An income verification letter from a CPA (Certified Public Accountant) is an official document that provides proof of an individual's income. This letter is typically requested by organizations or individuals when verifying an individual's financial status, such as during loan applications, rental agreements, or government assistance programs. The purpose of an income verification letter from a CPA is to confirm and validate an individual's income information. The letter is created by a licensed CPA who possesses the expertise and authority to authenticate the details provided by the individual. The CPA analyzes the individual's financial documents, such as tax returns, bank statements, pay stubs, and other income-related records, to accurately assess their income. The content of an income verification letter from a CPA includes essential details to support the accuracy of the income-related claims. These details generally include the name, address, and contact information of the CPA, along with their license number and firm's name. It also includes the name of the individual for whom the letter is being prepared and their corresponding financial information, such as the average monthly income, sources of income, and the time period these records represent. Different types of income verification letters from CPA samples may vary depending on specific requirements or purposes. Here are a few common types: 1. Standard Income Verification Letter: This type of letter is a generic form of income verification that covers basic information regarding an individual's income. It is applicable in various situations, including rental applications or basic loan requests. 2. Self-Employed Income Verification Letter: Self-employed individuals often require a specialized income verification letter that reflects their business income records, financial stability, and profitability. This letter should clearly outline the financial details of the individual's self-employment, including average monthly income, business expenses, and net income. 3. Employer-Specific Income Verification Letter: This type of income verification letter is specific to an individual's employment with a particular company. It typically includes details such as the employee's position, duration of employment, salary, bonuses, and any other relevant information requested by the employer. 4. Retirement Income Verification Letter: Individuals who rely on retirement benefits to support their finances may need a specific income verification letter that highlights their pension or retirement account details. This type of letter is commonly requested for various purposes, such as mortgage applications or determining eligibility for assistance programs. 5. Housing Assistance Income Verification Letter: Individuals applying for government-assisted housing, such as Section 8 or subsidized housing, frequently require an income verification letter tailored to the guidelines set by the housing agency. This letter must comply with specific income limits and details related to the applicant's household size, income sources, and dependents. Overall, an income verification letter from a CPA is a critical document to establish financial credibility and confirm an individual's income. It provides a reliable source of information, certified by a licensed professional, ensuring accuracy and authenticity in various financial transactions.

Income Verification Letter From Cpa Sample

Description

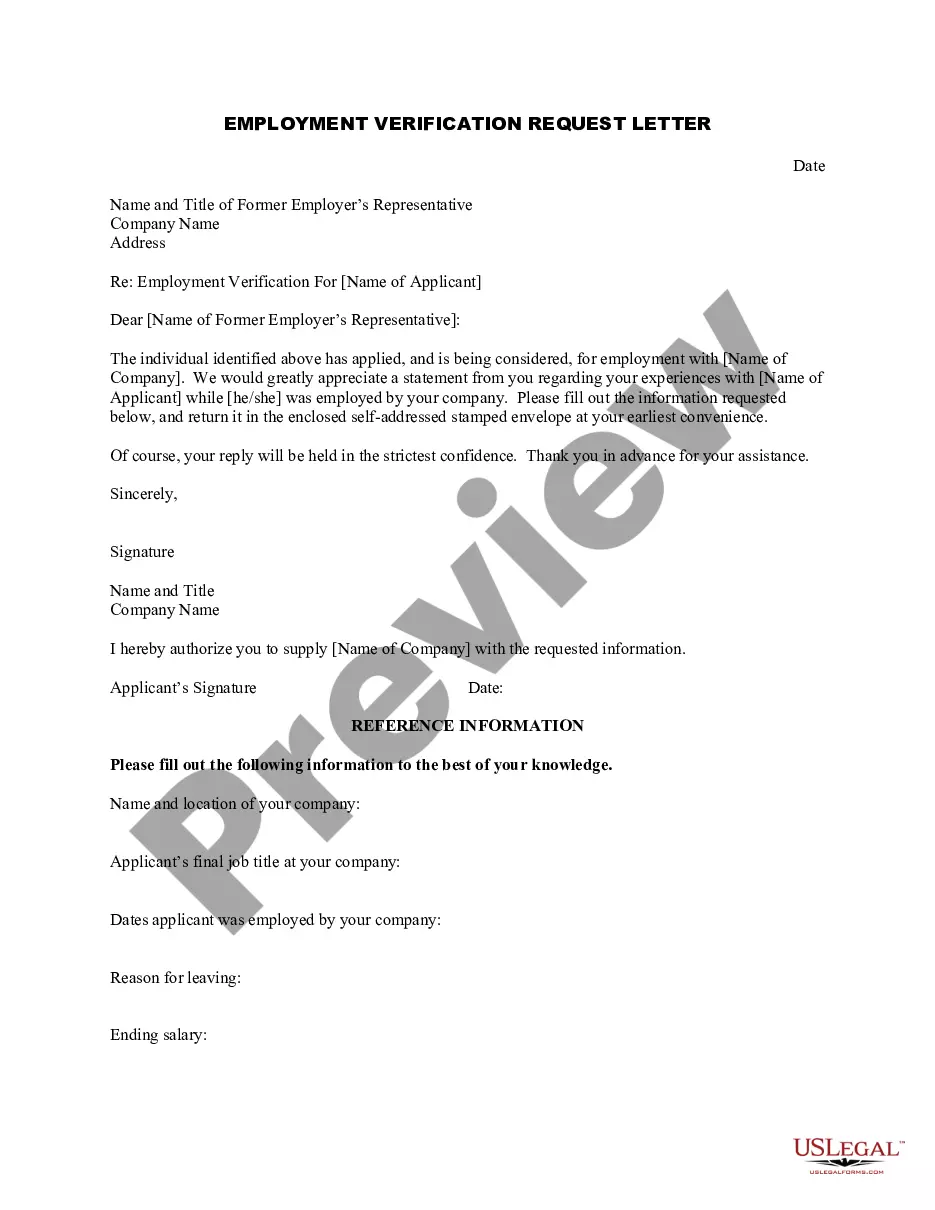

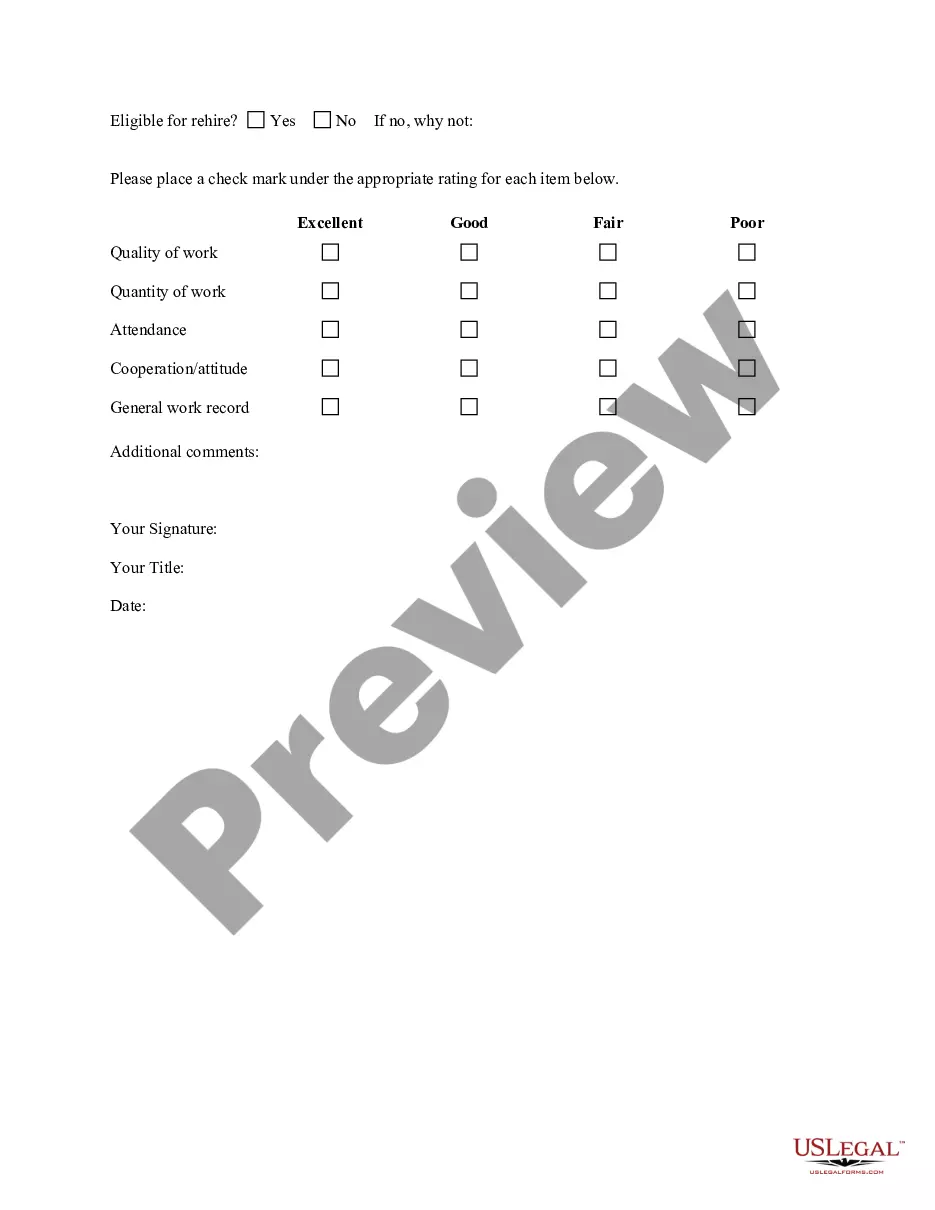

How to fill out Income Verification Letter From Cpa Sample?

Whether for business purposes or for individual matters, everyone has to manage legal situations at some point in their life. Completing legal papers requires careful attention, beginning from choosing the proper form template. For example, when you pick a wrong edition of a Income Verification Letter From Cpa Sample, it will be turned down when you submit it. It is therefore important to have a trustworthy source of legal documents like US Legal Forms.

If you have to obtain a Income Verification Letter From Cpa Sample template, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it fits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to find the Income Verification Letter From Cpa Sample sample you require.

- Get the file if it matches your needs.

- If you already have a US Legal Forms account, click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Income Verification Letter From Cpa Sample.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time looking for the appropriate template across the internet. Make use of the library’s easy navigation to get the correct form for any occasion.

Form popularity

FAQ

In the opening paragraph, introduce yourself and state the purpose of the letter, which is to confirm your self-employment status for a specific job or opportunity. Provide details about your self-employment, such as the name of your business, the nature of your work, and the duration of your self-employment.

Clearly state your income details, including: Your current employment status (e.g., employed, self-employed, retired). Your employer's name and contact information (address and phone number). Your job title and the length of time you've been employed. Your monthly or annual income before taxes.

CPA Letter for Verification of Self Employment is a document issued by the CPA who affirms that he/she has prepared or has reviewed the applicant's tax returns and that the applicant is self-employed.

A proof of income letter determines and confirms an individual's income and employment status. It is a formal, official letter usually composed by employers in order to confirm that an individual currently works for them or has worked for them in the past.

What is a CPA Letter or Comfort Letter? A CPA letter, also known as comfort letter or income verification letter, is an official document issued by a certified public accountant (CPA) attesting to the accuracy of a client's income and expense statements and confirming that they comply with IRS guidelines.