Acuerdos Prenupciales Withholding

Description

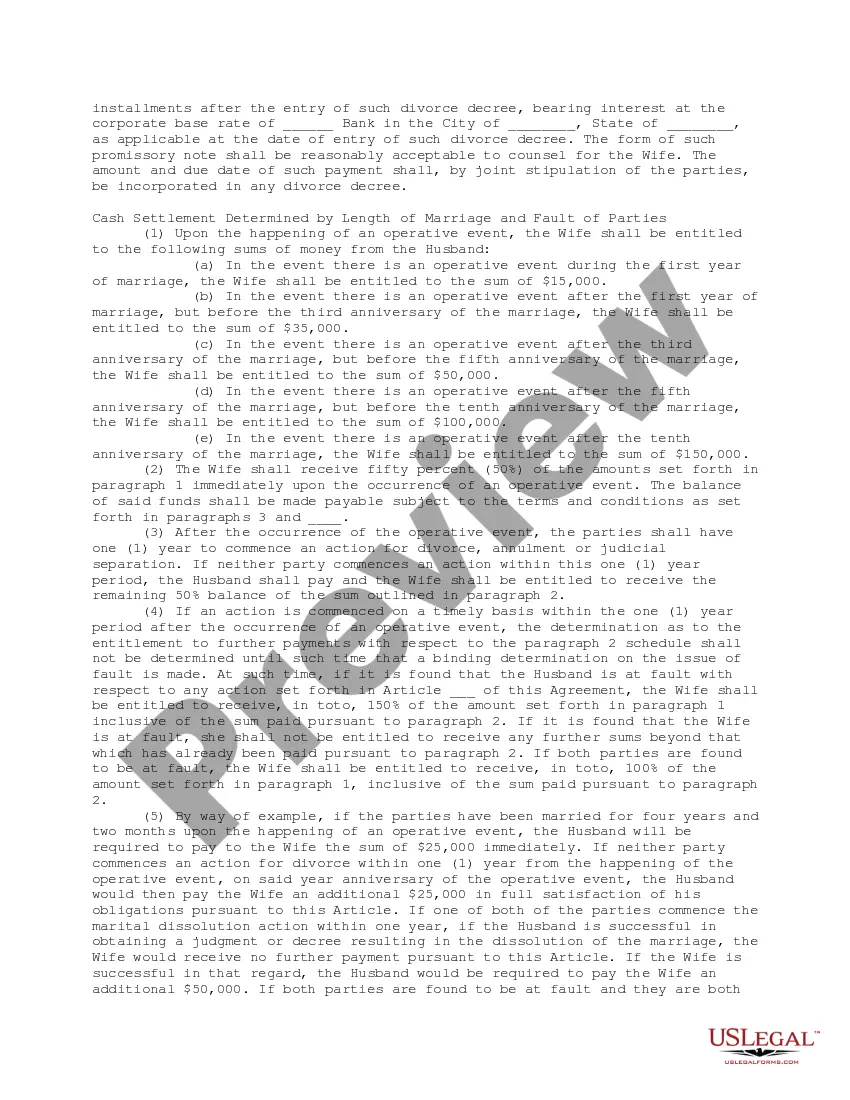

How to fill out Prenuptial Agreements - General Comments On The Negotiating, Drafting And Execution Of Prenuptial Agreements?

Employing legal templates that comply with federal and state laws is essential, and the web provides numerous choices to select from.

However, what's the point of wasting time searching for the appropriate Acuerdos Prenupciales Withholding example online when the US Legal Forms digital library has already gathered such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 customizable templates created by attorneys for various business and personal scenarios.

Utilize the Preview feature or the text outline to examine the template and verify its suitability for your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our specialists stay updated with legal amendments, ensuring that your documents remain current and compliant when acquiring an Acuerdos Prenupciales Withholding from our platform.

- Obtaining an Acuerdos Prenupciales Withholding is quick and easy for both new and existing users.

- If you already possess an account with an active subscription, Log In and download the required document template in the desired format.

- If you are visiting our site for the first time, follow these steps.

Form popularity

FAQ

From there, processing an amended return can take as long as 16 weeks. Thankfully, you can check the status of your identity online with your social security number or tax ID and the exact amount of your refund. For your Maryland refund, click here. For a federal refund, click here.

You can check the status of your current year refund online, or by calling the automated line at (410) 260-7701 or 1-800-218-8160. Be sure you have a copy of your return on hand to verify information. You can also e-mail us at taxhelp@marylandtaxes.gov to check on your refund.

How Can I Check the status of my amended return? Online Tool: Use the ?Where's My Amended Return?? tool on the IRS website. ... Automated Phone Service: Call the IRS at 1-866-464-2050 and follow the automated prompts to inquire about your amended return's status.

Forms 502X, 505X, and 505NR are Forms used for the Tax Amendment. Current and previous tax year: You can NOT prepare a Maryland Tax Amendment on eFile.com, however you must mail in the amendment as you can not e-File a Maryland tax amendment.

You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

How can I check the status of my amended return? You can check the status of your Form 1040-X, Amended U.S. Individual Income Tax Return using the Where's My Amended Return? online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

1. When to check... Your amended return will take up to 3 weeks after you mailed it to show up on our system. Processing it can take up to 16 weeks.