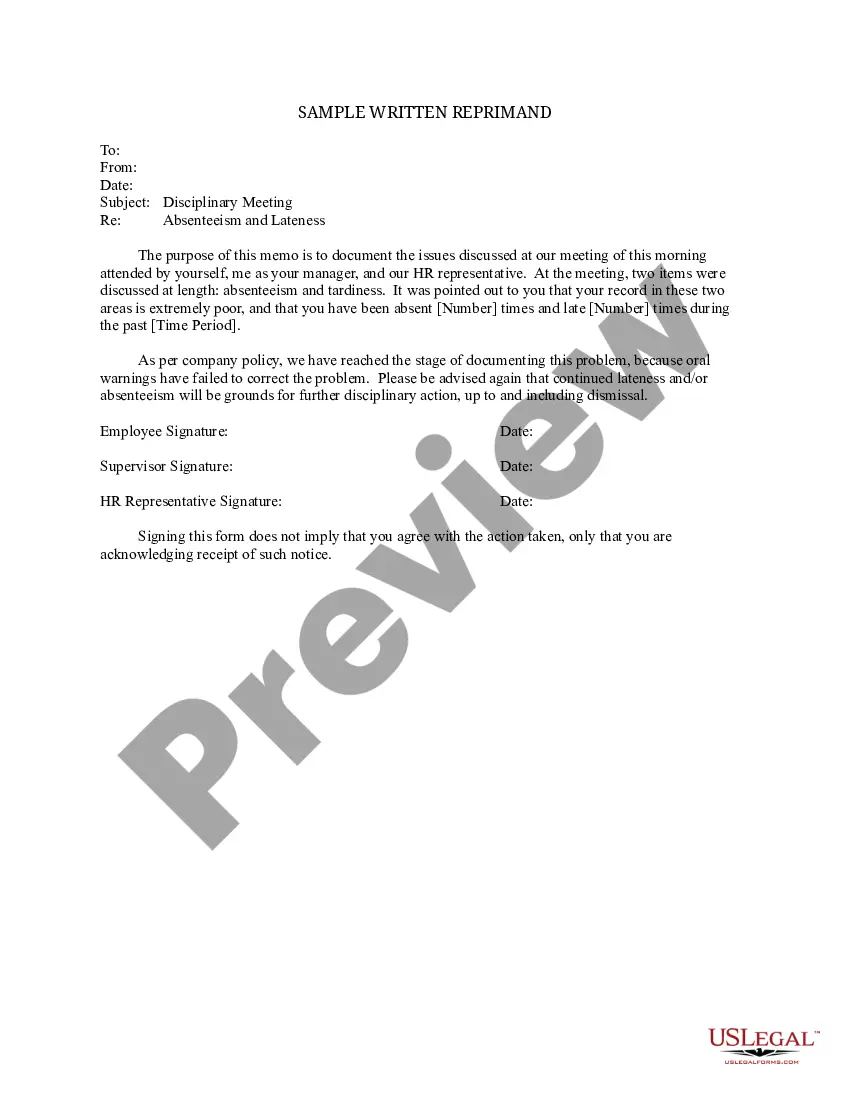

Written Reprimand In Tagalog

Description

How to fill out Sample Written Reprimand For Absenteeism And Tardiness?

Regardless of whether it is for commercial reasons or personal issues, everyone must confront legal matters at some stage of their lives.

Filling out legal paperwork requires meticulous focus, starting from selecting the correct template version.

Once downloaded, you can either fill in the form using editing software or print it and complete it by hand. With an extensive collection available at US Legal Forms, there's no need to waste time searching for the suitable template across the internet. Utilize the library’s straightforward navigation to discover the correct form for any event.

- For instance, if you choose an incorrect version of a Written Reprimand In Tagalog, it will be denied upon submission.

- Hence, it is crucial to find a trustworthy provider of legal documents like US Legal Forms.

- If you wish to get a Written Reprimand In Tagalog template, follow these simple instructions.

- Obtain the template you require through the search bar or catalog browsing.

- Review the form's description to confirm it aligns with your circumstances, state, and area.

- Click on the form’s preview to review it.

- If it is not the correct document, return to the search feature to find the Written Reprimand In Tagalog form you need.

- Download the template if it satisfies your criteria.

- If you already possess a US Legal Forms profile, click Log in to retrieve previously saved documents in My documents.

- In case you do not have an account yet, you can obtain the form by selecting Buy now.

- Choose the relevant pricing option.

- Complete the profile registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the desired file format and download the Written Reprimand In Tagalog.

Form popularity

FAQ

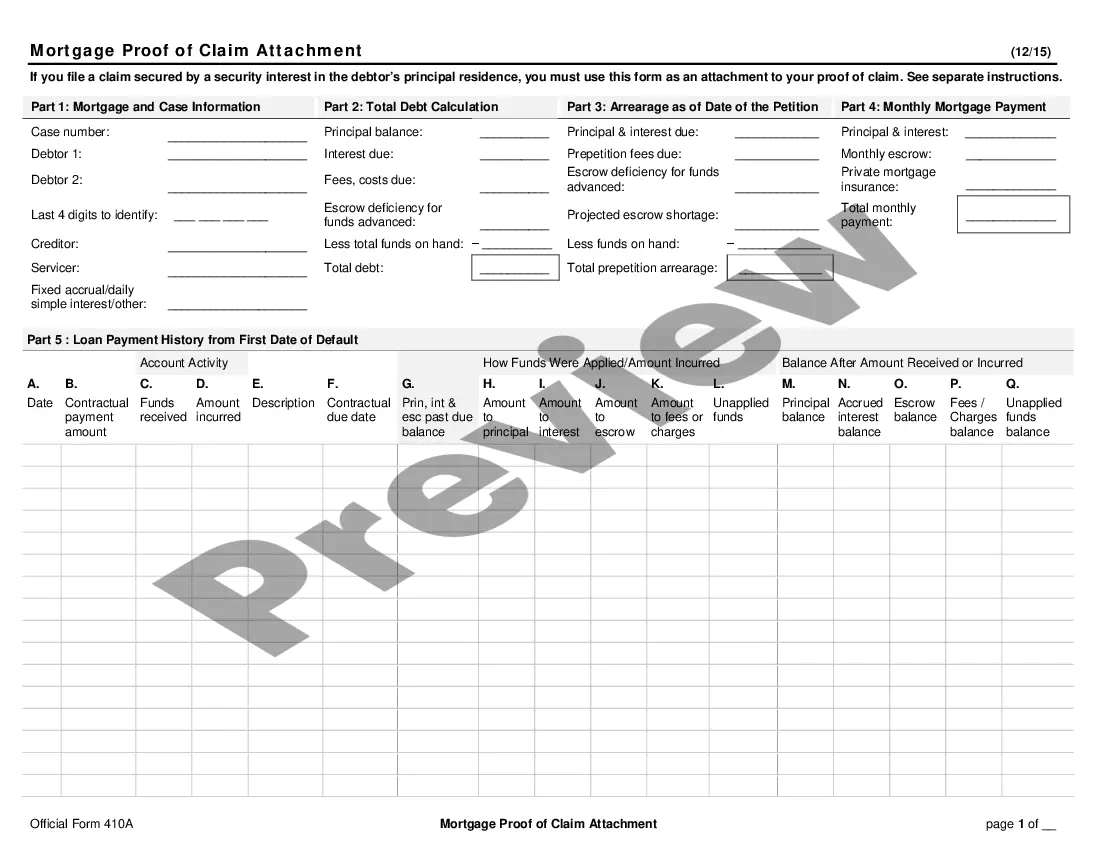

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Personal Loan for Emergency. An unsecured personal loan can act as an emergency loan, which can fund unexpected situations. They are typically swift, with deposits arriving within a day or two of loan approval. Some lenders fund emergency personal loans the same day you apply.

How to Create a Money Lending Mobile App: What to Start With? Start with registration form. You need to choose how to register a legal entity. ... Register your business name. ... Get initial capital. ... Find a reliable IT financial service provider. ... Figuring out the app's UI/UX Design. ... Software development. ... App launch and maintenance.

In this article: Check Your Credit Score. Calculate How Much You Need to Borrow. Calculate an Estimated Monthly Payment. Get Prequalified With Multiple Lenders. Compare All Loan Terms. Choose a Lender and Apply. Review the Offer and Accept the Loan.

Visit the branch of the financial lender. Procure the personal loan application form and enter all the required details. Submit relevant documents that prove one's income, age, address and identity. The lender will then verify the documents and check the eligibility of the applicant.

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.

Secured loans tend to have less stringent requirements and more favorable terms because the lender can take your collateral if you miss your loan payments. Some of the easiest loans to get in this category include auto title loans and pawnshop loans, but these also tend to be relatively expensive loans.

How To Get a Personal Loan in 5 Easy Steps? Step 1: Determine your requirement. Figure out why you need a Personal Loan and how much you need. ... Step 2: Check loan eligibility. ... Step 3: Calculate monthly instalments. ... Step 4: Approach the bank. ... Step 5: Submit documents.