Reasonable Accommodation Forms With Disabilities

Description

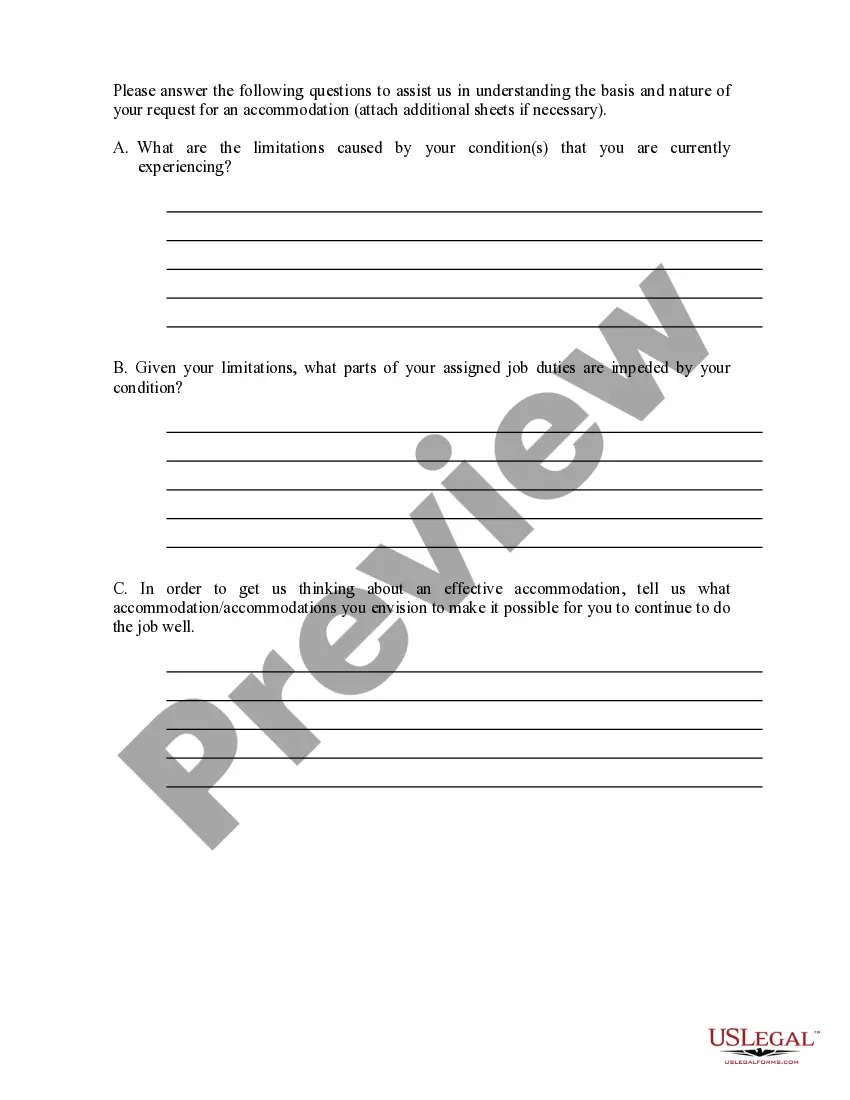

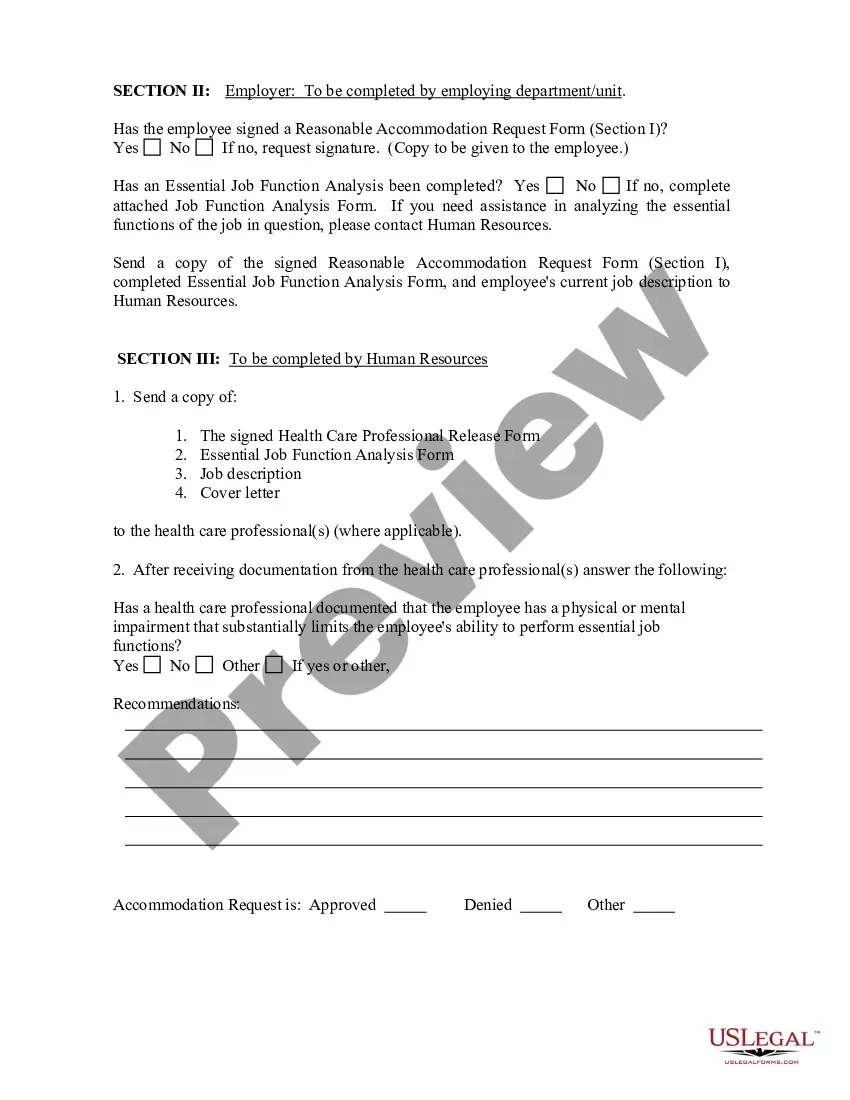

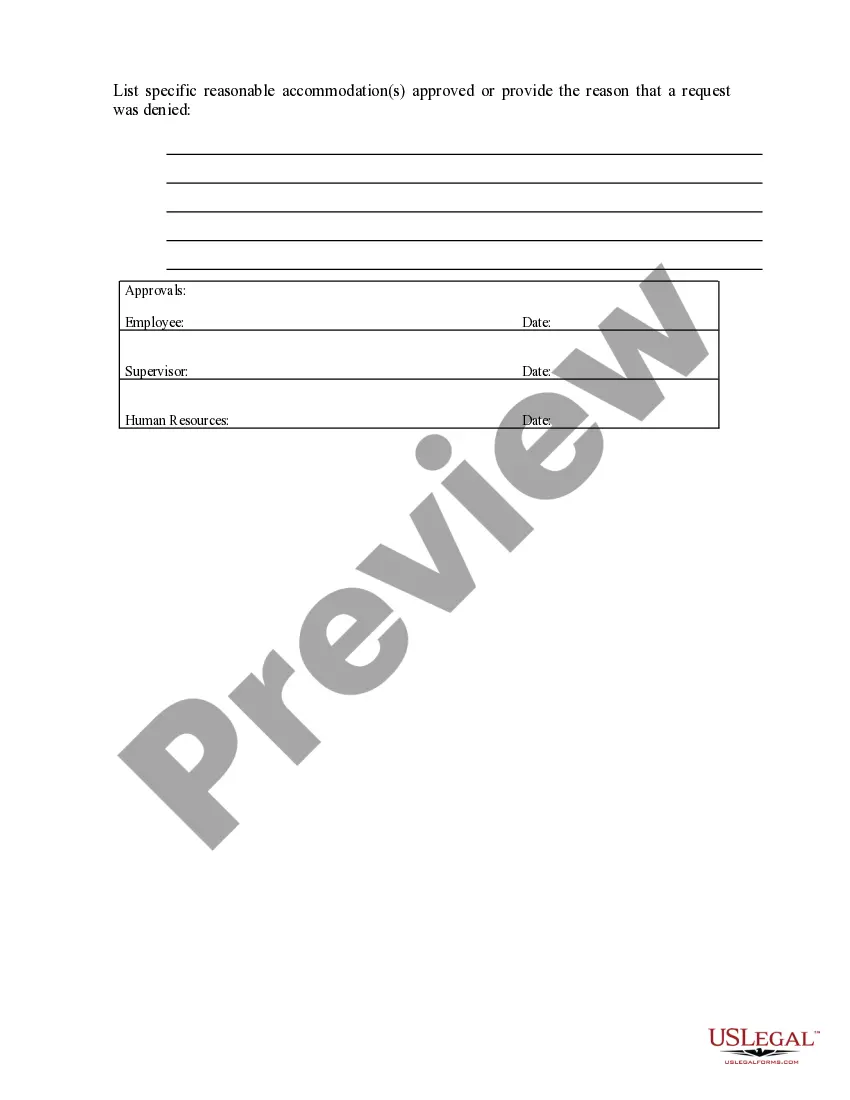

How to fill out Reasonable Accommodation Request Form?

Finding a reliable location to obtain the latest and pertinent legal samples is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents necessitates accuracy and meticulousness, which is why sourcing Reasonable Accommodation Forms With Disabilities exclusively from credible providers, such as US Legal Forms, is crucial. An incorrect template could squander your time and postpone your situation. With US Legal Forms, you are alleviated from worries. You can access and verify all information regarding the document’s application and suitability for your specific case and local jurisdiction.

Eliminate the complications associated with your legal paperwork. Explore the extensive US Legal Forms library, where you can locate legal samples, assess their applicability to your case, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Examine the form’s details to confirm it aligns with the specifications of your state and locality.

- View the form preview, if available, to ensure it meets your expectations.

- Return to the search to find the correct template if the Reasonable Accommodation Forms With Disabilities does not suit your requirements.

- Once you are confident in the form’s appropriateness, download it.

- As an authorized user, click Log in to verify and access your selected templates in My documents.

- If you aren’t registered yet, click Buy now to acquire the template.

- Choose the pricing structure that accommodates your requirements.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Reasonable Accommodation Forms With Disabilities.

- After obtaining the form on your device, you may edit it using the editor or print it to fill out manually.

Form popularity

FAQ

Forfeited Existence - An inactive status indicating that the corporation or limited liability company failed to file its franchise tax return or to pay the tax due thereunder.

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb), ...

The filing fee for a certificate of amendment for a nonprofit corporation or a cooperative association is $25. Fees may be paid by personal checks, money orders, LegalEase debit cards, or American Express, Discover, MasterCard, and Visa credit cards.

Within 120 days of the date of notice of forfeiture of privileges. § 171.252(1) states that a taxable entity that has forfeited its right to transact business is denied the right to sue or defend in a court in this state. Pursuant § 171.252(2) each officer and director is liable for the debts of the corporation.

If the Texas Comptroller forfeits an entity's ability to do business in the state, the entity will not be able to sue, and the entity's director and officers can be personally liable for the debts of the entity, including taxes. TBOC 171.252 and . 255.

The Comptroller will forfeit the corporate privileges or the right to transact businesses of a taxable entity if the taxable entity doesn't file a franchise tax report or pay franchise tax within 45 days after the date the Comptroller mails the entity a notice of forfeiture.[7]

This form is designed to provide a standardized amendment. form to effect a change of name for the filing entity. If the legal name of the entity is to be changed, state the new name of the entity in section 1.

Texas has one form for all domestic for-profit businesses. Fill out and file in duplicate Form 424, Certificate of Amendment. You can file it in person, by mail or online at Texas SOSDirect for $1 log in fee. You also can fax your amendment with form 807 with your credit card information.