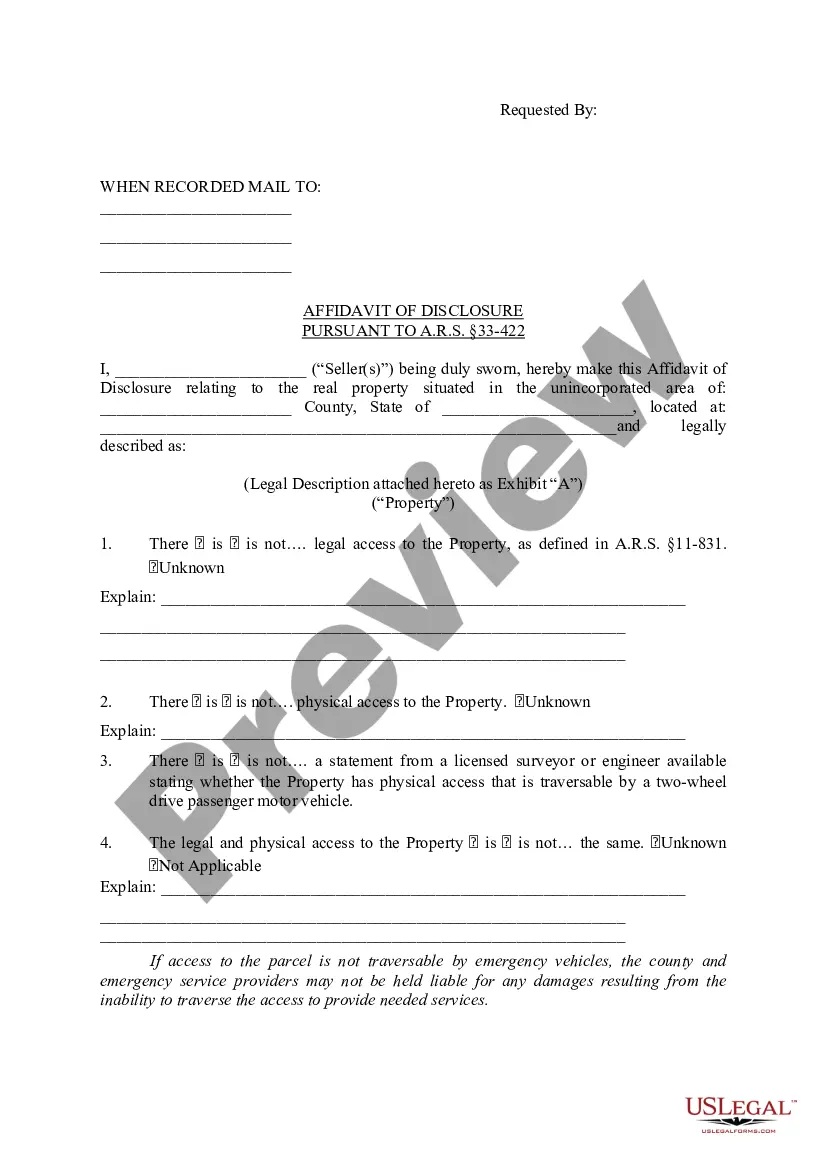

Consultants Self Employed Without Business License

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a simpler and more cost-effective way of preparing Consultants Self Employed Without Business License or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of more than 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-compliant templates diligently prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can quickly find and download the Consultants Self Employed Without Business License. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and navigate the catalog. But before jumping straight to downloading Consultants Self Employed Without Business License, follow these tips:

- Check the form preview and descriptions to make sure you are on the the form you are searching for.

- Check if form you select complies with the requirements of your state and county.

- Choose the right subscription option to get the Consultants Self Employed Without Business License.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform form execution into something simple and streamlined!

Form popularity

FAQ

Consultants who work for themselves are not employees. For tax purposes, they usually qualify as an independent contractor . This means that the client company who hires them to perform work does not have to pay for their benefits, unemployment or training.

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

But are they really the same things? The answer is no. When you're self-employed, you're not always a business owner. You may simply have created your own job.

All business owners are self-employed, but not all self-employed are small business owners. While being self-employed is defined as being your own boss, being a small business owner is simply characterized by having others work for you. As a small business owner, you can hire independent contractors or employees.

Answer: If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.