Names Amount Estate With Ette In Them

Description

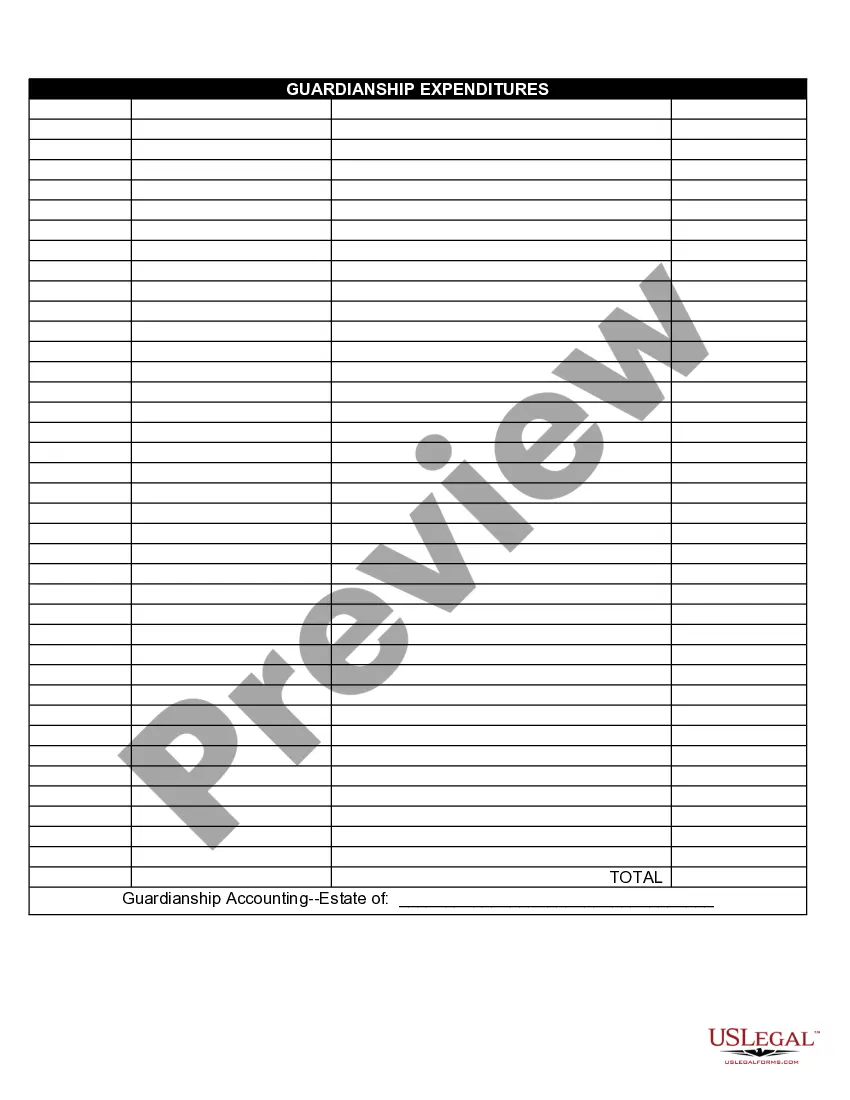

How to fill out Guardianship Expenditures?

Legal papers managing may be frustrating, even for experienced experts. When you are interested in a Names Amount Estate With Ette In Them and don’t get the time to commit trying to find the appropriate and updated version, the processes could be nerve-racking. A robust online form catalogue could be a gamechanger for everyone who wants to manage these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you may have, from personal to enterprise paperwork, in one location.

- Utilize advanced tools to accomplish and control your Names Amount Estate With Ette In Them

- Access a useful resource base of articles, tutorials and handbooks and resources related to your situation and needs

Save effort and time trying to find the paperwork you need, and make use of US Legal Forms’ advanced search and Preview tool to discover Names Amount Estate With Ette In Them and acquire it. For those who have a subscription, log in to the US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to view the paperwork you previously downloaded and to control your folders as you can see fit.

Should it be the first time with US Legal Forms, register an account and obtain limitless access to all advantages of the platform. Listed below are the steps to take after downloading the form you want:

- Validate this is the right form by previewing it and reading its information.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now when you are all set.

- Select a subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and send your papers.

Benefit from the US Legal Forms online catalogue, backed with 25 years of expertise and stability. Change your day-to-day papers managing into a smooth and easy-to-use process right now.

Form popularity

FAQ

Increases for 2023 The basic exclusion for determining the amount of the unified credit against estate tax under IRC Section 2010 will be $12,920,000 for decedents who die in 2023, an $860,000 increase from 2022. The annual gift tax exclusion increases to $17,000 for 2023, up $1,000.

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $12.06 million for decedents who died in 2022 ($12.92 million in 2023), or34.

What if my spouse and I want to give away property that we own together? Year of GiftAnnual Exclusion per DoneeAnnual Exclusion Total per Donee (from 2 spouses)2013 through 2017$14,000$28,0002018 through 2021$15,000$30,0002022$16,000$32,0002023$17,000$34,0001 more row ?

This letter indicates that the state estate tax return has been reviewed and accepted by the taxing authority. The document may also be required to clear any estate tax liens placed against a property. Once taxes are paid, and the lien is satisfied, the property can be transferred to beneficiaries.

Ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.