7 Discharge Chapter With Credit Card

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Whether for professional reasons or personal needs, everyone must confront legal issues at some point throughout their lives.

Filling out legal paperwork requires meticulous care, starting with selecting the right template form.

With an extensive catalog at US Legal Forms, you will never waste time searching for the correct document across the web. Take advantage of the straightforward navigation of the library to find the right template for any event.

- Locate the document you require by utilizing the search box or catalog browsing.

- Review the details of the form to ensure it aligns with your circumstances, state, and county.

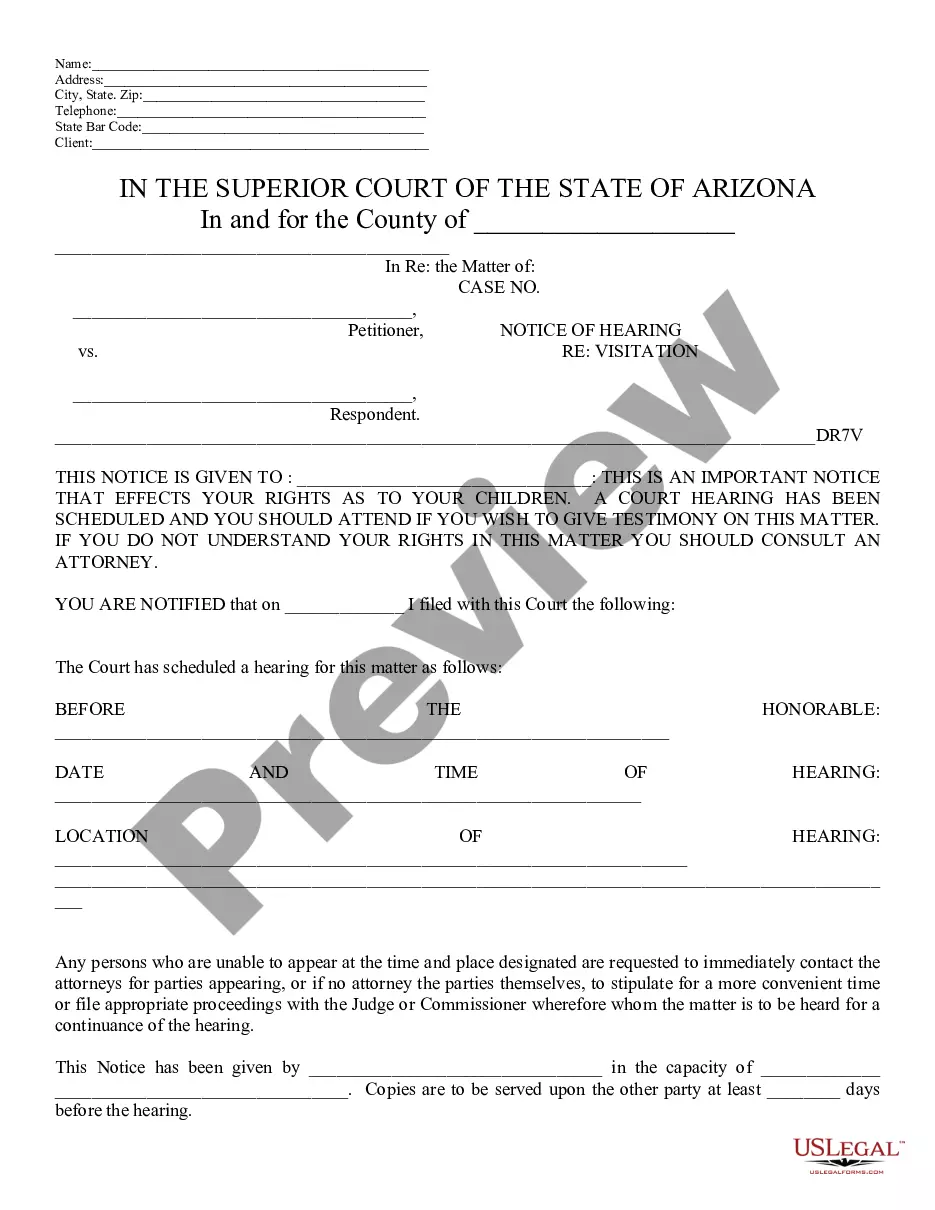

- Select the form’s preview to examine it.

- If it is the incorrect form, go back to the search feature to find the 7 Discharge Chapter With Credit Card template you need.

- Download the document if it meets your criteria.

- If you own a US Legal Forms account, click Log in to retrieve previously stored documents in My documents.

- If you don't have an account yet, you can obtain the form by clicking Buy now.

- Select the suitable payment option.

- Complete the account registration form.

- Choose your payment method: credit card or PayPal account.

- Select the desired file format and download the 7 Discharge Chapter With Credit Card.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

While you can include credit card debts when filing for Chapter 7, it is not possible to file for bankruptcy using credit card debts only. Chapter 7 requires you to list all your debts, not just credit card accounts. To navigate this process effectively, consider utilizing the US Legal Forms platform, which offers resources to help you compile your financial information and understand your options.

Yes, you can file a 7 discharge chapter with credit card debts included. This means that most credit card debts can be eliminated if you qualify for Chapter 7 bankruptcy. However, it is important to understand that not all debts are dischargeable. Using resources such as US Legal Forms can guide you through the intricacies of filing and ensure you make informed decisions.

It is generally advised to stop paying your credit cards before filing for a 7 discharge chapter with credit card. Continuing to make payments can complicate your case and may not benefit you in the long run. Instead, focus on gathering the necessary documents and understanding the process. Consulting with a qualified attorney or using platforms like US Legal Forms can help clarify your best course of action.

Once you file for Chapter 7, you should avoid using your credit cards. Continued use can complicate your case and may disqualify you from debt relief. It is best to seek expert guidance, such as that offered by uslegalforms, to navigate your case effectively.

It is not advisable to max out your credit cards before filing for Chapter 7. Doing so can trigger suspicion from the bankruptcy court and may lead to a denial of discharge. Instead, focus on managing your spending to prepare for the 7 discharge chapter with credit card.

Yes, Chapter 7 can eliminate credit card debt if the court approves your filing. Most unsecured debts, including credit cards, disappear through this process. However, you should be aware that certain debts, like student loans or tax obligations, may not be discharged in a Chapter 7 bankruptcy.

There is no specific minimum amount of credit card debt required to file for Chapter 7. However, many individuals choose to file when their overall financial situation becomes unmanageable. If credit card debt constitutes a significant part of your financial struggle, the 7 discharge chapter with credit card may provide relief.

You may use your credit cards before filing for Chapter 7 discharge with credit card debt, but it is crucial to understand the risks involved. Any charges made shortly before filing could be questioned by the bankruptcy court. Thus, it’s advisable to use credit sparingly and keep a record of your purchases.

You may have the option to exclude a secured credit card from your Chapter 7 bankruptcy proceedings. In a 7 discharge chapter with credit card, secured debts can often be reaffirmed, allowing you to retain the credit line while maintaining the asset. This can provide stability as you navigate your financial recovery. For tailored advice, consider consulting with professionals on platforms like uslegalforms.

Chapter 7 bankruptcy generally wipes out most unsecured credit card debt. After filing for a 7 discharge chapter with credit card, you may find significant relief from these financial burdens. However, not all debts can be discharged. For example, debts like student loans, taxes, and alimony usually remain intact.