Cobra coverage is a type of insurance that allows dependents who are turning 26 to continue their health coverage under their parent's plan. When dependents reach the age of 26, they are typically no longer eligible to stay on their parent's health insurance policy. However, with the Consolidated Omnibus Budget Reconciliation Act (COBRA), dependents have the option to extend their coverage for a limited period of time. Cobra coverage for dependents turning 26 ensures that young adults can maintain access to healthcare services and treatments without interruption. This coverage is particularly beneficial during transitional periods, such as when dependents are in between jobs or unable to secure their own insurance right away. There are different types of Cobra coverage available for dependents turning 26, including: 1. COBRA Continuation Coverage: This is the standard type of Cobra coverage, which allows eligible dependents to maintain the same healthcare benefits and level of coverage that they had under their parent's plan. The coverage period is typically limited to 18 months, although some circumstances may allow for an extension of up to 36 months. 2. Extended Cobra Coverage: In certain cases, dependents may be eligible for an extended period of Cobra coverage beyond the usual 18 months. This extended coverage can be granted if the beneficiary meets specific criteria, such as being disabled or experiencing other qualifying events. 3. State-Specific Cobra Coverage: Some states offer their own Cobra coverage options for dependents turning 26. These state-specific programs may have different eligibility requirements, coverage periods, or costs compared to the standard Cobra coverage. 4. Cobra Coverage Alternatives: In addition to traditional Cobra coverage, dependents turning 26 may also consider alternative options to ensure their health insurance needs are met. These alternatives can include purchasing individual health insurance plans through the Health Insurance Marketplace or exploring coverage through an employer or spouse's plan. It is important for dependents turning 26 to carefully evaluate their Cobra coverage options, compare costs, and understand the limitations and requirements associated with each type. This will enable them to make an informed decision regarding the most suitable coverage to ensure their ongoing access to vital healthcare services.

Cobra Coverage For Dependents Turning 26

Description

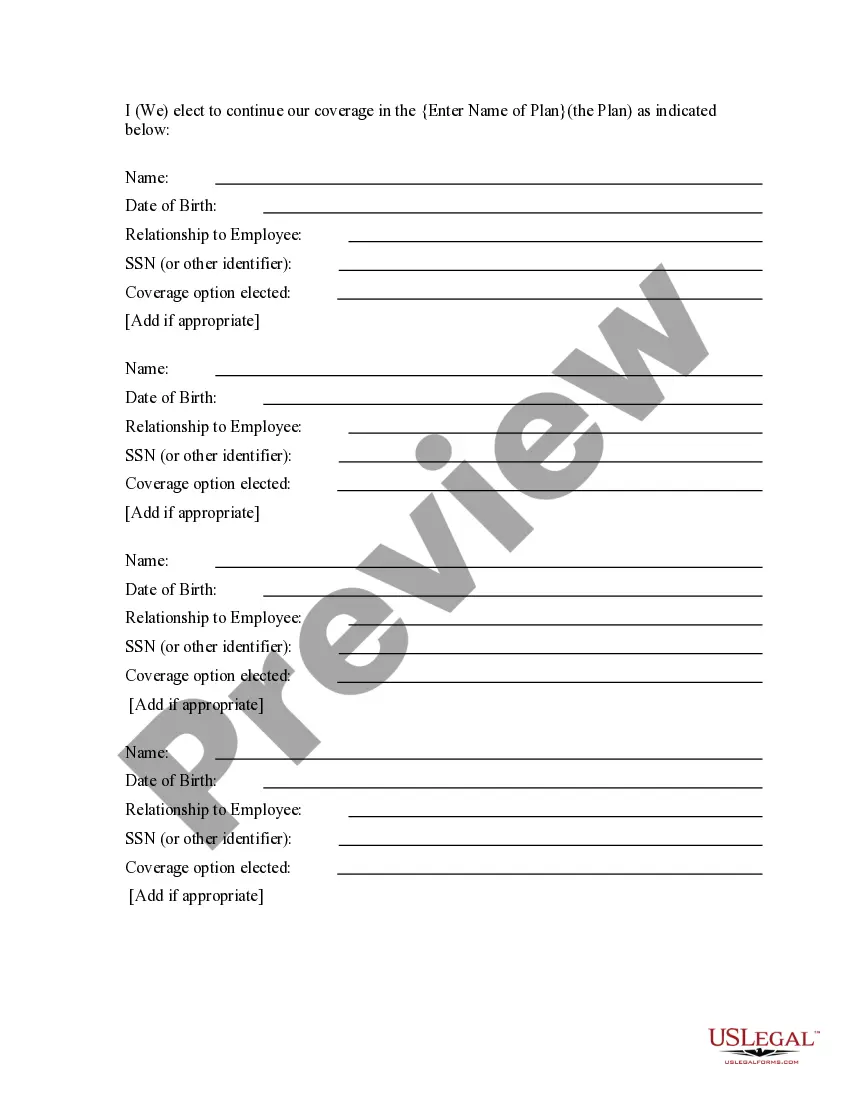

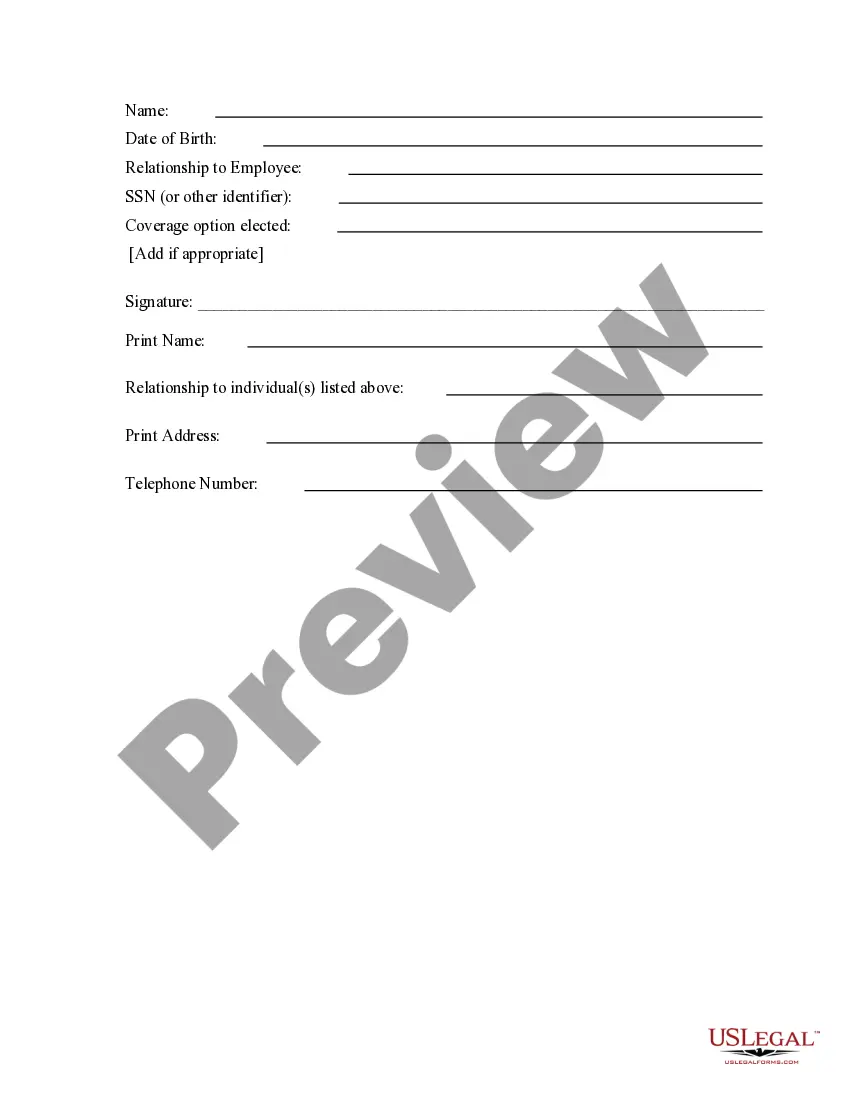

How to fill out Cobra Coverage For Dependents Turning 26?

It’s widely known that you cannot become a legal expert in a single night, nor can you easily learn how to swiftly compose Cobra Coverage For Dependents Turning 26 without a specific skill set.

Creating legal documents is a lengthy endeavor that necessitates particular education and competencies. So why not entrust the task of preparing the Cobra Coverage For Dependents Turning 26 to the experts.

With US Legal Forms, one of the most comprehensive legal document repositories, you can discover anything from legal papers to templates for internal business correspondence. We recognize the significance of compliance and adherence to federal and local regulations. That’s why, on our platform, all templates are region-specific and current.

You can access your documents from the My documents section whenever needed. If you’re an existing client, you can simply Log In, and locate and download the template from the same section.

Regardless of the intent of your forms—whether financial, legal, or personal—our website has everything you need. Explore US Legal Forms now!

- Locate the document you need using the search bar at the top of the page.

- Examine it (if this option is available) and review the accompanying description to determine if Cobra Coverage For Dependents Turning 26 is what you’re looking for.

- Start your search anew if you require another template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is processed, you can obtain the Cobra Coverage For Dependents Turning 26, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

COBRA allows you to continue your health insurance coverage for a limited time after you turn 26. It typically lasts for 18 months, but you must apply within a specified period after your coverage ends. By utilizing COBRA coverage for dependents turning 26, you ensure that you have medical coverage while you explore other health care options. The USLegalForms platform can guide you through the process to make it easier for you.

You do not necessarily lose your insurance immediately when you turn 26. Typically, your coverage ends at the conclusion of your policy period, such as the end of the month of your birthday. In this situation, COBRA coverage for dependents turning 26 can provide you with an extension of your existing benefits. Check your coverage details to understand when your coverage will officially end.

Yes, turning 26 is considered a qualifying life event. This means that you may have options to enroll in a new health insurance plan or switch plans immediately. With COBRA coverage for dependents turning 26, you can extend your current coverage, giving you time to make informed decisions about your health care. Make sure to act quickly to secure your coverage.

You typically lose your parents' insurance coverage the day you turn 26. However, you may be eligible for COBRA coverage for dependents turning 26, which allows you to maintain your health insurance for a limited period. It's important to review your options before your birthday to avoid any gaps in coverage. United Healthcare provides resources to help you navigate these changes.

Yes, a child turning 26 is often eligible for COBRA coverage. If you lose your parent's insurance due to reaching this age, COBRA can help you maintain your health benefits for a limited time. It’s an excellent choice to ensure continuity of care as you look for more permanent insurance solutions.

The answer is yes; you typically lose your parents' health insurance coverage on your 26th birthday. This shift may leave you looking for alternatives. Consider COBRA coverage for dependents turning 26, which can provide necessary health benefits during the transition.

Usually, car insurance does not align with age milestones like health insurance. You may still remain on your parents' car insurance after your 26th birthday. However, it is wise to discuss this situation with your insurance provider to avoid gaps in coverage.

In most cases, your parents cannot remove you from their health insurance plan until you turn 26. However, there are some exceptions based on specific circumstances. If you face any such issues, explore COBRA coverage for dependents turning 26 as an immediate solution.

With United Healthcare, you typically lose coverage the day you turn 26. This loss can create confusion regarding your healthcare options. It's a good idea to look into COBRA coverage for dependents turning 26 to ensure you have continuing health benefits.

Yes, you generally lose your parents' insurance on your 26th birthday. This is a significant milestone that determines your healthcare options moving forward. Consider COBRA coverage for dependents turning 26, as it allows you to maintain insurance temporarily while you assess new coverage.