401k Plan Termination Force Out

Description

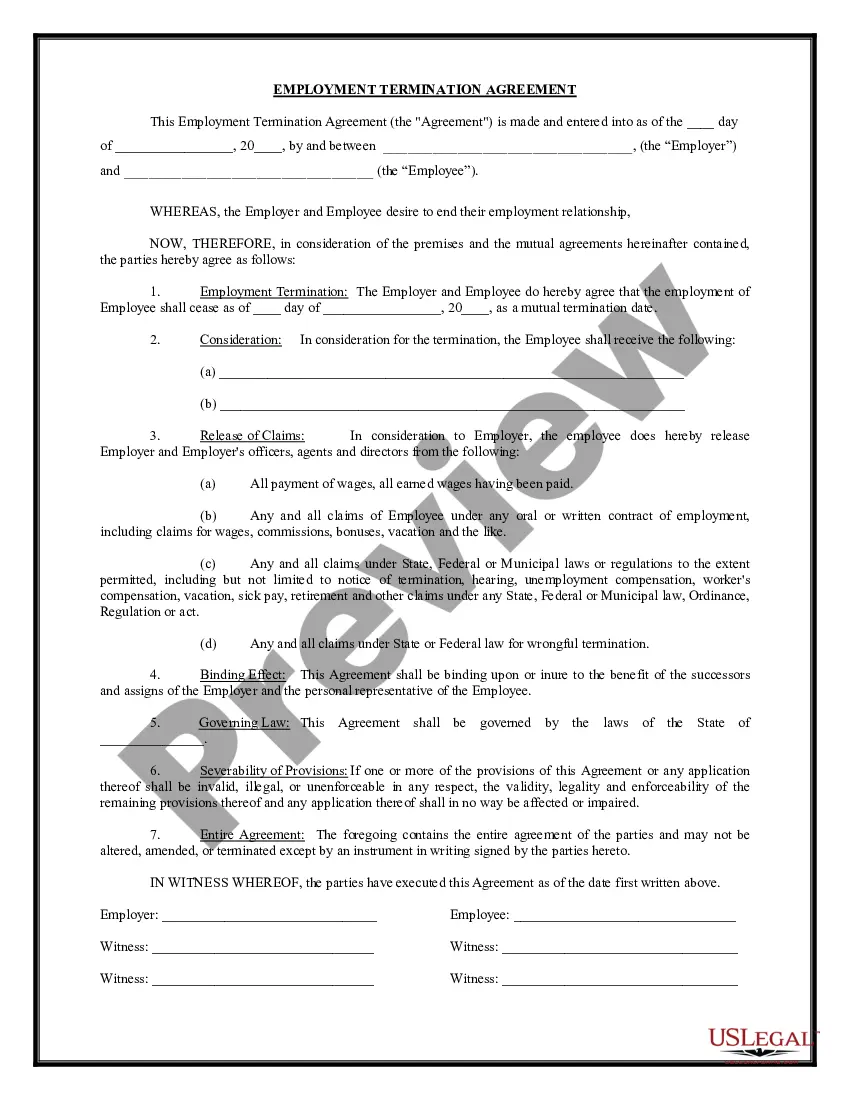

How to fill out Notification Of Layoff And Termination Compensation Plan Agreement?

It’s clear that one cannot instantly become an expert in law, nor can you swiftly devise a 401k Plan Termination Force Out without possessing a distinct set of abilities.

Compiling legal documents is an extensive undertaking that necessitates specialized training and skills. Thus, why not entrust the creation of the 401k Plan Termination Force Out to the experts.

With US Legal Forms, one of the most extensive libraries of legal templates, you can discover everything from court documents to in-office communication templates.

If you require a different template, start your search anew.

Create a free account and select a subscription plan to purchase the template. Click Buy now. Once the payment is finalized, you can download the 401k Plan Termination Force Out, complete it, print it, and send or mail it to the relevant individuals or organizations.

- We understand how crucial compliance and adherence to federal and local laws and regulations are.

- That’s why all templates on our site are location-specific and current.

- Here’s how to begin on our website and obtain the form you need in just minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the 401k Plan Termination Force Out meets your needs.

Form popularity

FAQ

Yes, you can close out your 401(k), but it's important to understand the implications of doing so. You will need to take formal action, such as requesting a distribution, which is often part of the 401k plan termination force out. Before proceeding, consider consulting with a financial advisor to evaluate any tax consequences or penalties. US Legal Forms provides useful resources to help you navigate this process smoothly.

For amounts below $5000, the employer can hold the funds for up to 60 days, after which the funds will be automatically rolled over to a new retirement account or cashed out. If you have accumulated a large amount of savings above $5000, your employer can hold the 401(k) for as long as you want.

Pursuant to these guidelines, the 401(k) plan may have a ?force-out? provision. That means when your vested balance is less than $5,000, you can be forced to take your money out of the plan. Your former employer is required to give you advance notice of this rule so you can decide what to do with the money.

Typically, you can't close an employer-sponsored 401k while you're still working there. You could elect to suspend payroll deductions but would lose the pre-tax benefits and any employer matches. In some cases, if your employer allows, you can make an in-service withdrawal if you've reached the age of 59 ½.

Withdrawing money from your 401(k) is not the same thing as cashing out. You can do a 401(k) withdrawal while you're still employed at the company that sponsors your 401(k), but you can only cash out your 401(k) from previous employers. Learn what do with your 401(k) after changing jobs.

If an account balance is more than $5000, you cannot force any action on the former employee. But your options are not yet exhausted. You can keep an open dialogue with your former employees and encourage them to roll over their funds to a new 401(k) plan or move their money to an IRA.