Form 1099 For Independent Contractors

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

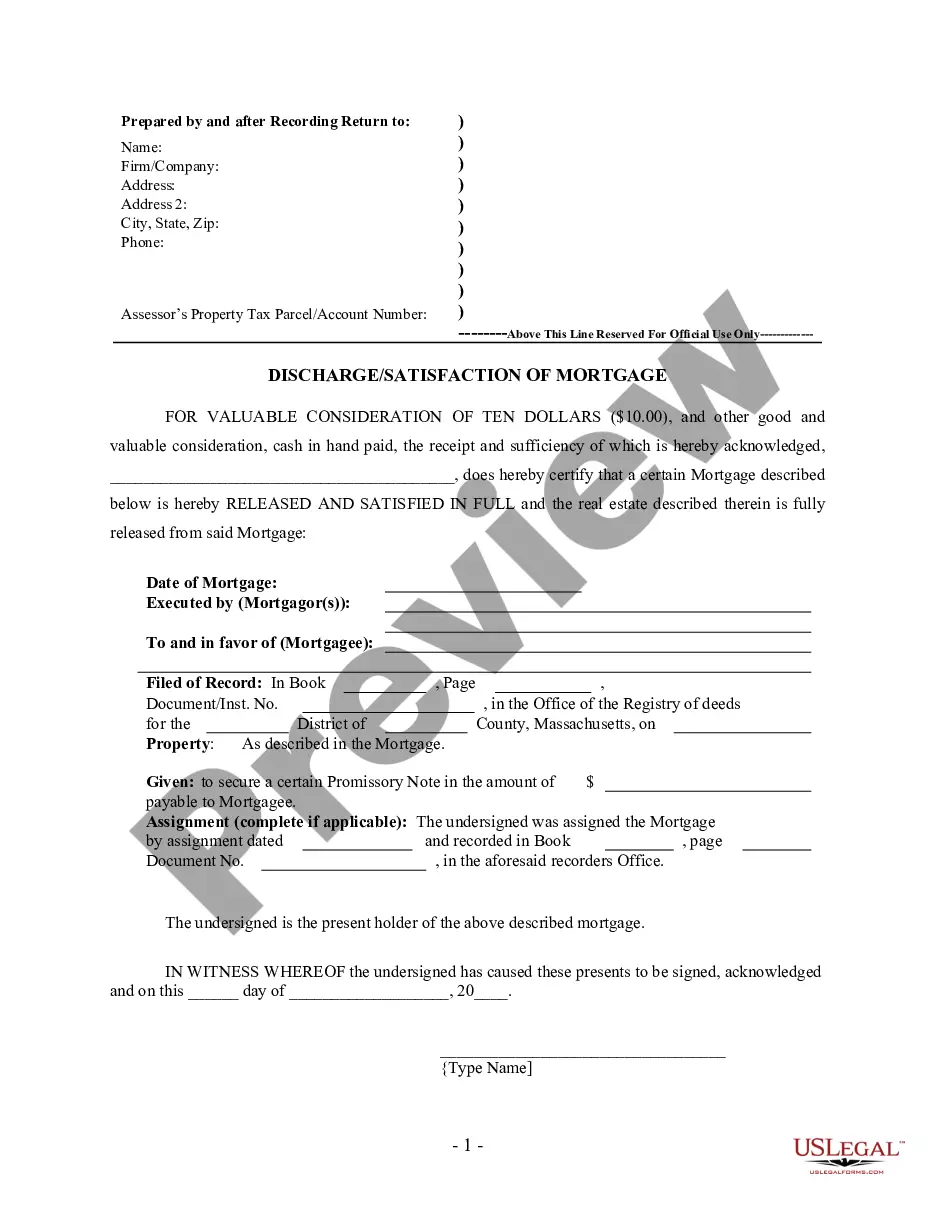

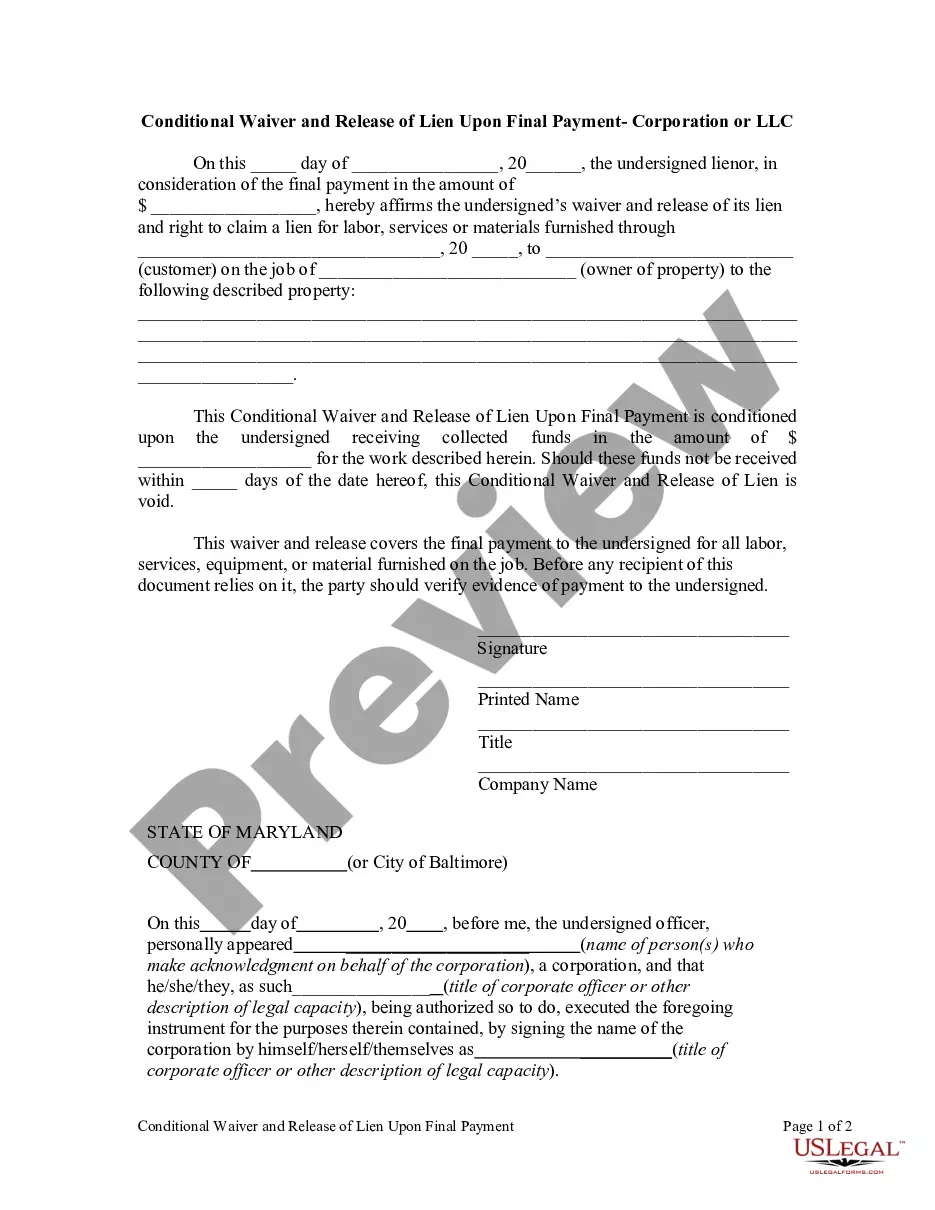

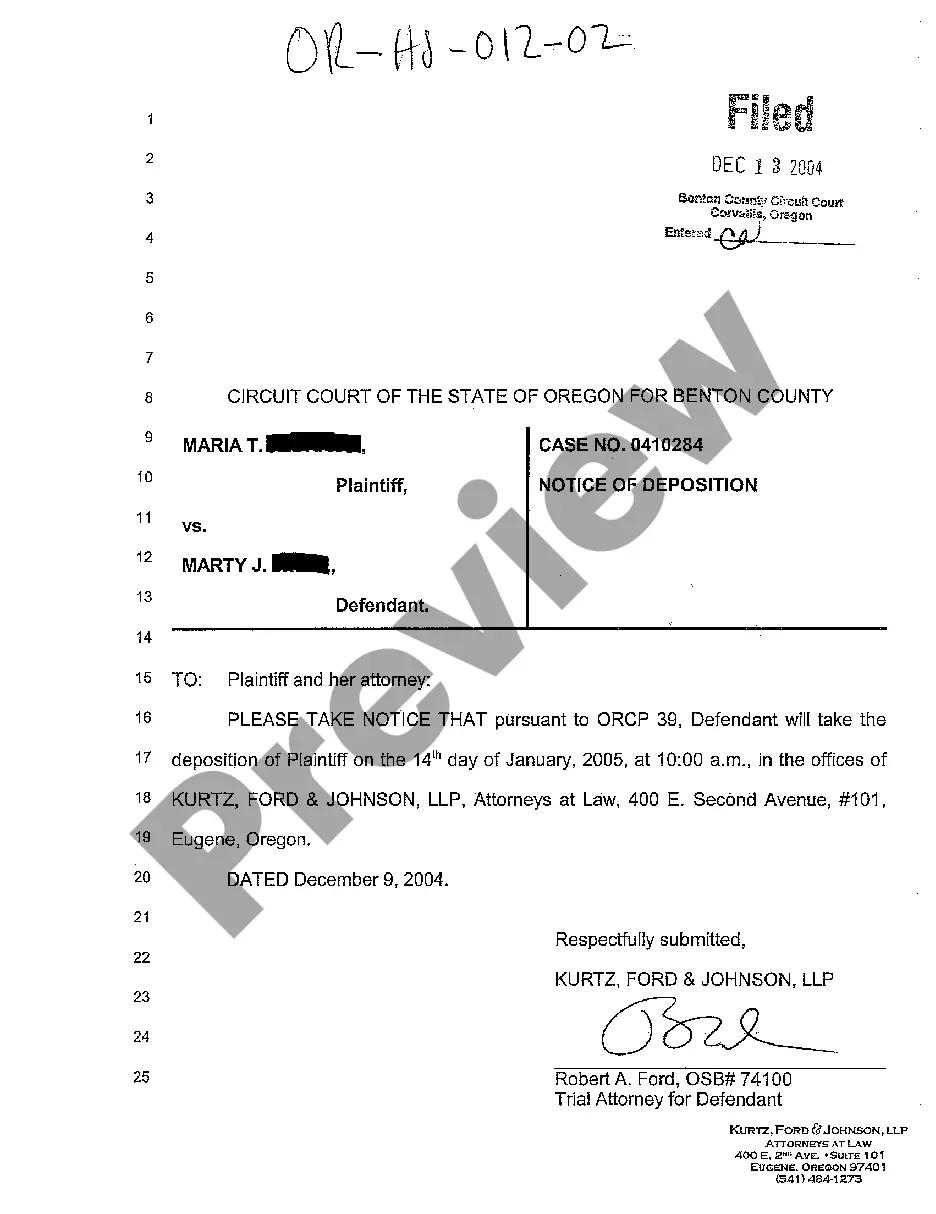

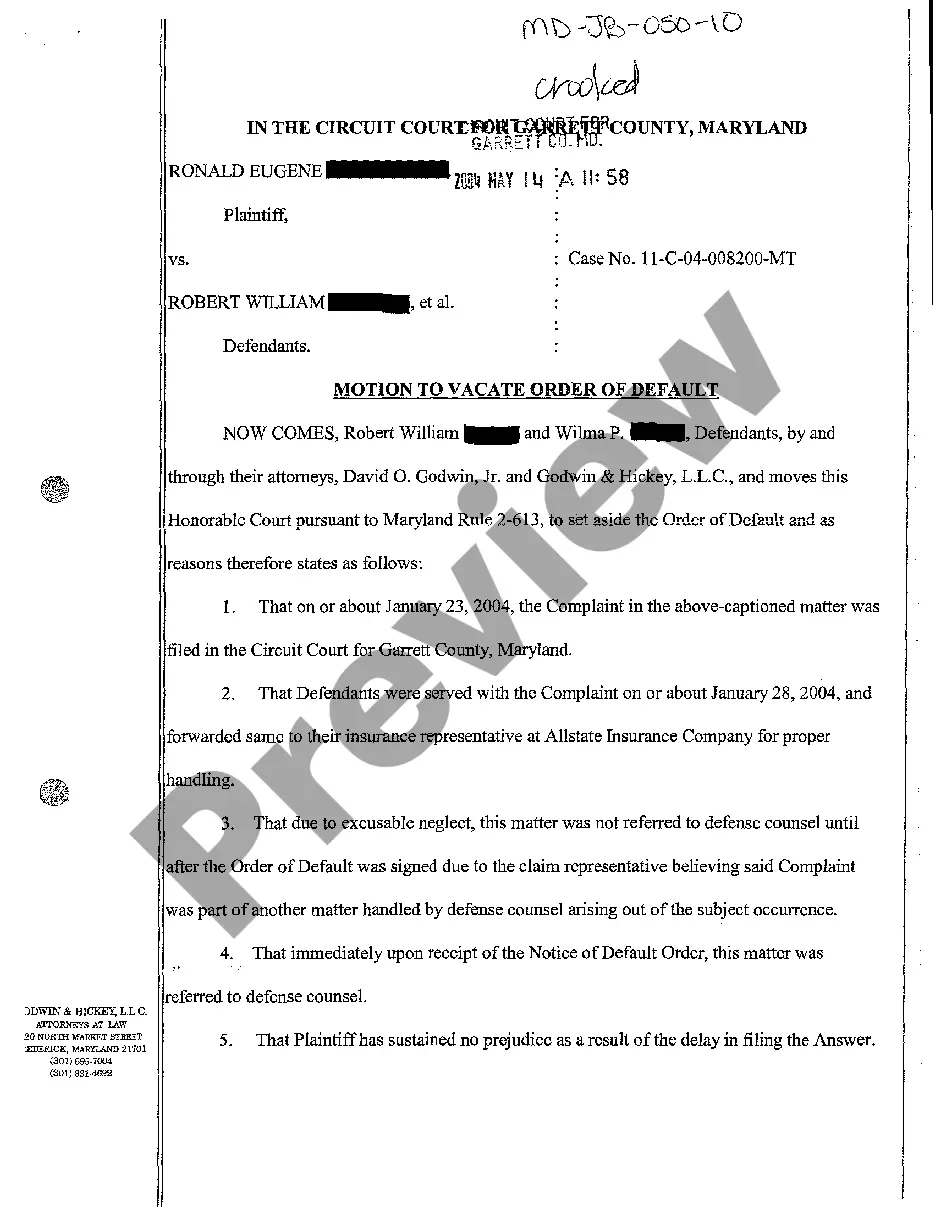

Obtaining a reliable source for the latest and applicable legal templates is a significant part of navigating bureaucracy. Securing the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to obtain samples of Form 1099 For Independent Contractors exclusively from reputable providers, like US Legal Forms. An incorrect template could squander your time and stall your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all the particulars about the document’s applicability and importance for your situation and in your state or region.

Consider the following steps to finalize your Form 1099 For Independent Contractors.

Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms library to locate legal templates, verify their suitability for your situation, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Examine the form's description to determine if it meets the specifications of your state and locality.

- Check the form preview, if accessible, to confirm it is the document you need.

- Continue the search and find the suitable document if the Form 1099 For Independent Contractors does not fulfill your requirements.

- If you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you have not yet created a profile, click Buy now to acquire the form.

- Choose the pricing package that aligns with your needs.

- Continue to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Form 1099 For Independent Contractors.

- Once you have the form on your device, you can edit it using the editor or print it and complete it by hand.

Form popularity

FAQ

New Hampshire Birth, Marriage and Death Records A copy or an extract of most original records can be purchased from the New Hampshire Vital Records State Department of Health or the Town Clerk's office of the town where the event occurred. See also records at the FamilySearch Library, online at FamilySearch.

Searching Public Records You can access vital records, including marriage records, online or in person at the courthouse of the city where the marriage was likely to occur, and you can usually see a copy for free or for a small fee.

But you and your partner may choose not to get married and enter instead into what is known as a "common-law marriage". This type of relationship can give you many of the same benefits as married couples, but only in certain states - and it's not always automatic.

New Hampshire is a "Closed Record" State, which means that only certain individuals have access to birth, death, marriage or divorce records. Access is granted to the individual the record belongs to, their immediate family members or someone who establishes a direct and tangible interest in the record.

The divorce certificate is available from the New Hampshire Division of Vital Records Administration (DVRA), New Hampshire town or city clerks, or the New Hampshire Superior Court or Family Division. A certified divorce decree is available from the Superior or Family Division courts.

Certified Copies of Marriage Certificates Please allow approximately two weeks from the date of the ceremony before requesting certified copies. You may then contact any New Hampshire city/town clerk to obtain certified copies. The state-set fee for one certified copy is $15.

You must have full name, exact date and place of marriage to order from the New Hampshire Department of State Division of Vital Records Administration. If you do not have the exact information, contact the Vital Records Office for more information. They may be able to do a search.

You must have full name, exact date and place of marriage to order from the New Hampshire Department of State Division of Vital Records Administration. If you do not have the exact information, contact the Vital Records Office for more information. They may be able to do a search.