Employee Family Medical Leave Form Washington State

Description

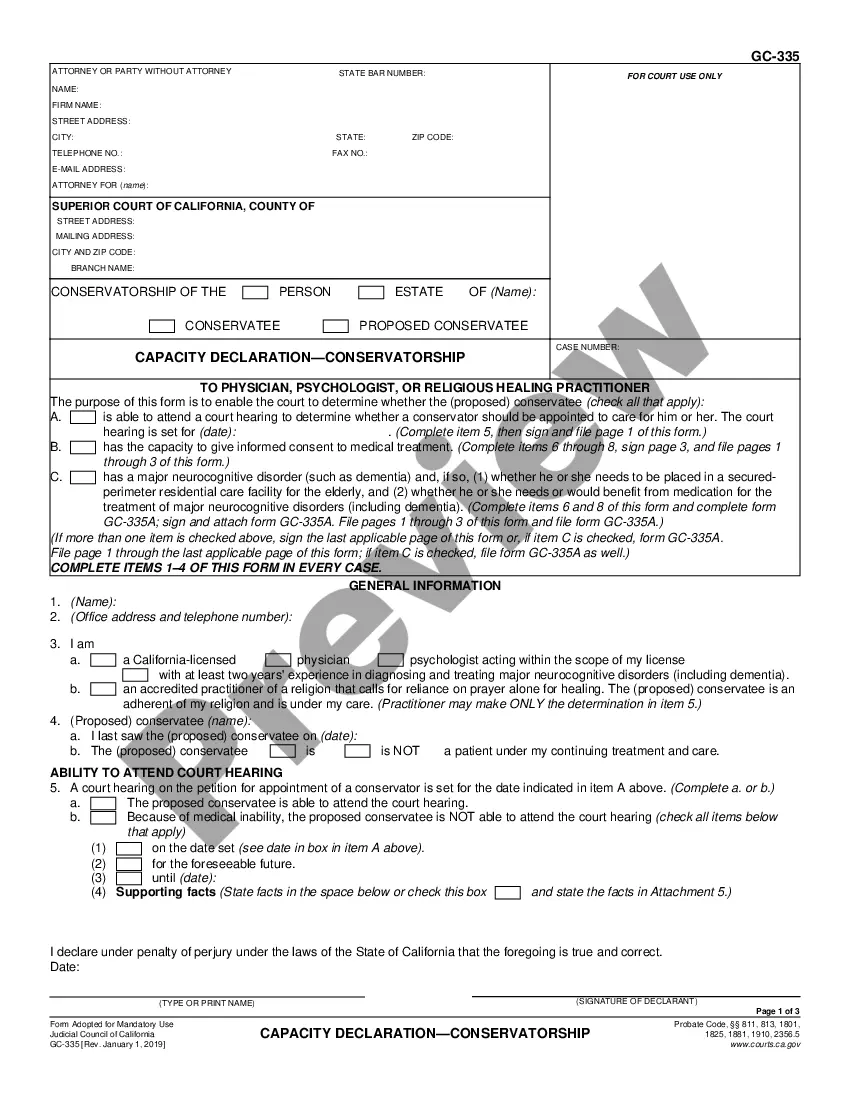

How to fill out Employee Rights Memo Under The Family And Medical Leave Act?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Completing legal papers requires careful attention, starting with choosing the proper form template. For instance, when you choose a wrong version of a Employee Family Medical Leave Form Washington State, it will be declined once you submit it. It is therefore important to have a dependable source of legal papers like US Legal Forms.

If you have to get a Employee Family Medical Leave Form Washington State template, follow these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Check out the form’s description to ensure it fits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect form, return to the search function to locate the Employee Family Medical Leave Form Washington State sample you need.

- Get the template when it matches your needs.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Select the document format you want and download the Employee Family Medical Leave Form Washington State.

- When it is downloaded, you are able to complete the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the right sample across the web. Utilize the library’s simple navigation to find the appropriate template for any occasion.

Form popularity

FAQ

Log into your account each week to file your weekly claim. Your payment will be processed within two weeks. Remember: You must file every week, even during your waiting week. (There is no waiting week for parental bonding leave, medical leave taken during the ?postnatal period? and military exigency.)

For medical leave and for family leave to care for a family member with a serious health condition, including medical events related to pregnancy or childbirth, you must provide ONE of the following: Certification form filled out by you and your healthcare provider.

Apply now Create your account. See the help center for instructions on creating a SAW account and adding Paid Leave as a service. Fill out the online application that applies to you: medical leave or family leave. You'll provide basic information and verify your employment history. ... Upload documents.

PFML provides up to 90% of an employee's weekly pay ? up to the maximum weekly benefit amount (which is updated annually). PFML is available to eligible employees regardless of the size of the employer, whereas FMLA leave is available only for eligible employees working in organizations with 50 or more employees.

Premiums are split between employer (26.78%) and employee (73.22%) for most employers. Employers with fewer than 50 employees are not required to pay the employer portion of the premium, but must collect the full employee portion (73.22%) from the employee's gross wages or opt to pay the employee portion.