Position Exempt

Description

How to fill out Job Offer Letter - Exempt Position - Detailed?

- Log in to your existing US Legal Forms account to download the necessary template. Ensure your subscription is active. If not, renew it according to your chosen plan.

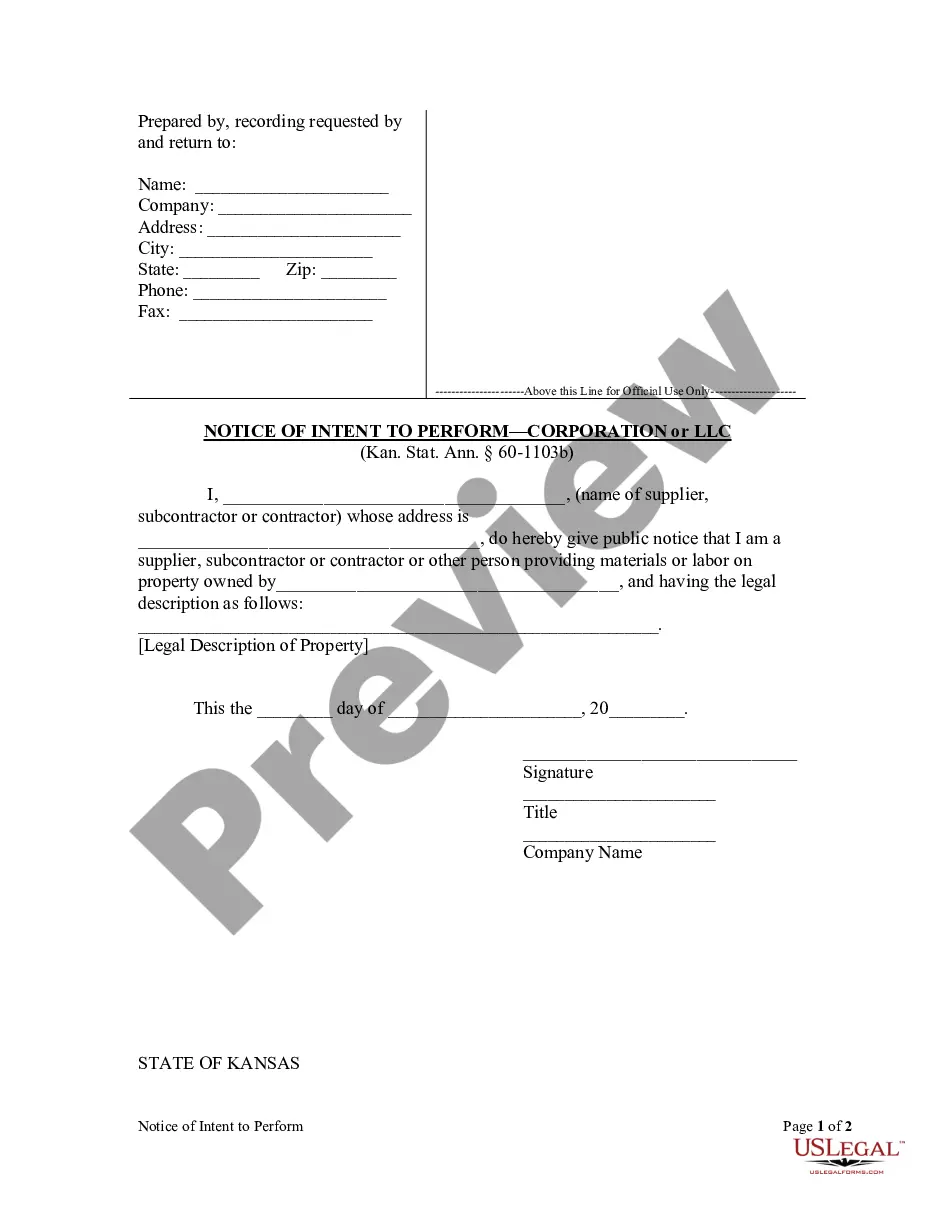

- For first-time users, start by verifying the Preview mode and description of the form. This ensures it aligns with your requirements and complies with your local laws.

- If the selected form isn't what you need, utilize the Search feature to find a suitable template.

- Once you find the correct document, click the Buy Now button, select your preferred subscription plan, and create an account to gain access to the complete library.

- Complete your purchase by entering your payment details, either through a credit card or PayPal.

- Finally, download the form and save it on your device. You can always access it later via the My Forms section of your account.

US Legal Forms empowers users to swiftly execute their legal documents with an extensive library that surpasses competitors in both quality and quantity. With guidance from premium experts, you can ensure that all documents are accurate and legally binding.

Ready to simplify your legal document needs? Visit US Legal Forms today and explore the vast resources available to you!

Form popularity

FAQ

The number of allowances you should claim when indicating exempt can vary based on your individual circumstances. Typically, claiming zero allowances implies the highest tax withholding, while claiming one or more allowances can reduce this amount. Review your financial obligations and expected income to determine the best option for you. For guidance, you can explore the extensive resources available at US Legal Forms.

To fill out a W-4 and claim exempt, you need to complete the form by stating your exempt status in the appropriate section. Typically, you should write 'Exempt' in the area provided and ensure you've met the criteria for this classification. It’s important to review IRS guidelines to ensure you qualify for exempt withholding. Resources from US Legal Forms can assist you in understanding this process better.

When responding to the question about being exempt from withholding, you should clarify your employment status. If you qualify as an exempt employee under IRS guidelines, you may indicate this on your tax forms. Ensure that you have a full understanding of your financial situation to determine if this status is appropriate for you. Taking advantage of resources like US Legal Forms can provide clarity in this process.

To fill out the exempt status correctly, begin by understanding your job responsibilities and salary level. Employers must classify positions based on job duties, and you may need to consult your HR department for accurate designation. Additionally, ensure you accurately complete tax forms that may inquire about your exempt status to avoid any potential legal issues.

The question of whether exempt or nonexempt is better often leads to diverse opinions. If you prioritize consistent income without the worry of hourly tracking, then an exempt position might be your best choice. However, if you value the ability to earn more through overtime, a nonexempt role could suit you better. Consider your personal needs, as both options have their unique merits.

Determining whether exempt or nonexempt is better depends largely on your individual circumstances. If you prefer stability and a set salary, an exempt position may appeal to you. Conversely, if you value earning potential through overtime, being nonexempt might be more advantageous. Each classification has its benefits, so think about what aligns best with your lifestyle and career aspirations.

Making an employee tax exempt generally involves submitting a W-4 form where the employee claims exemption status based on their personal tax situation. However, it's important to remember that tax exemption depends on individual circumstances rather than the job's exempt status. For guidance on handling these classifications effectively, US Legal Forms can provide templates and resources.

The three primary factors to determine if an employee is exempt or nonexempt include the salary basis, the salary level, and the nature of job duties. An employee must earn a minimum salary and primarily perform exempt duties such as managerial tasks. Understanding these factors can aid businesses in correctly classifying their employees and avoiding labor disputes.

Federal law, particularly the Fair Labor Standards Act (FLSA), outlines the criteria for classifying employees as exempt. This law sets forth eligibility requirements based on duties, salary levels, and specific job functions. Familiarizing yourself with these regulations is essential for ensuring that your workforce complies with the legal standards surrounding positions exempt.

A position is considered exempt when it fulfills specific criteria set by law, focusing on the job's primary duties and salary metrics. For instance, executive roles that manage others and professional positions requiring specialized skills typically qualify. Being informed about what makes a position exempt can protect businesses from misclassification risks.