Annual Report Form Sample With Tax

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may entail extensive research and significant financial investment.

If you're seeking a more direct and budget-friendly method for preparing the Annual Report Form Sample With Tax or any other documents without unnecessary hassles, US Legal Forms is always accessible to you.

Our online collection of over 85,000 current legal forms covers nearly every area of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously assembled for you by our legal professionals.

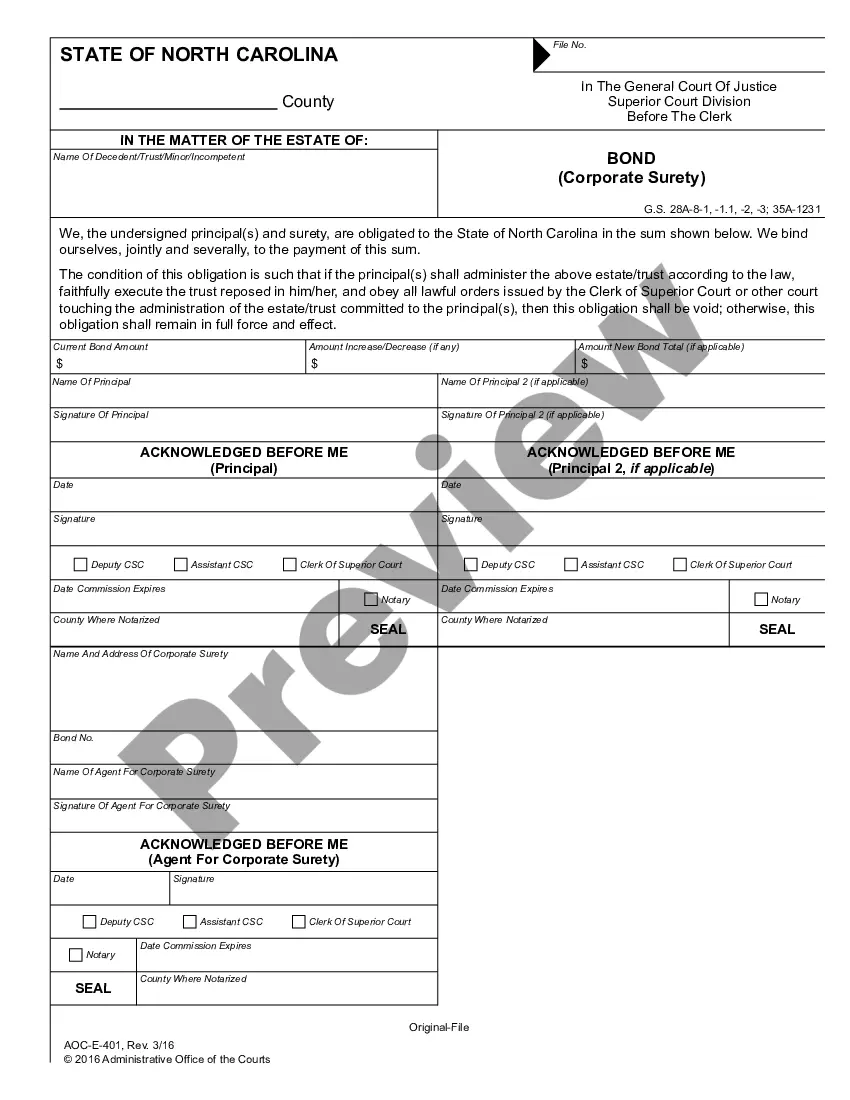

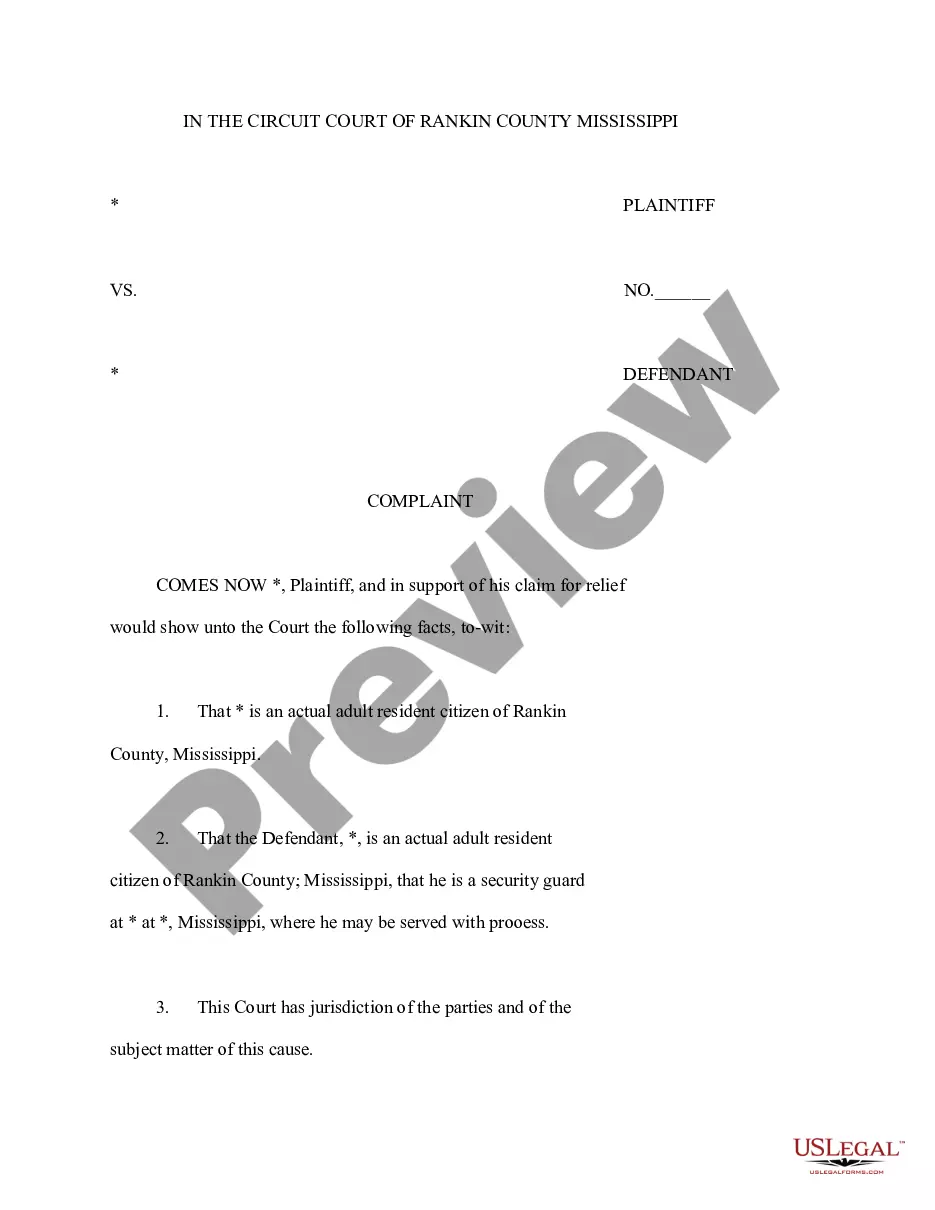

Examine the form preview and descriptions to confirm that you are on the correct form you are looking for.

- Utilize our platform whenever you require dependable and trustworthy services through which you can effortlessly find and download the Annual Report Form Sample With Tax.

- If you're already familiar with our website and have previously created an account, simply Log In to your account, find the template, and download it or re-download it later in the My documents section.

- Not registered yet? No worries. It takes minimal time to set it up and browse the catalog.

- However, before proceeding to download the Annual Report Form Sample With Tax, adhere to these suggestions.

Form popularity

FAQ

Generally, these are the 7 must-have pages: Cover Page. Table of content. Note From CEO, Chief Operating Officer, or Director. Executive Summary. Financial Overview. Project Overview. Projections.

How to create a successful annual report Summarize your business profile. Provide detailed company's financial position and statements. Include an overview of the company's operational performance. Make annual reports authentic by including challenges. Add your progress on corporate social responsibility.

Aside from legally required information, a strong and well-crafted annual report includes a cover page, a table of contents, a letter from the owner or CEO, a summary of your business's mission, vision, values, and goals, a description of your products or services, a detailed and comprehensive financial report, a ...

An annual report is a document that contains comprehensive financial information about public companies, small and large corporations, non-profit organizations, partnerships, and other businesses. It includes their financial performance and activities over the prior fiscal year.

Filing your state income tax return does not take care of your annual report requirement. State annual reports and state income tax returns are different things. Even if one has already been filed, the other still needs to be filed. You still need to file, even if you've never received a notice.