Independent Contractor Acknowledgement Form For Independent

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

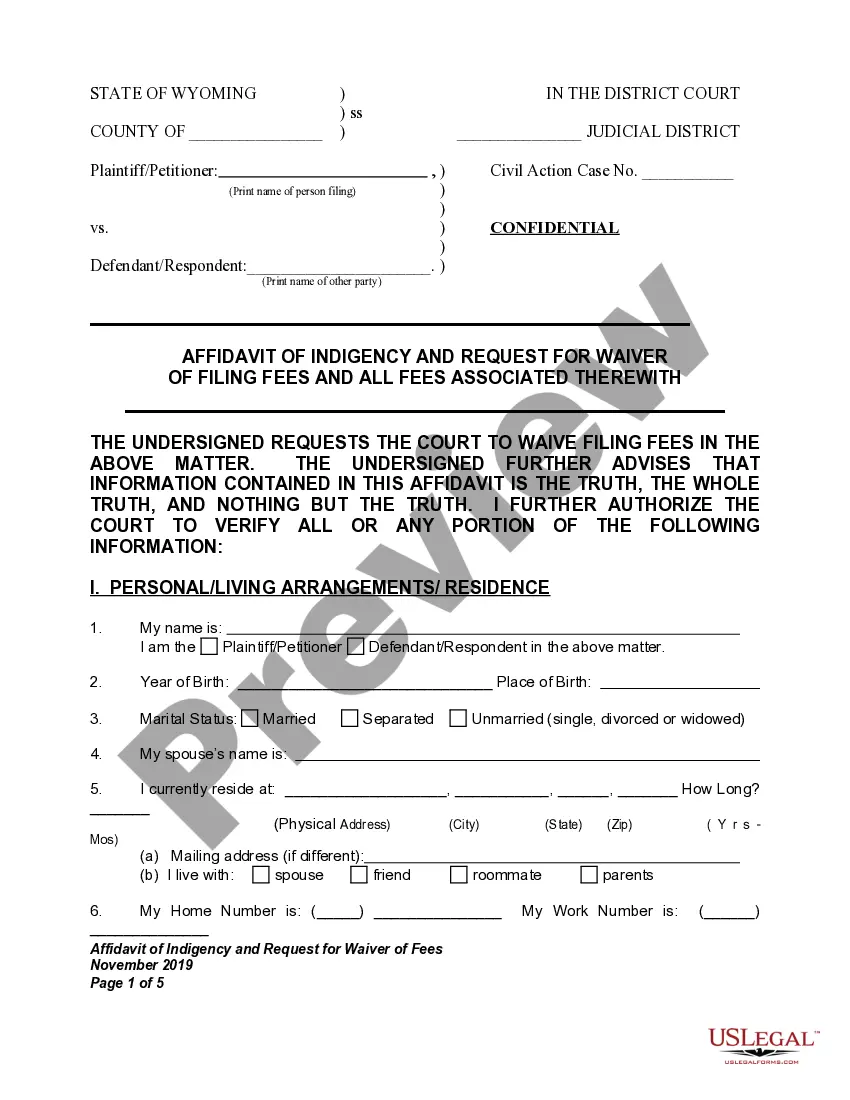

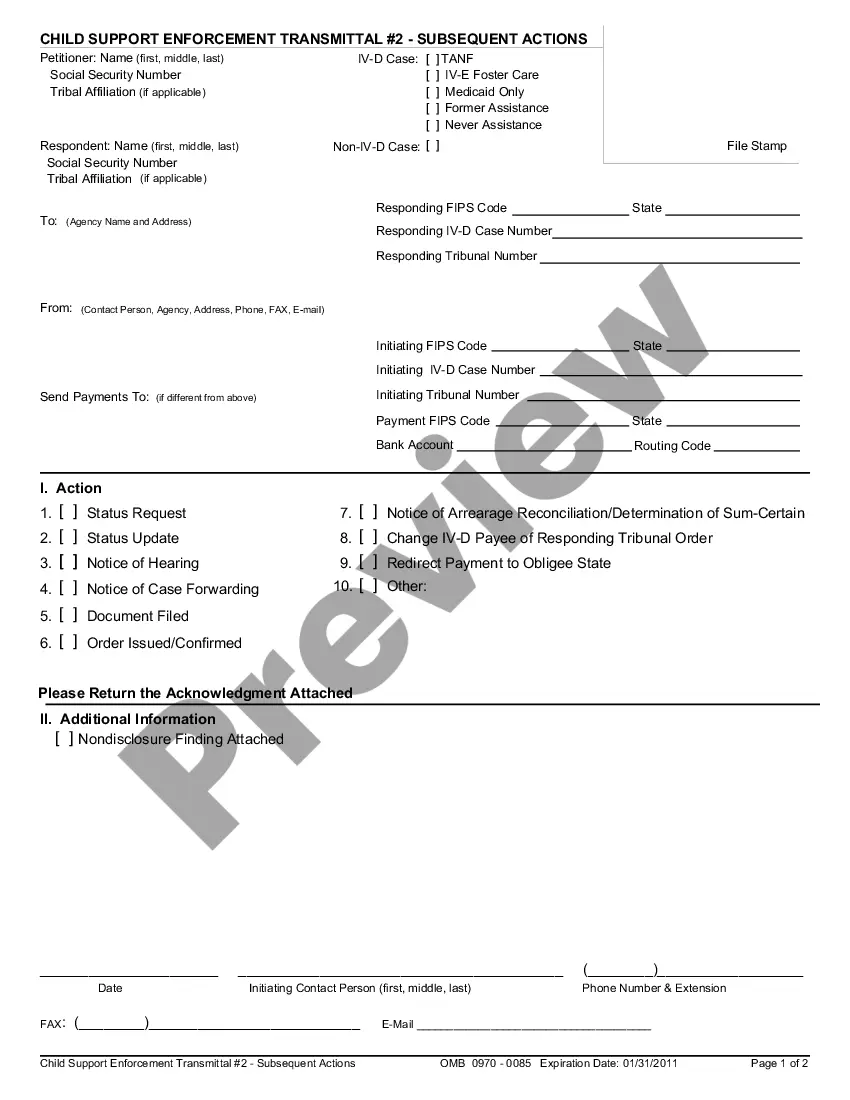

When you have to fill out the Independent Contractor Acknowledgement Form for Independents that adheres to your local state's laws and regulations, there can be numerous options available.

There's no need to sift through each document to verify that it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Obtaining expertly composed formal documentation becomes effortless with US Legal Forms. Moreover, Premium members can also take advantage of the powerful built-in tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online directory with a compilation of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading the Independent Contractor Acknowledgement Form for Independents from our platform, you can be assured that you possess a valid and current document.

- Acquiring the required sample from our platform is incredibly straightforward.

- If you already have an account, simply Log In to the system, ensure that your subscription is active, and save the chosen file.

- Later, you can access the My documents section in your profile and retrieve the Independent Contractor Acknowledgement Form for Independents at any time.

- If it's your initial experience with our library, please follow the instructions below.

- Review the suggested page and verify it for adherence to your standards.

Form popularity

FAQ

The entire agreement should cover the following:General information about the contractor and client.Services and scope of work.Permission to hire subcontractors.Equipment and facilities.Compensation for the services provided.Expenses, travel, and reimbursement policies.Effective date of the agreement.More items...?

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How to demonstrate that you are an independent worker on your resumeMention that time when you had to work on a project on your own.Talk about projects that required extra accountability.Describe times when you had to manage several projects all at once.More items...

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.