Consulting Contractors Agreement With Consultant

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

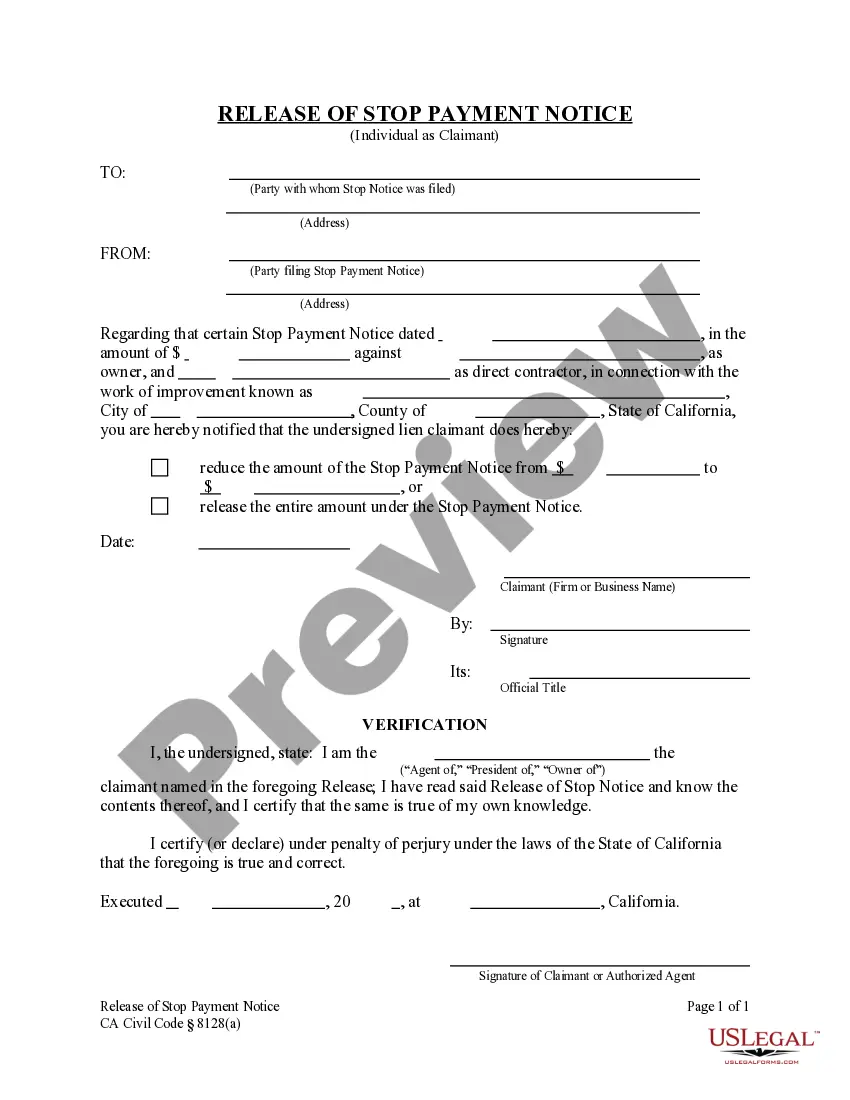

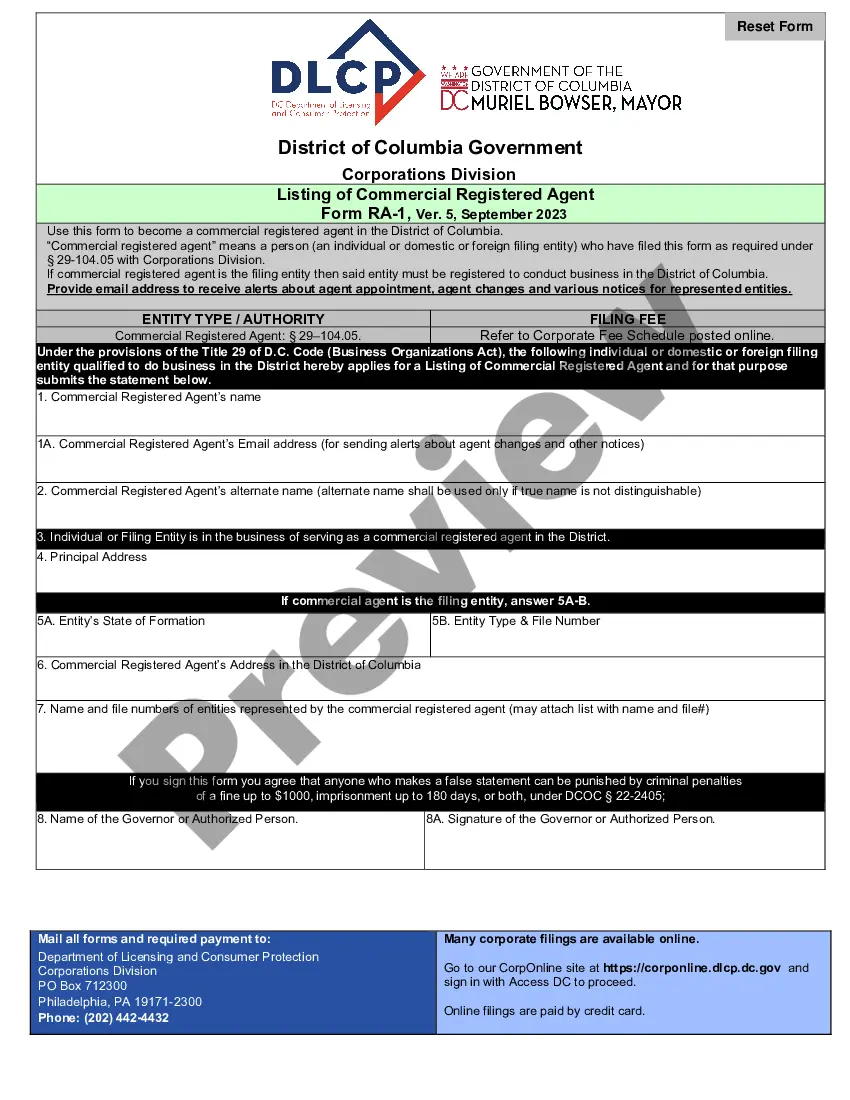

The Consulting Contractors Agreement With Consultant displayed on this page is a reusable legal document crafted by professional attorneys in accordance with federal and state statutes and regulations.

For more than 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with over 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, most straightforward, and most reliable method to acquire the forms you require, as the service guarantees bank-grade data security and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life’s events readily available.

- Search for the document you require and review it.

- Look through the example you found, preview it or review the form description to confirm it meets your requirements. If it doesn’t, utilize the search feature to find the suitable one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the fillable document.

- Choose the format you wish for your Consulting Contractors Agreement With Consultant (PDF, Word, RTF) and download the sample onto your device.

- Complete and sign the document.

- Print the template to finish it manually. Alternatively, employ an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a valid signature.

- Download your documents one more time.

- Utilize the same document again whenever needed. Access the My documents tab in your profile to redownload any forms you’ve previously downloaded.

Form popularity

FAQ

Taking action quickly can prevent additional unauthorized charges that could damage your credit or hurt your savings. The simplest way to find out whether someone opened an account in your name is to check your credit reports. They will list all accounts associated with your name and Social Security number.

What you can do to detect identity theft Track what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address. Review your bills. ... Check your bank account statement. ... Get and review your credit reports.

Where to find free protection Your bank or credit union. Your credit card issuers. Your employee benefits plan. Your homeowners or renters insurance. Organizations you belong to, such as AAA or AARP.

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies.

How To Know If Someone Is Using Your Identity Errors on your credit report. Suspicious transactions on your bank statements. Your health insurance benefits are used up. Your tax return is rejected. You're locked out of your online accounts. You start to receive more spam. Missing or unexpected physical mail.

Credit Card Offers, Bank Statements, Canceled Checks, and More Documents Containing Financial Information. An identity thief could potentially use anything that comes from a financial institution. ... Documents Containing Personal Information. ... Documents Containing Account Information. ... Junk Mail. ... Child- and School-Related Mail.

If a person violates any part of this section under circumstances that reasonably indicate an intent to manufacture, dispense, or distribute another's personal identifying information then that individual is guilty of felony identity fraud and faces up to 15 years in prison and/or a fine of up to $25,000.

You can check whether someone has stolen your Social Security number by reviewing the earnings posted in your Social Security statement, which you can review online via My Social Security. Or, request free credit reports from each of the three credit bureaus annually to check your statements for suspicious activity.