How Many Members For Llc

Description

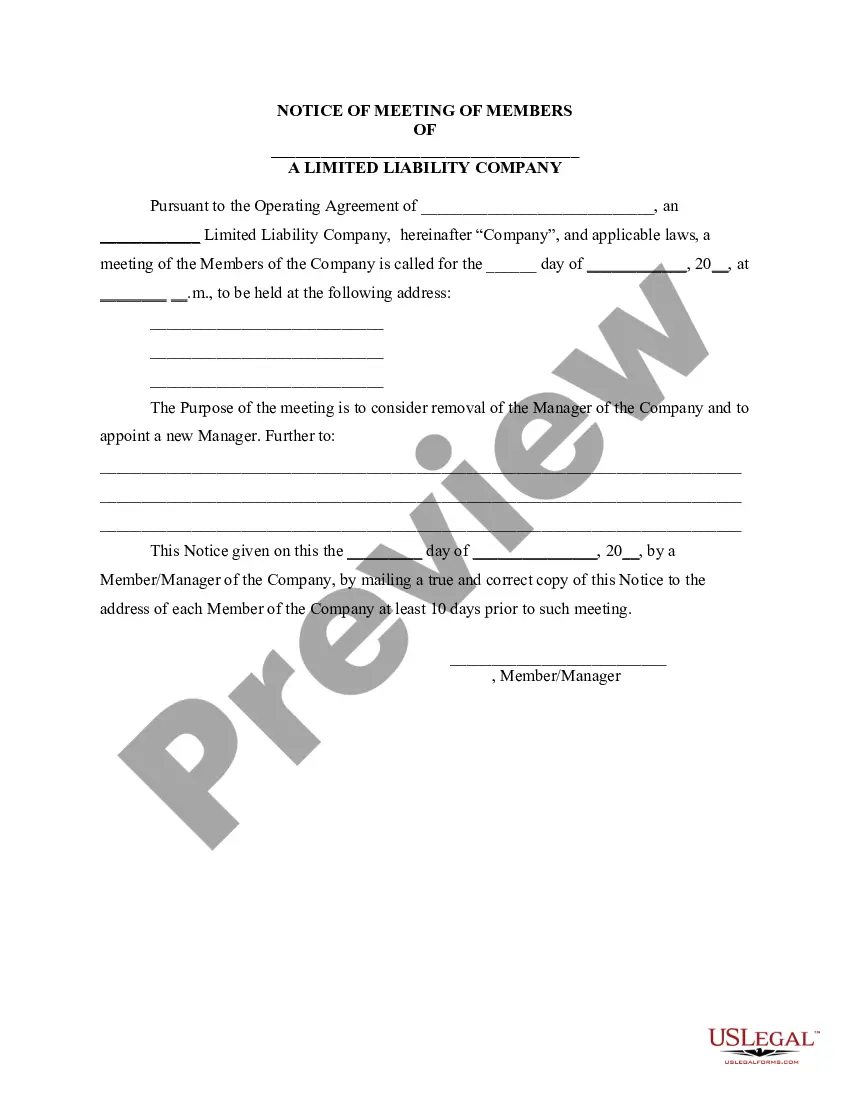

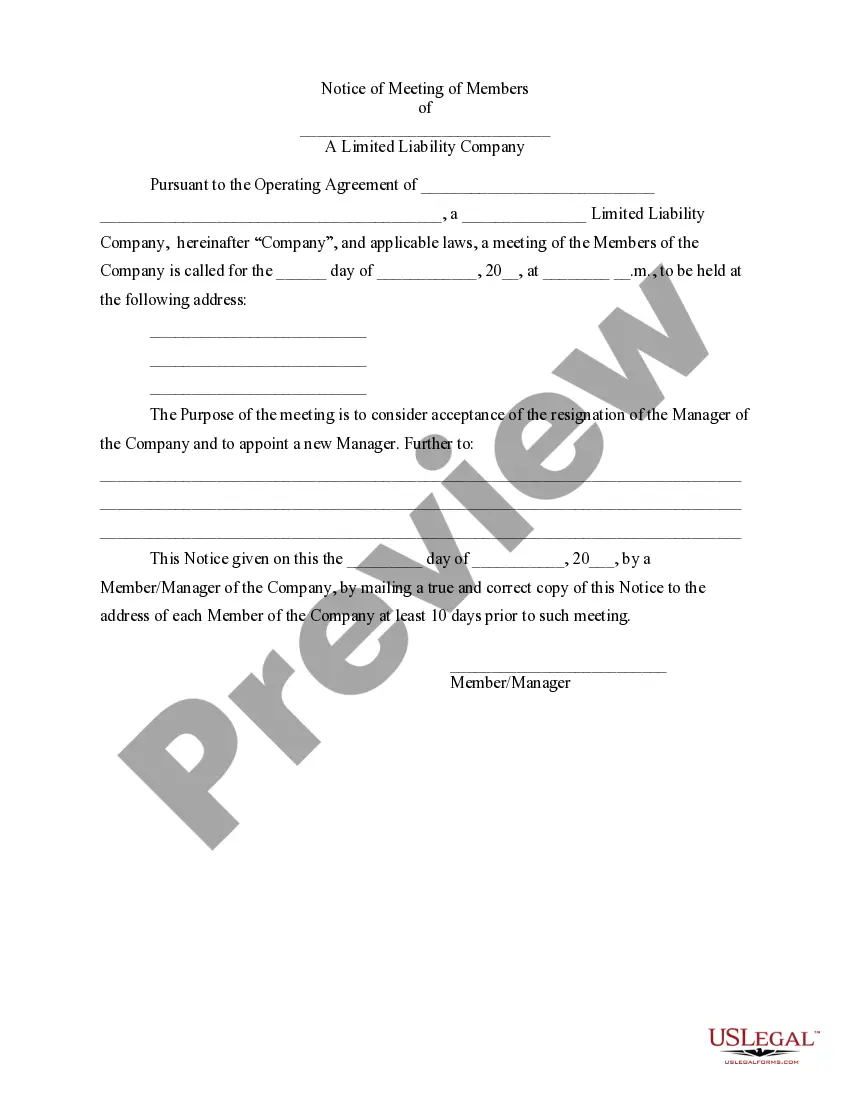

How to fill out Resolution Of Meeting Of LLC Members To Remove The Manager Of The Company And Appoint A New Manager?

- If you're returning to US Legal Forms, log into your account and locate the required form template. Ensure your subscription is active; if not, renew it based on your existing payment plan.

- For new users, start by previewing the form and reading its description. Make sure it matches your needs and complies with local laws.

- If the selected form doesn’t meet your expectations, utilize the Search bar on the top of the page to find more relevant templates.

- Once you find the desired document, click on the Buy Now button and select a suitable subscription plan. Create an account to gain access to the extensive library.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize the subscription.

- After purchasing, download your form directly to your device. You can also access it anytime in the My Forms section of your profile.

US Legal Forms not only simplifies the process of obtaining legal documents but also provides users with access to premium experts. This ensures that all your forms are accurately filled out and legally compliant.

Ready to streamline your LLC formation? Visit US Legal Forms today and start your journey to easy document creation!

Form popularity

FAQ

The decision for a husband and wife to choose between a single-member or multi-member LLC should align with their business dynamics. If one spouse primarily manages the business, a single-member LLC may be straightforward. Conversely, if both wish to be involved and share responsibilities, a multi-member LLC could enhance collaboration and resource pooling. Consider your business goals carefully when making this decision.

While multi-member LLCs offer benefits, they also come with disadvantages. Decision-making can become complicated with multiple members, leading to potential conflicts. Additionally, all members are generally liable for the business's debts, which can heighten risk. Therefore, it’s crucial to establish clear agreements upfront when forming a multi-member LLC.

For a husband and wife, the best structure often varies based on their specific needs and involvement in the business. A multi-member LLC allows for shared management responsibilities and can provide valuable tax benefits. If one spouse has a significant controlling role, a single-member LLC might simplify things, but ensure you weigh the pros and cons of each option.

Whether a husband and wife should form a single or multi-member LLC depends on their business approach. A single-member LLC simplifies operations and tax filings, but a multi-member LLC may offer enhanced flexibility and shared liability. If both spouses plan to actively manage the business, a multi-member LLC can leverage their combined efforts and expertise.

Choosing between a single-member and a multi-member LLC often depends on your business goals. A multi-member LLC can provide benefits such as shared management and combined resources. With more members, you can also share liability and tax advantages. However, consider that working with partners may introduce additional complexities in decision-making and profit-sharing.

member LLC has one owner, while a multimember LLC includes two or more owners. The primary distinction lies in the management structure and the tax implications. With one member, the LLC is typically treated as a disregarded entity for tax purposes. Conversely, a multimember LLC is treated as a partnership, allowing for shared responsibilities and potential tax benefits.

The choice between a single or multi-member LLC depends on your business structure and collaboration preferences. A single-member LLC offers simplicity in decision-making and management, while a multi-member LLC allows shared responsibilities and diverse input. Assess your needs to determine which fits your business best, and consider tools like USLegalForms for tailored advice.

member LLC involves two or more owners, distinguishing it from a singlemember LLC. To identify if your LLC is multimember, review your operating agreement and the formation documents. If they list multiple individuals as members, then you indeed have a multimember LLC.

Yes, you can run multiple businesses under one LLC, which can simplify your management structure. When using one LLC for three businesses, be mindful of potential liabilities and how they can impact each other. To ensure your setup complies with legal requirements, consider seeking guidance from platforms like USLegalForms.

Yes, an LLC can have four owners, which is perfectly acceptable under the guidelines for how many members for LLC. It allows diverse skills and viewpoints to help operate the business. Just ensure all members comply with the formation documents and agreements to facilitate smooth operations.