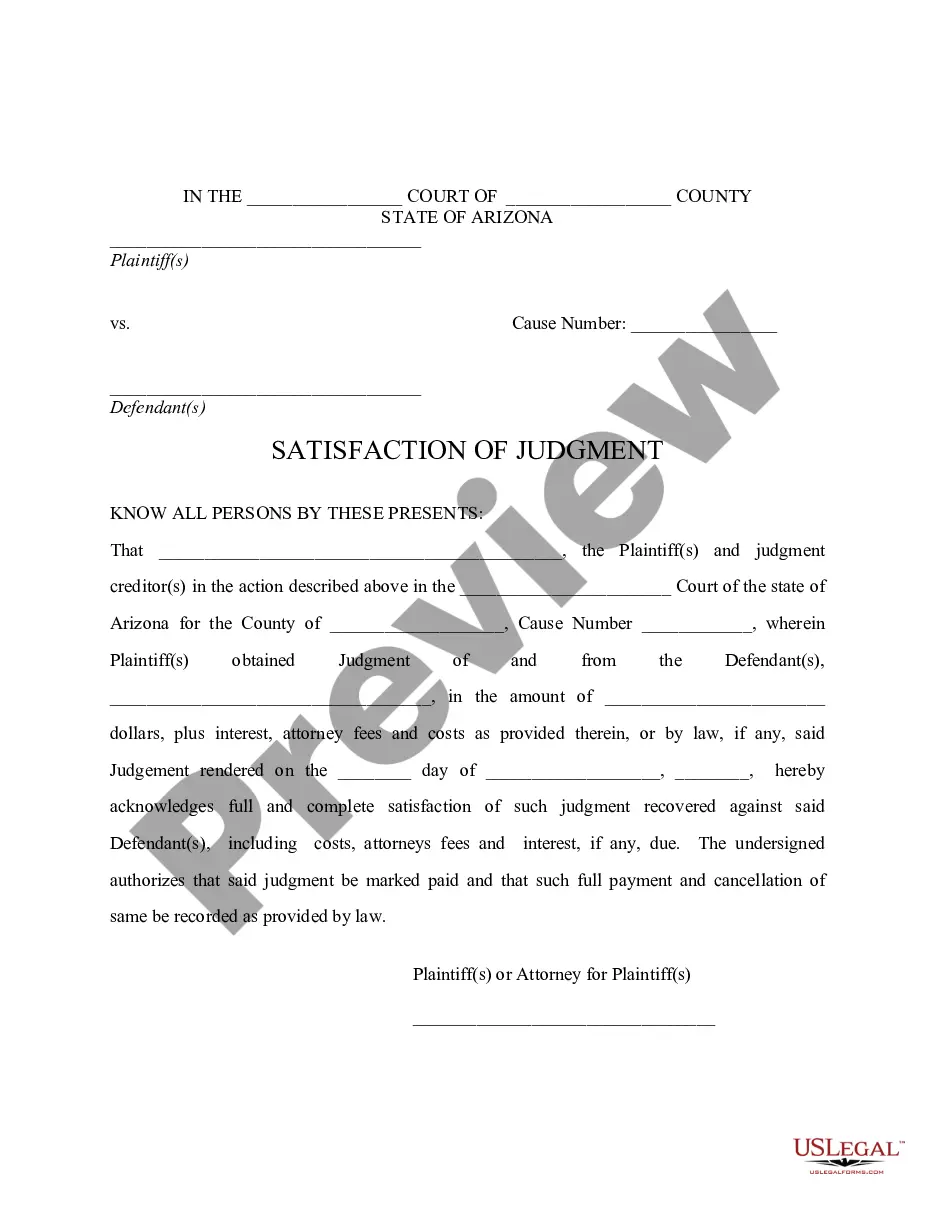

An income verification letter for an apartment is a document issued by an employer or a financial institution to confirm an individual's ability to pay rent. It serves as proof of income and helps landlords evaluate the financial stability of prospective tenants. This letter is crucial in the rental application process and can significantly impact the approval or denial of an apartment lease. Keywords: income verification letter, apartment, proof of income, rental application, financial stability, landlord, prospective tenants, approval, denial, lease. Different types of income verification letters for apartments may include: 1. Employer Income Verification Letter: This type of letter is issued by an employer on the company's letterhead. It verifies the applicant's employment status, gross income, and typically includes details such as job title, start date, and regular employment status (full-time, part-time, contract). 2. Self-Employed Income Verification Letter: Individuals who are self-employed may need to provide an income verification letter based on their business income. This letter usually includes information about the nature of the business, average monthly or annual income, and the stability of the business. 3. Pay Stub Income Verification Letter: Some landlords may accept copies of recent pay stubs as proof of income. These pay stubs should clearly state the applicant's name, employer information, gross income, deductions, and year-to-date earnings. 4. Bank Statement Income Verification Letter: In some cases, financial institutions may issue verification letters based on bank statements. These letters state the average monthly income, account stability, and can be used as proof of the tenant's ability to meet monthly rental obligations. 5. Social Security or Benefits Income Verification Letter: Individuals receiving social security benefits or other government assistance can request an income verification letter from the appropriate agency. These letters confirm the income received and the stability of the benefits. Remember, the specific requirements for income verification letters may vary depending on the landlord or property management company. It's essential to contact the landlord or property manager beforehand to determine the preferred format and details they require in the letter.

Income Verification Letter For Apartment

Description

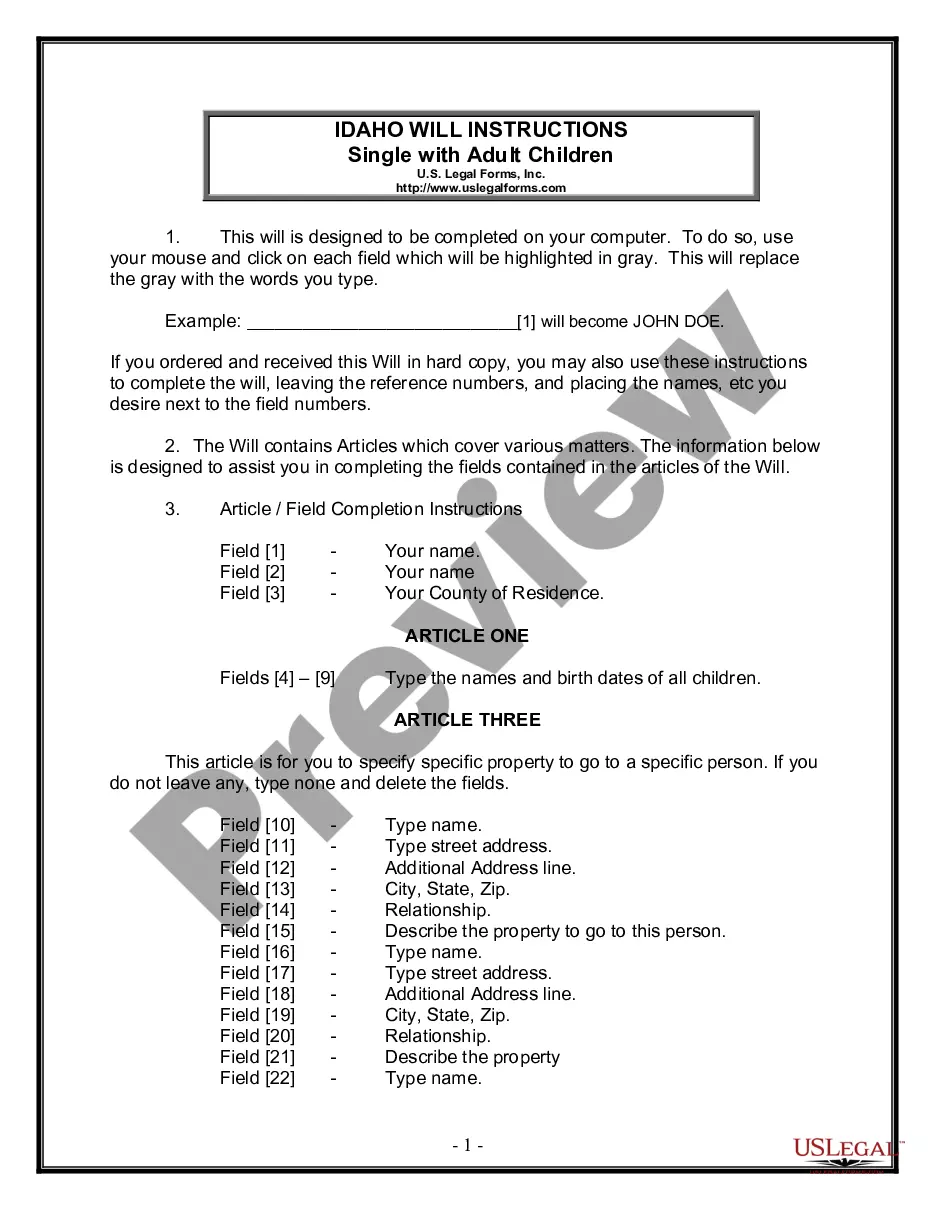

How to fill out Income Verification Letter For Apartment?

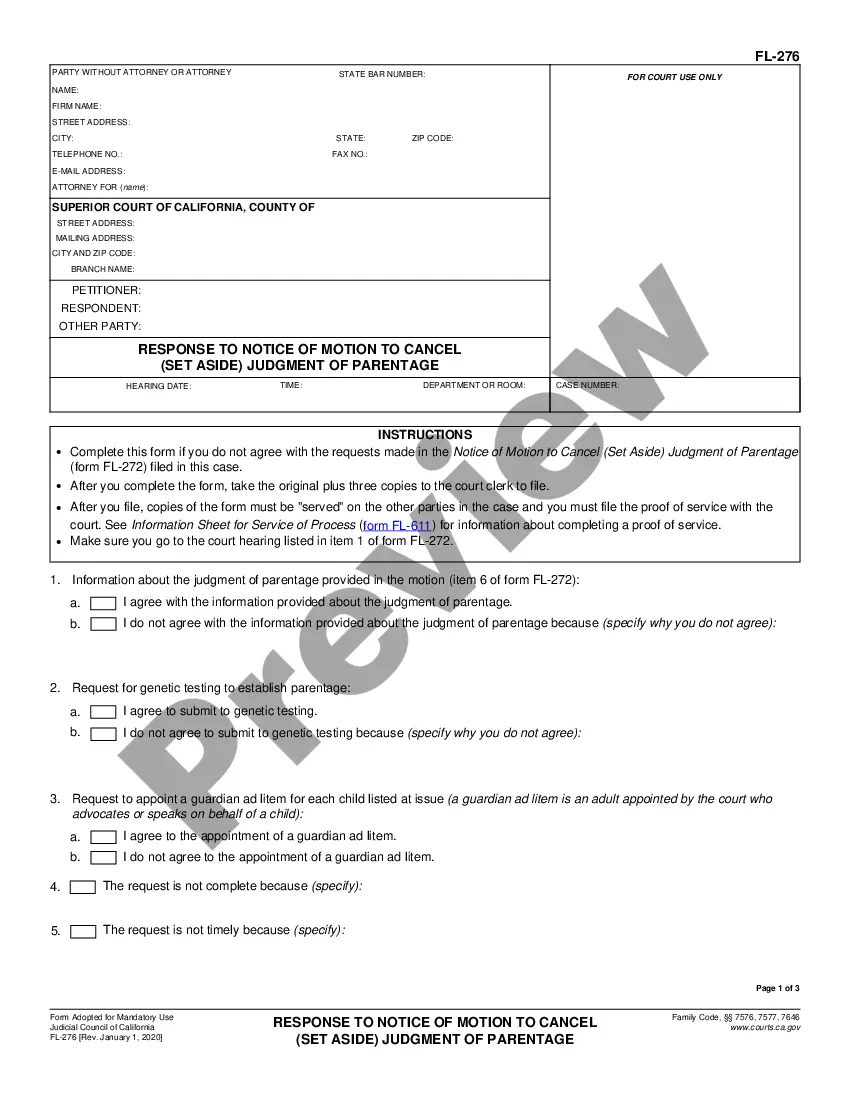

Getting a go-to place to access the most current and relevant legal samples is half the struggle of handling bureaucracy. Finding the right legal papers demands precision and attention to detail, which explains why it is vital to take samples of Income Verification Letter For Apartment only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the details concerning the document’s use and relevance for the situation and in your state or county.

Take the following steps to finish your Income Verification Letter For Apartment:

- Use the library navigation or search field to find your sample.

- View the form’s information to check if it fits the requirements of your state and region.

- View the form preview, if available, to make sure the form is definitely the one you are looking for.

- Get back to the search and find the correct template if the Income Verification Letter For Apartment does not fit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Pick the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Pick the file format for downloading Income Verification Letter For Apartment.

- When you have the form on your gadget, you may change it with the editor or print it and finish it manually.

Get rid of the headache that comes with your legal documentation. Check out the comprehensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

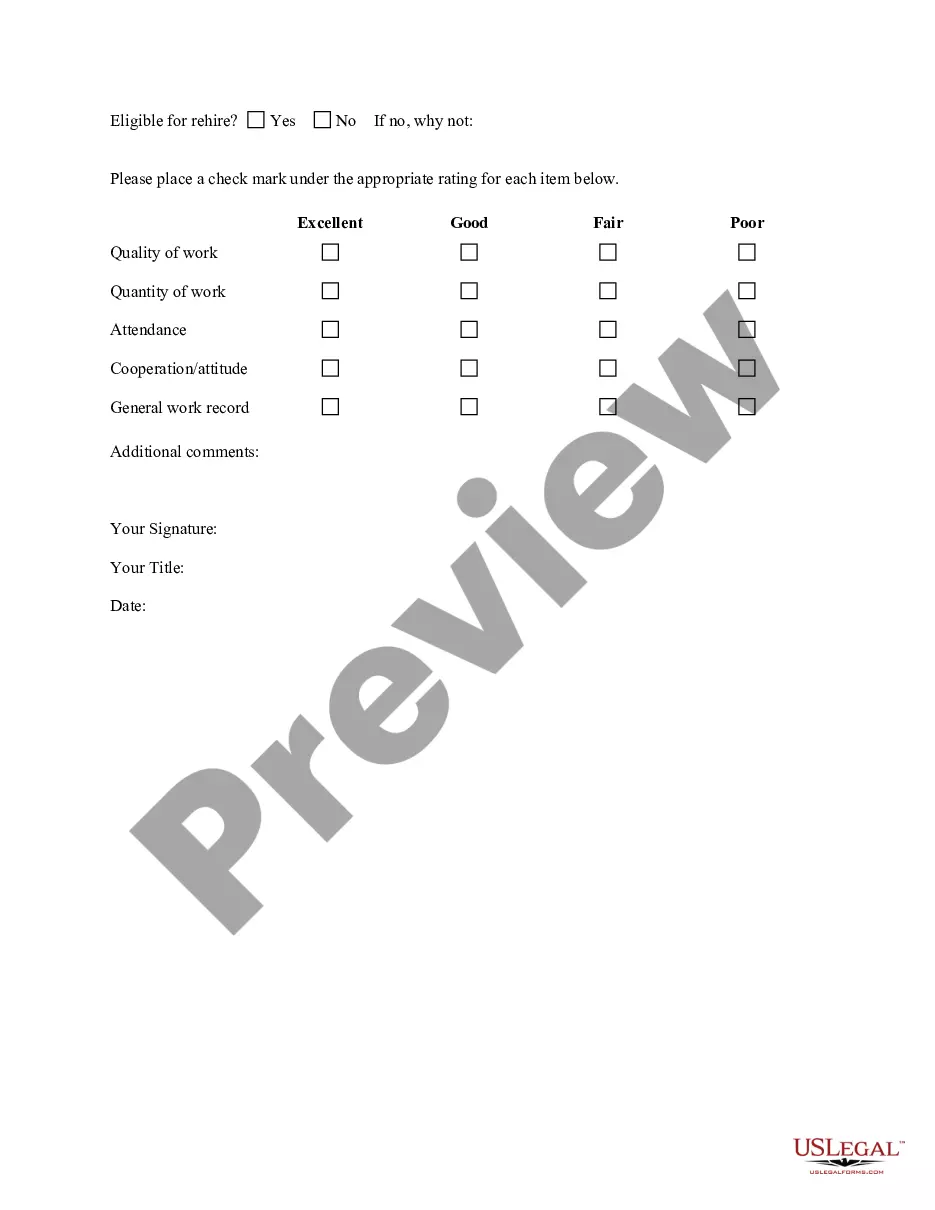

Supporting Documents Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings. Bank statements demonstrating regular income. Attestation from a current or former employer.

You should connect your primary checking and/or savings account(s) - the account(s) that receive your payroll income and direct deposits. Please ensure the account type is a traditional account, not other types of account (business/retirement/CD) as that ay not allowed for the Verification of Income.

I [YOUR NAME], confirm that I have been self-employed for [NUMBER] [WEEK/MONTH/YEAR], as a [YOUR DESIGNATION] under the business name of [YOUR COMPANY NAME]. The nature of my business is as follows: [TYPE OF BUSINESS]. I conduct my business in [COUNTRY/STATE/PROVIENCE].

My name is [full name] and I am [professional position and how it relates to the employee or former employee]. I'm writing to confirm that [employee name] has worked for [company name] for [length of time worked] as an [employee job title]. [Employee name] earns [hourly, monthly or yearly salary or wages].

In this case, it is best to open a basic savings account and deposit all your income, so the statement of that account will serve as proof. If you choose this option, keep in mind that the same amount of money must be deposited for at least three months in order to verify that you have a fixed income.