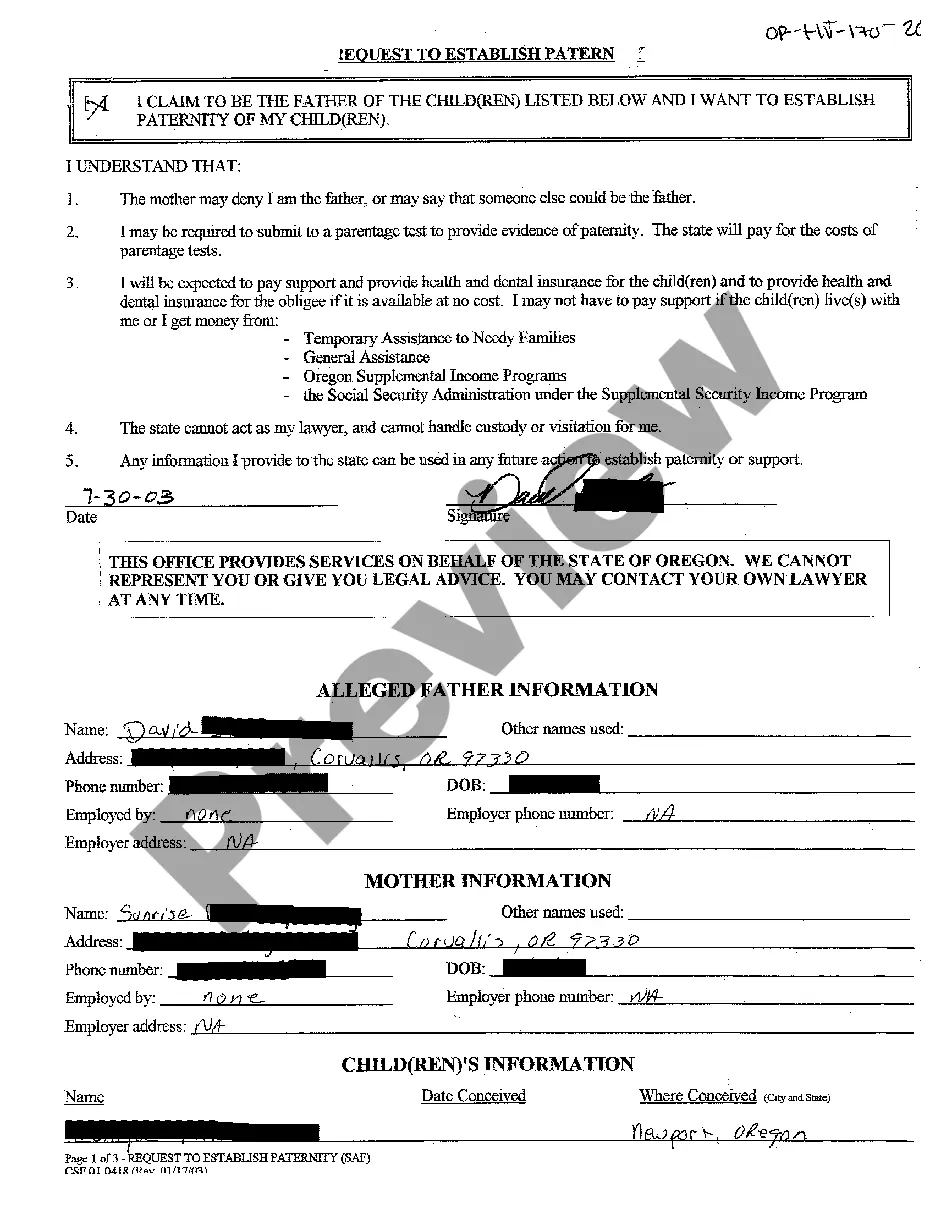

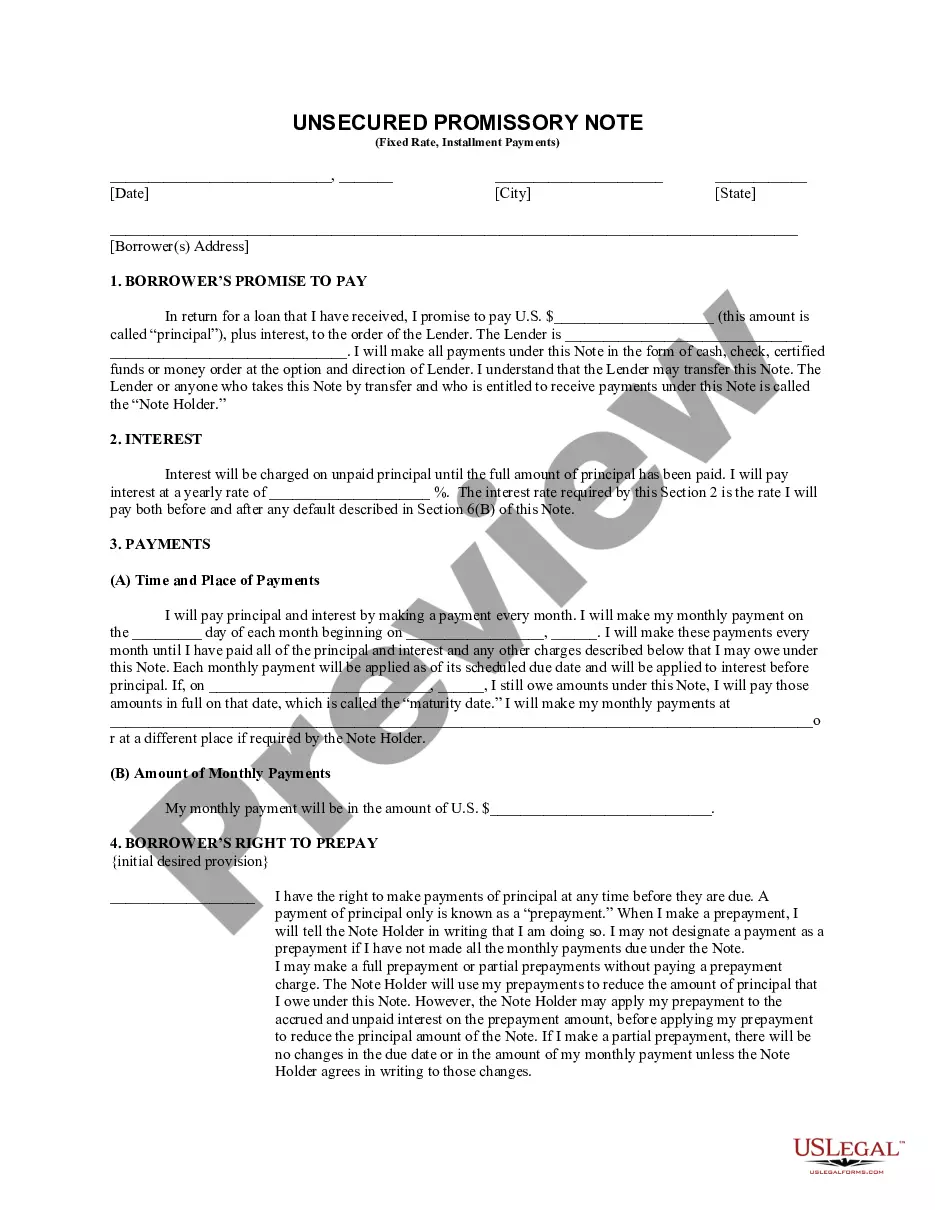

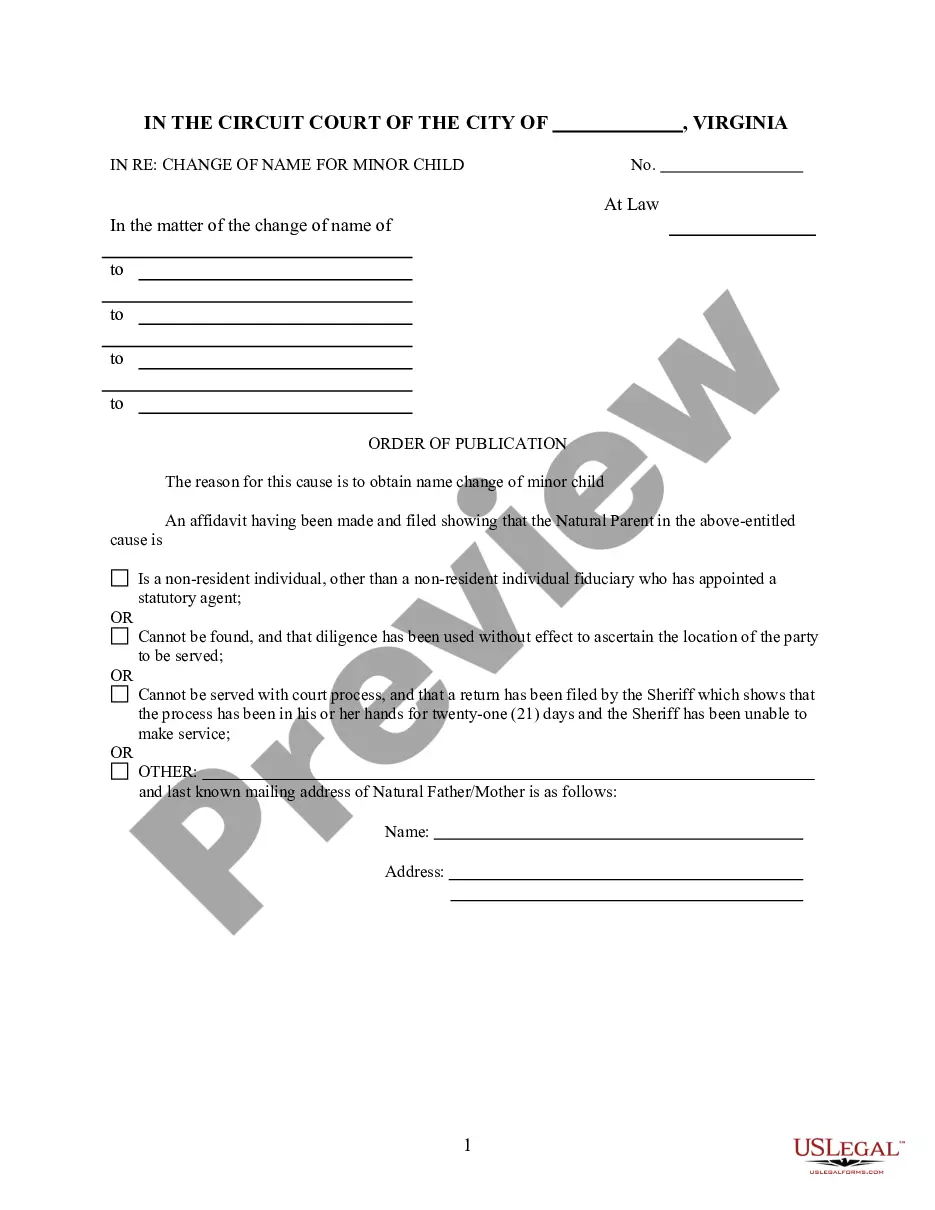

Legal papers managing can be frustrating, even for experienced specialists. When you are looking for a Order Relief In Withholding Tax and don’t get the time to spend looking for the appropriate and updated version, the operations can be stressful. A strong web form library might be a gamechanger for anybody who wants to take care of these situations successfully. US Legal Forms is a industry leader in online legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from personal to business paperwork, all in one location.

- Utilize innovative tools to complete and control your Order Relief In Withholding Tax

- Access a useful resource base of articles, guides and handbooks and materials relevant to your situation and needs

Help save effort and time looking for the paperwork you need, and use US Legal Forms’ advanced search and Preview feature to locate Order Relief In Withholding Tax and download it. If you have a monthly subscription, log in in your US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to see the paperwork you previously downloaded as well as to control your folders as you can see fit.

Should it be the first time with US Legal Forms, make a free account and obtain unrestricted use of all advantages of the platform. Listed below are the steps to take after downloading the form you need:

- Validate this is the right form by previewing it and reading its information.

- Be sure that the sample is approved in your state or county.

- Select Buy Now when you are ready.

- Select a monthly subscription plan.

- Pick the file format you need, and Download, complete, eSign, print out and send your papers.

Enjoy the US Legal Forms web library, backed with 25 years of experience and reliability. Change your daily papers managing into a easy and easy-to-use process today.

Form popularity

FAQ

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.