Agreement Professional Services Withholding Tax

Description

How to fill out Agreement For Professional Services - Engineer And City?

Individuals often link legal documentation with something intricate that only an expert can handle.

In a certain sense, this is accurate, as formulating Agreement Professional Services Withholding Tax necessitates a significant grasp of subject criteria, including state and county laws.

Nevertheless, with US Legal Forms, everything has become more user-friendly: pre-prepared legal templates for any life and business scenario specific to state regulations are compiled in a single online repository and are now accessible to all.

Print your document or upload it to an online editor for a quicker completion. All templates in our library are reusable: once purchased, they remain stored in your profile. You can access them anytime via the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current documents classified by state and purpose, so searching for Agreement Professional Services Withholding Tax or any other specific template only takes a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to acquire the form.

- New users to the service will first need to create an account and subscribe before they can download any paperwork.

- Here is the step-by-step guide on how to obtain the Agreement Professional Services Withholding Tax.

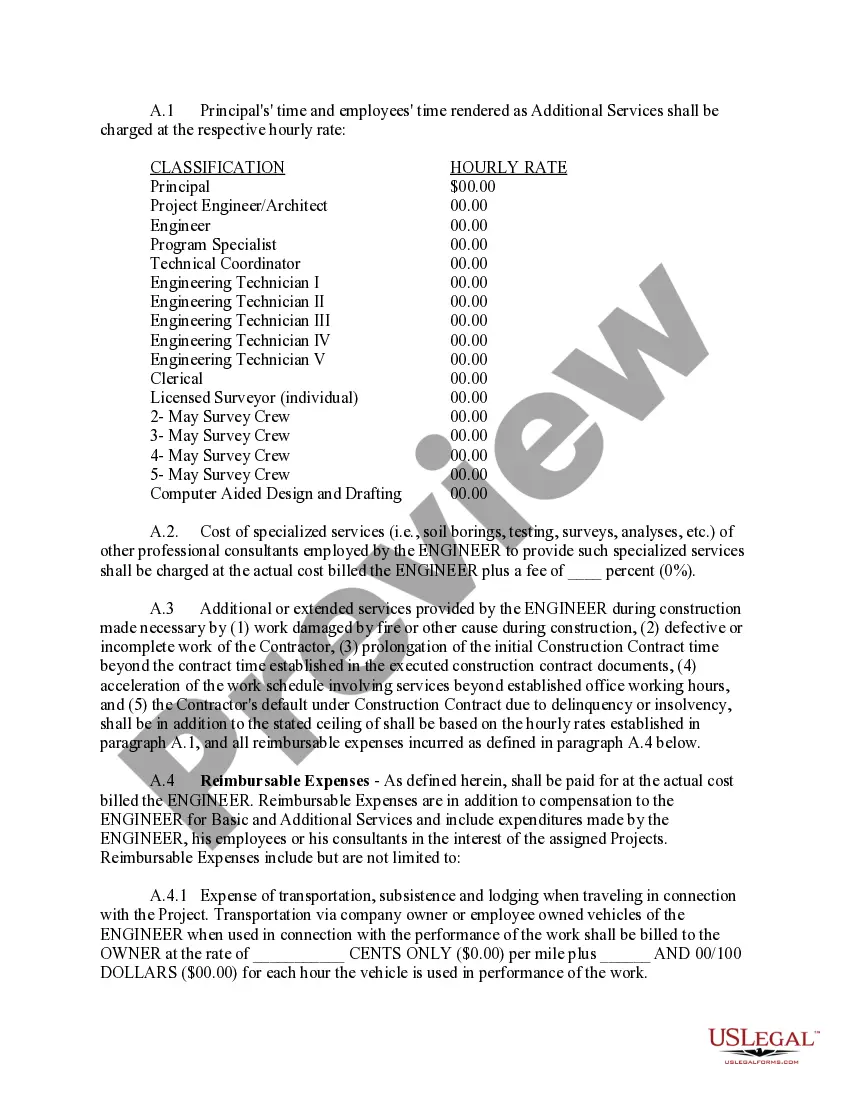

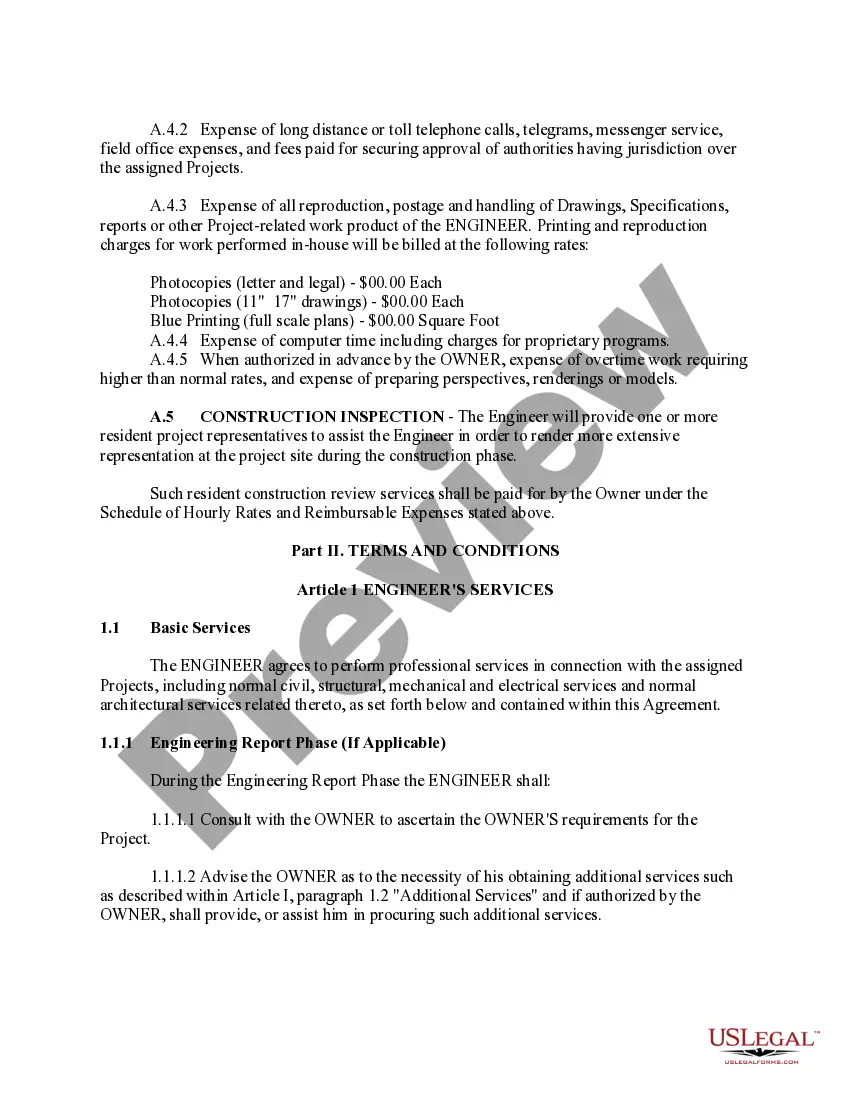

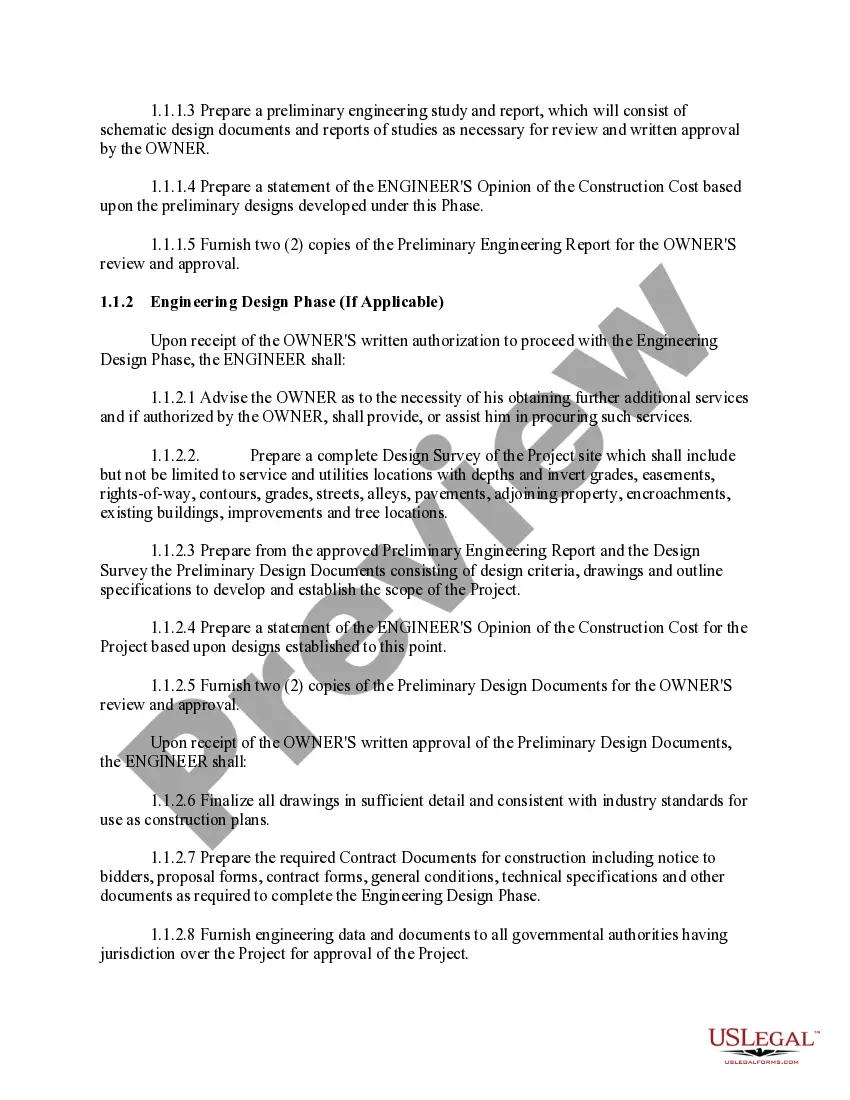

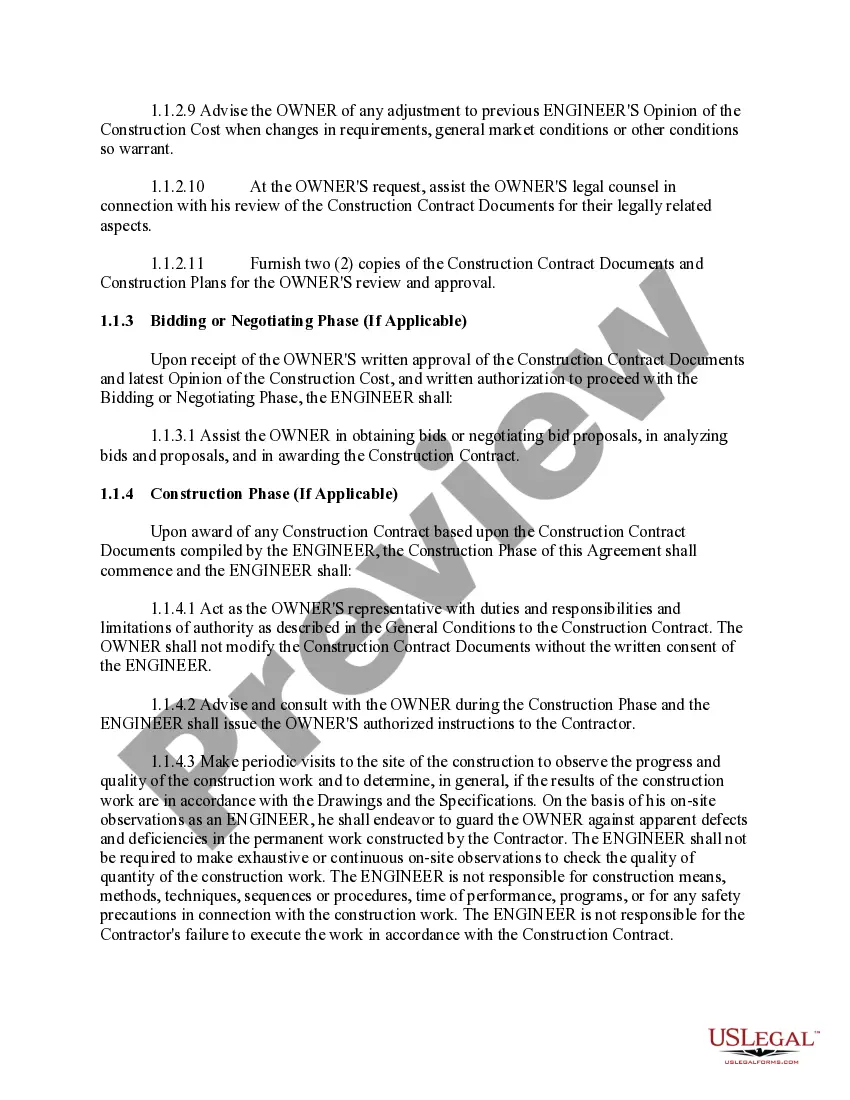

- Review the page content thoroughly to ensure it meets your requirements.

- Examine the form description or confirm it through the Preview option.

- Find another example using the Search field above if the previous one doesn't fit your needs.

- Click Buy Now once you've located the appropriate Agreement Professional Services Withholding Tax.

- Choose the subscription plan that aligns with your needs and budget.

- Create an account or Log In to proceed to the payment page.

- Pay for your subscription via PayPal or with your credit card.

- Select the format for your sample and click Download.

Form popularity

FAQ

You generally must withhold tax at the 30 percent rate on compensation you pay to a nonresident alien individual for labor or personal services performed in the United States, unless that pay is specifically exempted from NRA withholding or subject to graduated withholding, Wage Withholding under Internal Revenue Code

Hence, the computation of tax to be withheld is as follows:EWT= Income payments x tax rate. EWT= P20,000 x 5%Documentary Requirements.Procedures.Filing Via EFPS.Payment Via EFPS.Manual Filing and Payment.Source:28-Feb-2011

Withholding tax rates are usually 10% or 5% depending on the type of transaction and collecting authority for the tax (which can be a Federal Inland Revenue or the State Inland Revenue).

Professional fees, talent fees, and consultancy fees payable to individual payees are now subject to 5%/10% withholding tax (8% under RMC No. 01-2018, and 10%/15% prior to this ). Fees received by an individual from a lone income payor amounting to not exceeding P250,000 may not be subject to withholding tax.

Hence, the computation of tax to be withheld is as follows:EWT= Income payments x tax rate. EWT= P20,000 x 5%Documentary Requirements.Procedures.Filing Via EFPS.Payment Via EFPS.Manual Filing and Payment.Source: